8 Things You Need To Know on the Financial Markets Today

FOMC meeting minutes this week will be a key driver of market direction

- Home

- 8 Things You Need To Know on the Financial Markets Today

Good Day. A quiet start to the Trading week yet again after a dramatic move in Oil last Friday, and U.S. Dollar getting hammered. FOMC meeting minutes this week will be a key driver of market direction.

Jeremy Hunt is set to reveal plans to cut the UK’s tax burden on Wednesday, a pivotal moment for the struggling Tories ahead of an election expected next year.

The Chancellor said yesterday he plans to cut business taxes and reform welfare in a bid to lift the economy. Hunt has also considered a cut to inheritance taxes, but that has drawn criticism from some Tory MPs. He pushed back against reports he may cut income tax and the national insurance levy, saying that might fuel inflation.

UK Tax Burden

Jeremy Hunt is set to reveal plans to cut the UK’s tax burden on Wednesday, a pivotal moment for the struggling Tories ahead of an election expected next year.

The Chancellor said yesterday he plans to cut business taxes and reform welfare in a bid to lift the economy. Hunt has also considered a cut to inheritance taxes, but that has drawn criticism from some Tory MPs. He pushed back against reports he may cut income tax and the national insurance levy, saying that might fuel inflation.

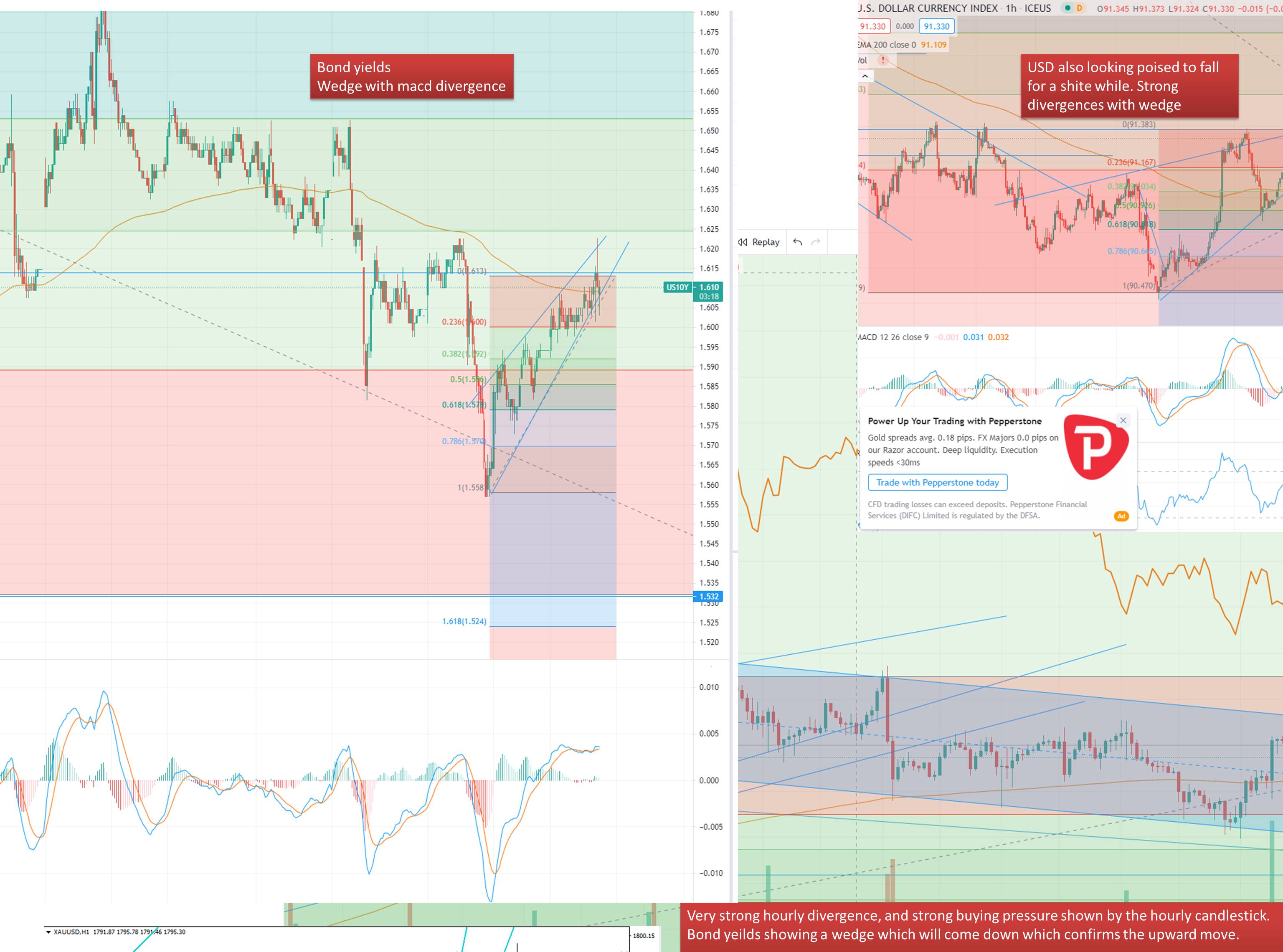

Bond Market

Treasuries are enjoying their best month since March as investors grow confident that the Federal Reserve is done raising rates. An upcoming bond sale is going to test their mettle. Weak demand for Monday’s 20-year auction could send yields higher, mirroring a response from the 30-year auction earlier in the month. A strong reception, however, would be a powerful endorsement of the rally.

European Trading

European stocks are on track for a muted start as investors continue to weigh up the outlook for global monetary policy. That comes ahead of a big day for central bank commentary, with the ECB's Pablo Hernandez de Cos, Francois Villeroy de Galhau and Boris Vujcic scheduled to speak, plus BOE Governor Andrew Bailey. Expected data include German PPI. Compass Group, Diploma and Big Yellow Group are slated to report earnings.

