5 Things You Need To Know

Good Day, Wall Street's top bankers caution about rate-cut bets. Red sea tensions, and China concerns.

- Home

- 5 Things You Need To Know

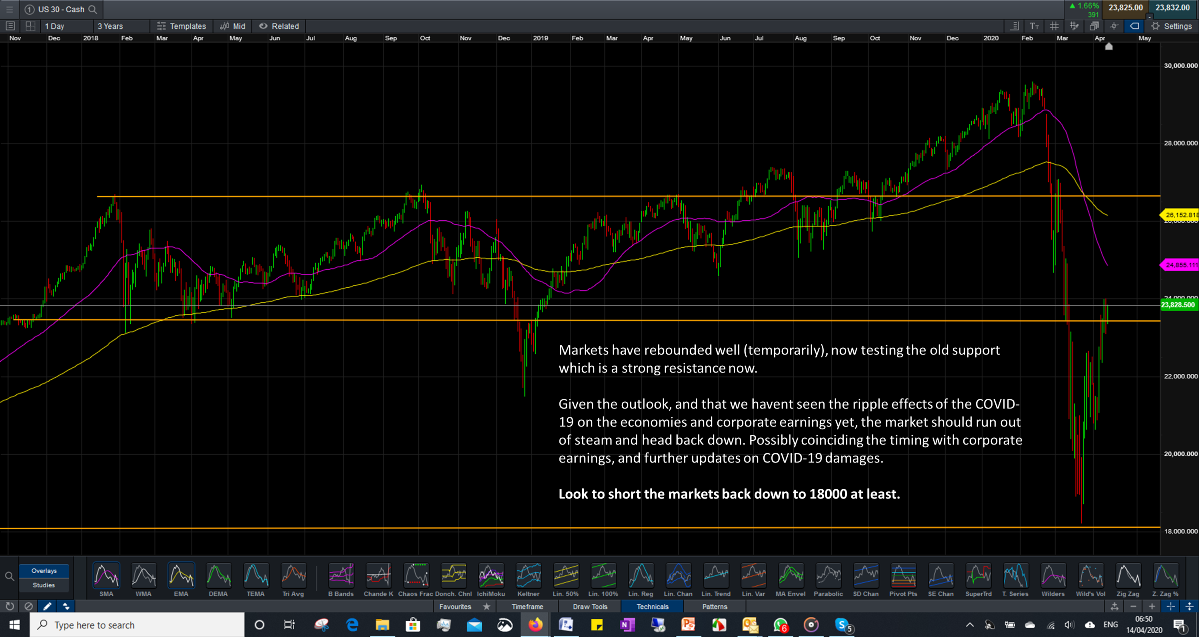

Caution Ahead

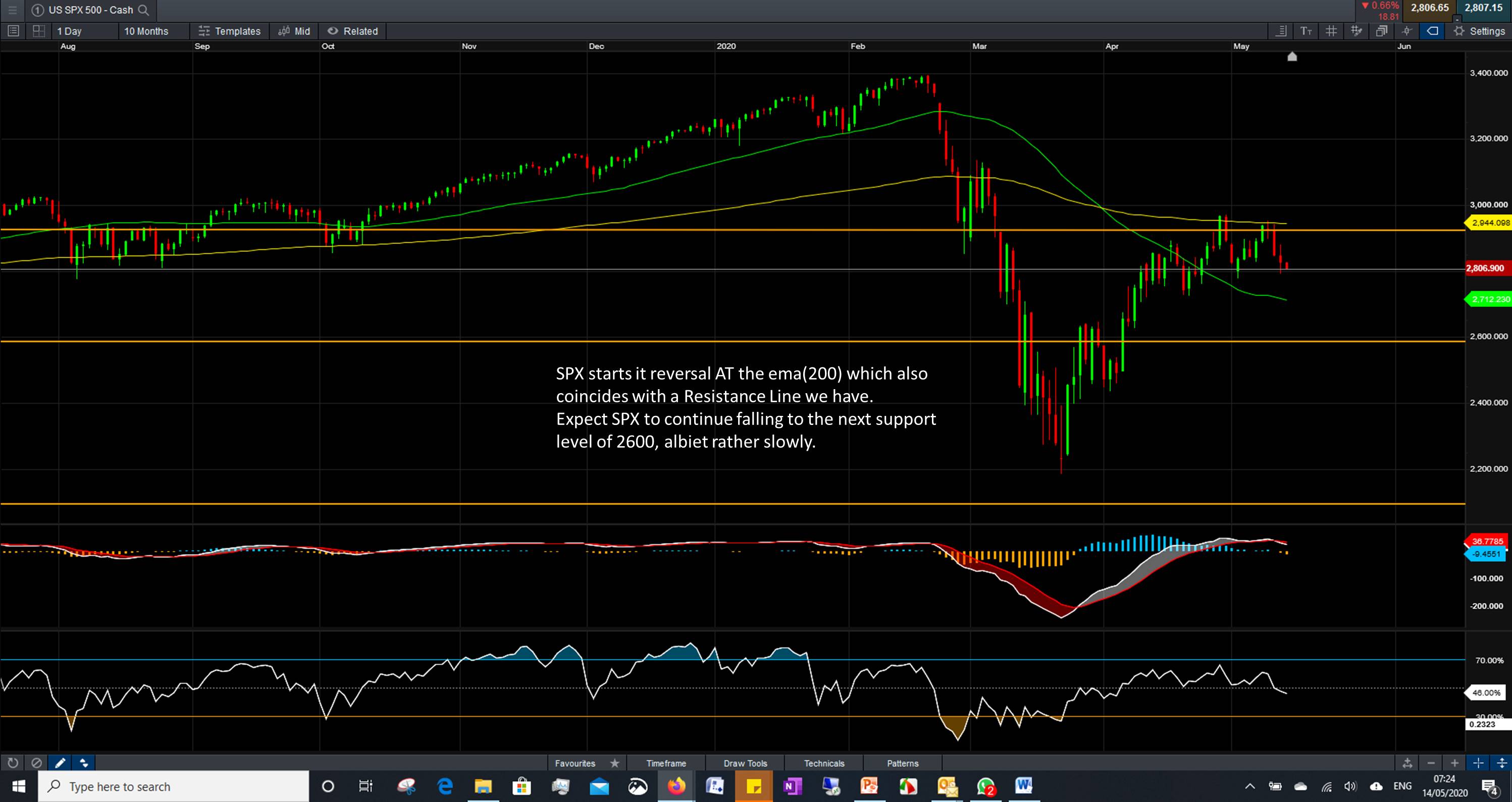

Top Wall Street bankers are saying they expect central banks to cut interest rates more slowly than the market is anticipating. Their caution echoes that of central bankers in recent days, prompting traders to wind back aggressive bets for lower rates this year. “It doesn’t make sense,” State Street Chairman and CEO Ron O’Hanley said. “The Fed was very clear in their dot plot.” Everyone from JPMorgan’s Daniel Pinto to Standard Chartered’s Bill Winters to Cantor Fitzgerald’s Howard Lutnick have said they expect monetary policy to ease slower than anticipated by the market. Their caution echoes that of central bankers in recent days, which has already prompted traders to wind back bets on aggressive interest-rate cuts this year.

