Crude Oil Prices Ready to Pop Again - Expect $6 movement either direction

- Home

- Crude Oil Prices Ready to Pop Again - Expect $6 movement either direction

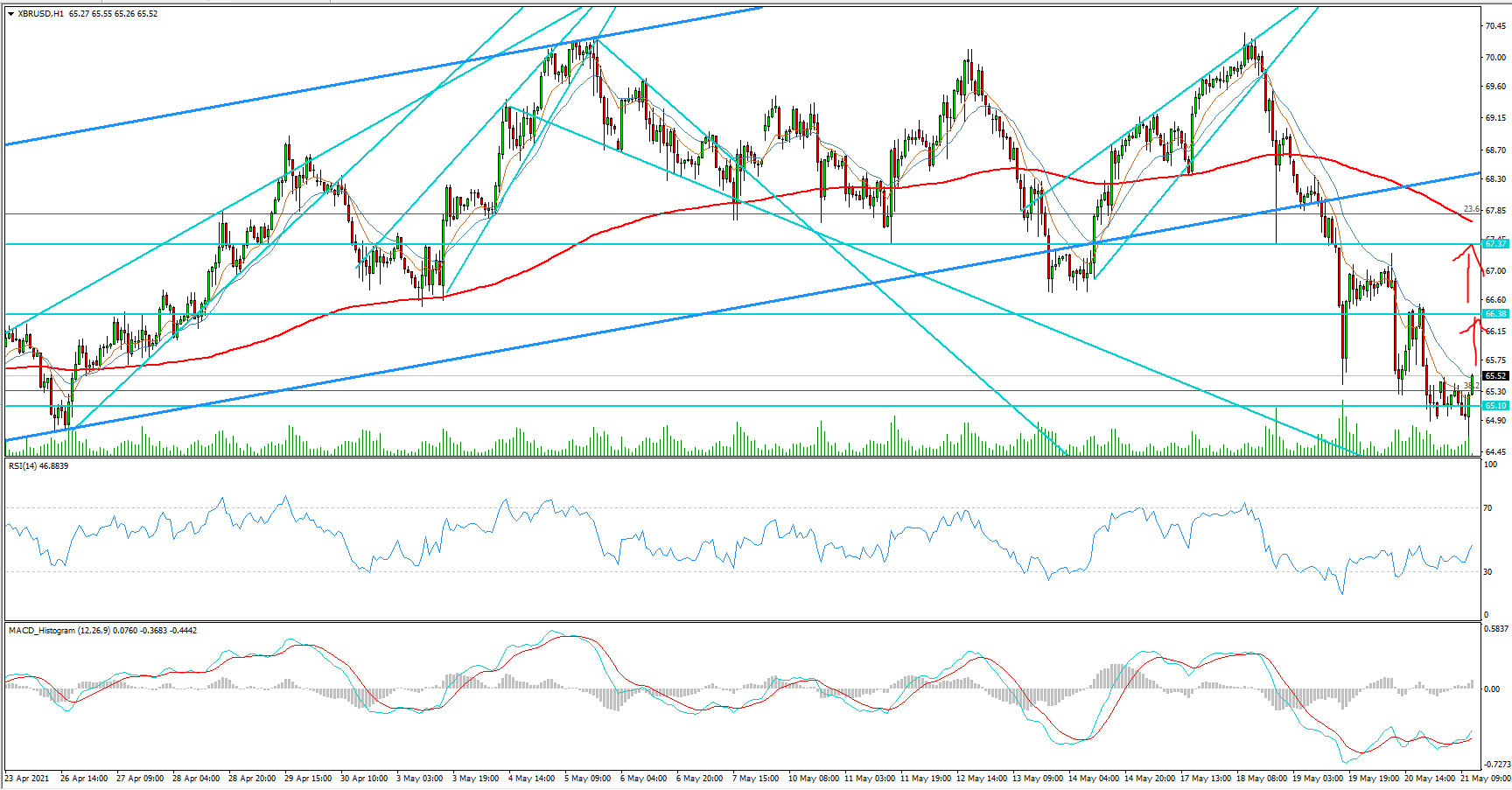

