9 Things You Need To Know on the Markets Today

Sunak opened a rift in his party, US inflation data lies ahead and a fentanyl crackdown is coming. Here’s what people are talking about.

- Home

- 9 Things You Need To Know on the Markets Today

Good Day. Sunak opened a rift in his party, US inflation data lies ahead and a fentanyl crackdown is coming. Here’s what people are talking about.

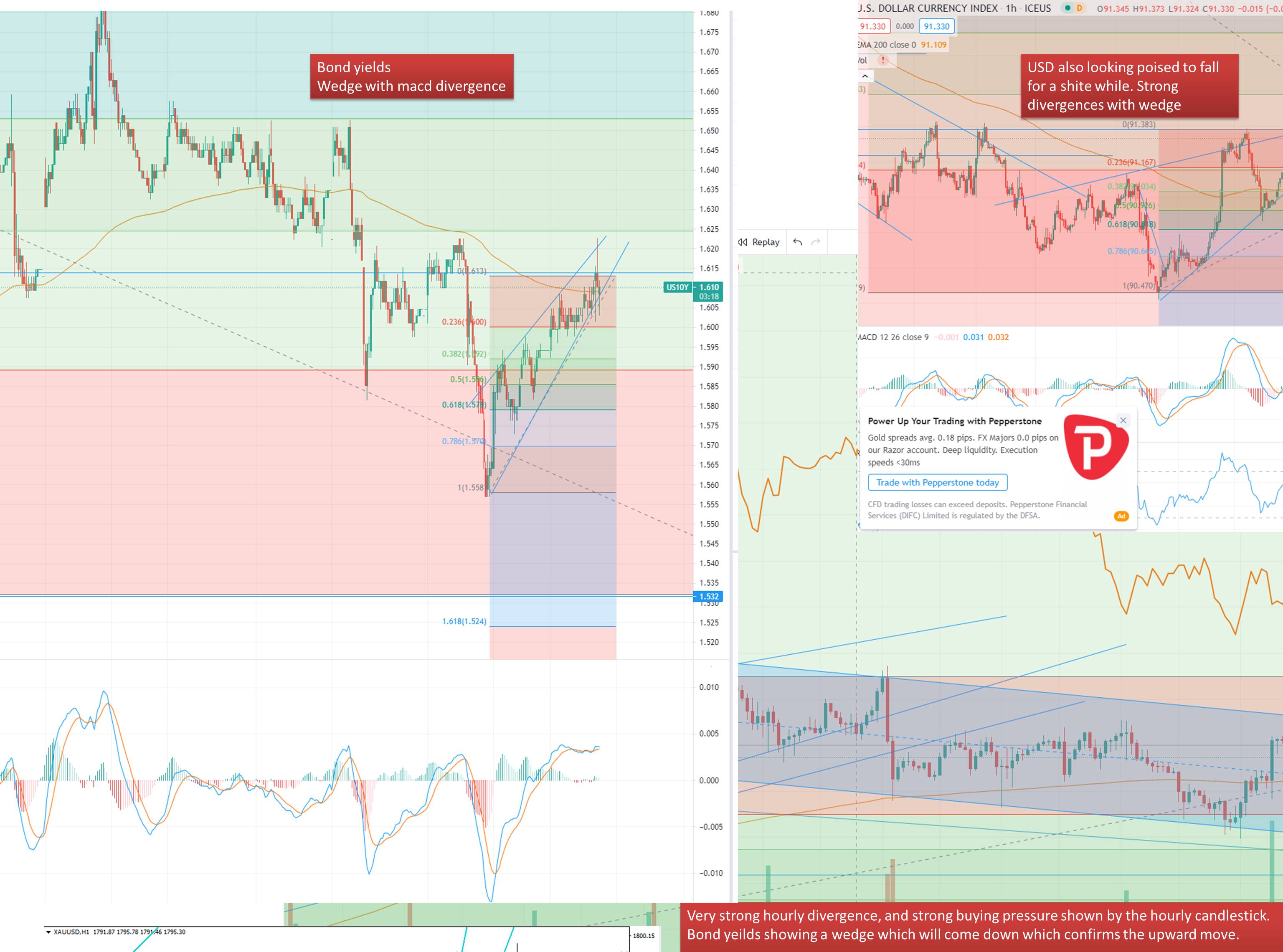

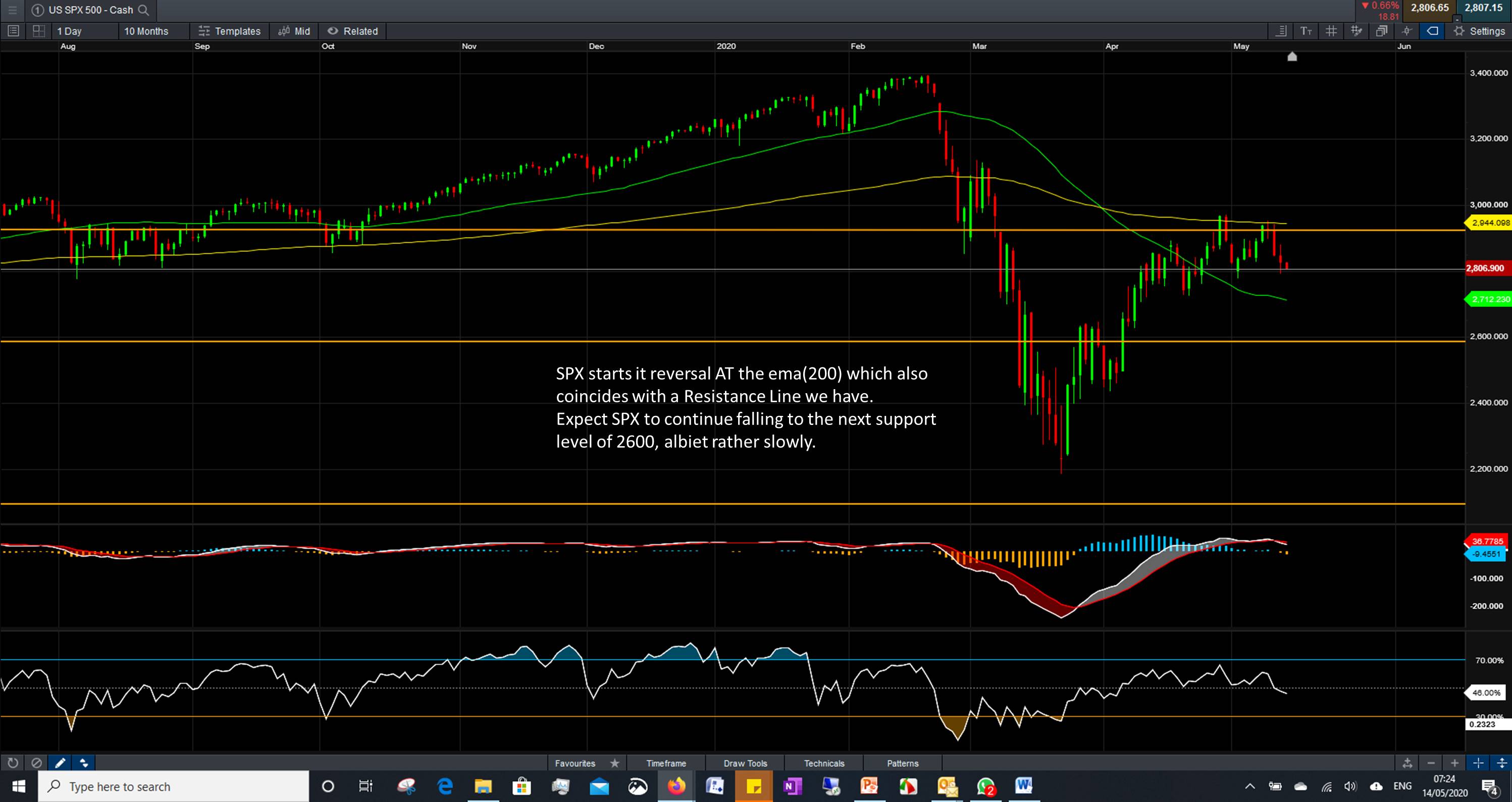

Big Bond Rally

Up and down Wall Street, it’s becoming increasingly clear that the US bond market won’t see a sustained rally unless the economy surprises even the Federal Reserve by falling into a deep recession. Over the past three years, Treasuries staged several false rebounds from the deepest rout in decades, only to reverse course, sending yields higher again and burning those who had bet big on the swing. The economy’s continued resilience has strengthened the odds that the central bank will be able to steer the US into a rare soft landing.

Up and down Wall Street, it’s becoming increasingly clear that the US bond market won’t see a sustained rally unless the economy surprises even the Federal Reserve by falling into a deep recession. Over the past three years, Treasuries staged several false rebounds from the deepest rout in decades, only to reverse course, sending yields higher again and burning those who had bet big on the swing. The economy’s continued resilience has strengthened the odds that the central bank will be able to steer the US into a rare soft landing.

U.S China Ties

