Markets Looking Bullish Until Next Earning Season Q2 2020

- Home

- Markets Looking Bullish Until Next Earning Season Q2 2020

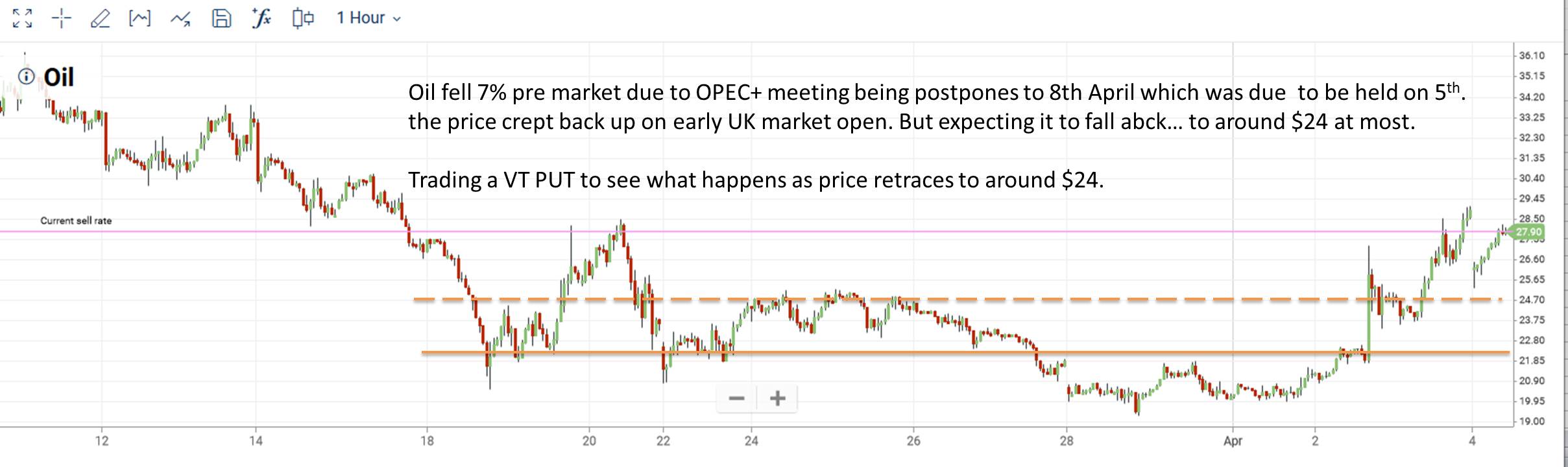

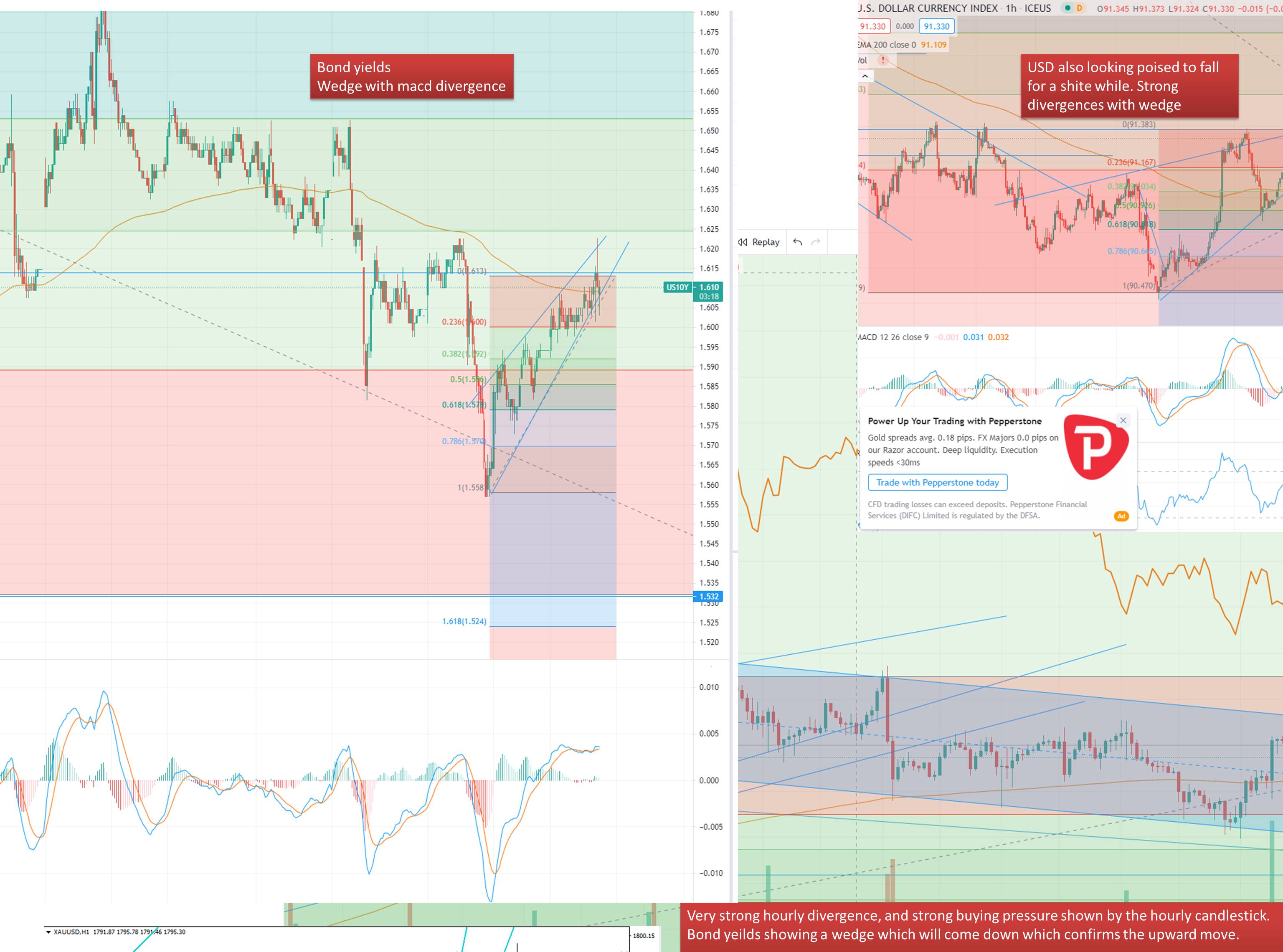

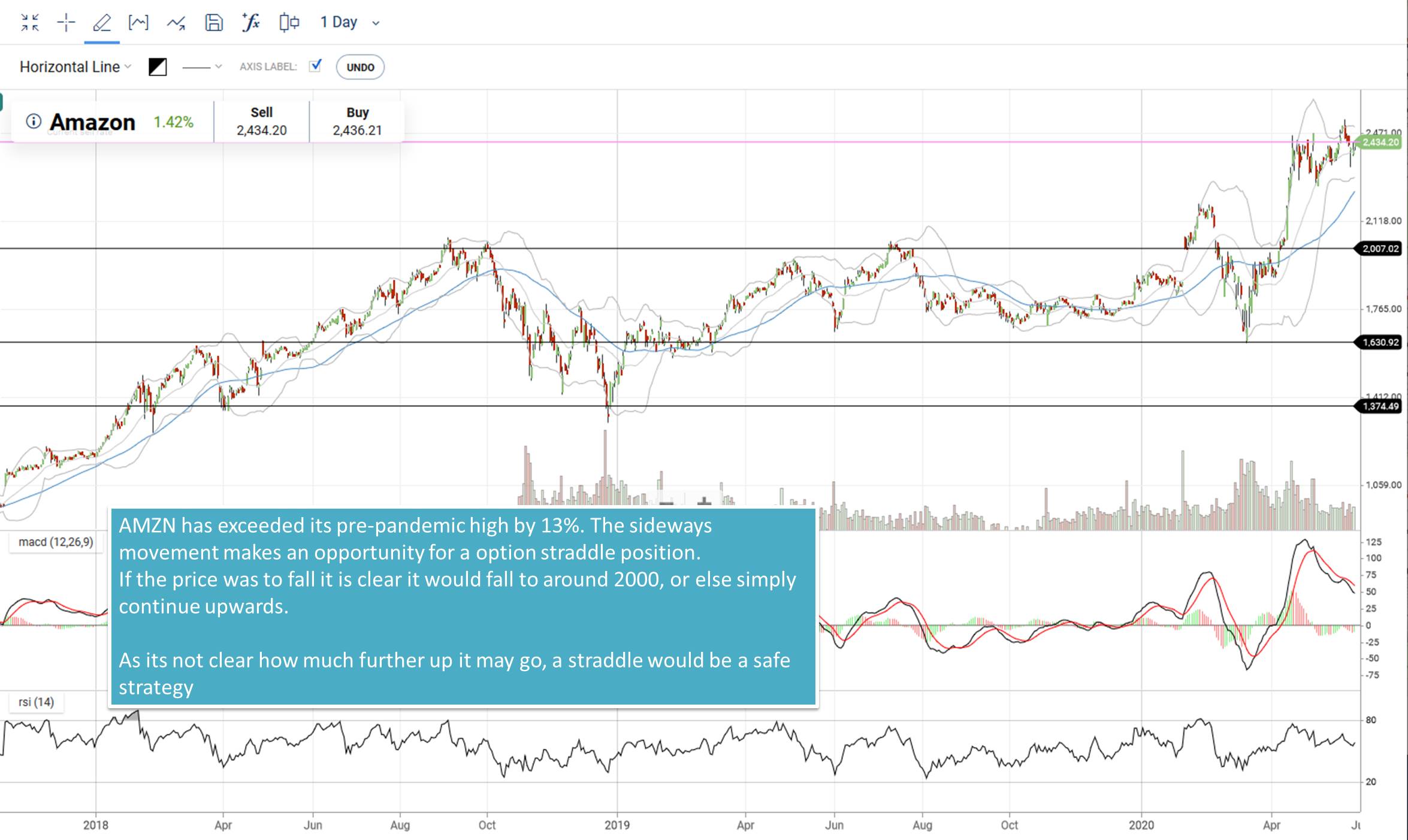

Couple of days ago, I changed my stance on the market. With S&P500 breaking above 3000 level and sustaining this, and commodities such as Oil heading up and strong, along with world economies opening up, it seems we have at least a couple of months of bullish markets.

Interestingly enough Goldman Sacs changed their stance as well on the same day, issuing a press release where they expect the S&P500 to go as low as 2800 only. In my years of being the markets, I have rarely seen investment banks change their view on the markets so quickly. But I can't blame them, circumstances seem to be changing every other week for the last couple of months.

I say at least, as I am sure in the next earning seasons the true damage of the covid lock down will be realised, as companies come out with their earnings.

Moreover, the covid virus hasnt exactly disappeared, so we may see another wave of this virus, taking us all back to lock down again. This may quite easily coincide closely with the next earning season.