Dangerous Path

Another commercial vessel was struck by a drone south of Yemen, the third such incident in as many days that’s underscoring the intensifying danger to vessels in one of the world’s most vital waterways. The attack occurred about 60 miles (97 kilometers) southeast of Aden, Yemen, according to the UK Navy. Meanwhile, the US launched another round of strikes at 14 Houthi targets in Yemen overnight as the militant group’s attacks on shipping in the Red Sea continue.

China Risk-Reward

The “risk-reward” equation in China has “changed dramatically,” said JPMorgan CEO Jamie Dimon, even as the nation has been “very consistent” in opening up to financial-services companies. This came as Chinese Premier Li Qiang gave his clearest signal yet that Beijing won’t resort to huge stimulus to revive growth amid the worst bout of deflation in decades, even as another batch of troubling economic data tested the patience of investors.

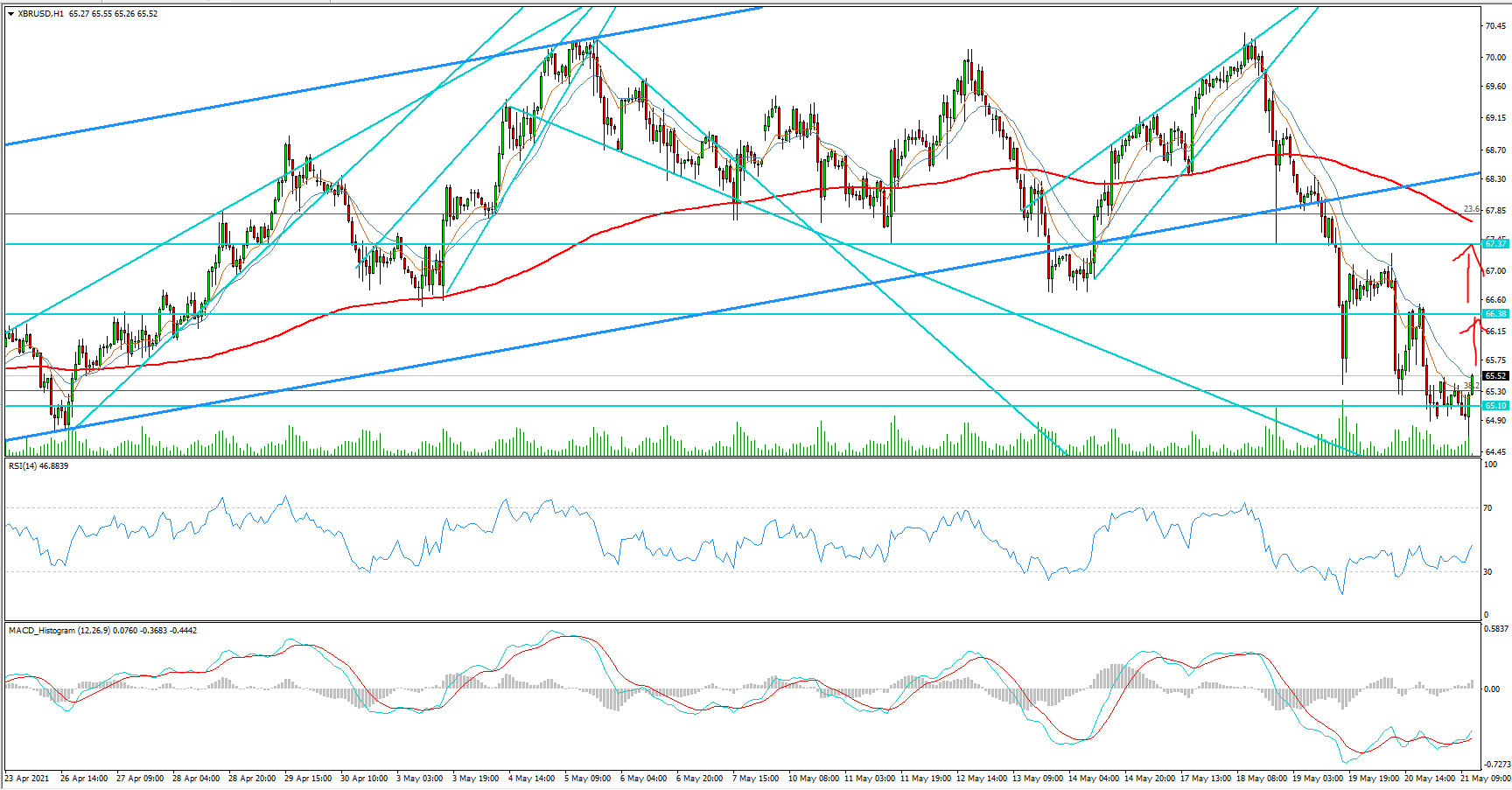

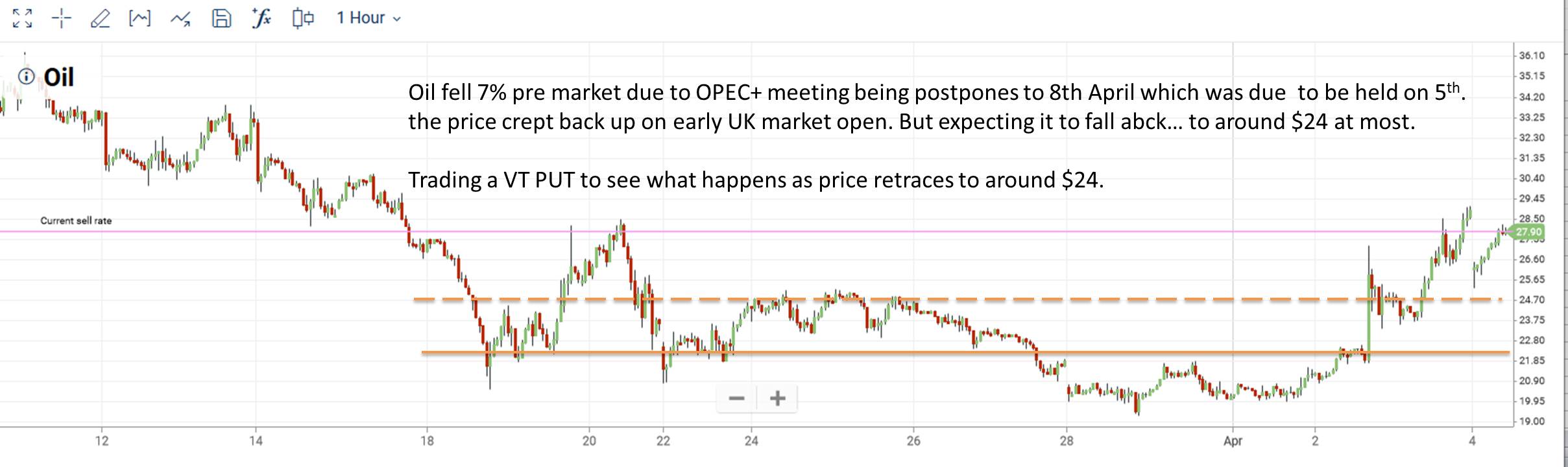

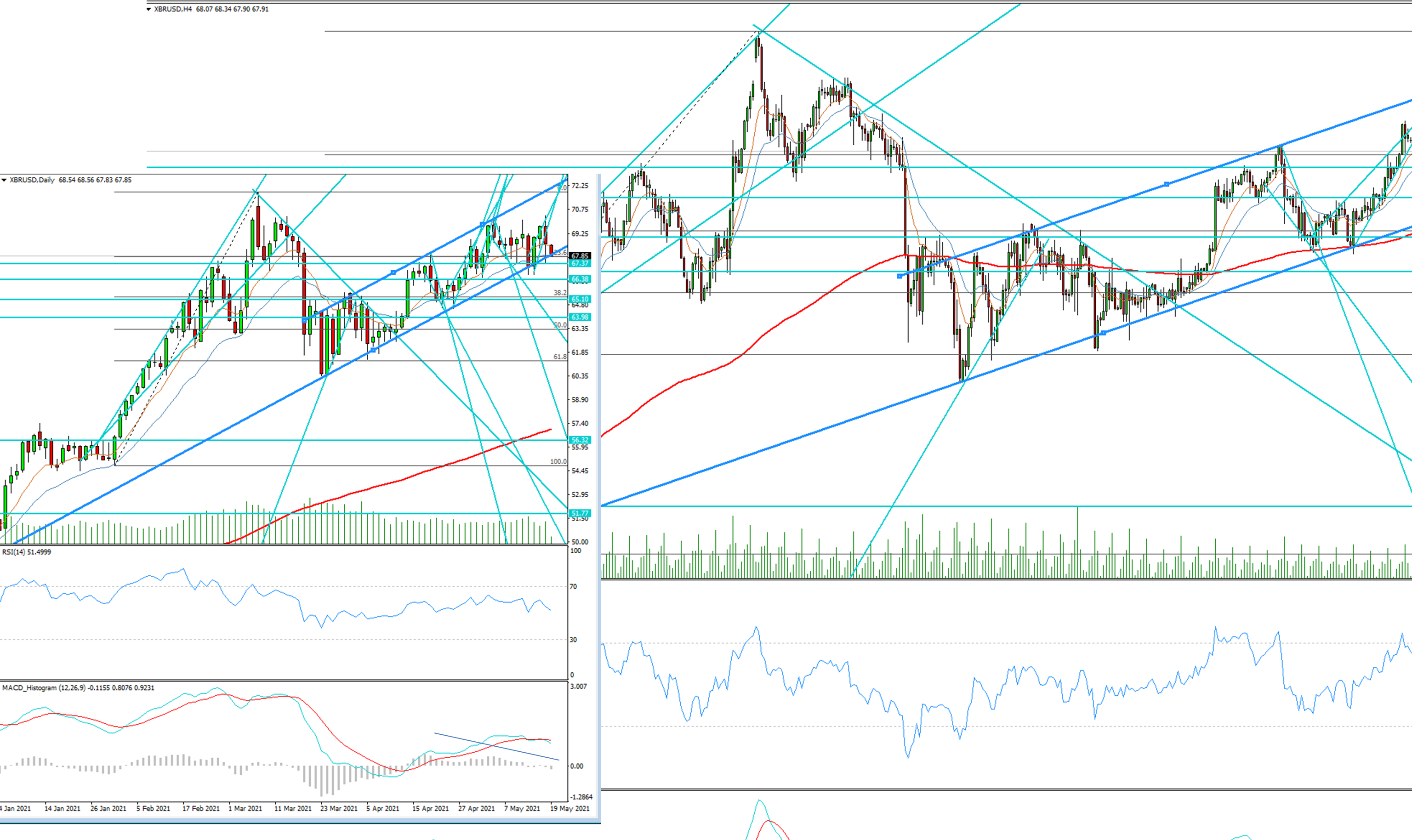

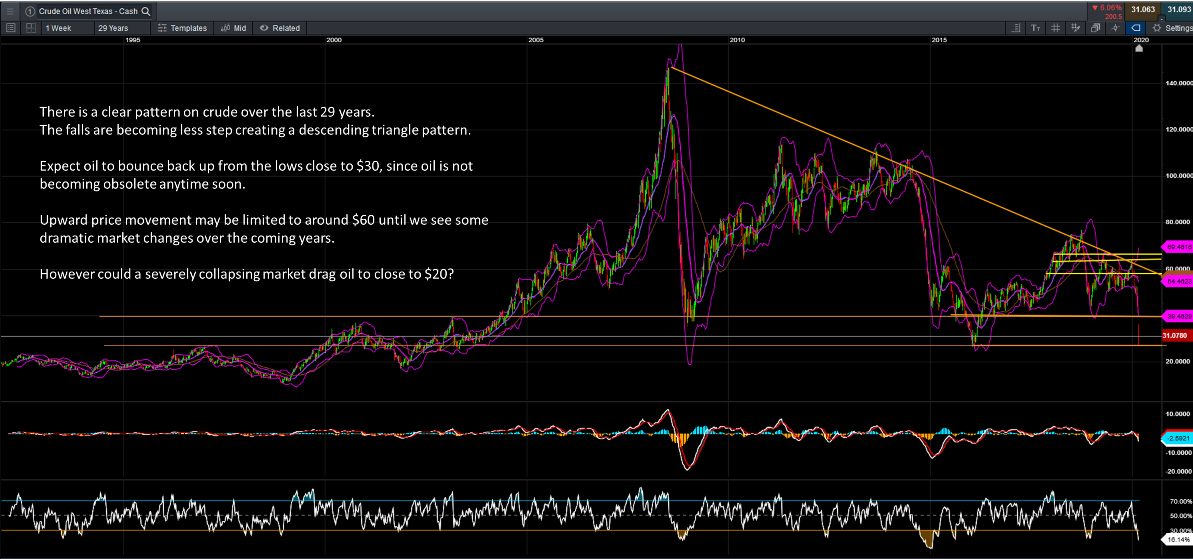

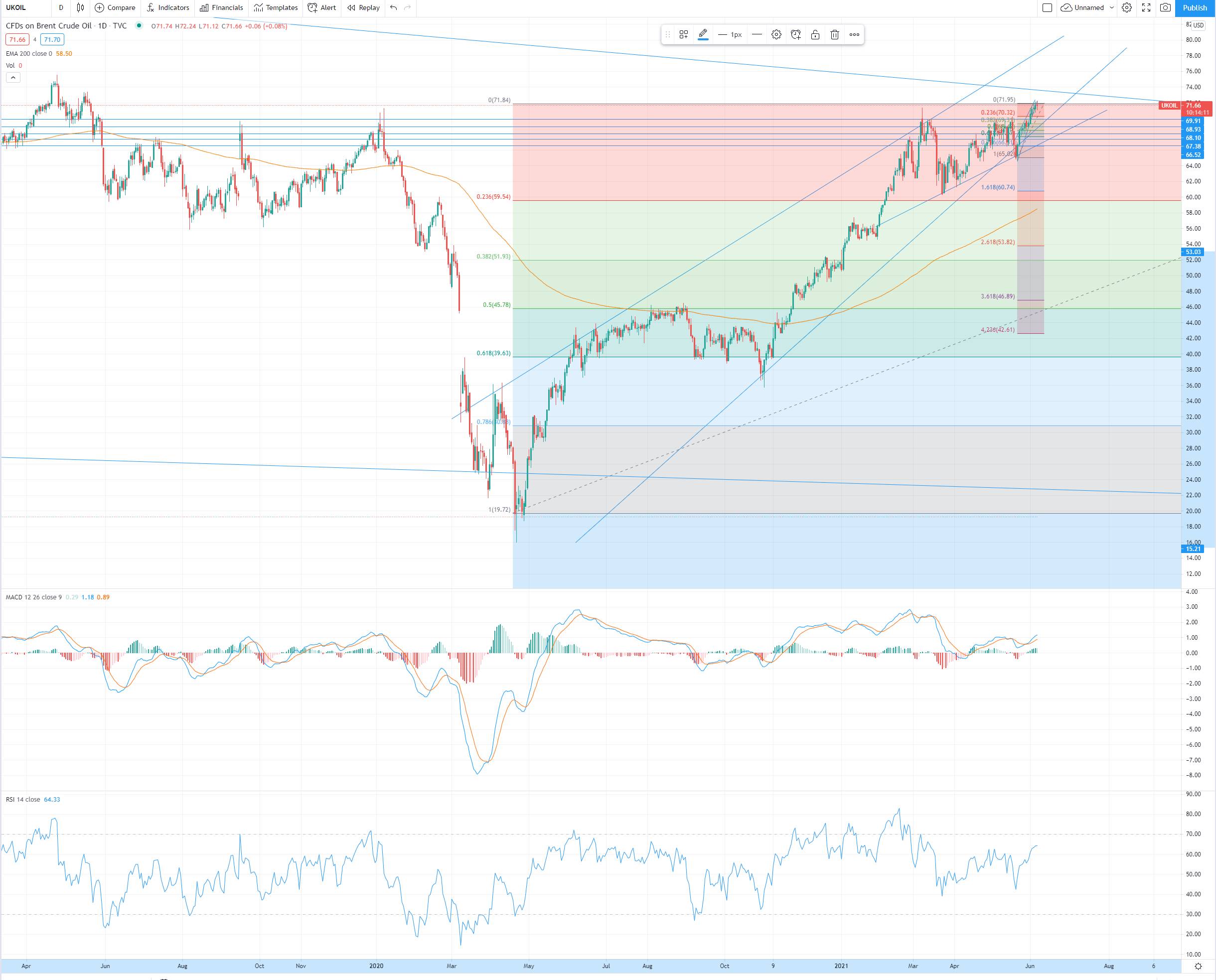