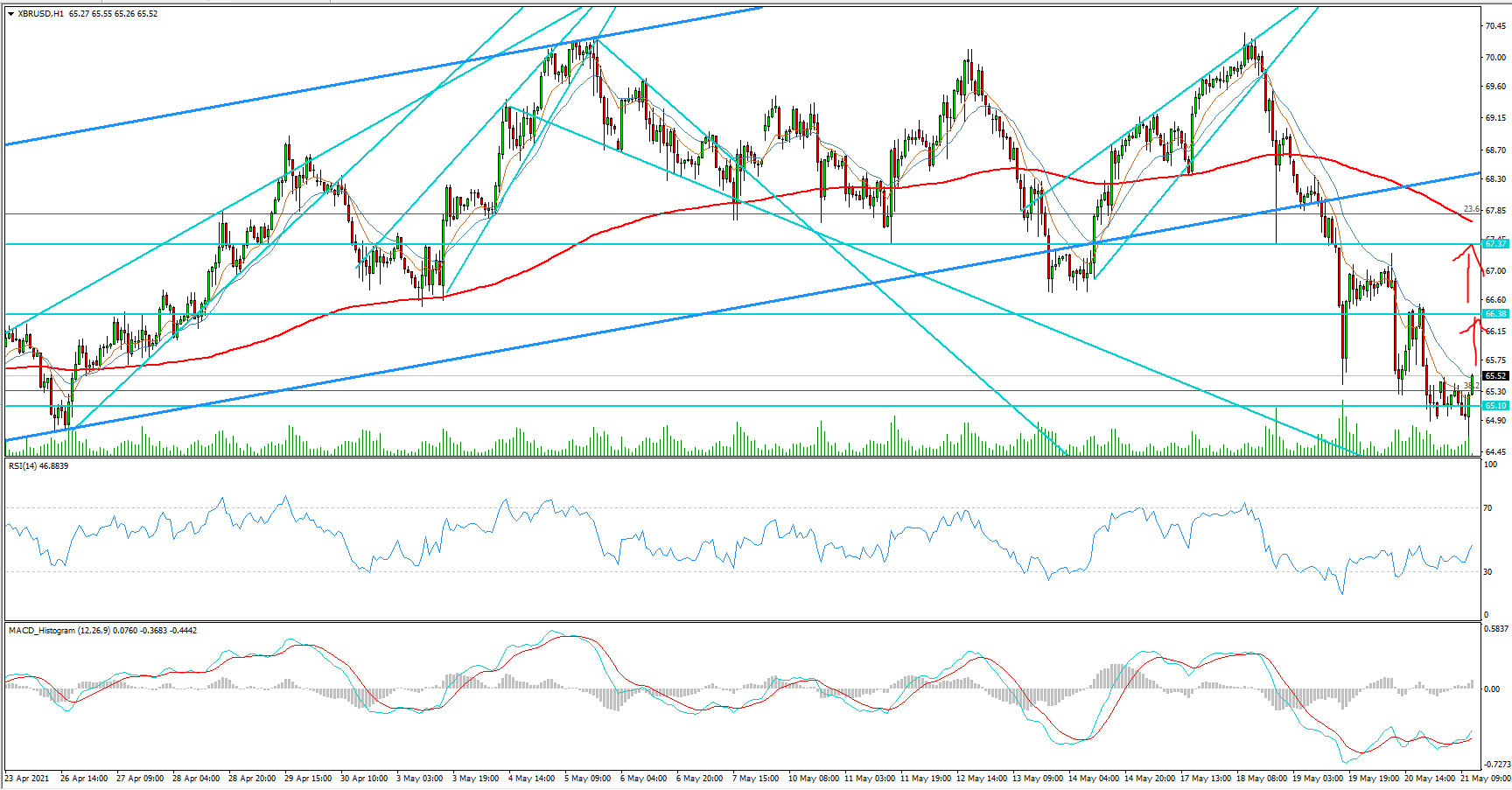

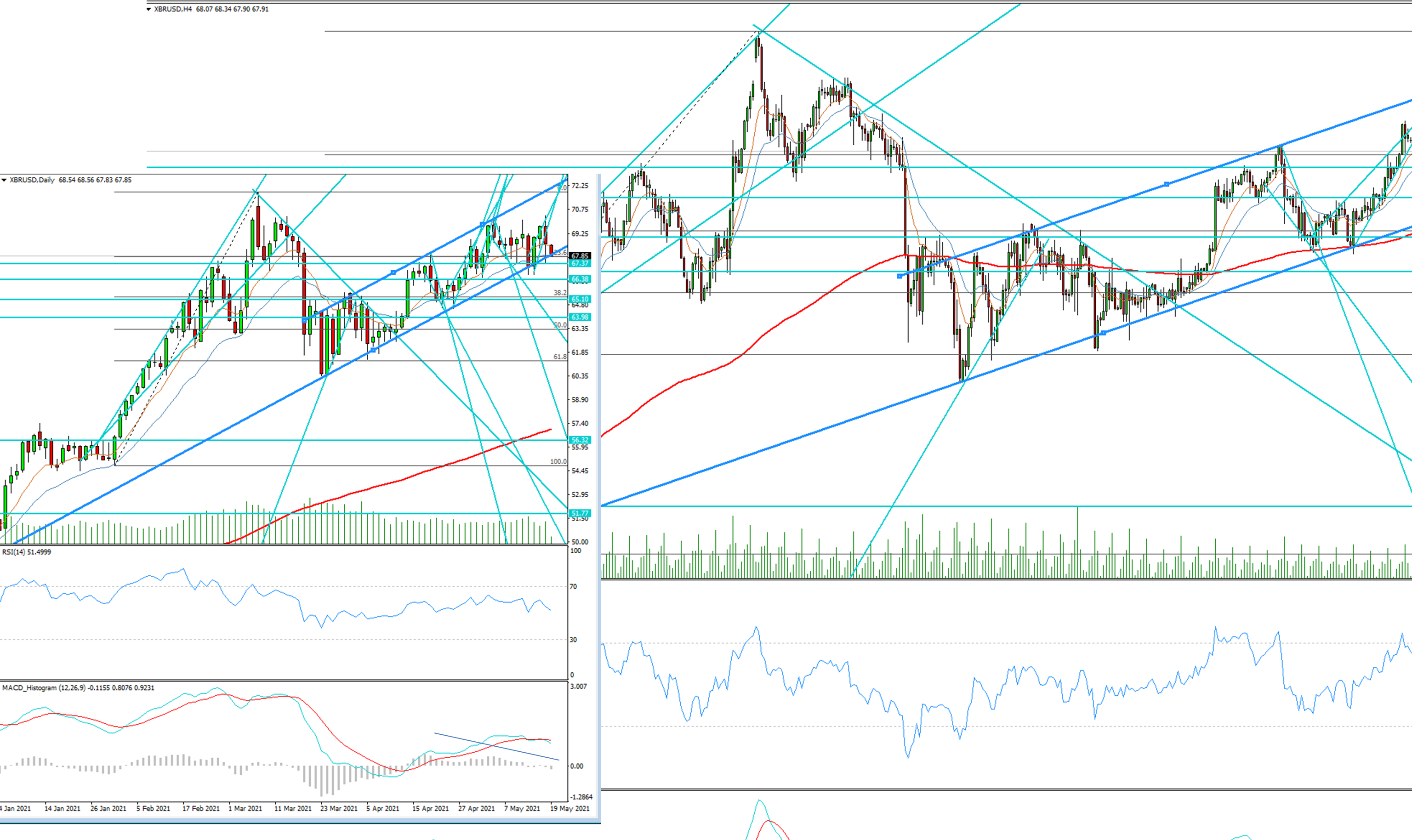

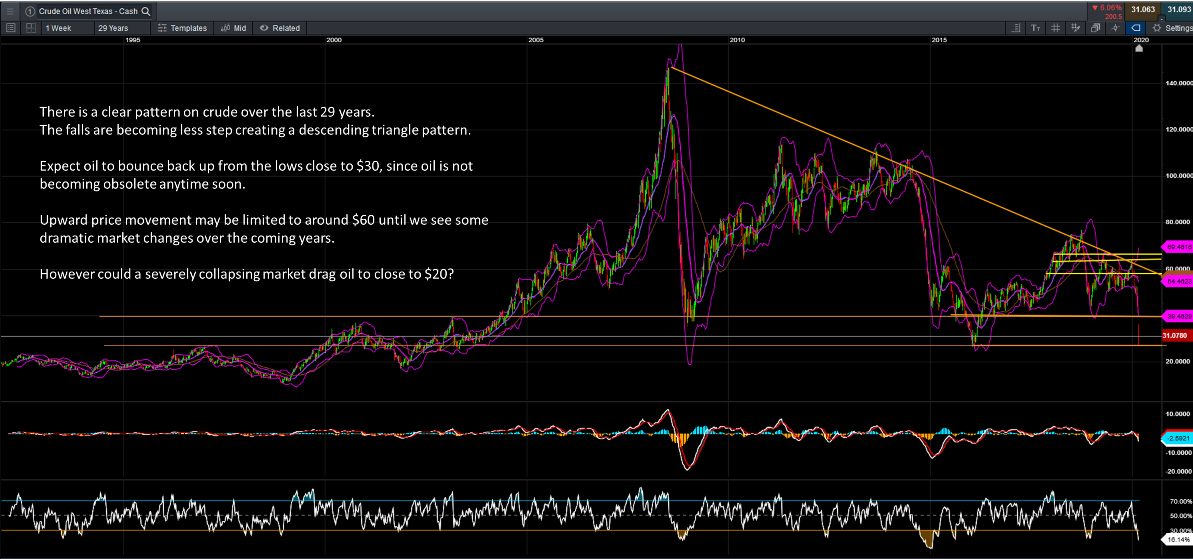

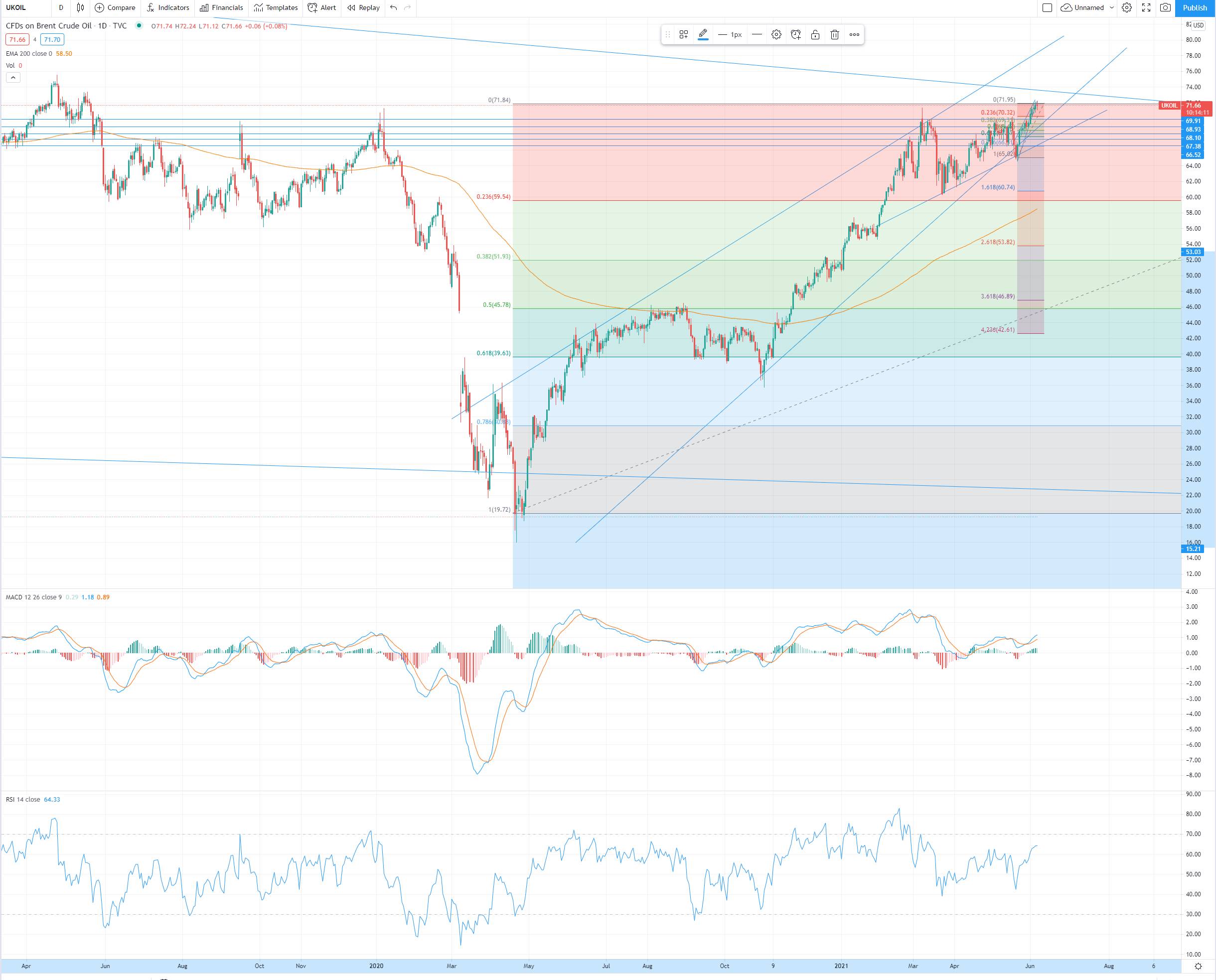

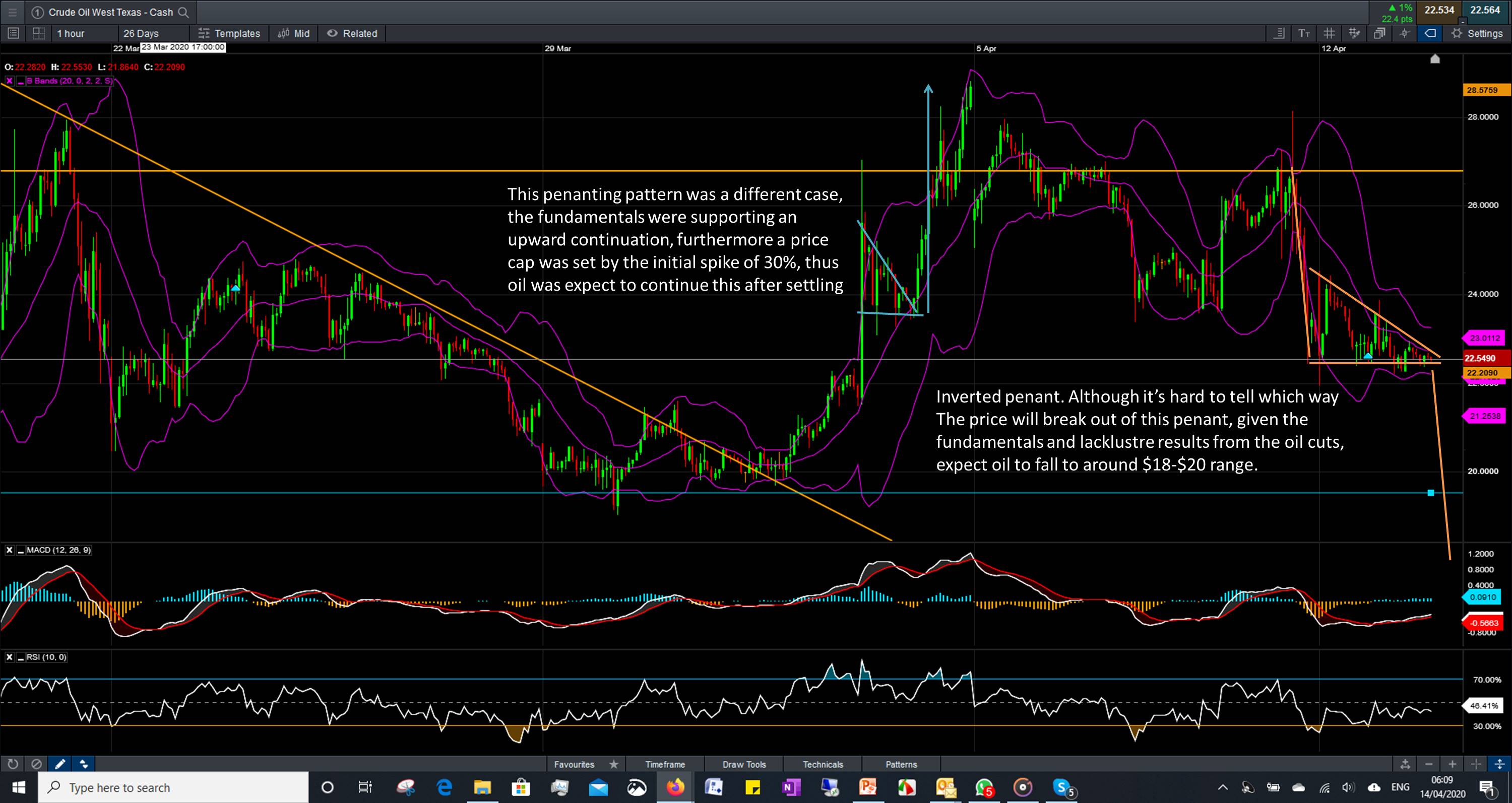

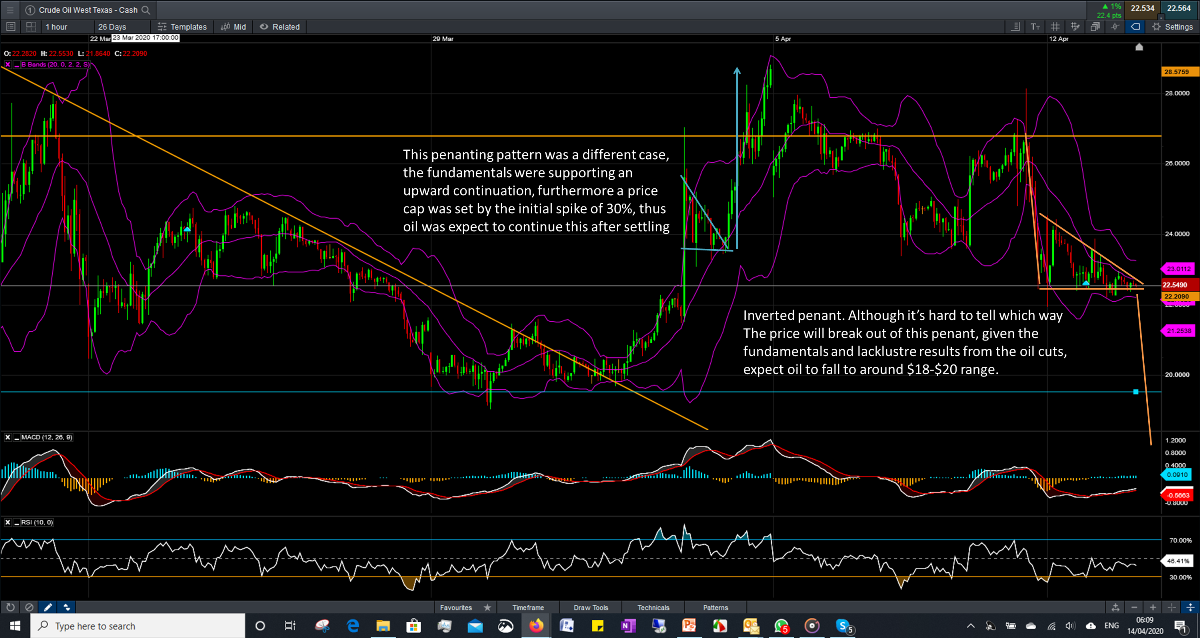

Oil Market Yesterday

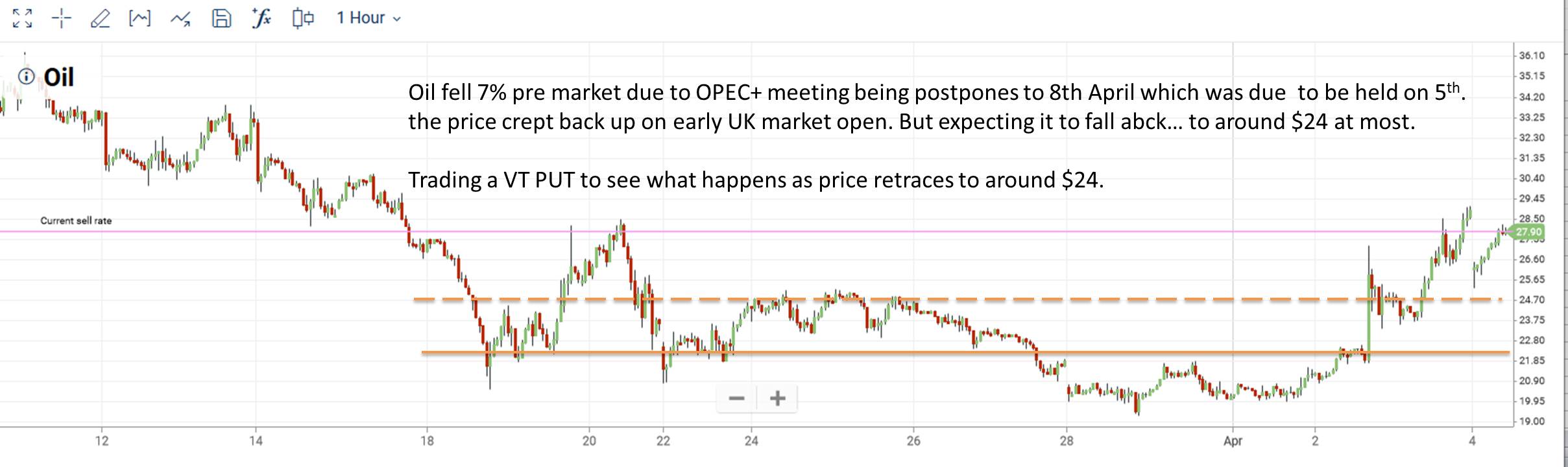

Brent Oil futures nudged higher on Monday, extending gains on expectations of OPEC+ deepening supply cuts to shore up prices, which have fallen for four weeks on easing concern of Middle East supply disruption amid the Israel-Hamas conflict.

OPEC+ is set to consider whether to make additional oil supply cuts when the group meets later this month, three OPEC+ sources told Reuters after prices dropped by almost 20 percent since late September. Oil has slid to around $79 a barrel for Brent crude from a 2023 high in September near $98. Concern about demand and a possible surplus next year has pressured prices, despite support from the OPEC+ cuts and conflict in the Middle East.

China resumed adding to crude oil inventories in October as refinery processing slid from a record high and imports rose slightly from September. About 560,000 barrels per day (bpd) was put into stockpiles in October, based on calculations using official data for imports, domestic production and refinery throughput. This was a reversal from September, when refiners dipped into storage tanks, processing 240,000 bpd more than what was available from imports and domestic output.