The White House cited a resumption of US-China military communications as a priority ahead of this week’s meeting between Presidents Joe Biden and Xi Jinping. “The Chinese have basically severed those communication links,” US National Security Advisor Jake Sullivan said on CNN’s State of the Union. “President Biden would like to reestablish them. And he will look to this summit as an opportunity to try to advance the ball on that.”

U.S CPI

Traders are keeping a close eye on the release of US inflation data Tuesday that will shed light on the Federal Reserve’s rate-hike path. There’s a stark divide among Wall Street banks currently over how aggressive they think the Fed will be in cutting interest rates next year. The diverging opinions come after Treasuries were whipsawed in recent weeks, with traders seeking to make sense of the latest economic data even as looming debt sales fueled supply concerns.

UK Mess

The British premier began the day by firing Home Secretary Suella Braverman, setting up one of the most consequential weeks of his premiership so far — one with implications lasting until the general election likely next year. Braverman had openly clashed with Sunak’s office by taking a hard line against pro-Palestinian demonstrations in London and accusing the police of bias in the protesters’ favor. Those incendiary remarks presented Sunak with a direct challenge to his authority, and left him with a call to make about her future in his government.

The departure of the most senior right-winger in his cabinet shows the electorate that the turmoil of this Conservative government is never far from the surface, belying Sunak’s efforts to distance himself from his predecessors after years of turbulent Tory rule.