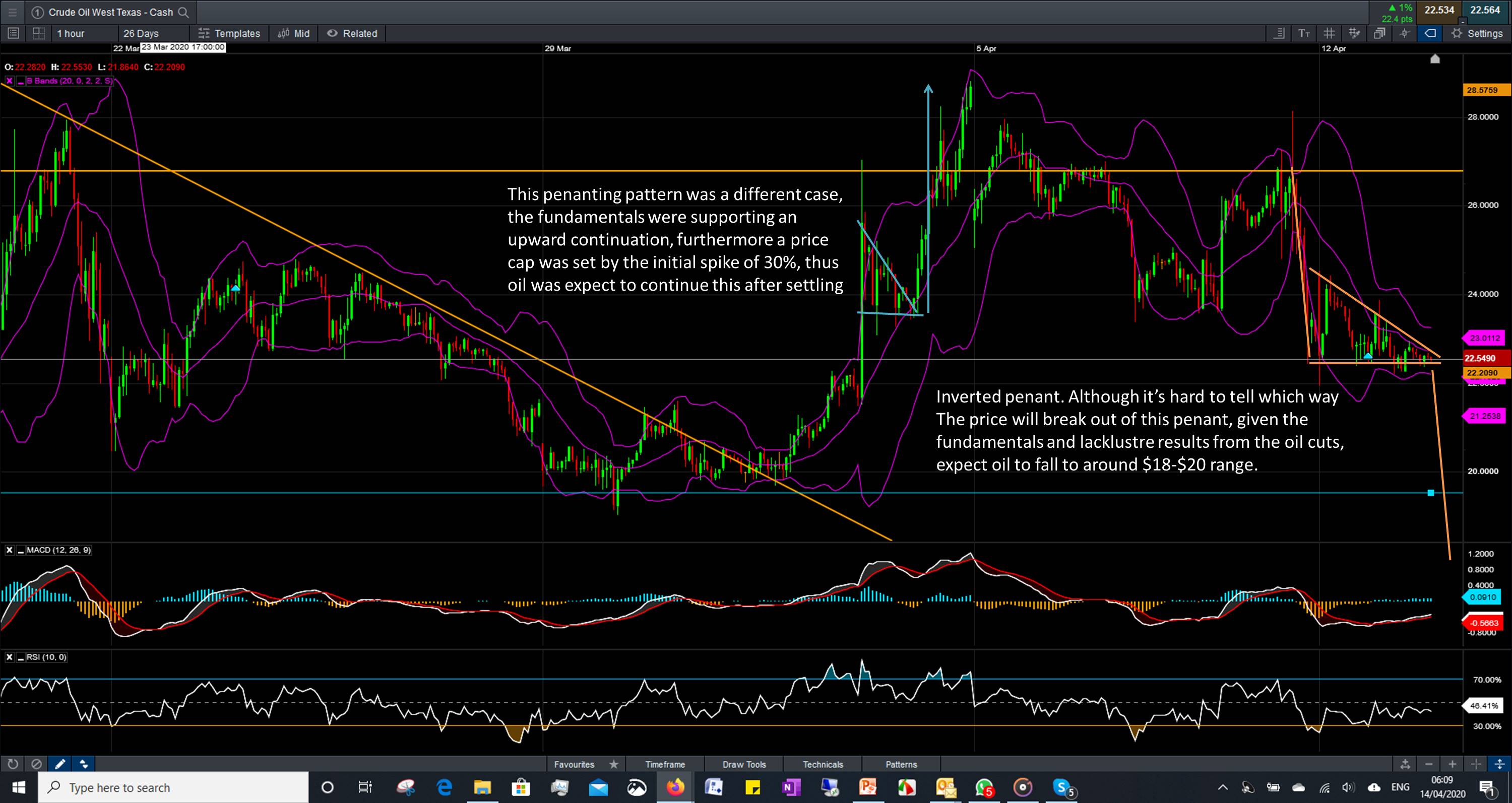

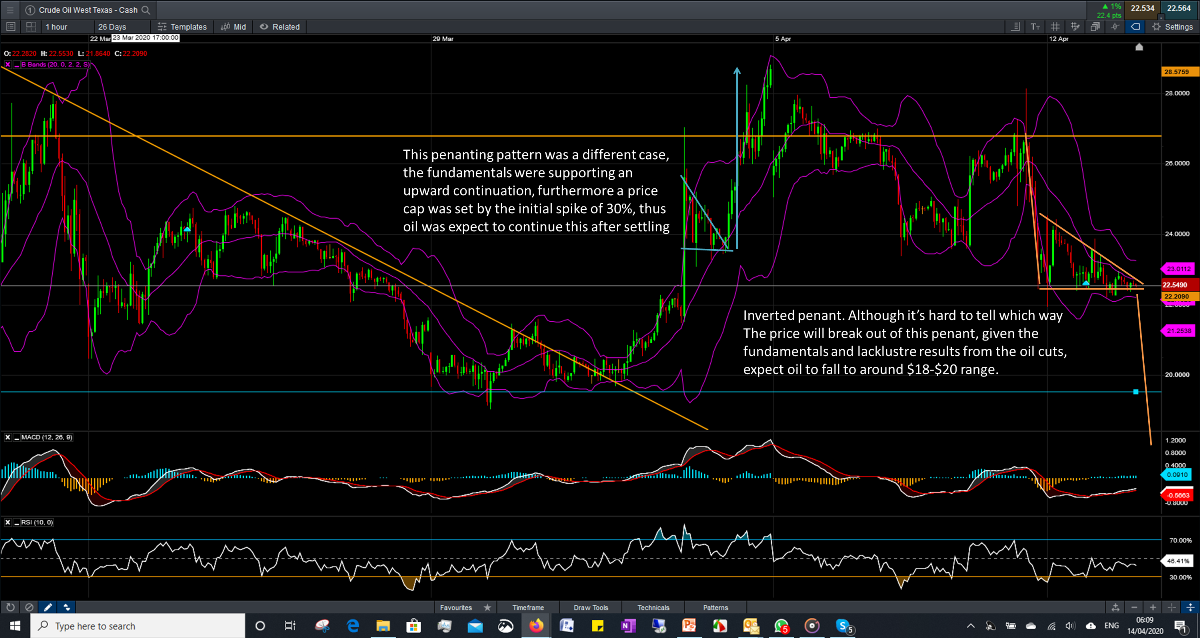

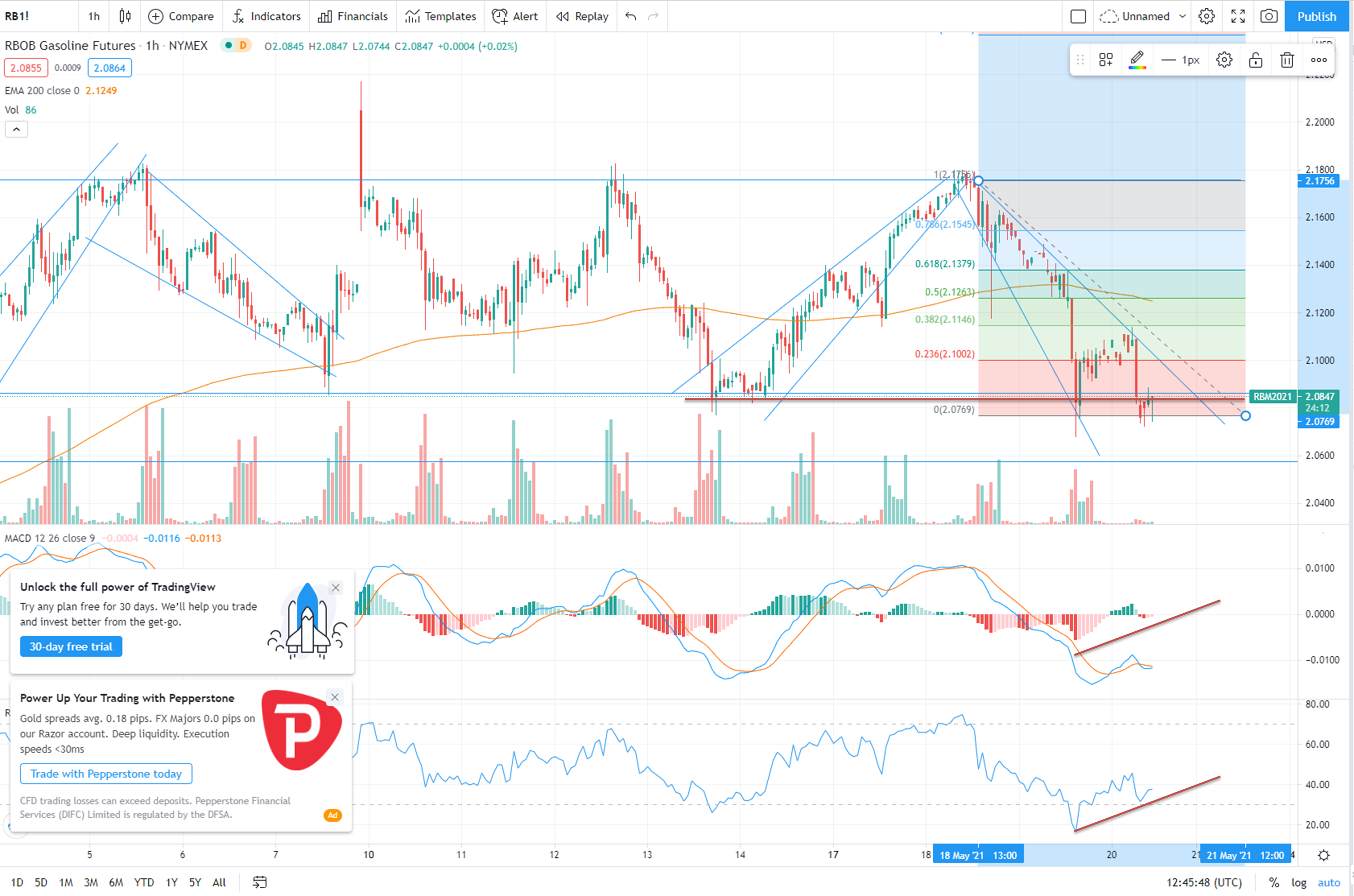

Oil Market Yesterday

Oil prices rose on Thursday as OPEC forecast relatively strong growth in global oil demand over the next two years and the market eyed disrupted U.S. oil production amid a cold blast, as well as geopolitical tensions in the Middle East. The IEA expects oil markets to be in a "comfortable and balanced position" this year, despite Middle East tensions amid a rising supply and slowing demand growth outlook, its executive director Fatih Birol told the Reuters