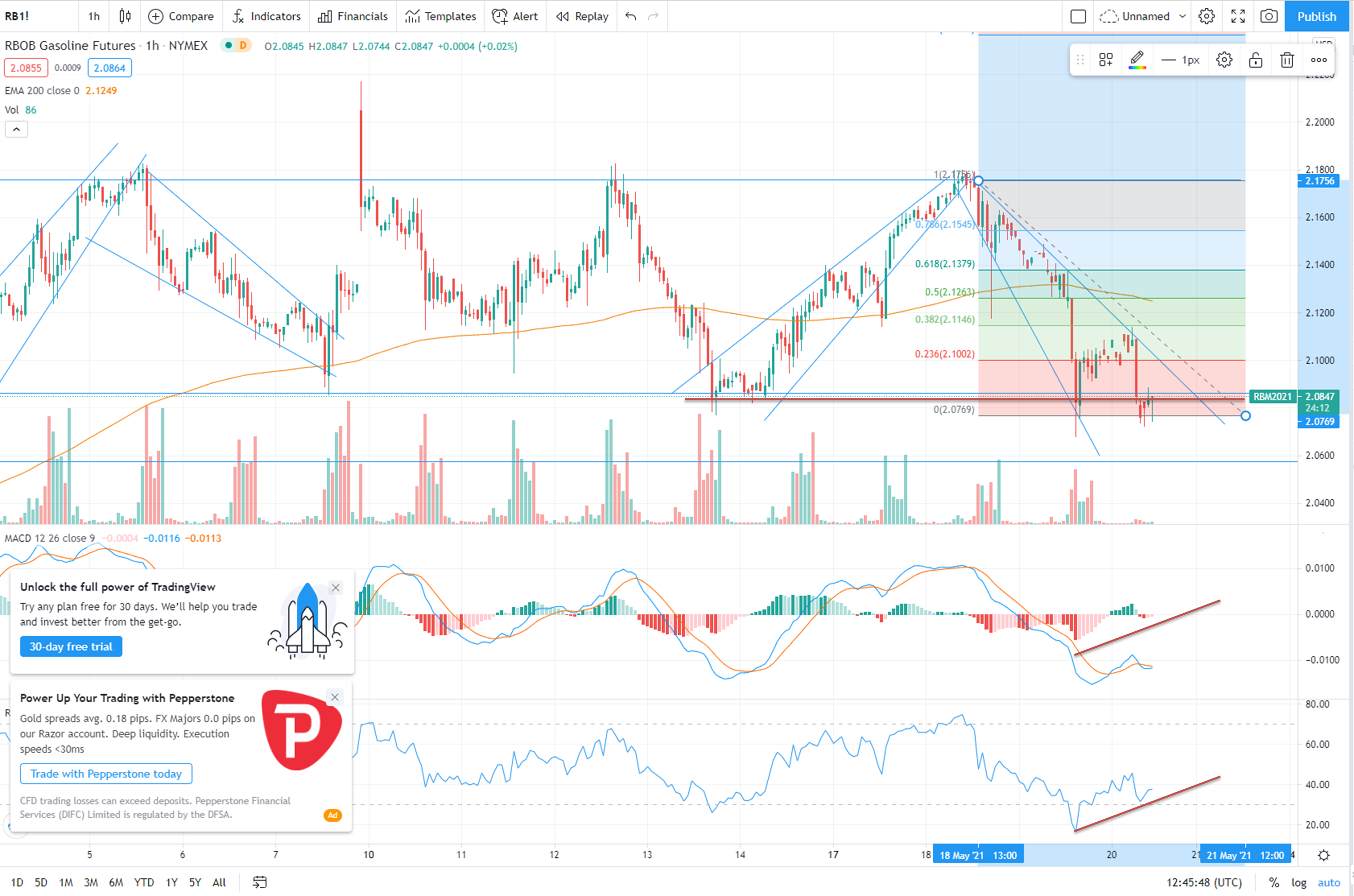

The recent rise and then fall in U.S. oil prices has been driven primarily by changes in crude inventories around the NYMEX delivery point at Cushing, but changes in gasoline stocks have added to the volatility.

MACRO Economics

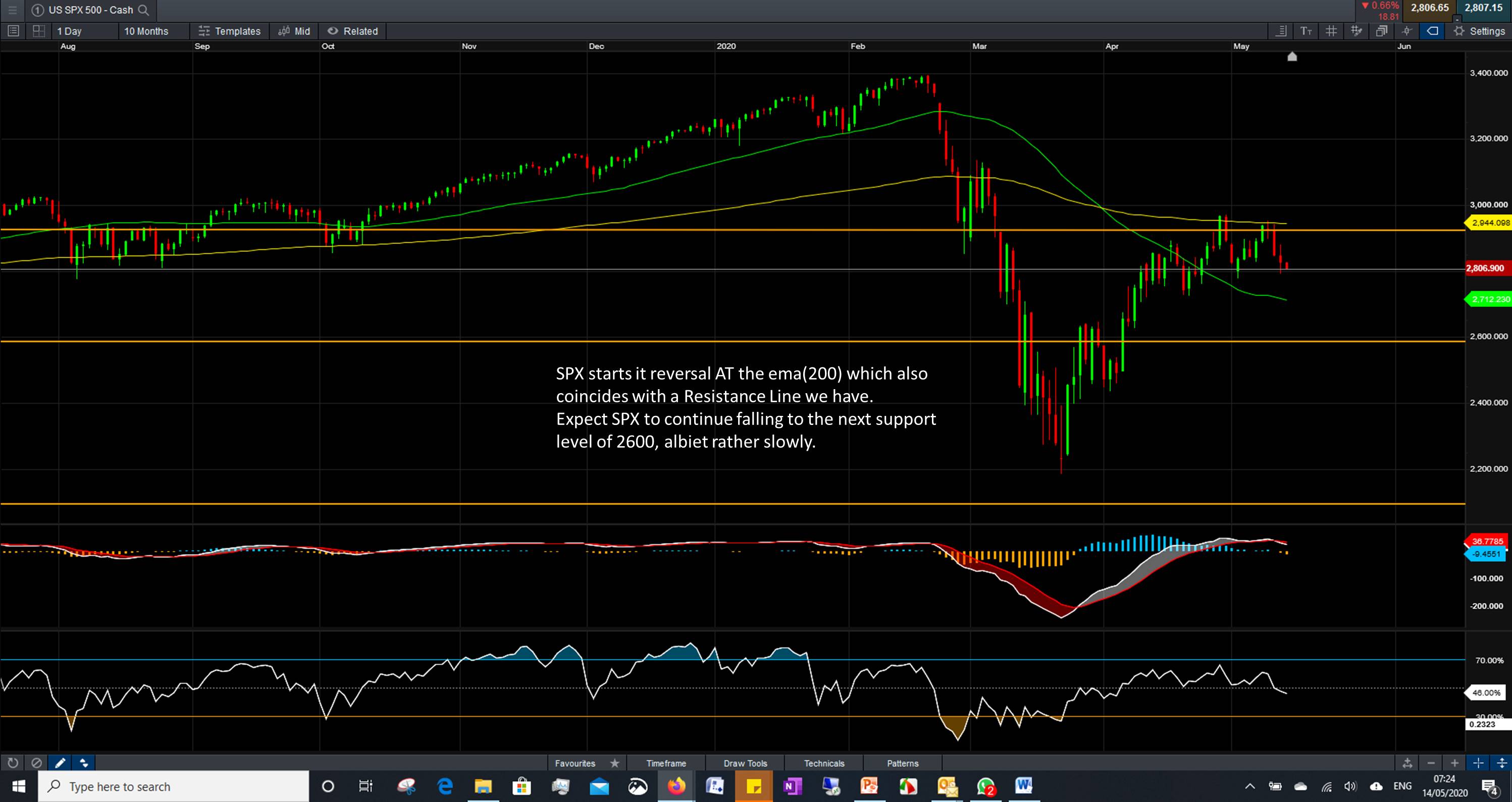

The dollar slid to a two-month low on Monday, extending its downtrend from last week as traders reaffirmed their belief that U.S. rates have peaked and turned their attention to when the Federal Reserve could begin cutting rates.

USD/Asians kick off the new week lower following a slide in the U.S. dollar index to sub-104 levels due to a rally in EUR/USD. Focus on the 103.60 200-day moving average in the USD and Federal Reserve minutes this week. U.S. weekly jobless claims and PMI data are eyed too.