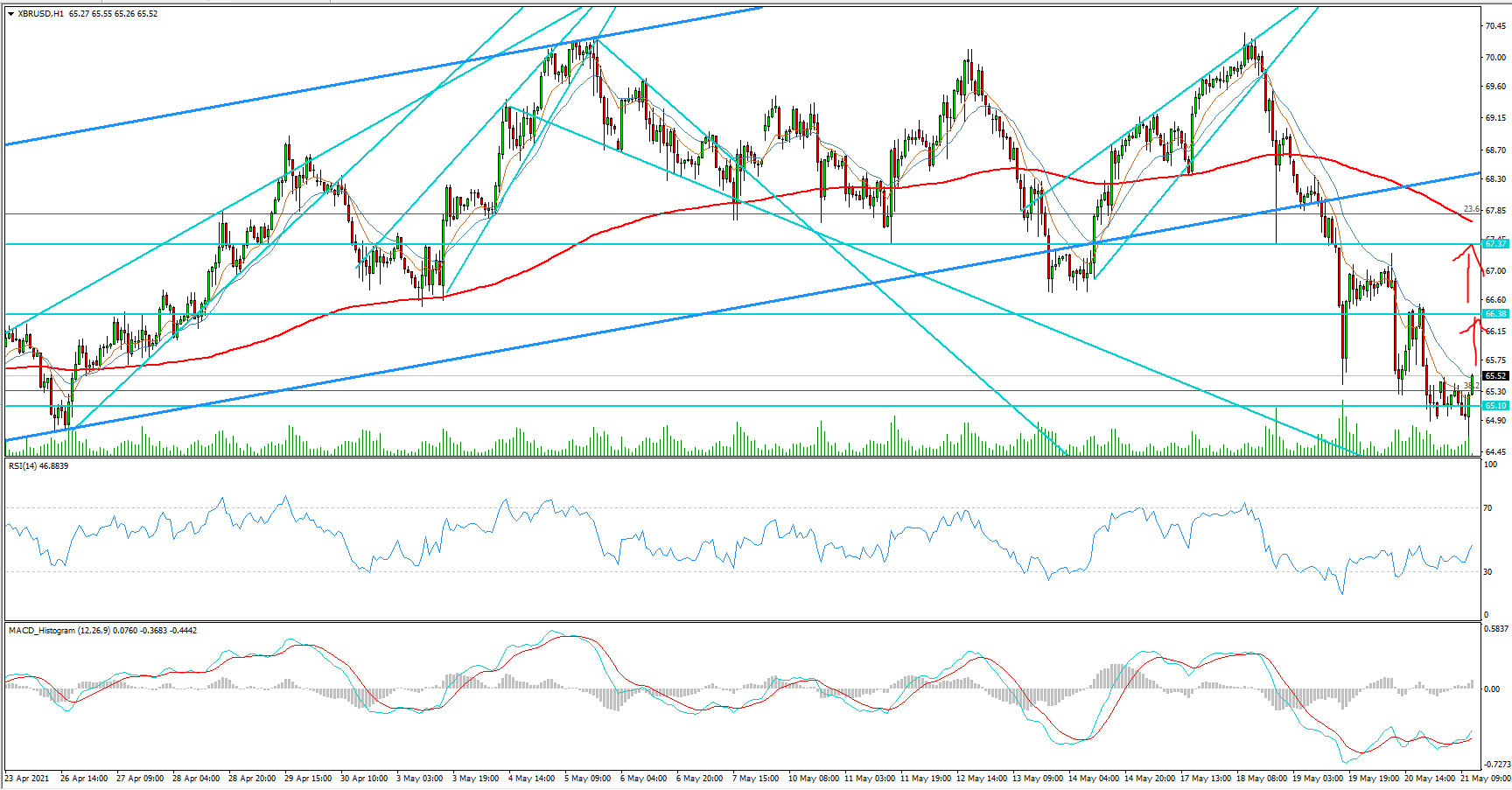

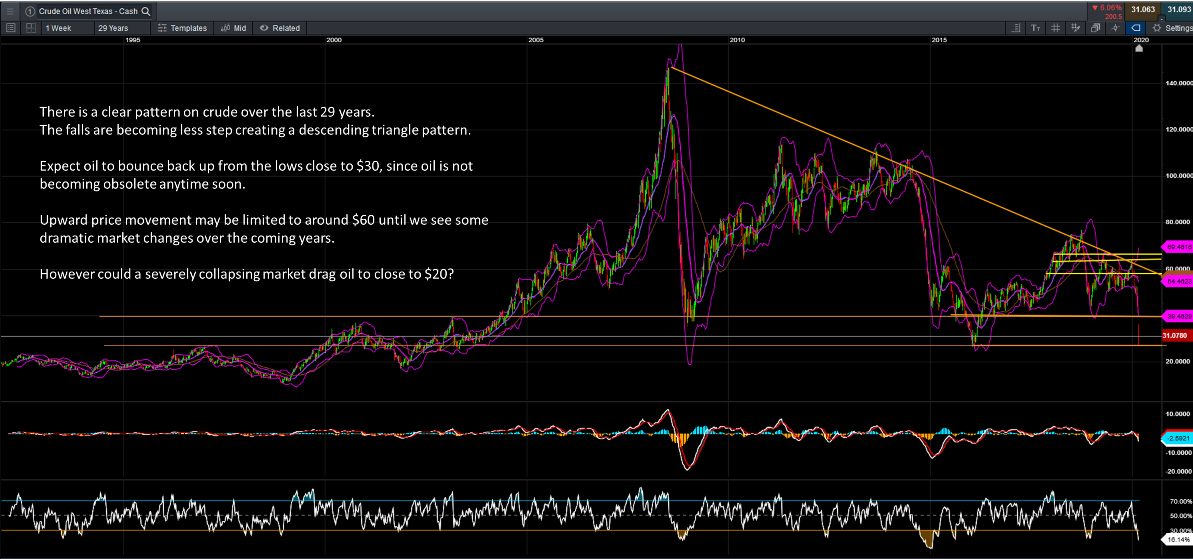

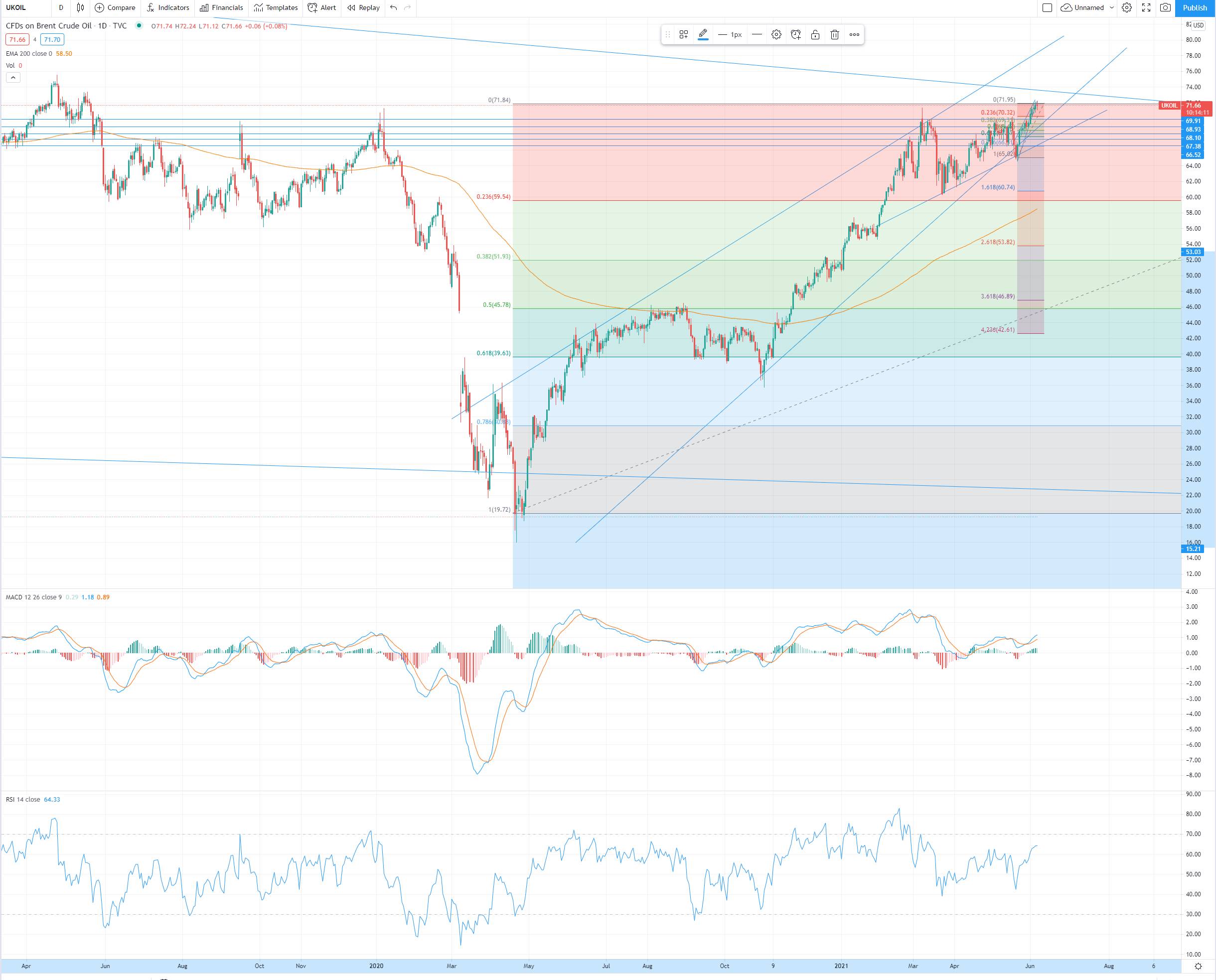