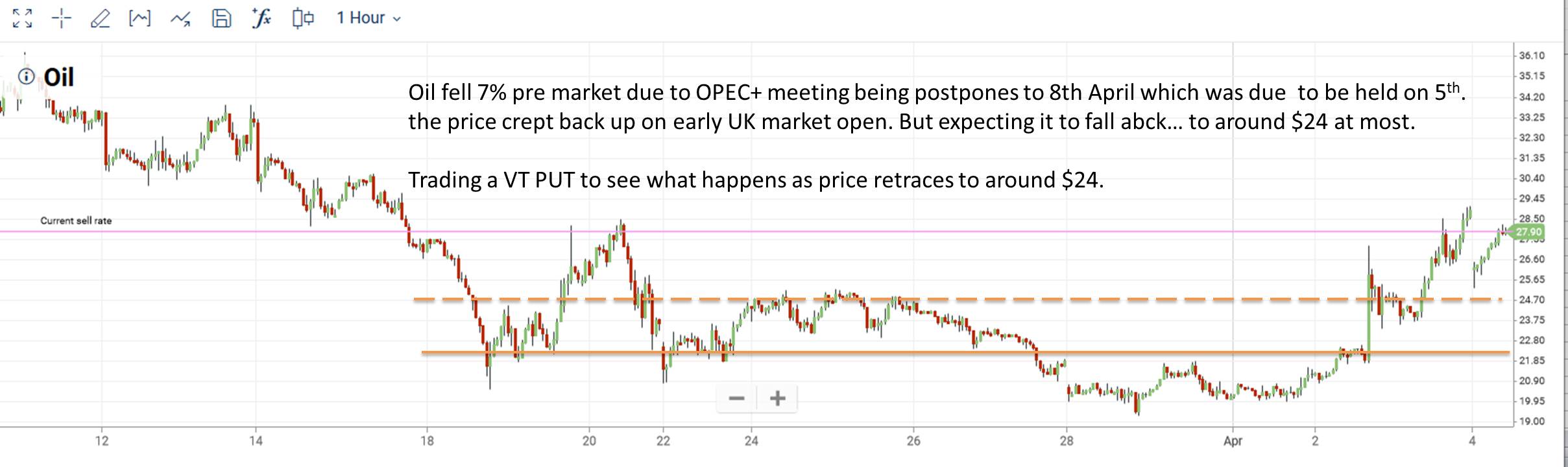

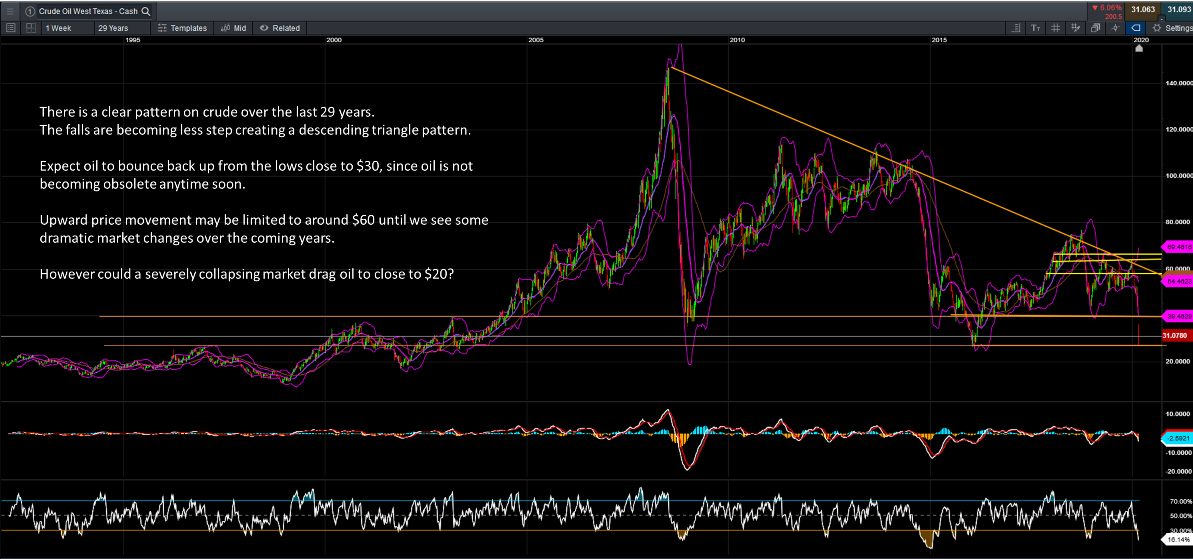

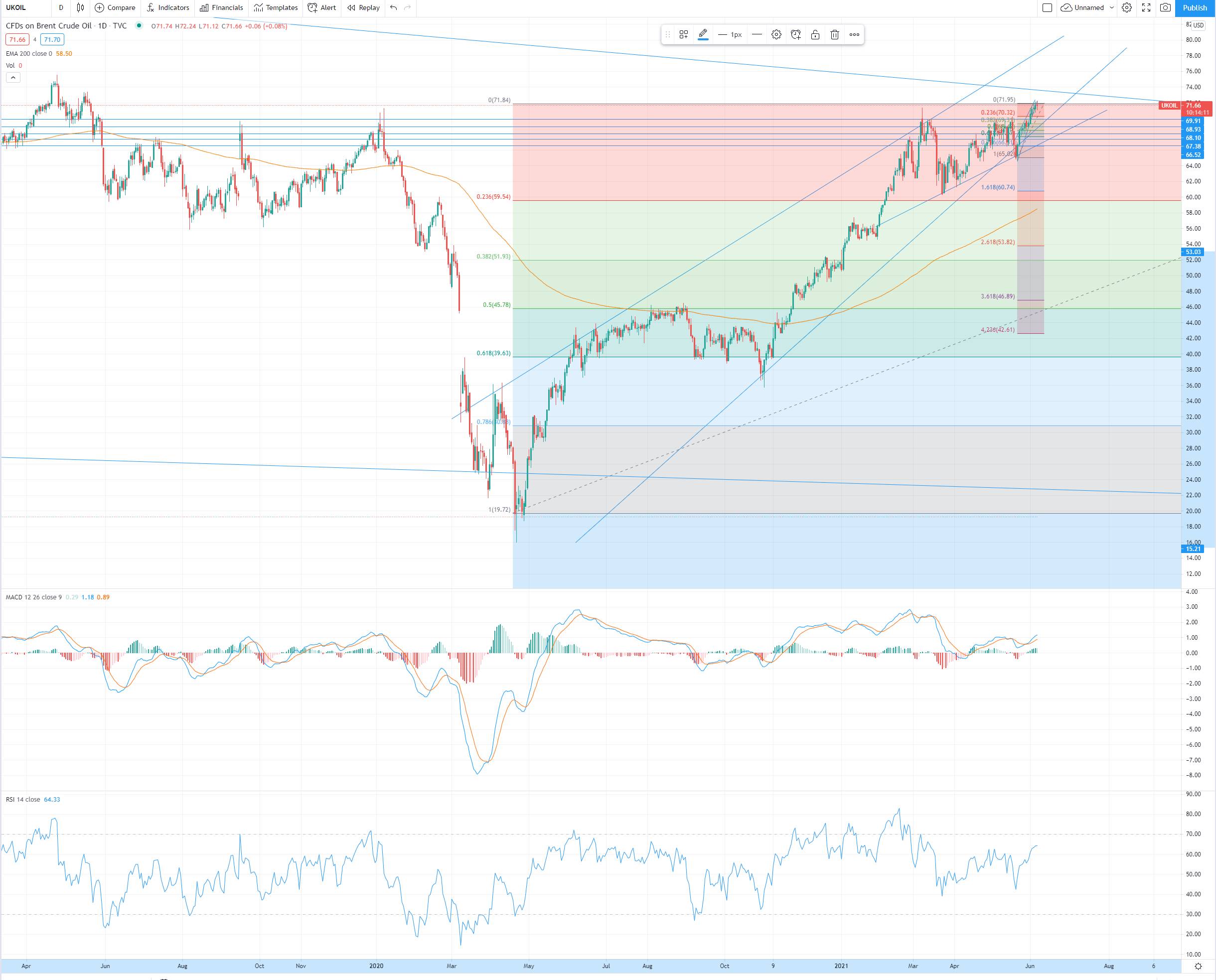

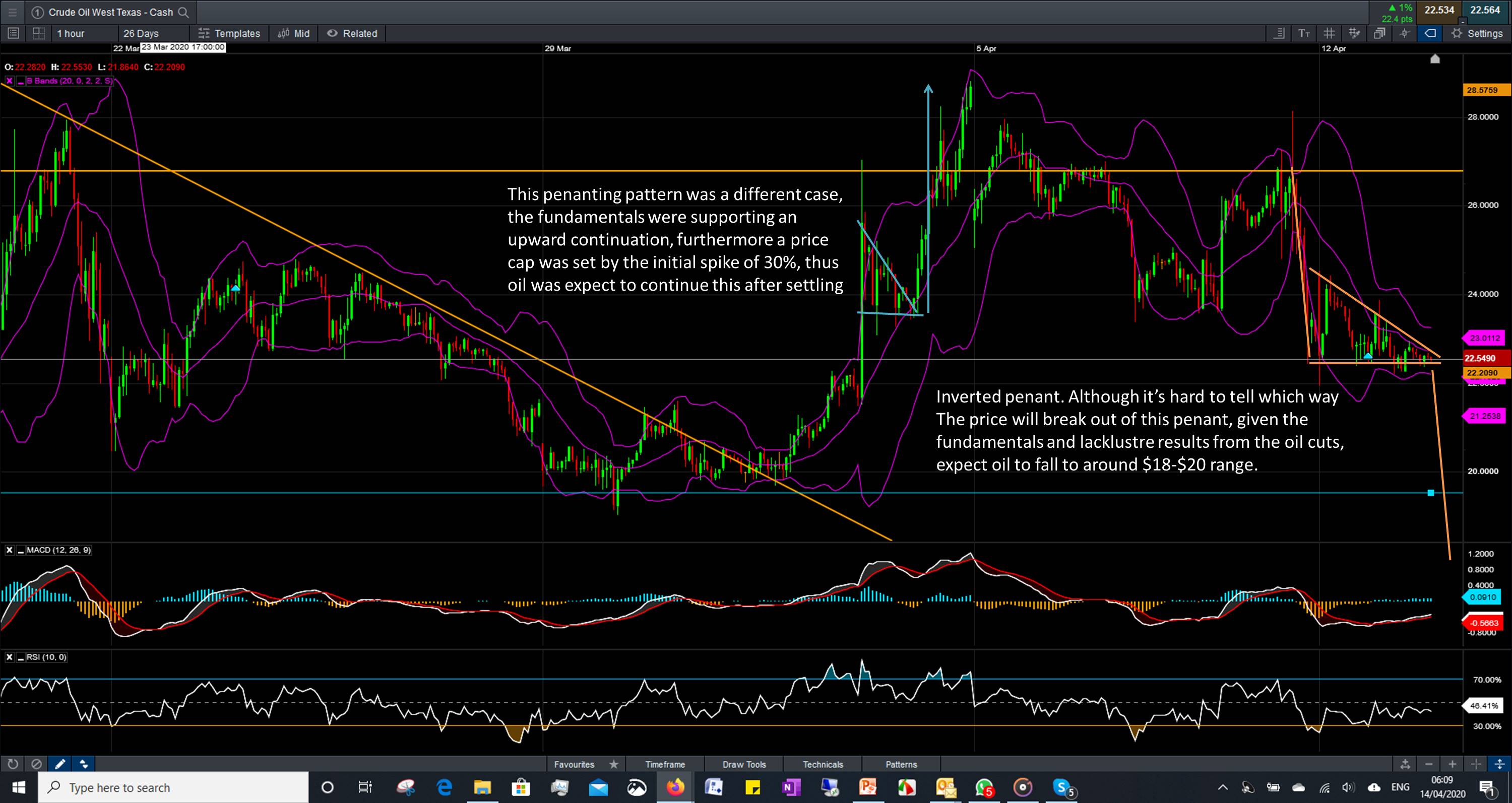

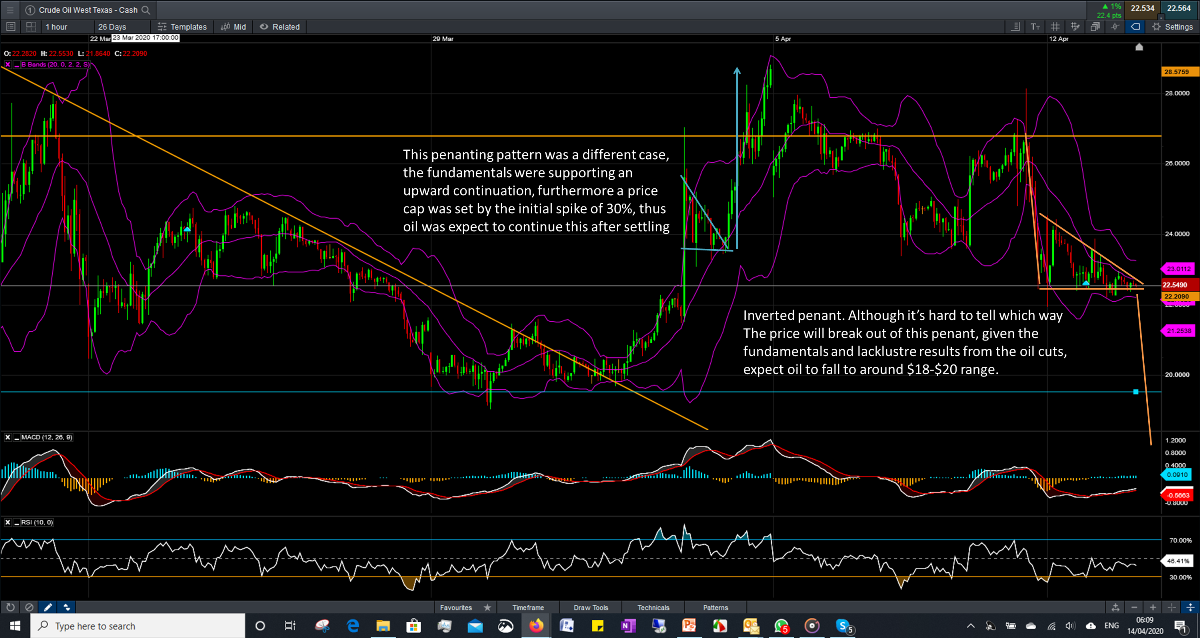

