7 Things You Need To Know On FInancial Markets

Good day, we had a quiet start to the week, expecting some action today onwards - oil has been steady moving sideways, here's your market report.

- Home

- 7 Things You Need To Know On FInancial Markets

Inflation ticks Higher

Who ever said the war on inflation

would be a straight line ending in a

soft landing (or downturn)? While the

US Federal Reserve has made a lot of

progress over the past two years, this

week proved that some battles will be

lost along the way. With interest rates

still sky high, the American economy

has continued to make mincemeat out

of Team Recession’s two years of unrealized predictions. But as the central bank chases its 2% inflation target, pockets of a too-hot US economy have proven stubborn. Consumer prices jumped in January, stalling recent disinflation progress

and dashing hopes on Wall Street that the Fed would start dropping rates soon. The main contributor to

the uptick? Shelter costs. Then there were the prices paid to US producers, which also rose in January by

more than forecast. Of course there was also more good news for Americans: Consumer sentiment

ticked up again and prices of used cars dropped on a monthly basis by the most since 1969 after the

methodology was updated. Broader goods prices and energy also continued to fall.

Fed Insight

Minutes from the Federal Reserve’s latest gathering show most officials remained more worried about

the risk of cutting interest rates too soon than keeping them high for too long and damaging the economy. A summary of the Jan. 30-31 Federal Open Market Committee meeting released Wednesday showed

policymakers want to see more evidence inflation is firmly on a path to their 2% target before lowering

interest rates, with some raising concerns that progress could stall. Together, the minutes reinforced

expectations that borrowing costs will remain high for the foreseeable future.

Chinese Spending Boost

Chinese travel and spending during the Lunar New Year holiday exceeded levels from before the pandemic, adding to signs that consumption is improving. Some 474 million tourist trips were made around

the country during the festival, which began Feb. 10 and concluded Saturday — up 19% from the comparable period in 2019, while tourism spending for the holiday climbed nearly 8% from that

year. Chinese stocks look poised for a strong open when onshore traders return from the Lunar New

Year break, with the data seen bringing much-needed relief to one of the world’s worst-performing major markets.