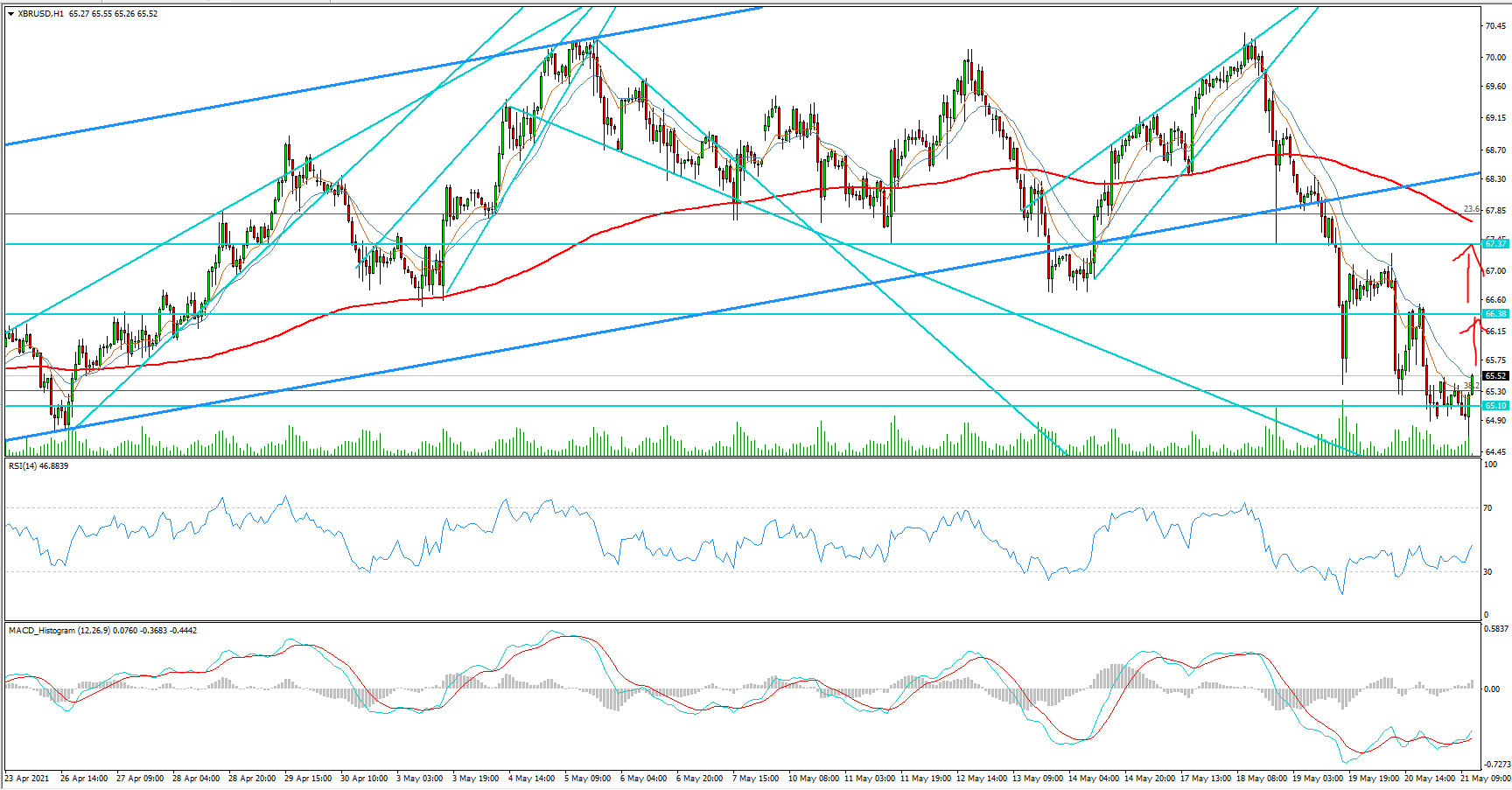

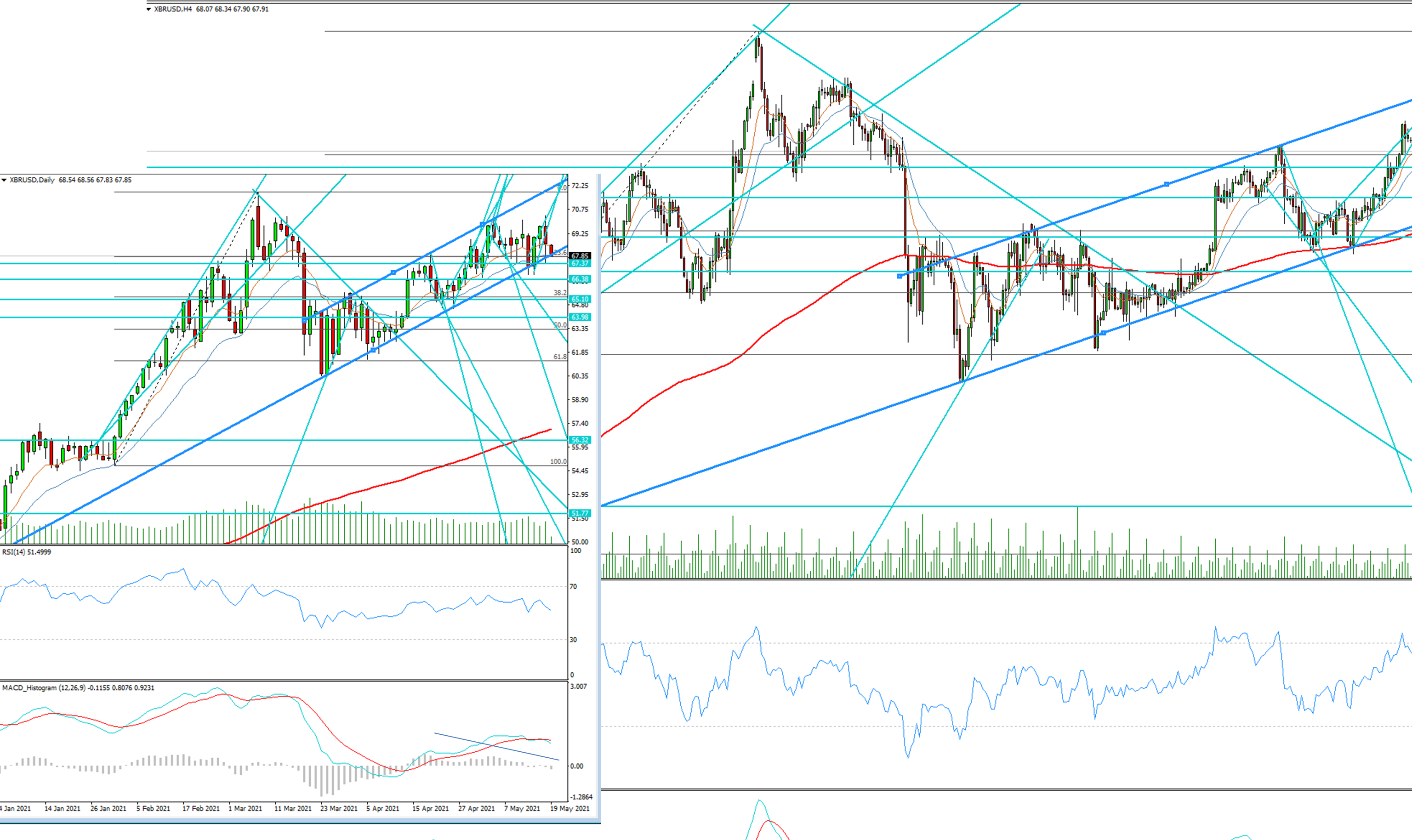

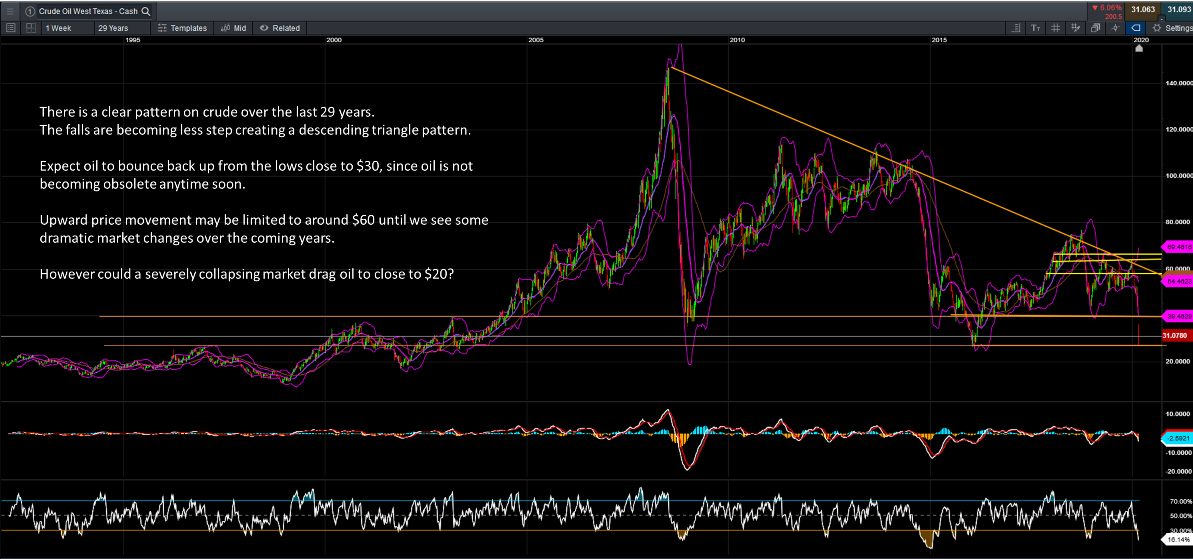

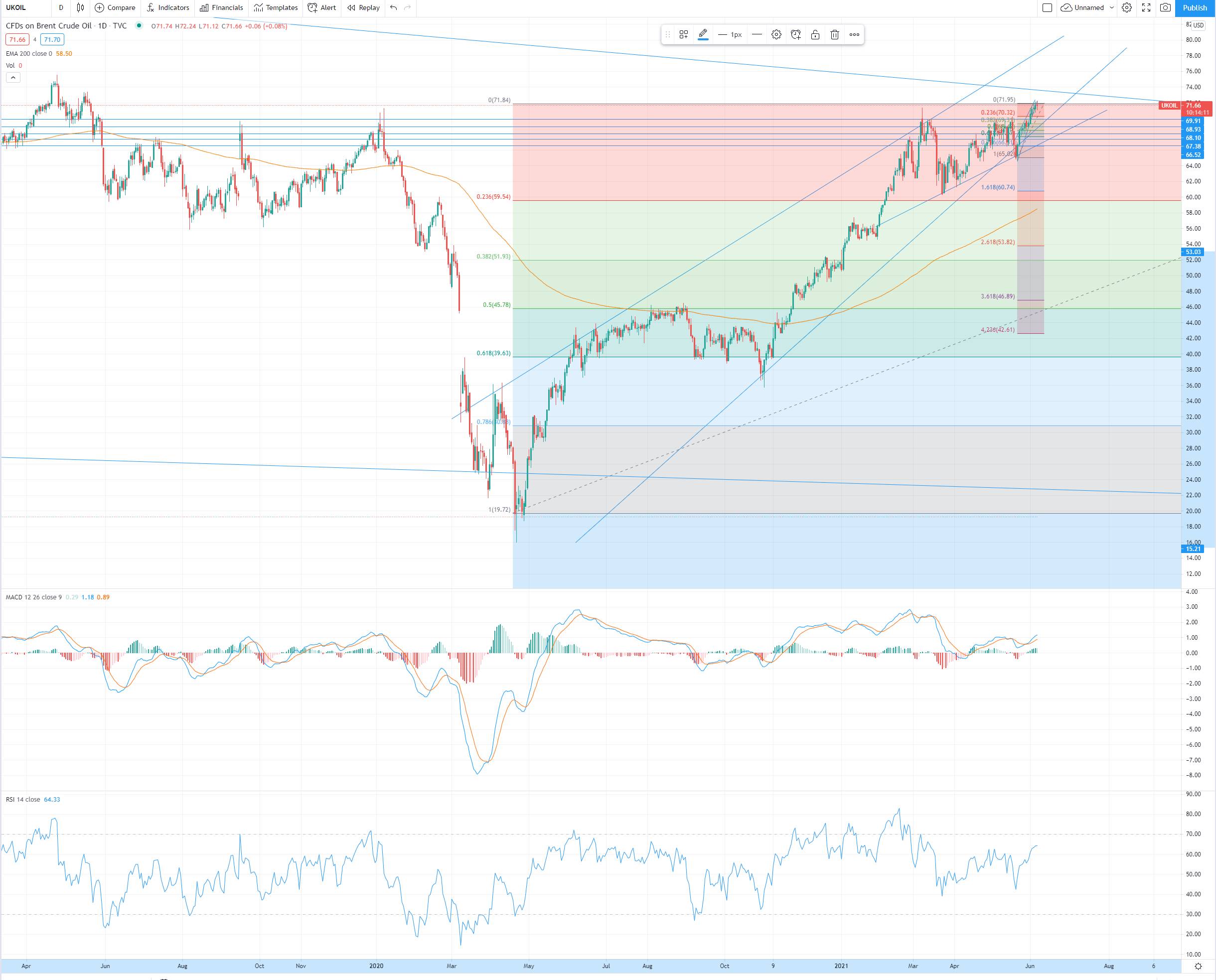

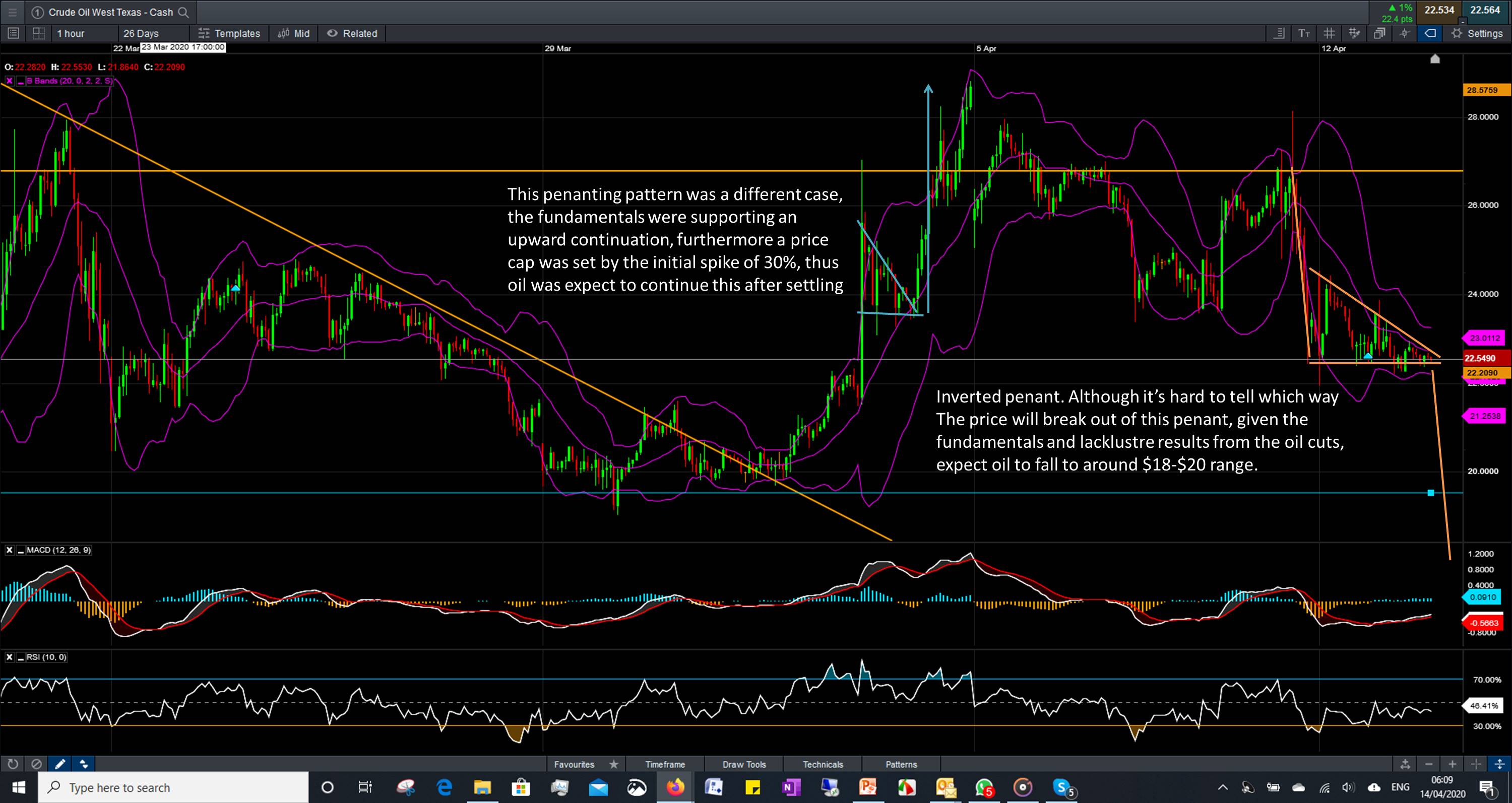

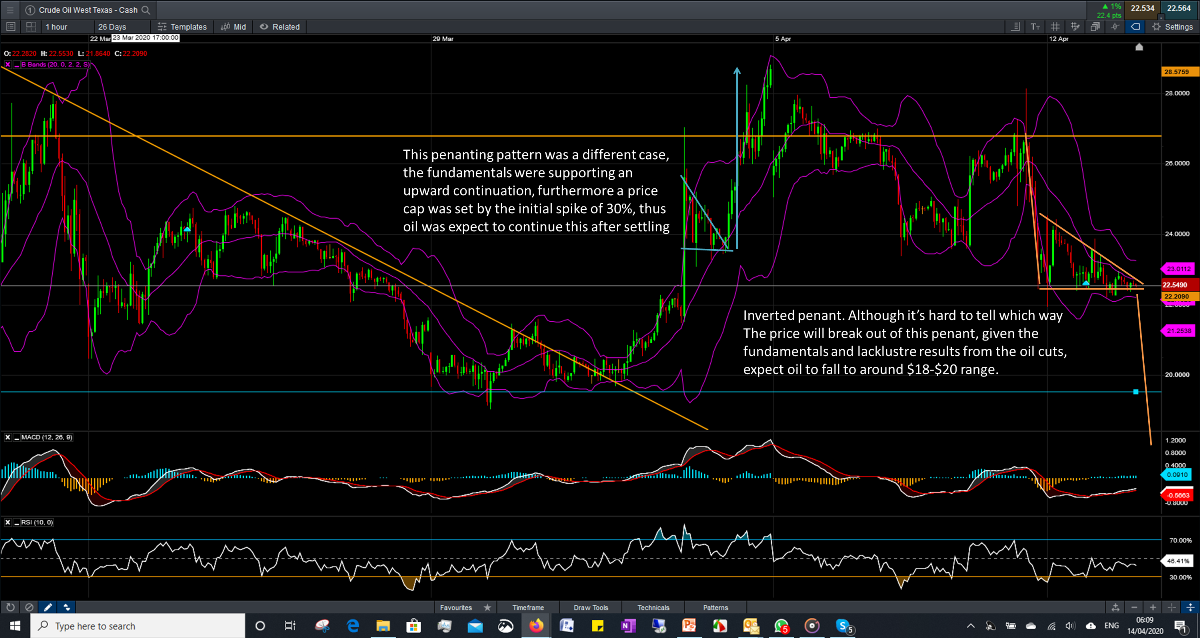

Oil Market Yesterday

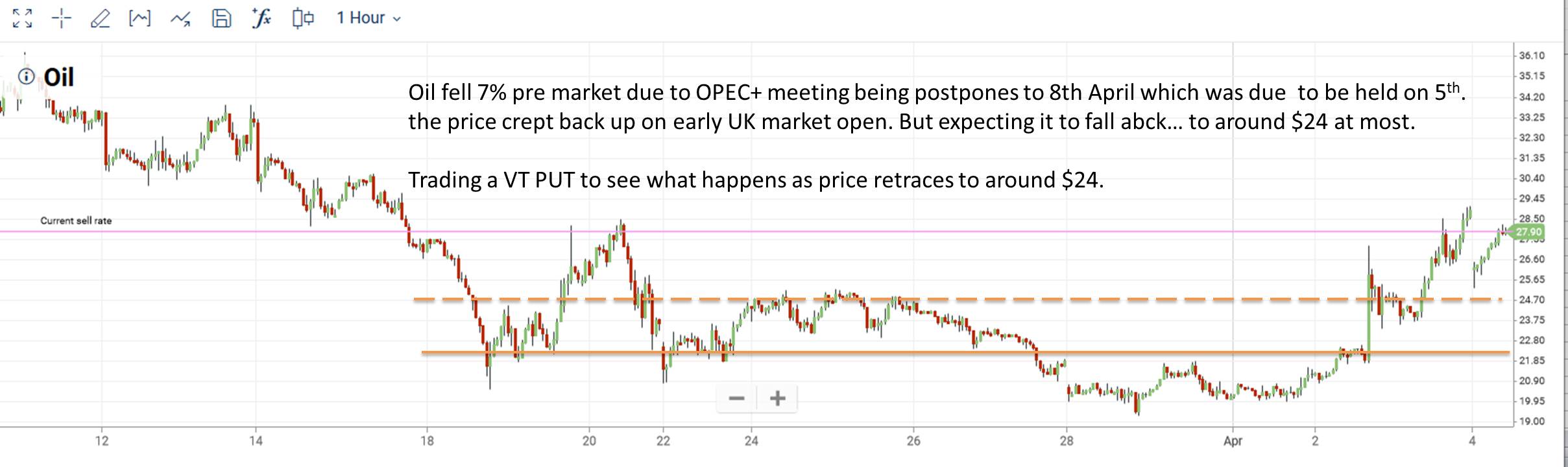

Brent Oil prices inched up on Tuesday on expectations of healthy market fundamentals, following an OPEC report saying demand remains strong, and concerns that supplies might be disrupted as the U.S. cracks down on Russian oil exports.

The U.S. plans to buy 1.2 million barrels of oil to help replenish the Strategic Petroleum Reserve after it sold off the largest amount ever last year, the Energy Department said on Monday. The department said the planned purchase for the oil is at an average price of $77.57 a barrel from two companies after 18 bids were submitted.

U.S. oil output from top shale-producing regions is set to decline in December for a second consecutive month, the U.S. Energy Information Administration (EIA) said in its monthly Drilling Productivity Report on Monday. Oil output is expected to drop to 9.652 million barrels per day (bpd) in December, from an estimated 9.653 million bpd in November, the EIA said.

Money managers cut their net long U.S. crude futures and options positions in the week to November 7, the U.S. Commodity Futures Trading Commission (CFTC) said on Monday. The speculator group cut its combined futures and options position in New York and London by 27,944 contracts to 89,858 during the period.