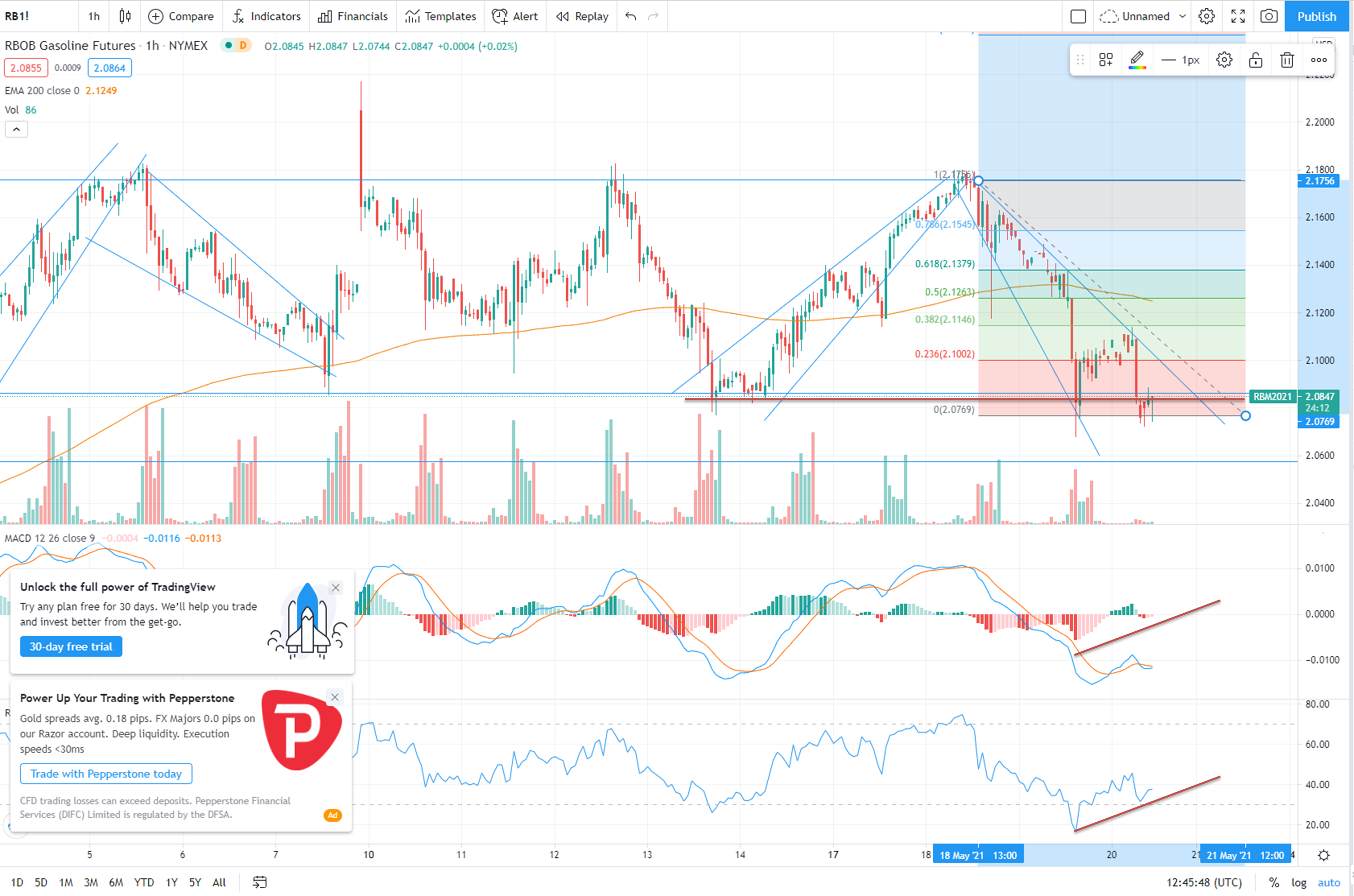

Crude Oil has been moving sideways since June (around 6 weeks now), progressively moving in a narrowing trading range.

To be honest I didn’t quite expect this, and I did have 2 Options straddle positions that expired worthless, since we didn’t get a large enough move in either direction.

However I think we have reached a ‘biting point’ again with Crude Oil.

It is clear that we have an Ascending Triangle formation, which should give us at least a $6 movement on crude oil in either direction once the break out happens.