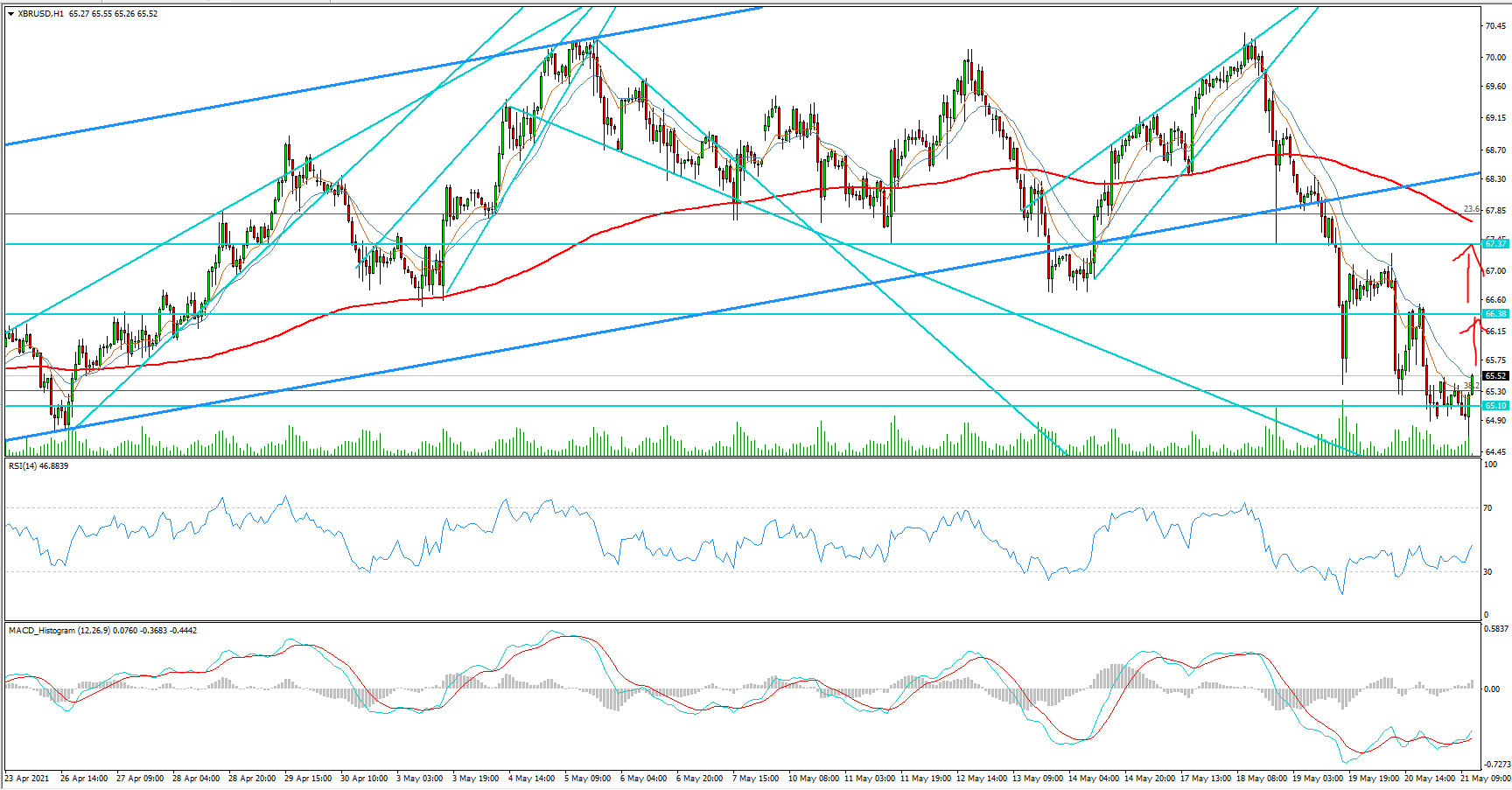

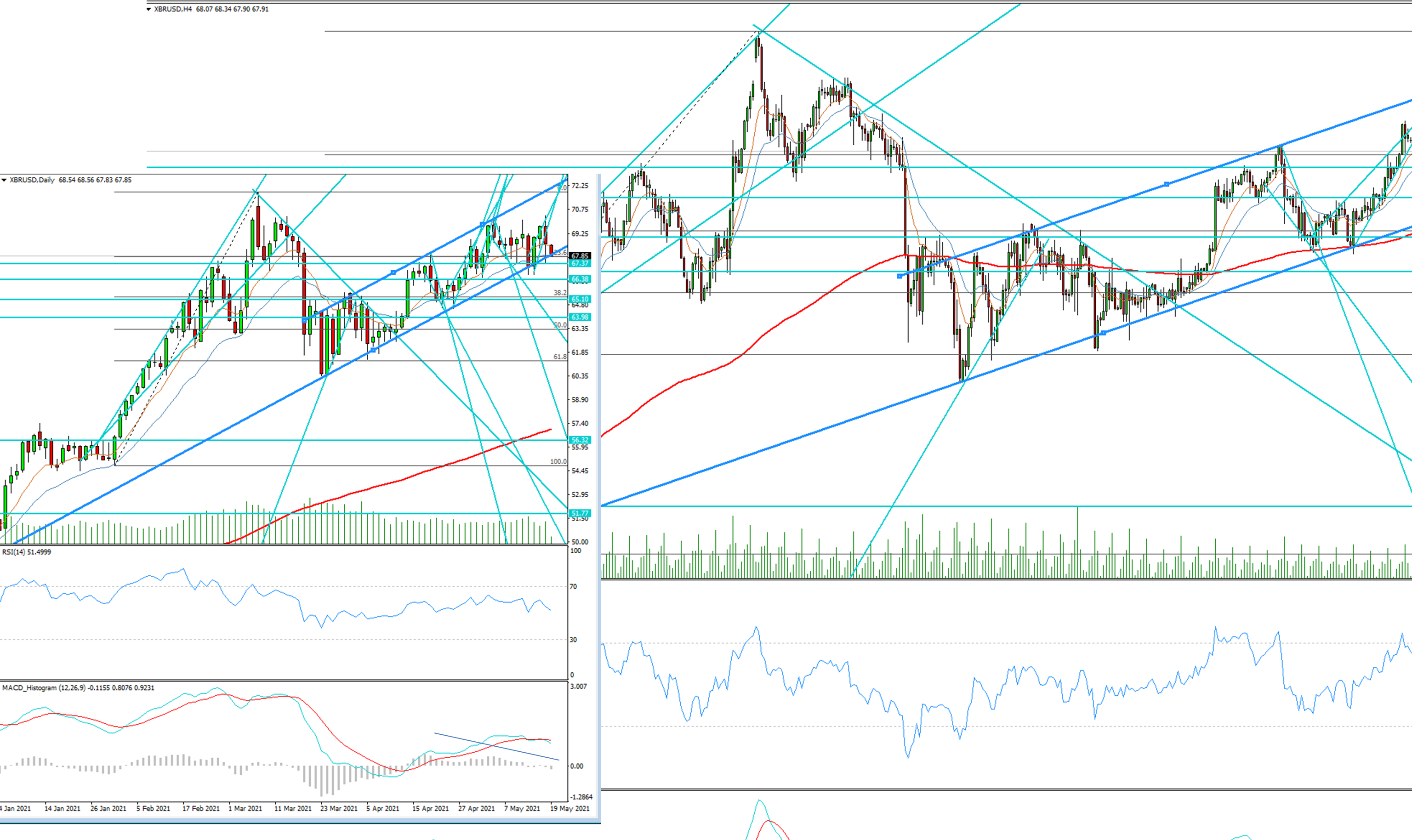

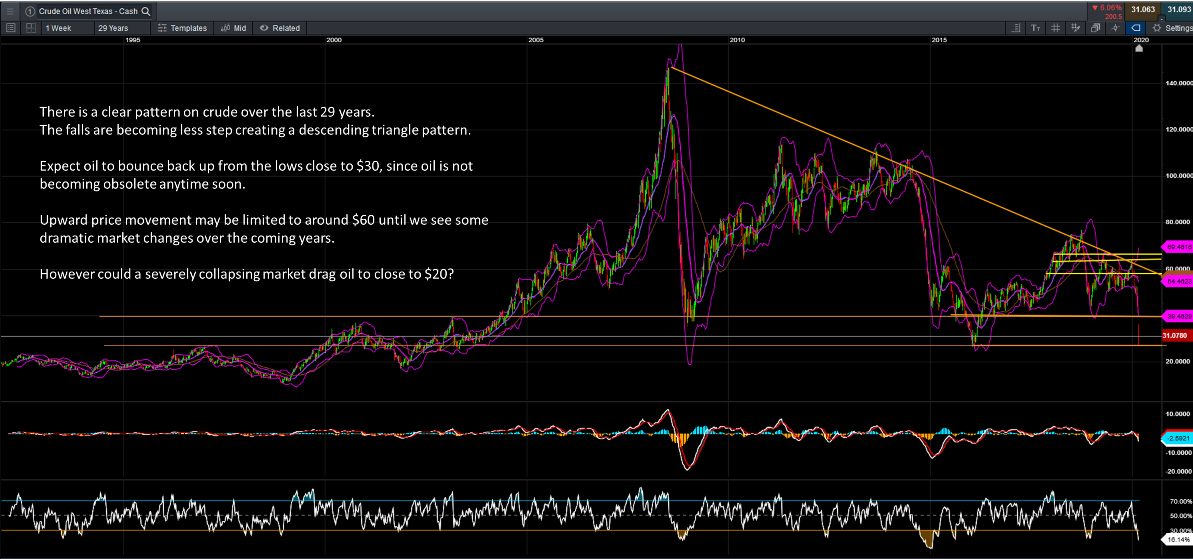

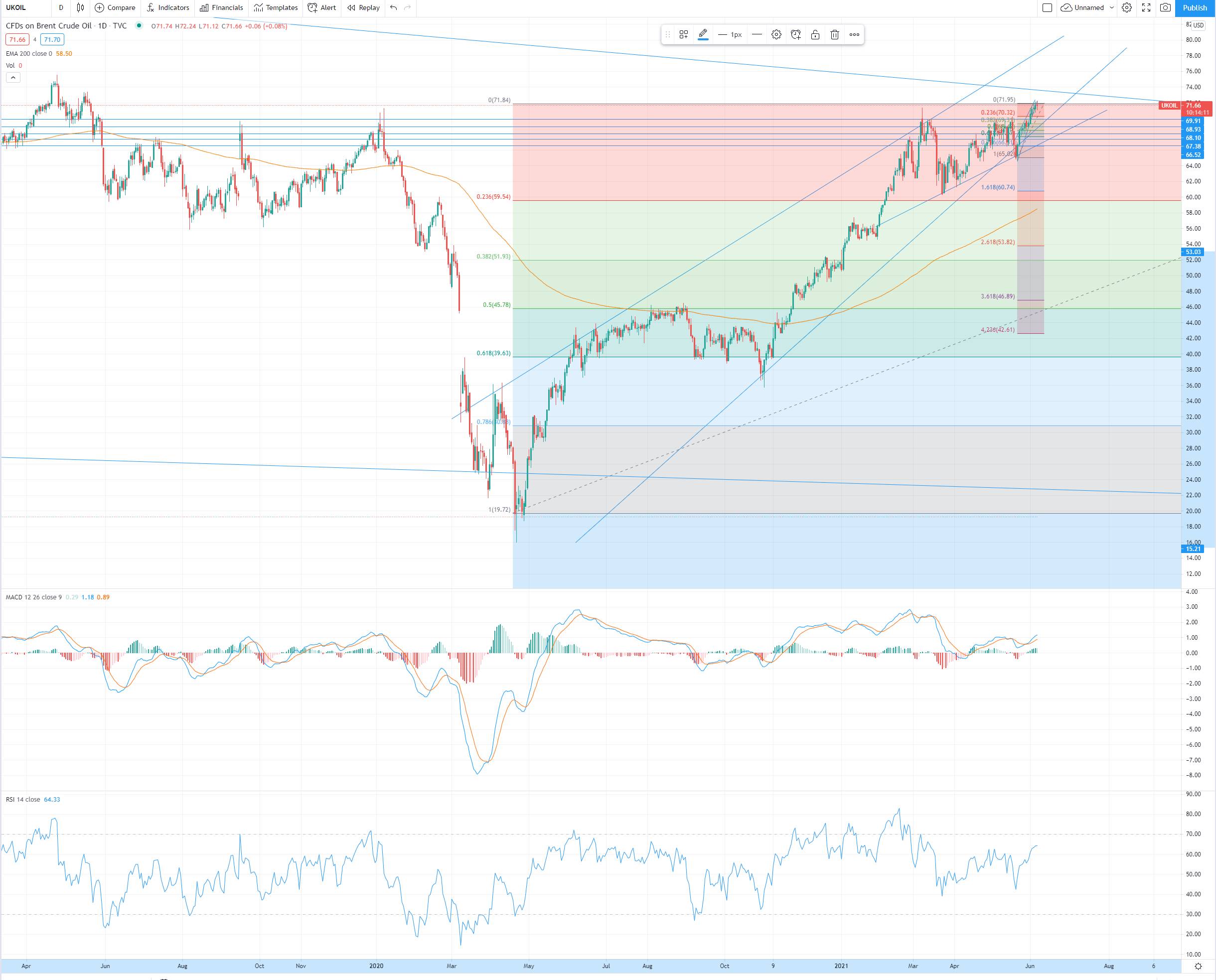

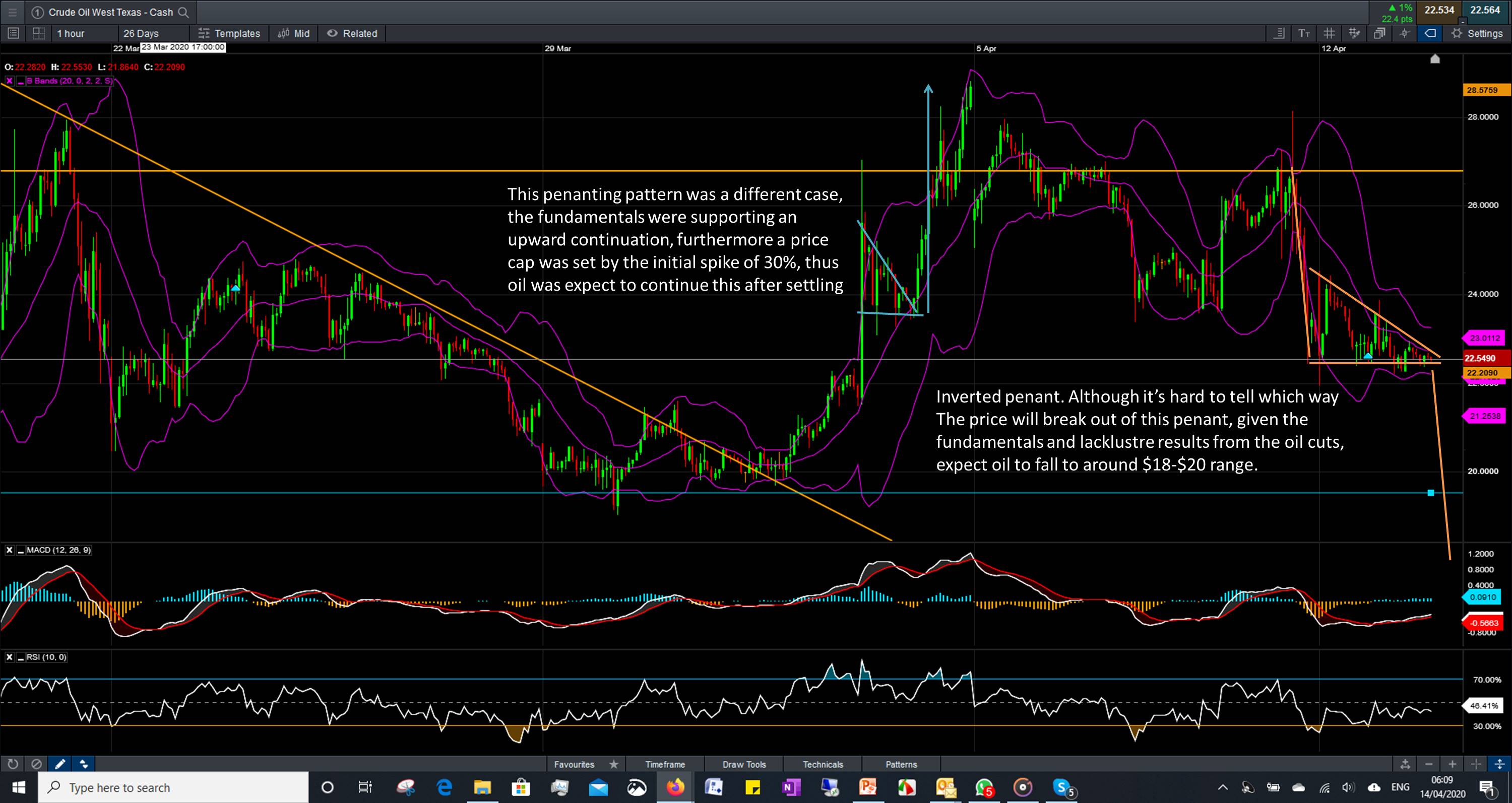

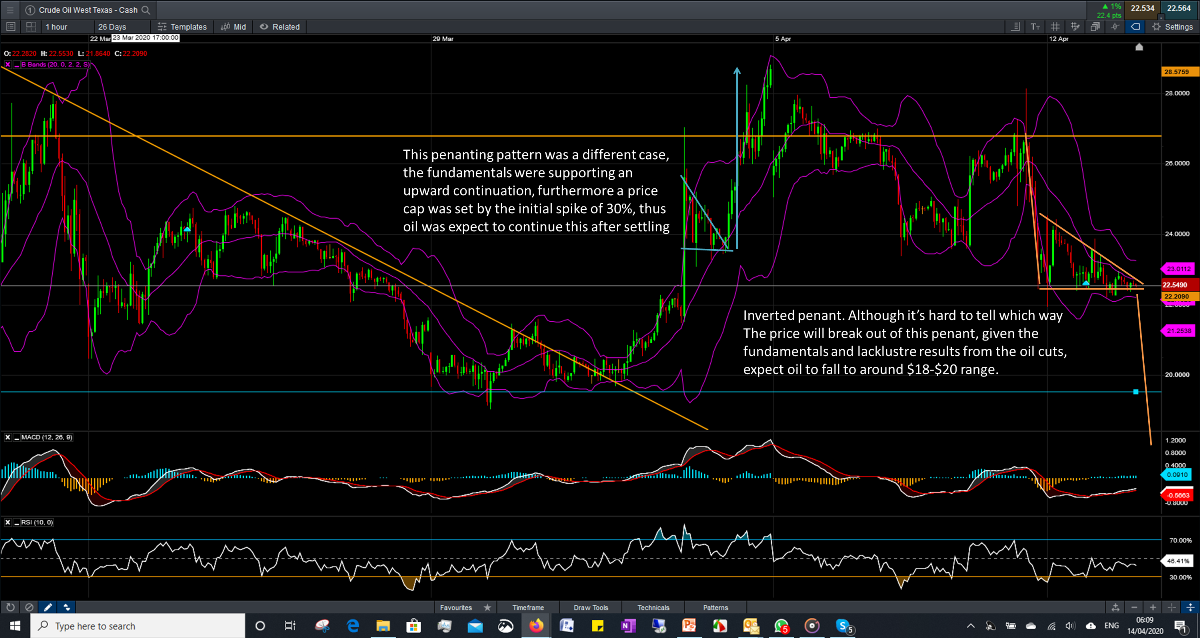

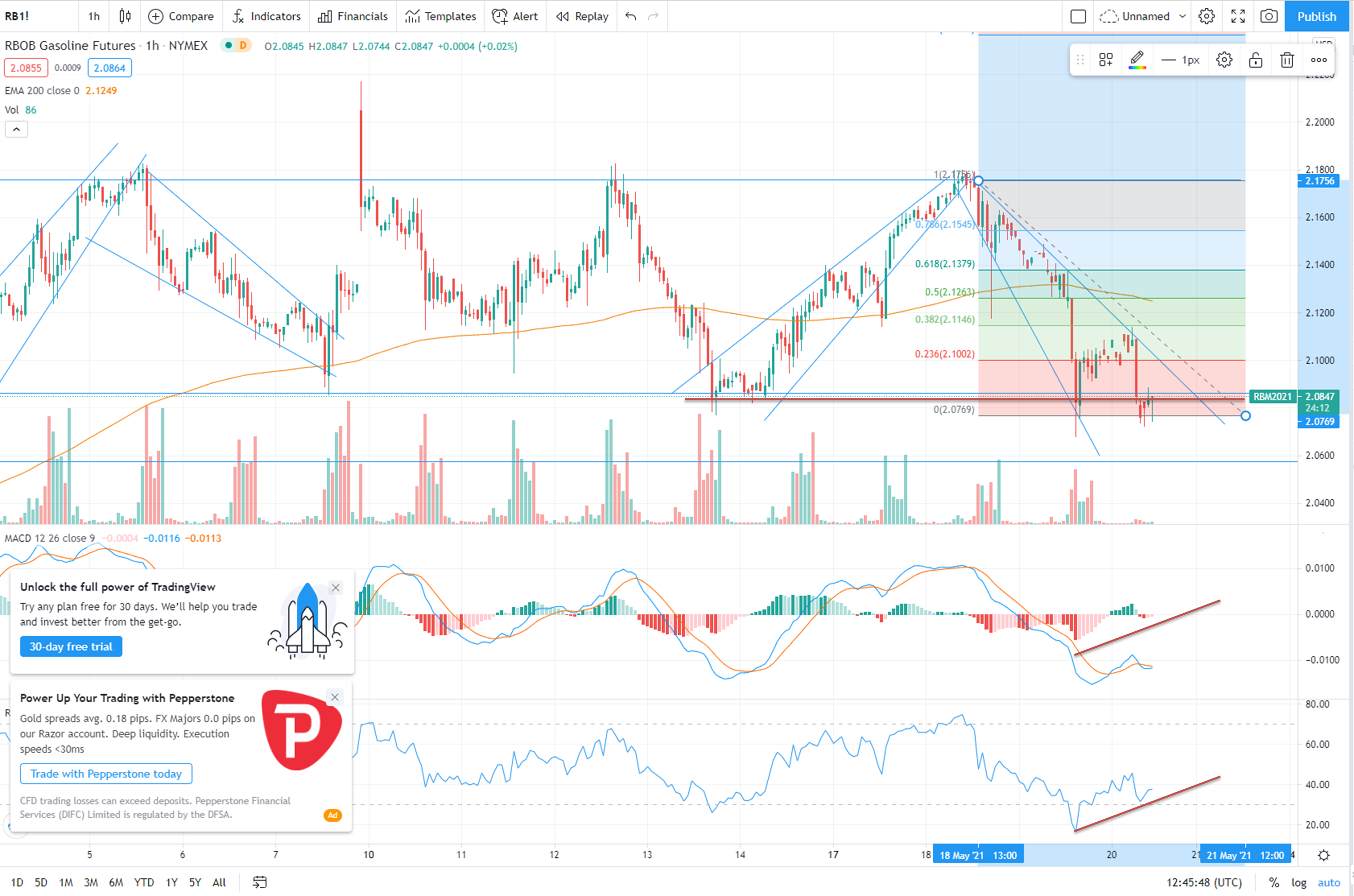

Oil Market Yesterday

Oil prices rose for a second day on Thursday on expectations that demand in the U.S., the world's biggest oil consumer, will improve as refineries try to

return to service after outages and as the dollar

weakened.

Crude stocks rose 7.17 million barrels in the week

ended Feb. 16, market sources citing American Petroleum Institute figures said on Wednesday. Gasoline stockpiles also rose while distillate fuel inventories declined.

Shipping risks have escalated due to repeated drone

and missile strikes in the Red Sea and Bab alMandab Strait by the Iran-aligned Houthis since November. U.S. and British forces have responded with

several strikes on Houthi facilities but have so far

failed to halt the attacks.

Oil contracts tied to near-term deliveries have been

trading at their steepest premium to later-dated

contracts in multiple months, a market structure

known as backwardation and considered a sign of a

tightly supplied market. Timespreads are showing

markets tightening, UBS analyst Giovanni Staunovo

said, adding that crude stocks declined in the Amsterdam-Rotterdam-Antwerp trading hub while

product stocks slid in Fujairah last week.