MACRO Economics

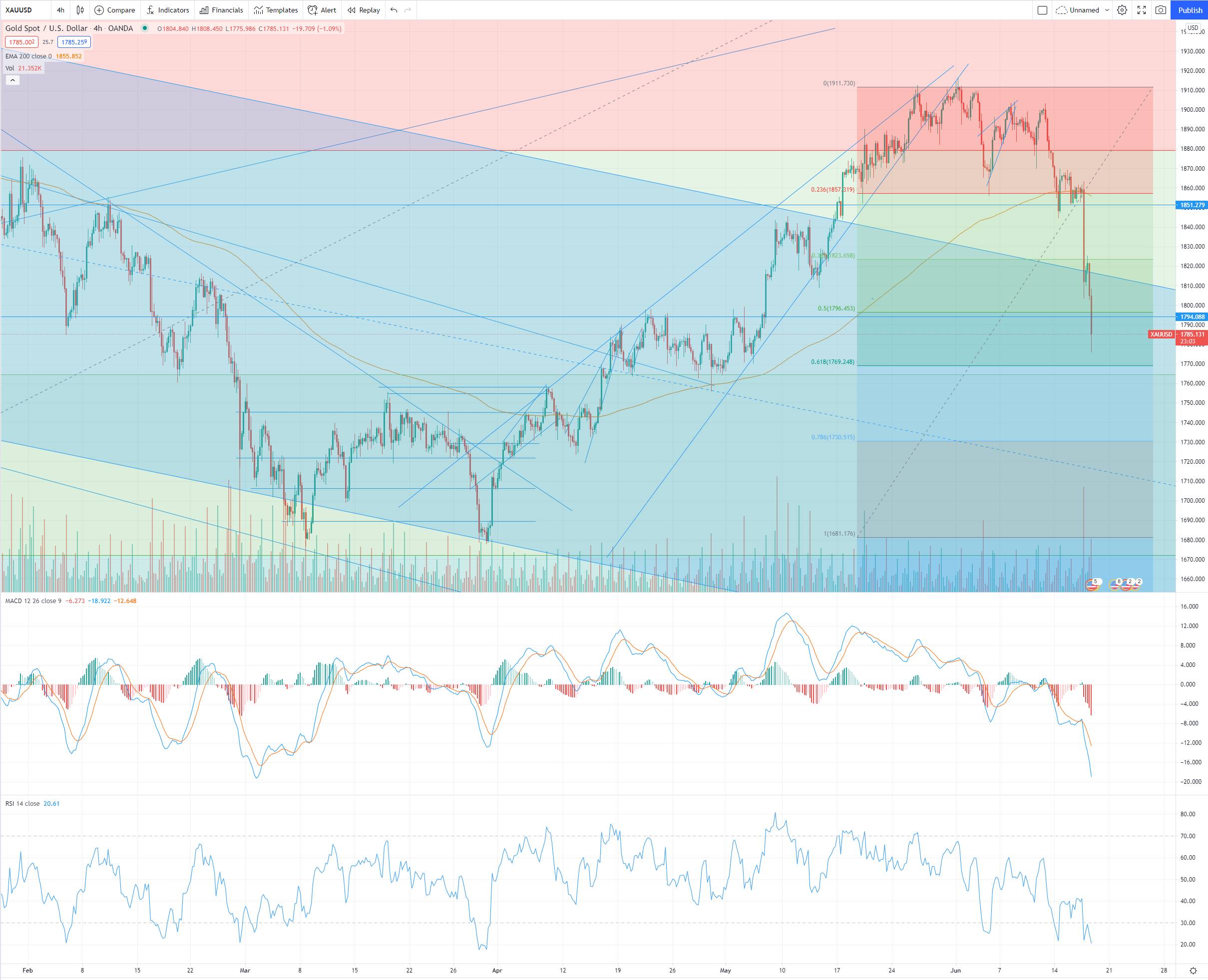

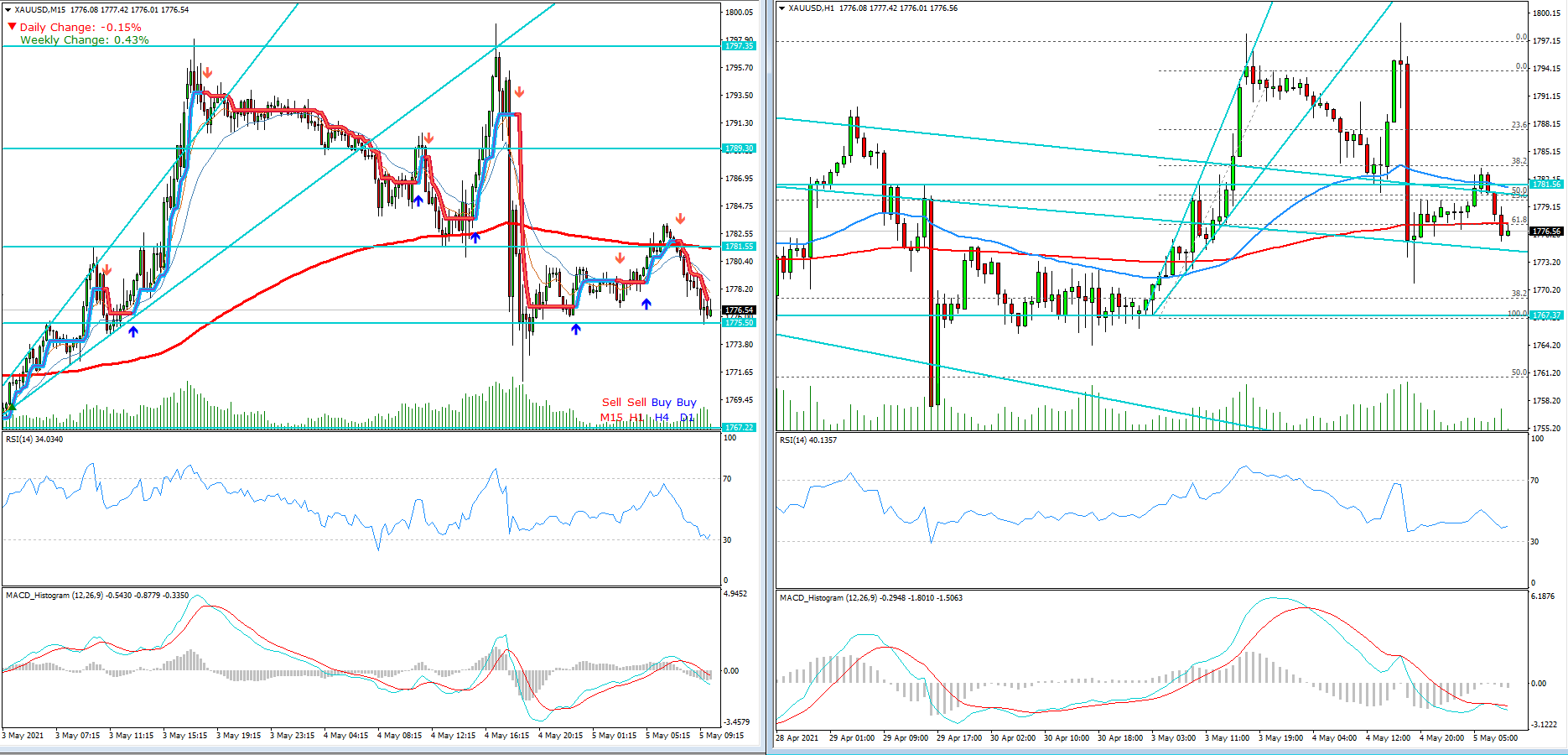

Gold prices rose $12.50 to settle at $1,950.20 an ounce, bouncing off 3-week lows, helped as the dollar and Treasury yields pulled back.

The U.S. dollar climbed to its highest level in more than a year against the Japanese yen, near the key psychological level of 152, but then fell sharply. The dollar index (DXY) overall slipped -0.2% to around 105.65 after rising in the last few weeks.

Treasury yields opened the trading day higher, with the 10-yr rising as high as 4.695% before ending the trading day back at lows around 4.63% ahead of the CPI data tomorrow morning.

Oct budget deficit $67B (consensus $65.00B deficit) vs Oct 2022 deficit $88B. U.S. Oct budget outlays $470B vs $406B in Oct 2022; receipts $403B vs $319B in Oct 2022. Interest on the debt was $89B in October, the second largest outlay after social security payments of $118B.

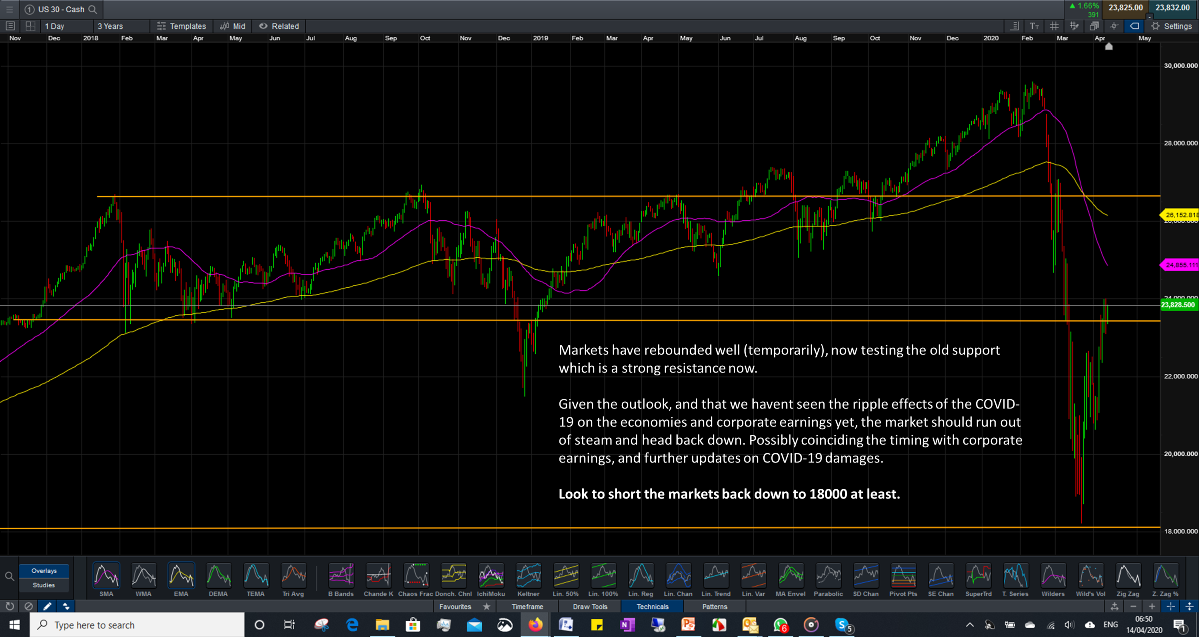

Quick look at Equity Markets

U.S. stocks opened lower after last week’s strong advance, squeezed higher most of the day before finishing with modest losses into a handful of potential market moving catalysts. The Nasdaq 100 Index snapped its streak of 18-straight higher Monday's (a trend that started 7/3), while QQQ is now up 17 weeks out of the last 19.