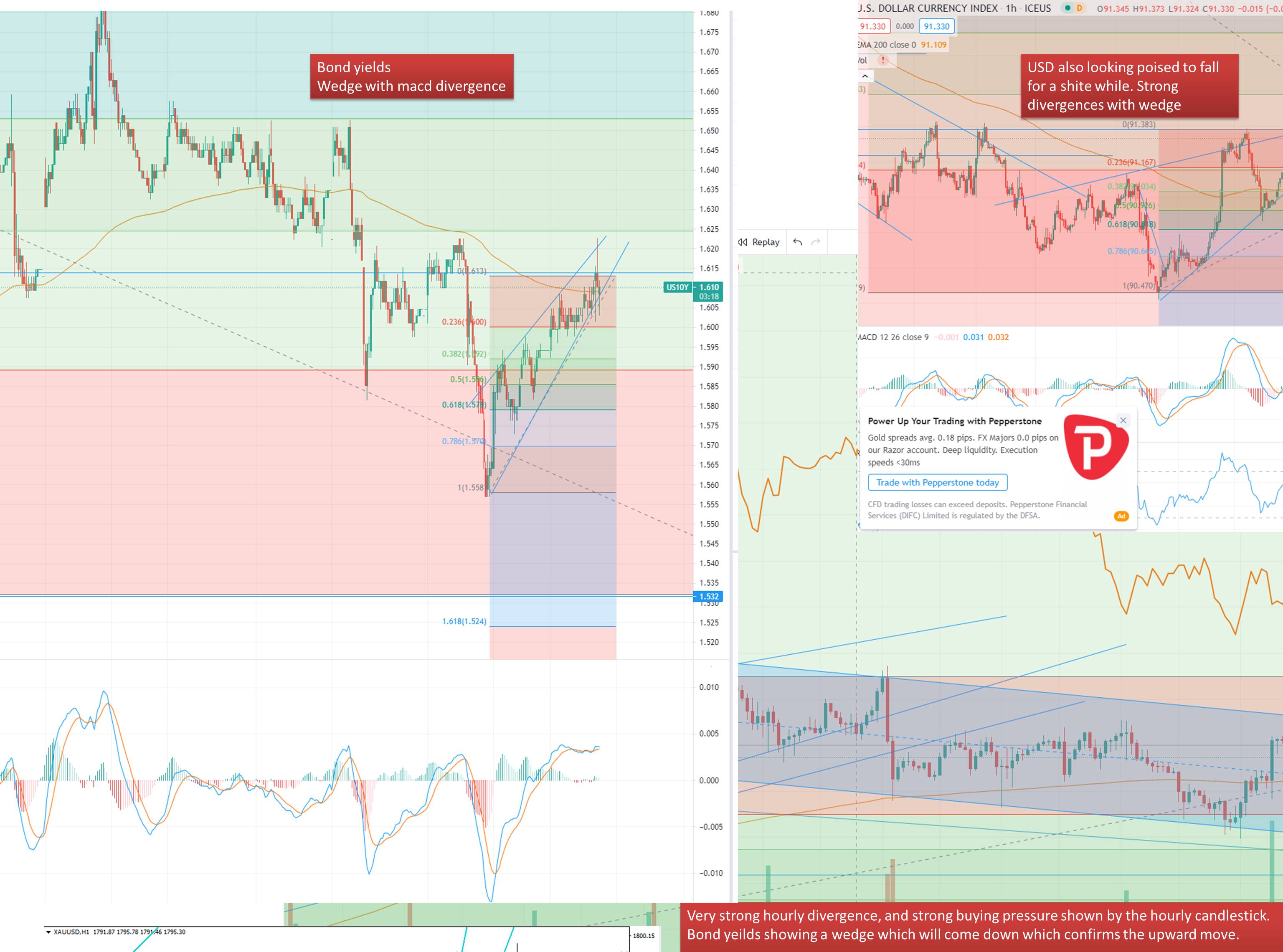

Which way will the break out be?

It’s a difficult one actually, there are no robust fundamentals that support a break out in either direction (as yet!). But I imagine something is around the corner that will trigger the breakout.