Global Markets Forum on Wednesday. OPEC on Wednesday stuck to its forecast for relatively strong growth in global oil demand in 2024 and said 2025 will see a robust increase in oil use, led by China and the Middle East, in a surprise early prediction. China boosted the volume of crude oil being stockpiled in December as lower prices encouraged refiners to lift imports and maintain high levels of throughput at their plants. U.S. government data on oil inventories is due at 11 a.m. ET (1600 GMT) on Thursday. Domestic crude stockpiles rose last week by 480,000 barrels, according to market sources citing American Petroleum Institute figures on Wednesday.

MACRO Economics

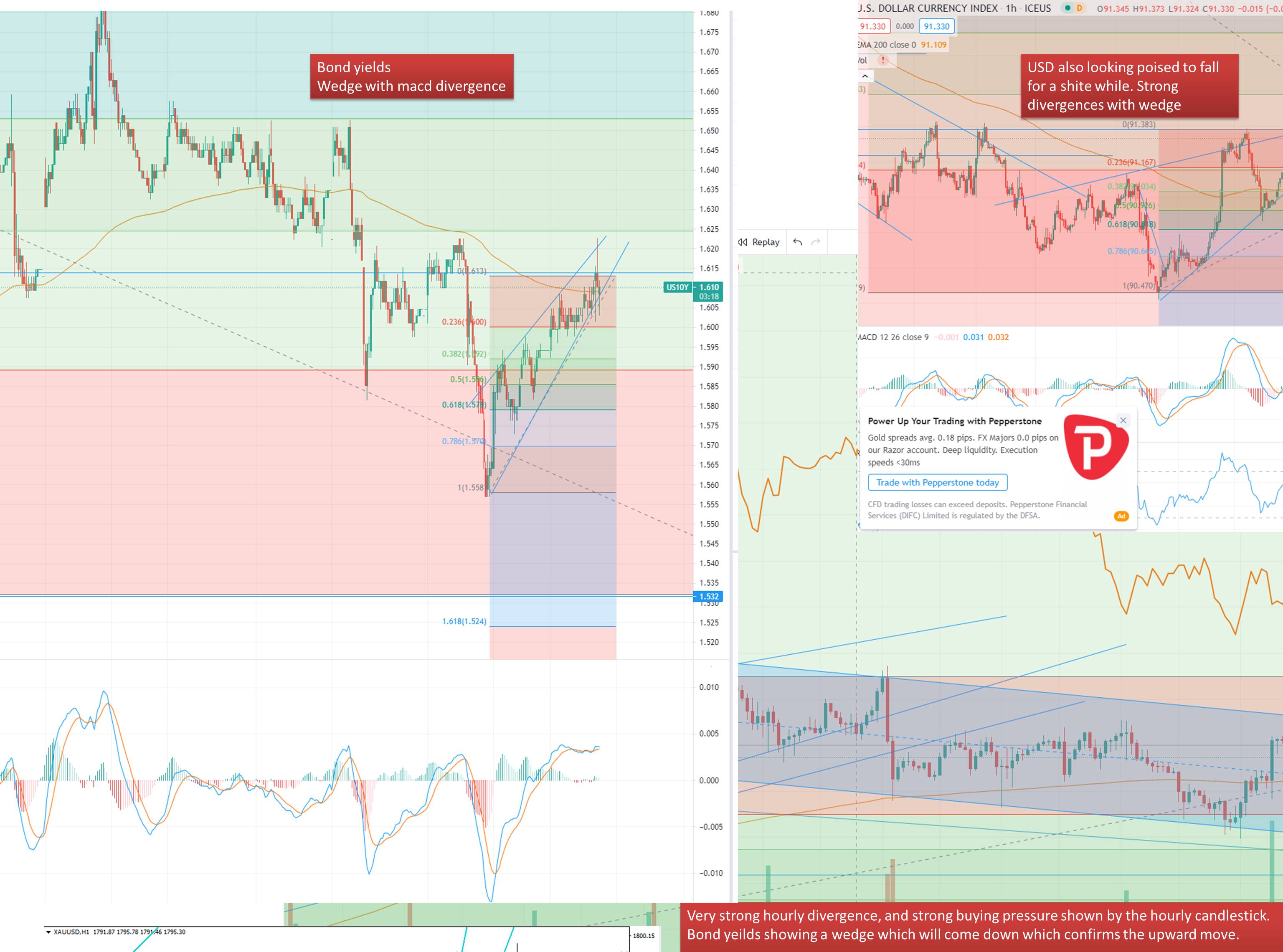

The dollar hovered near a one-month peak versus

major peers on Thursday after robust U.S. retail

sales data added to building expectations the Federal Reserve will not rush to lower interest rates.

U.S. Treasury yields climbed on Wednesday after an

unexpected rise in UK inflation last month and

stronger-than-expected U.S. December retail sales

data strengthened the case that interest rate cuts

will not be as imminent as the market expects.