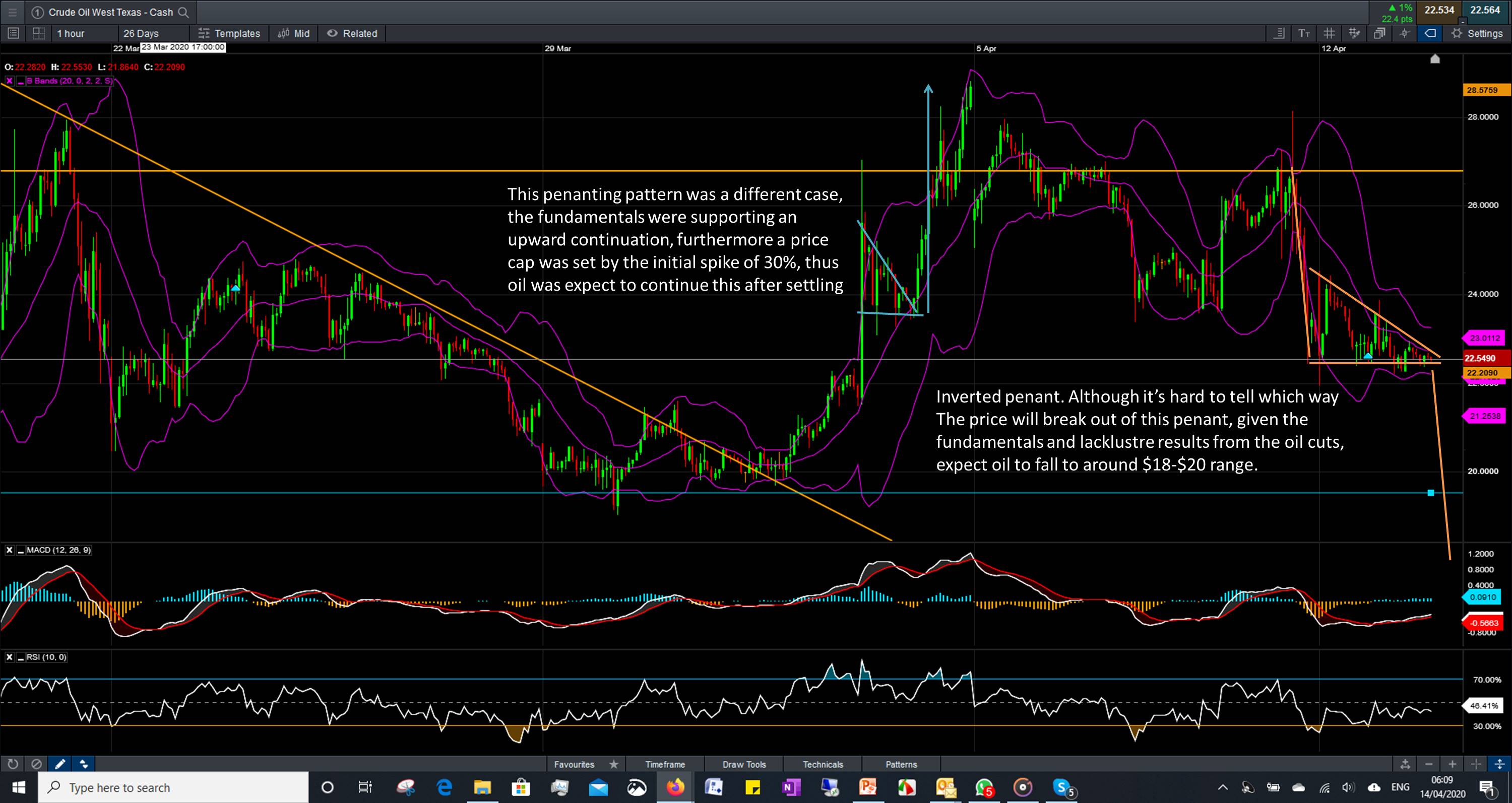

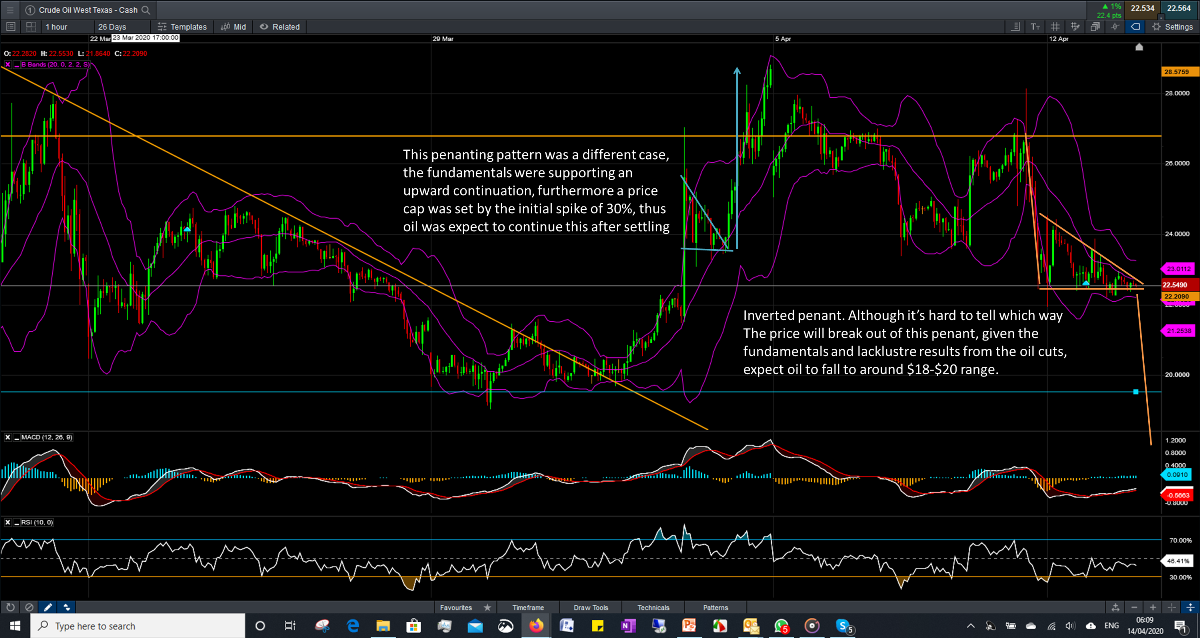

Until then.... I can see the markets potentially making "new highs" rising above the high they set before the March collapse. So here is a summary of some of the hot stocks I got my eyes on. My watch list include Crude Oil - for which i have a separate blog post here: http://financialmarkets.club/trader-blog/wti-crude-is-too-strong-heading-towards-43-48