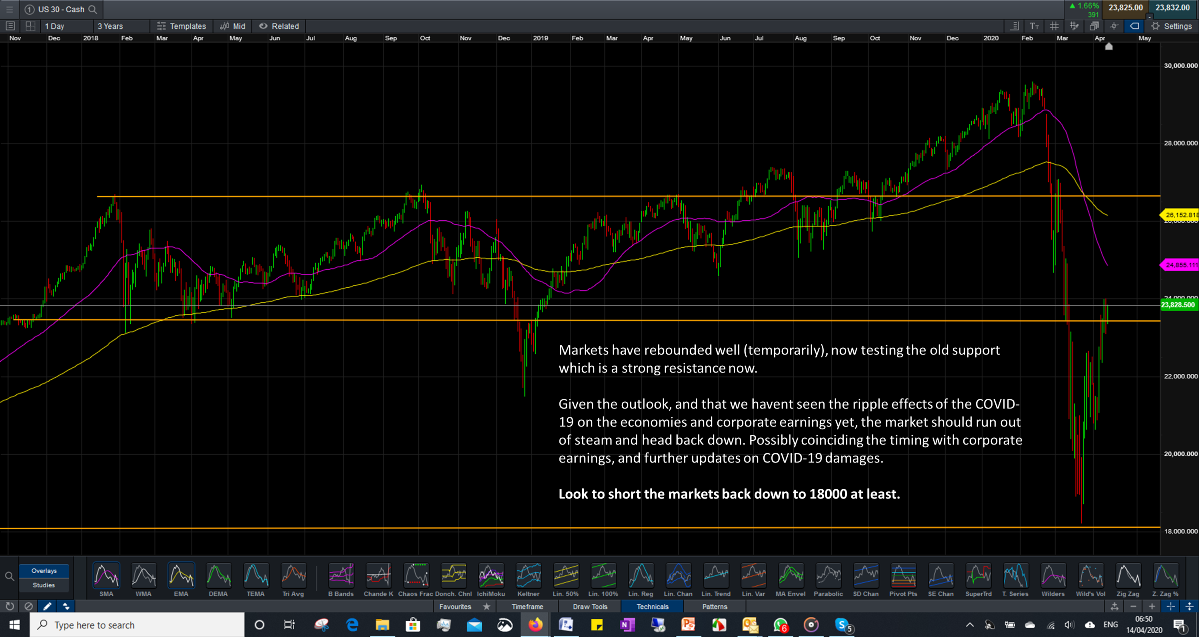

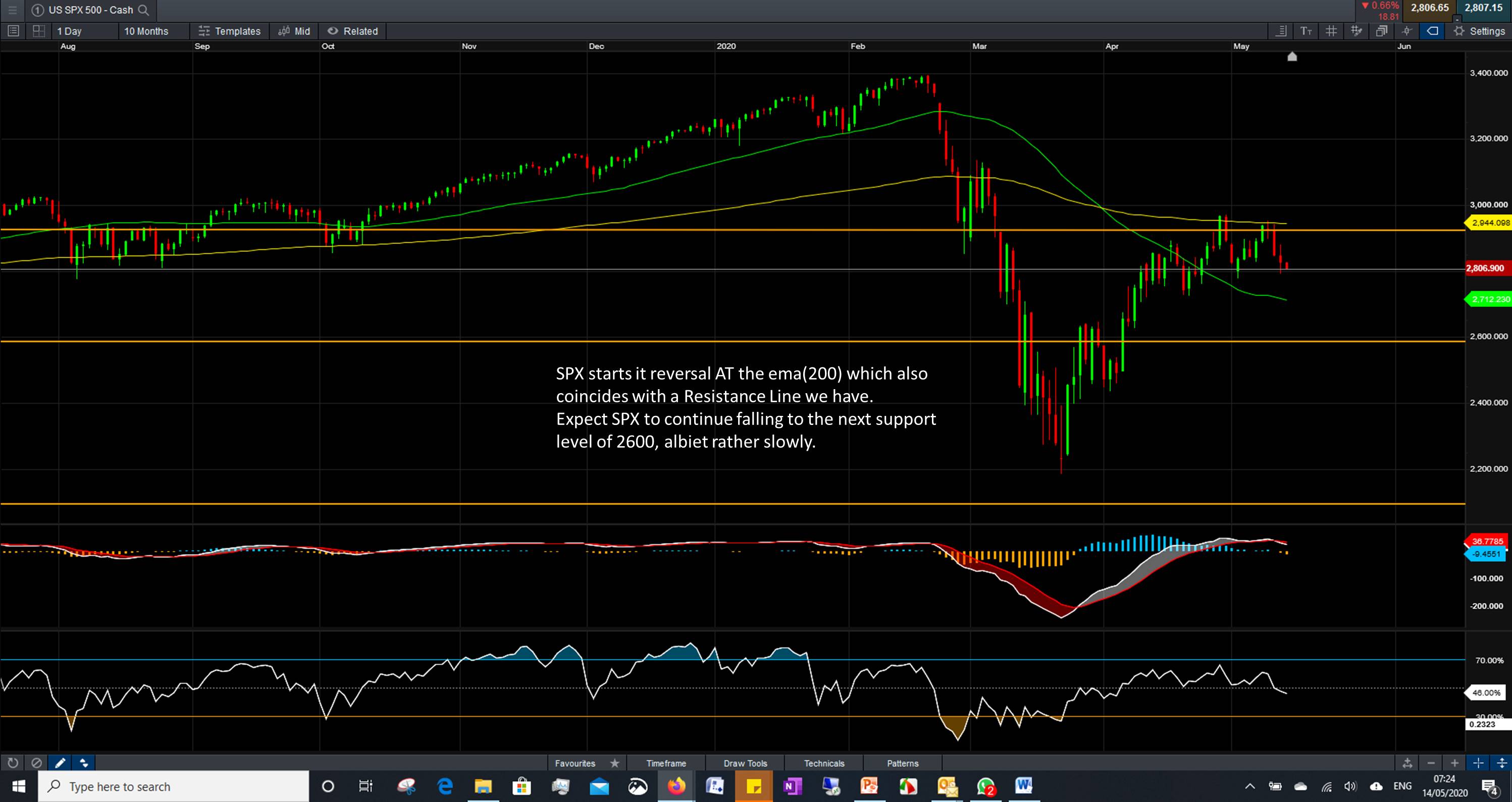

My judgement tells me oil will remain within the $20-$40 trading range for some time until all the COVID-19 commotion has died out.

However, being a strong commodity and necessity, it is easily possible to see crude oil pop back into its original trading range of $40-$50 (pre COVID).

Given the uncertainty of the direction, I would go for an Option Straddle with strike prices very close to ATM.

Good luck!

- Admin

- 09 Jul 20

- 0 Comment

Related Posts

You have to logged in for comment.

Email Newsletter

Get subscriber only insights & news delivered by Financial Markets Club

Weekly Trading Lessons by Email

Do you want to Learn to Trade like a Pro? Every Week we will share some Trading Tips to help you Succeed.

Just enter your Name and Email, and click Subscribe!

FinancialMarkets

FinancialMarkets

Comments