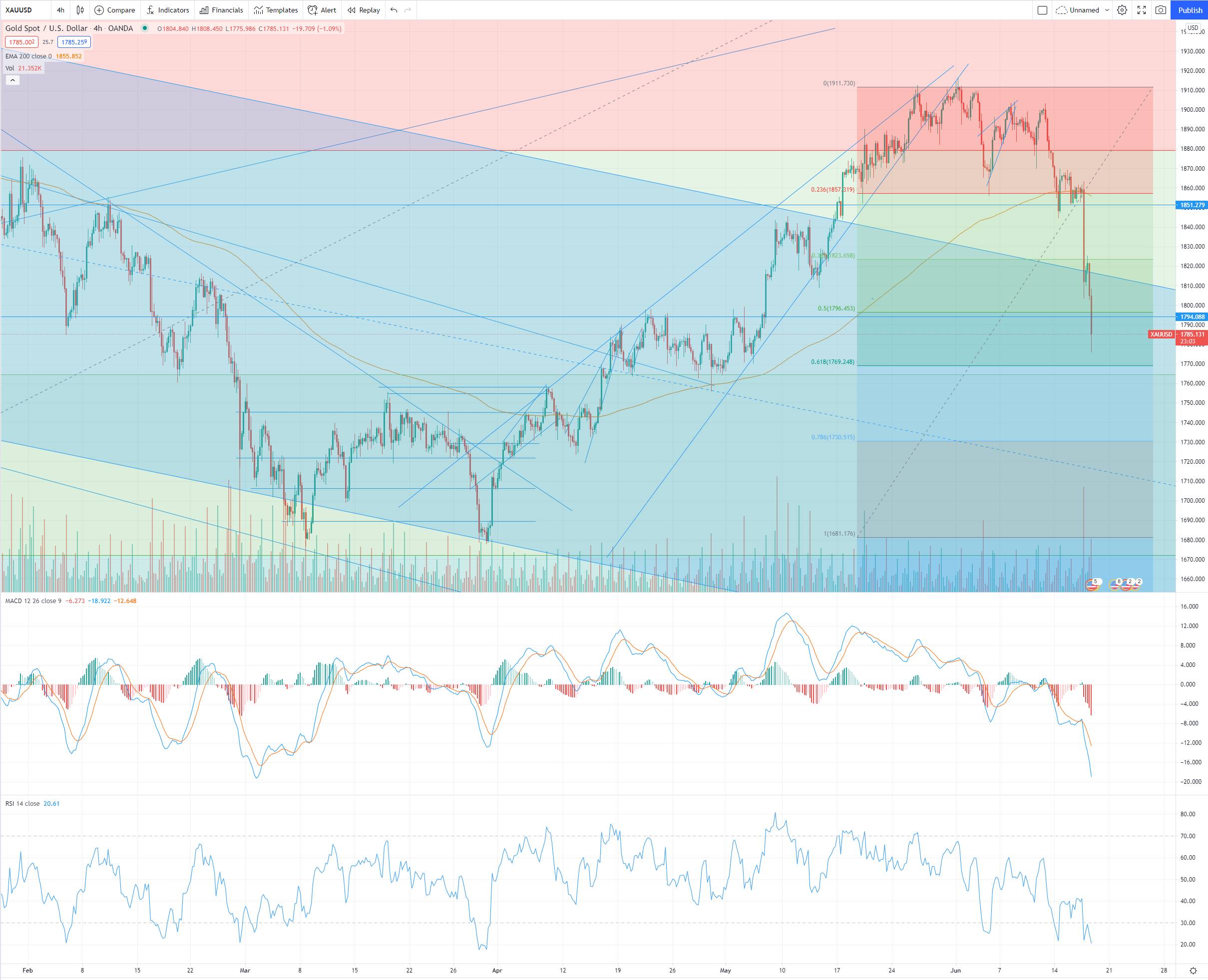

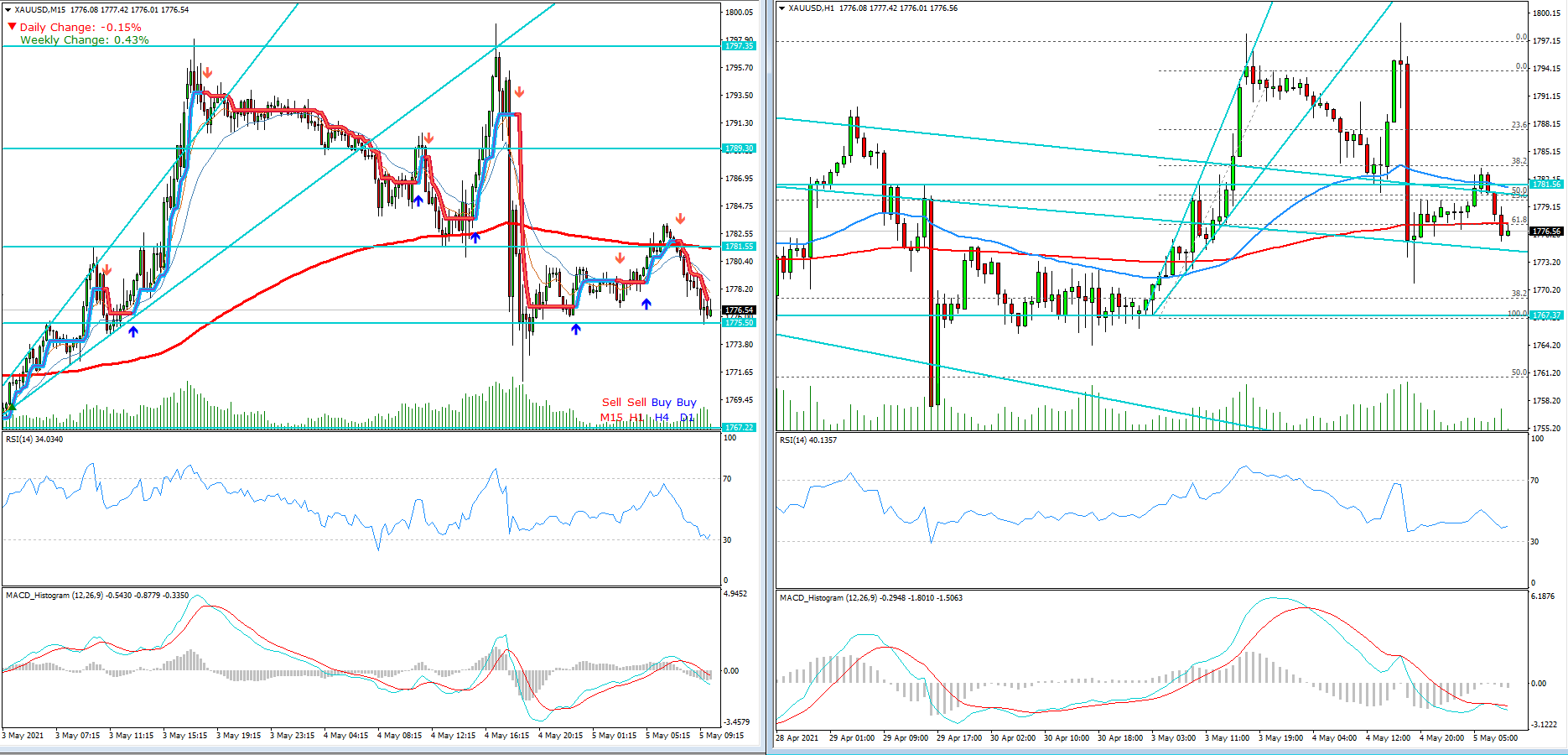

Gold prices hovered near five-week lows on Thursday, as hawkish remarks from Federal Reserve officials and robust data dampened investors' expectation for deeper and early interest rate cuts in U.S.

this year.

U.S. Retail sales for December rose +0.6%, more

than the +0.4% rise expected as consumers stepped

up purchases of motor vehicles and retailers offered

discounts. Data for November was unrevised to

show sales rising +0.3%. Ex: autos, gasoline, building

materials and food services, retail sales jumped

+0.8% last month. November core sales were revised higher to show them rising 0.5% instead of

0.4% as previously reported. Retail Sales increased

5.6% YoY in December, the biggest increase in 11

months, following a downwardly revised 4% rise in

November.

Key Market Data

Today / Tomorrow

Thursday

Housing Starts

08.30

Jobless Claims