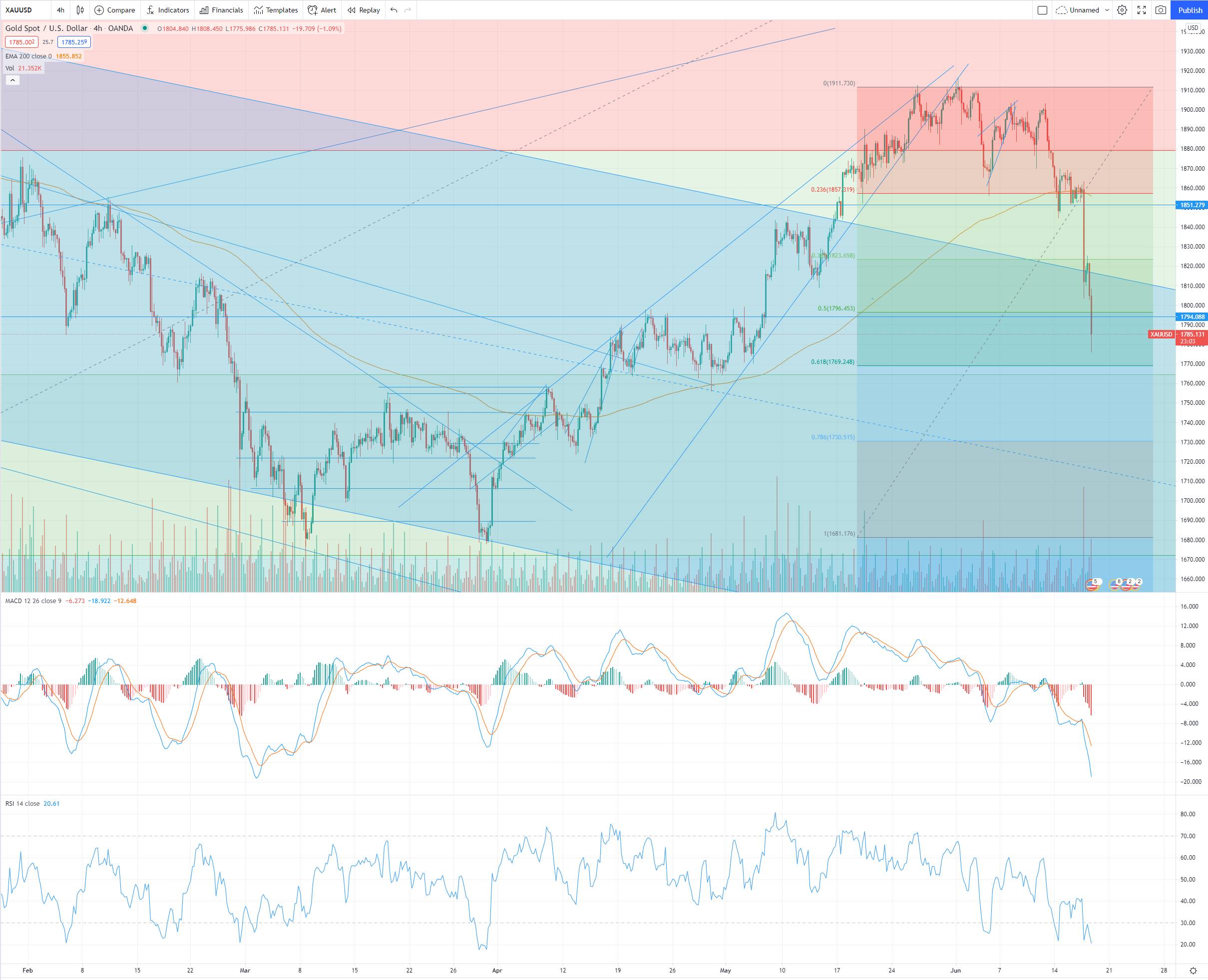

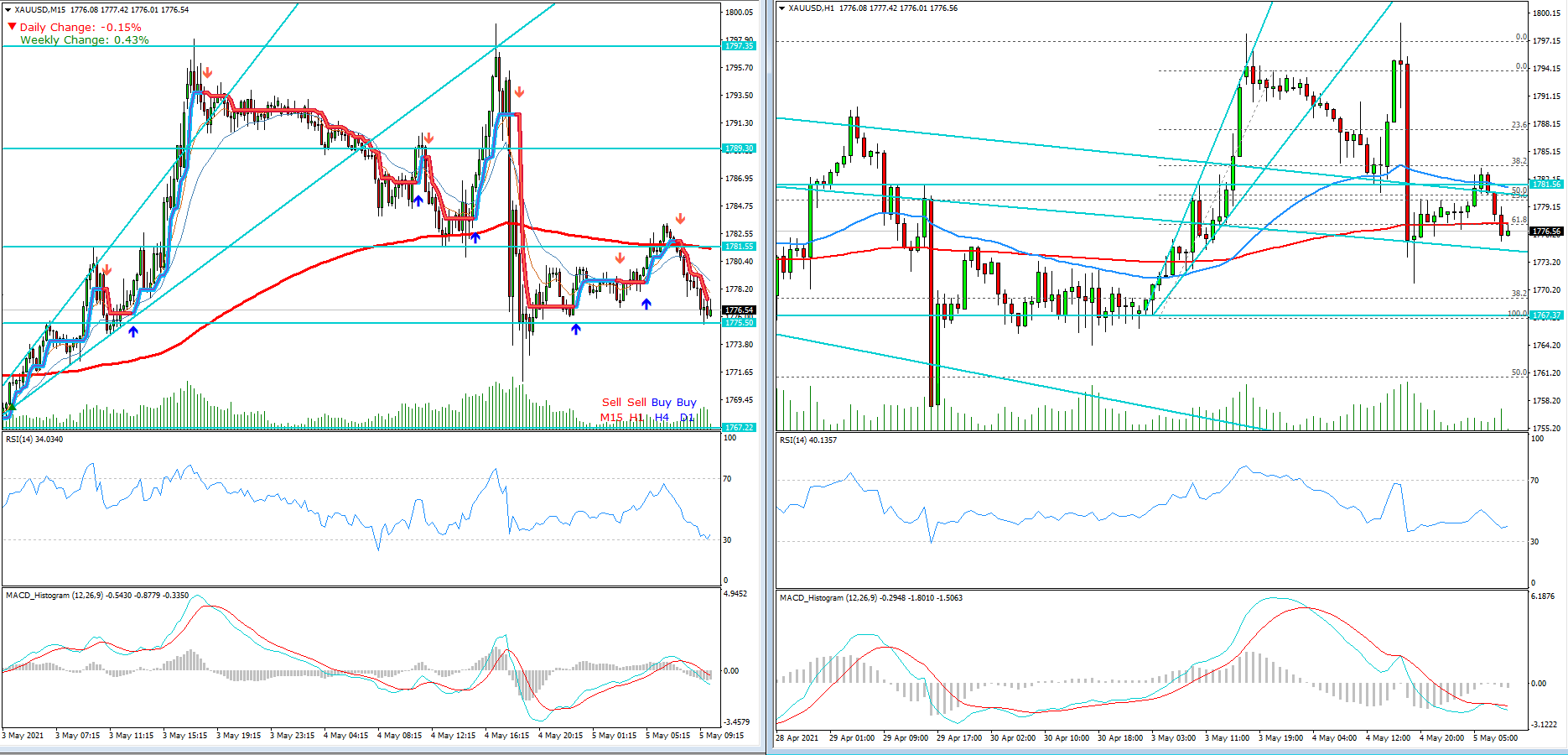

Gold prices edged higher on Monday as the dollar extended its slide after recent U.S. economic data boosted bets that the Federal Reserve was done with its rate hike campaign.

Bonds continued to grind higher all morning as yields sank further. Data that showed U.S. single-family homebuilding increased marginally in October briefly supported the dollar, but with inflation the main market driver it remained lower on the day. The 10-yr yield was flattish today but was down -18.6 bps to 4.441% this week and MTD down -43.3 bps while the 2-yr yield was +6.7 bps today to 4.907%, but down 15.3 bps this week.

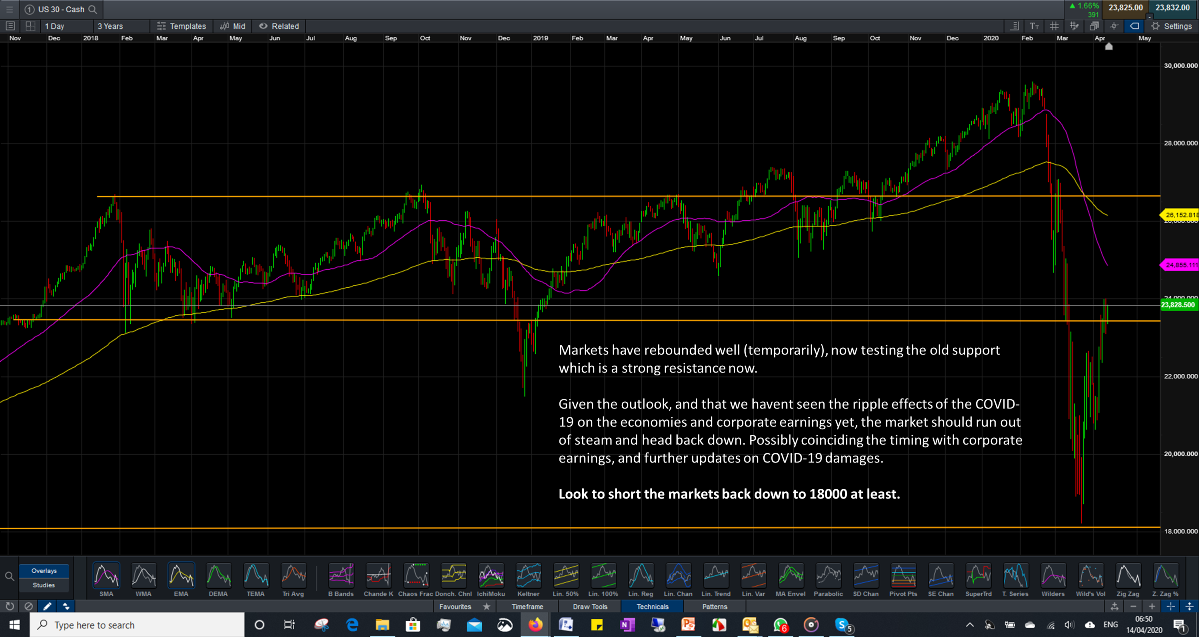

A Quick Look at Equity Markets

In Energy: after lagging the broader S&P most of the week, the energy complex seeing biggest move higher today across the board; US total rig count 618 Baker Hughes (BKR) noted as oil rig count 6 to 500 and gas rig count down 4 to 114.

In Aerospace & Defense: HUBB was upgraded from Neutral to Overweight at JP Morgan on the back of its utility checks at the annual EEI conference this week, which suggests that market concerns on utility appear overdone.