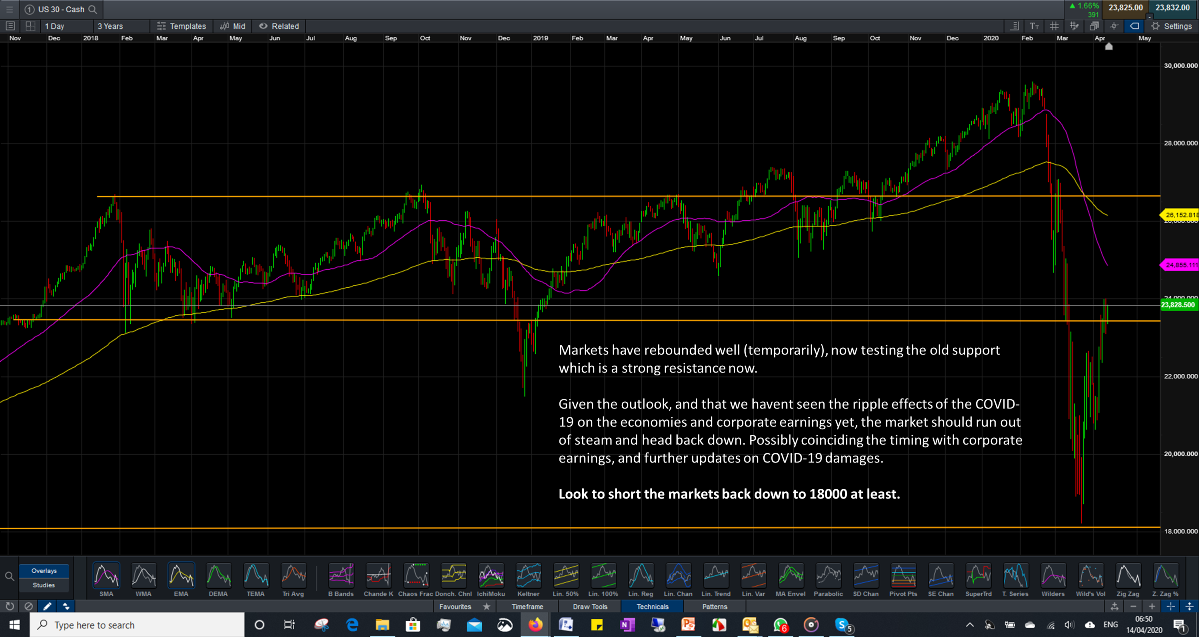

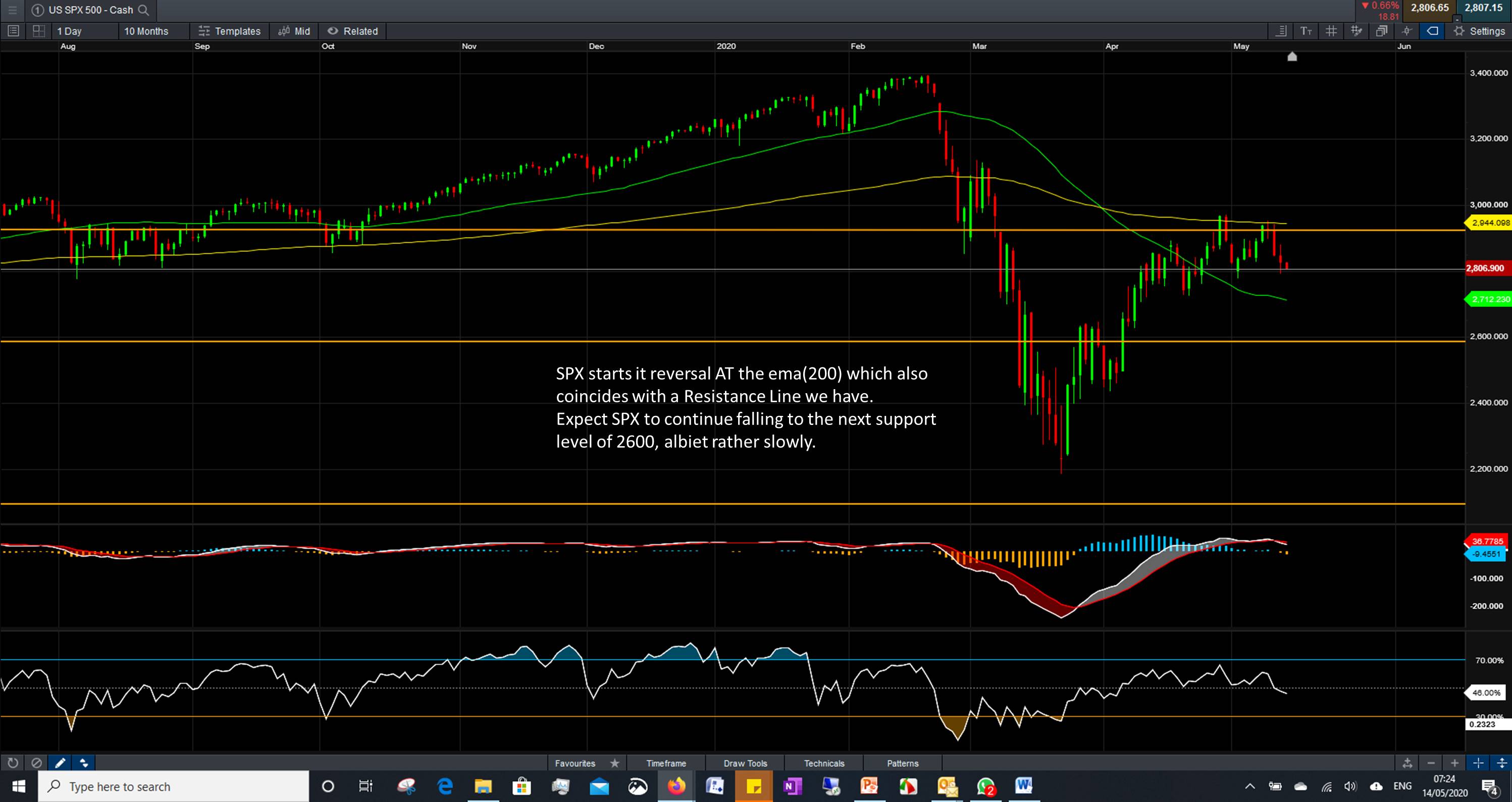

SPX is looking intersting now. Surpassed MA(50) and now testing ema(200).

Judging by the widening bollinger bands, and increase RSI and MACD, market should continue, most possibly to previous highs – as witnessed by some stock such as FB, AAPL, GOOG, MSFT.

I think the next 2 months will be good for SPX. Come the next earning season is when everyone should be reporting the damages done by lock downs, which should bring the market back down.

- Admin

- 03 Jun 20

- 0 Comment

Related Posts

You have to logged in for comment.

Email Newsletter

Get subscriber only insights & news delivered by Financial Markets Club

Weekly Trading Lessons by Email

Do you want to Learn to Trade like a Pro? Every Week we will share some Trading Tips to help you Succeed.

Just enter your Name and Email, and click Subscribe!

FinancialMarkets

FinancialMarkets

Comments