In Oil majors: XOM announced it plans to begin producing lithium for electric-vehicle batteries by 2027 from a mining operation in southwest Arkansas under the brand Mobil Lithium; said it’s planning to be a “a leading producer of lithium” but it did not provide any projected sales figures.

In Aerospace & Defense: BA shares rise on two pieces of news: 1) Boeing is closing in on a major order for its 777X widebody model from Emirates; 2) China is contemplating resuming purchases of Boeing's 737 Max aircraft when U.S. President Joe Biden and Chinese President Xi Jinping meet this week (also helped shares of plane supplier SPR).

In Lithium sector: shares of LTHM, ALB, SQM pressured on competitive fears after XOM said it is drilling first lithium well in Arkansas, aims to be a leading supplier for electric vehicles by 2030.

Key Market Data

TUESDAY

Core CPI

08.30

API Weekly Crude Stock

16.30

WEDNESDAY

U.K CPI

02.00

Core Retail Sales

08.30

PPI

08.30

Crude Oil Inventories

10.30

- Admin

- 14 Nov 23

- 0 Comment

Related Posts

You have to logged in for comment.

Email Newsletter

Get subscriber only insights & news delivered by Financial Markets Club

Weekly Trading Lessons by Email

Do you want to Learn to Trade like a Pro? Every Week we will share some Trading Tips to help you Succeed.

Just enter your Name and Email, and click Subscribe!

FinancialMarkets

FinancialMarkets

Comments