In Paper & Packaging: WRK upgraded from Hold to Buy at Argus with $42 tgt saying it is going through a challenging period; sales and earnings in the latest quarter both fell from the prior year – but notes volume is starting to pick up, and mgmt has an ambitious cost-cutting program.

In Materials: CMP reported Q4 EBITDA of $33M vs. Street $42.5M, largely driven by higher Corporate and Other costs because of recognition timing for Fortress EBITDA to Q1 vs the initially expected Q4 (~$12M of EBITDA).

Key Market Data

Monday

Nothing major in our opinion

Tuesday

Existing Home Sales

08.30

FOMC Meeting Minutes

14.00

API Weekly Crude Stocks

16.30

Is your Derivatives Trading making

5-15% Profit Monthly?

Our Oil Trading Clients in Dubai generate up to $1,790,000 profit per year, on Oil Paper Trading, by following our unique Strategies.

Book a Meeting Today

To discuss your Challenges with Oil Hedging & Paper Trading

Call: +971 58 540 0412

Email: nasir@financialmarkets.club

- Admin

- 20 Nov 23

- 0 Comment

Related Posts

You have to logged in for comment.

Email Newsletter

Get subscriber only insights & news delivered by Financial Markets Club

Weekly Trading Lessons by Email

Do you want to Learn to Trade like a Pro? Every Week we will share some Trading Tips to help you Succeed.

Just enter your Name and Email, and click Subscribe!

FinancialMarkets

FinancialMarkets

Comments