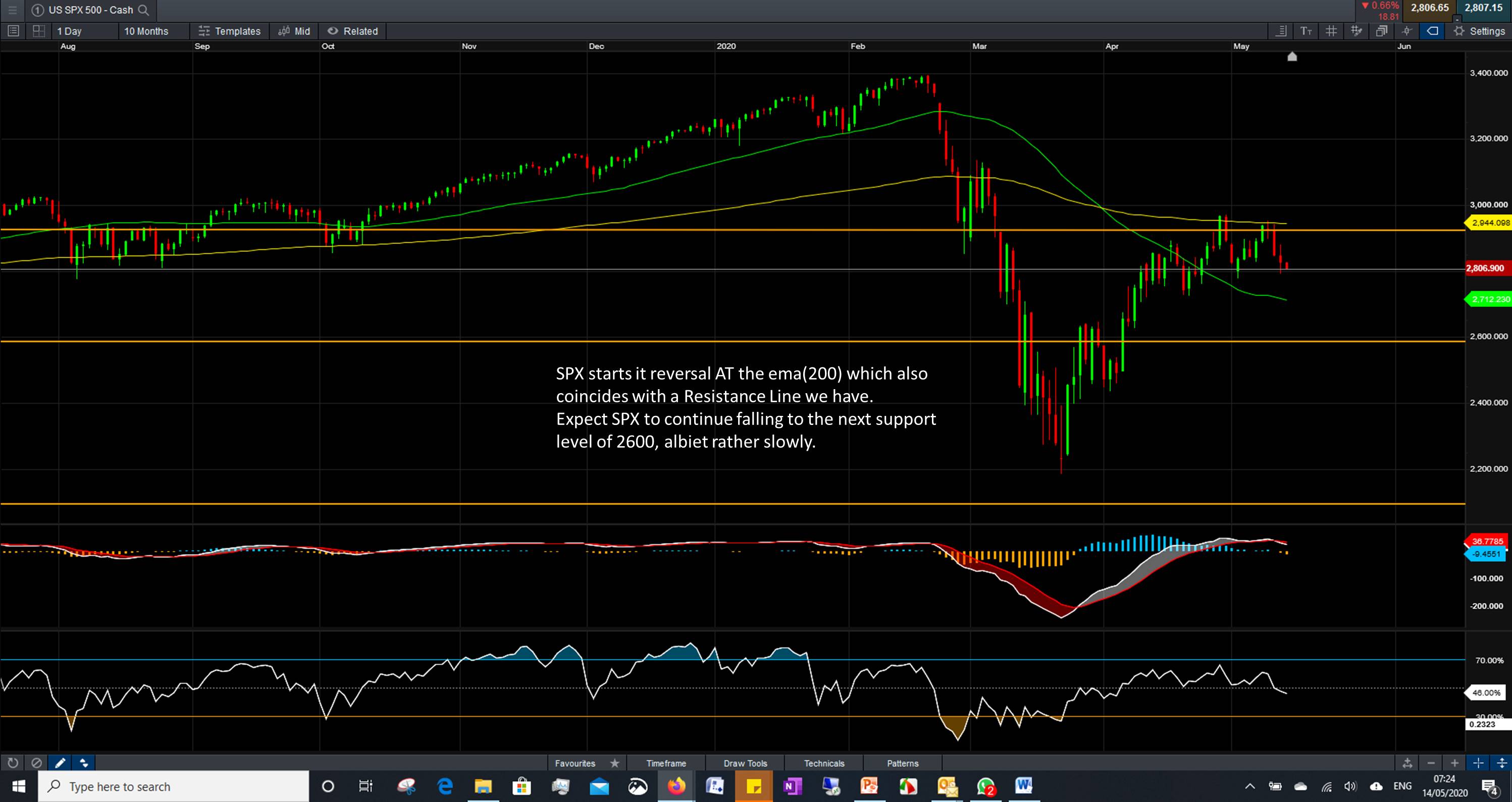

MACRO Economics

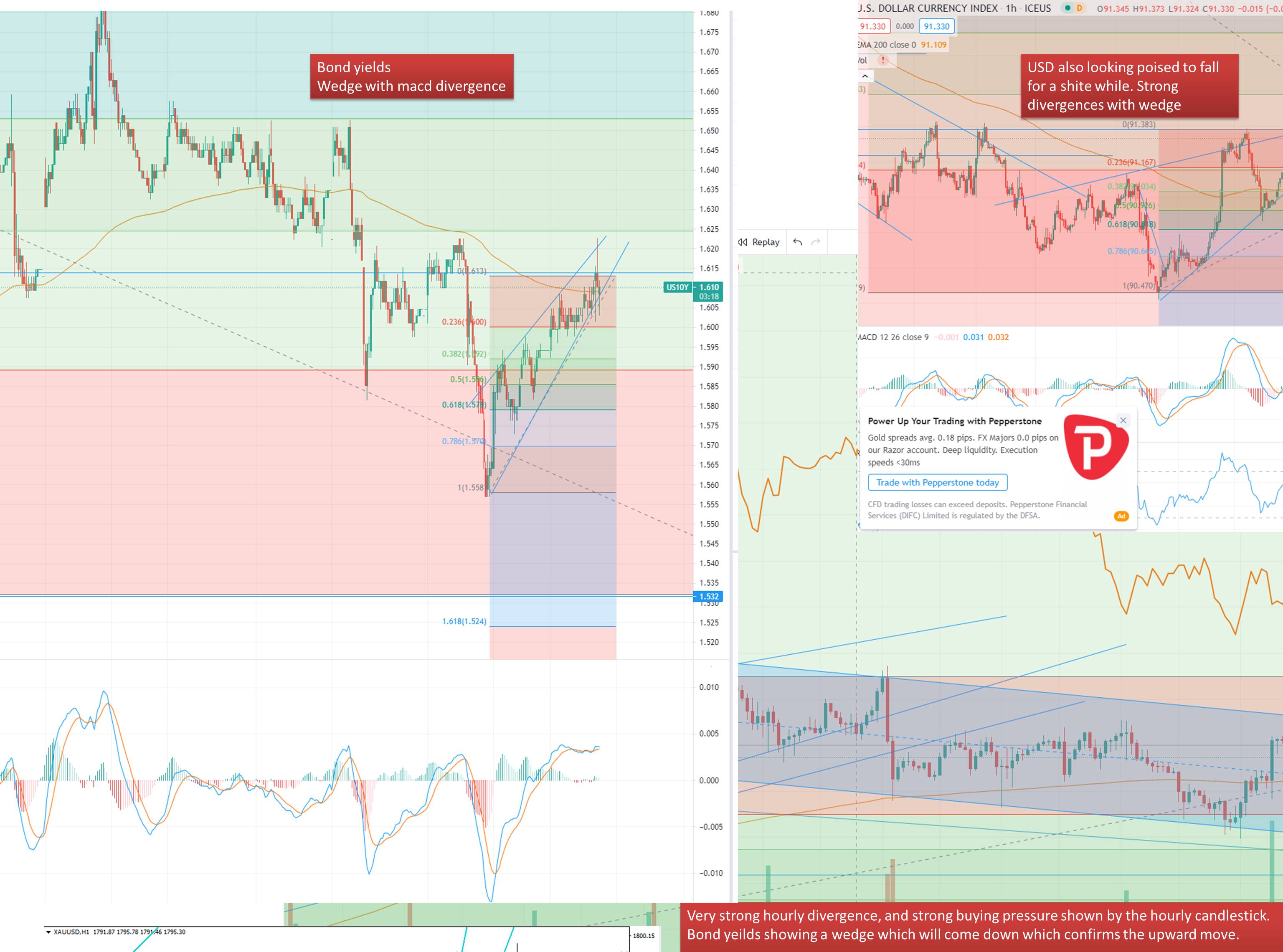

The dollar held broadly steady on Thursday as traders

awaited a slew of business activity surveys to gauge the

health of major economies and what that may mean for

the global interest rate outlook.

U.S. Treasury prices tumbled, pushing yields higher across

the board on Wednesday, weighed down by a weakerthan-expected 20-year bond auction and minutes of the

last Federal Reserve meeting that expressed concern

about cutting interest rates too quickly.

The bulk of policymakers at the Federal Reserve's last

meeting were concerned about the risks of cutting interest rates too soon, with broad uncertainty about how

long borrowing costs should remain at their current level,

according to the minutes of the Jan. 30-31 session.