08.30

Philly Fed Manufacturing Index

08.30

Crude Oil Inventories

11.00

Wednesday

Existing Home Sales

10.00

Michigan Consumer Expectations

10.00

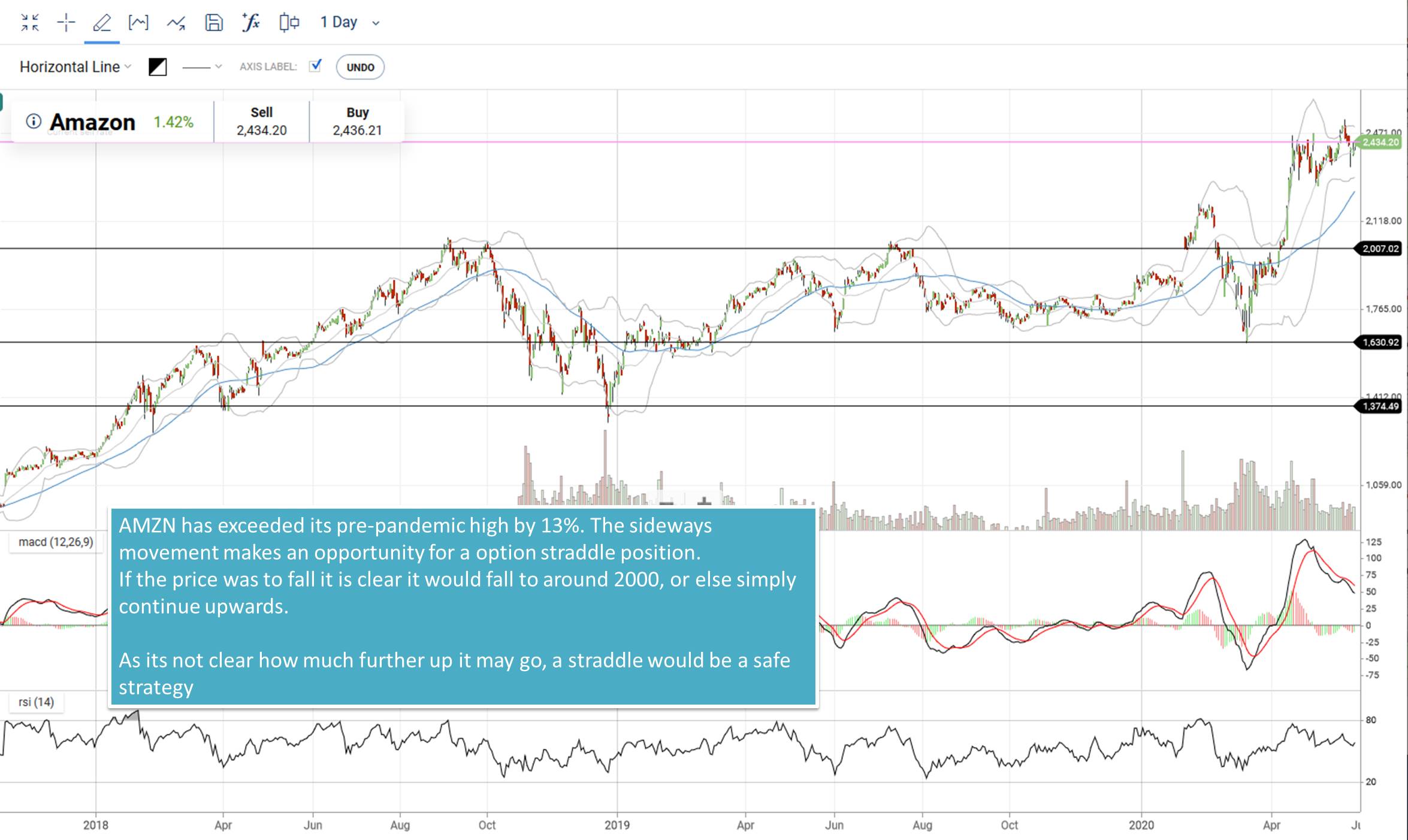

Is your Paper Trading on Brent Crude making 5-15% Profit Monthly?

Our Oil Trading Clients in Dubai gained 85% Profit in 2023,

on Oil Paper Trading by following our unique Strategies.

Book a Meeting Today

To discuss your Challenges with Oil Hedging & Paper Trading

Call: +971 58 540 0412

Email: nasir@financialmarkets.club

- Admin

- 18 Jan 24

- 0 Comment

Related Posts

You have to logged in for comment.

Email Newsletter

Get subscriber only insights & news delivered by Financial Markets Club

Weekly Trading Lessons by Email

Do you want to Learn to Trade like a Pro? Every Week we will share some Trading Tips to help you Succeed.

Just enter your Name and Email, and click Subscribe!

FinancialMarkets

FinancialMarkets

Comments