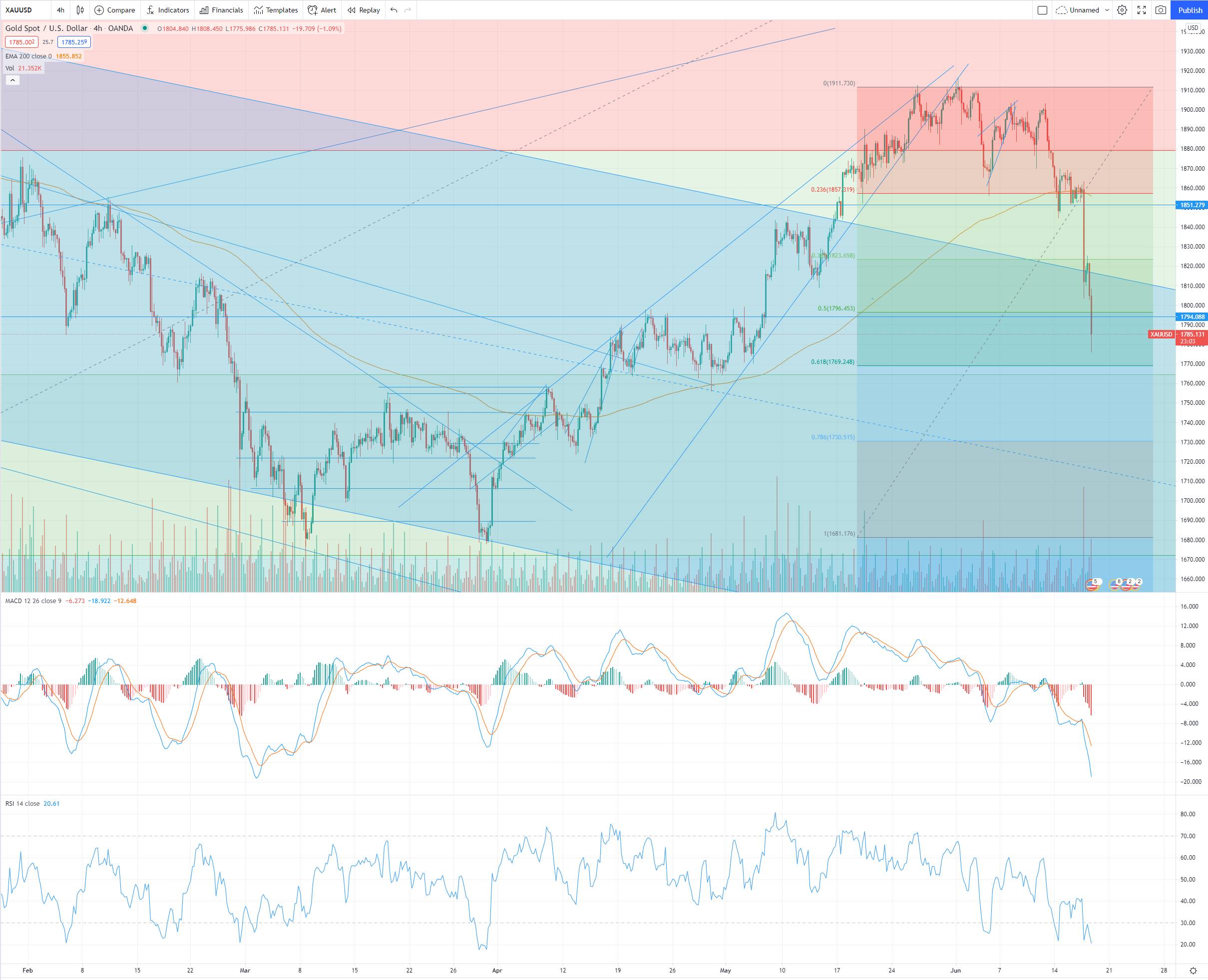

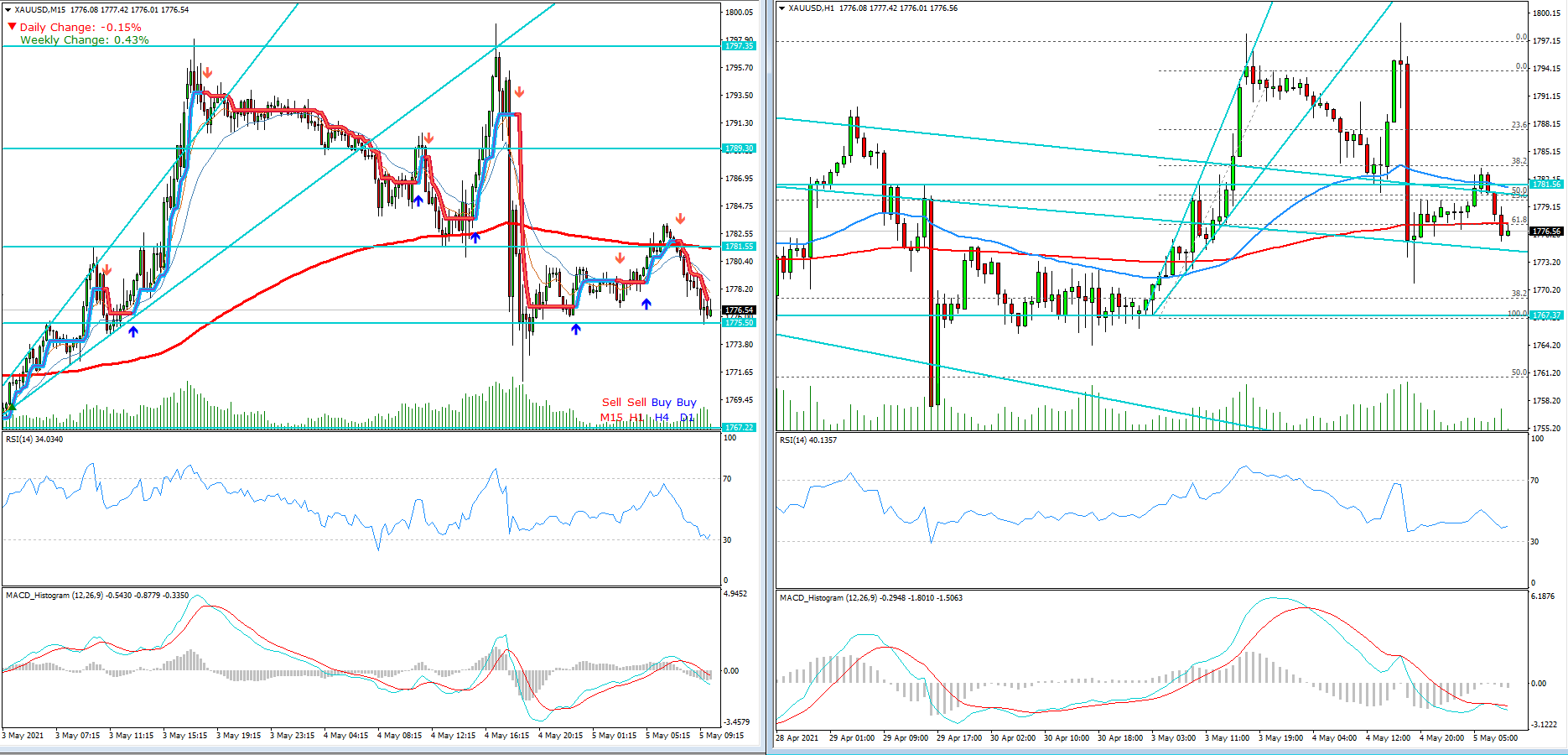

Gold prices edged higher on Thursday, buoyed by a weaker dollar and escalating tensions in the Middle East, while

investors await more U.S. economic data that could shed

light on the Federal Reserve's interest rate outlook.

(prior revised down to +1.7%).

Key Market Data

Today / Tomorrow

Thursday

Eurozone CPI

05.00

Initial Jobless Claims

08.30

Manufacturing PMI

09.45

Services PMI

09.45

Existing Home Sales

10.00

Crude Oil Inventories

11.00

Friday

Nothing Major in our Opinion

Is your Paper Trading on Brent Crude making

5-15% Profit Monthly?

Our Oil Trading Clients in Dubai gained 85% Profit in 2023,

on Oil Paper Trading, by following our unique Strategies.

Book a Meeting Today

To discuss your Challenges with Oil Hedging & Paper Trading

Call: +971 58 540 0412

Email: nasir@financialmarkets.club

- Admin

- 22 Feb 24

- 0 Comment

Related Posts

You have to logged in for comment.

Email Newsletter

Get subscriber only insights & news delivered by Financial Markets Club

Weekly Trading Lessons by Email

Do you want to Learn to Trade like a Pro? Every Week we will share some Trading Tips to help you Succeed.

Just enter your Name and Email, and click Subscribe!

FinancialMarkets

FinancialMarkets

Comments