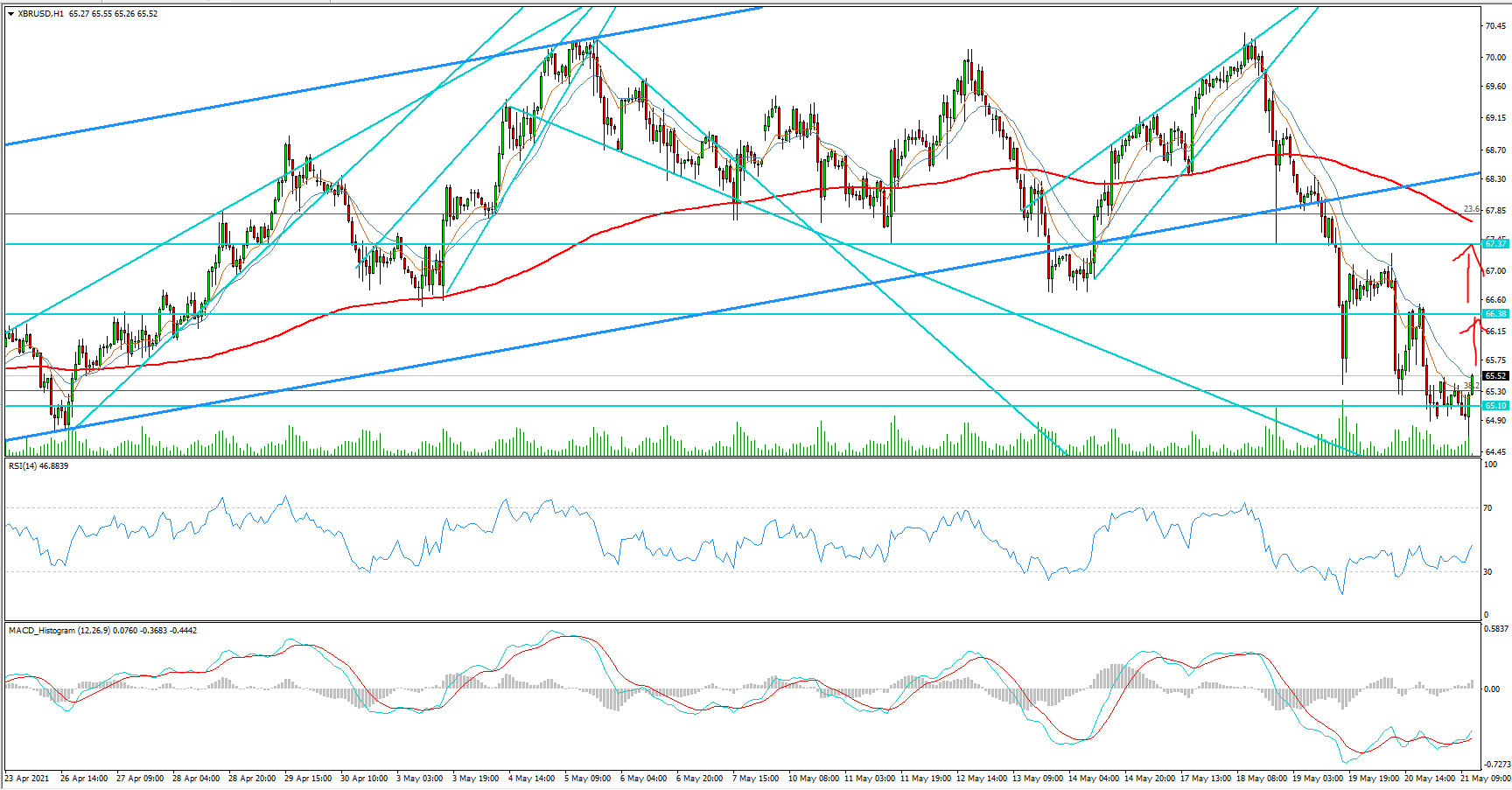

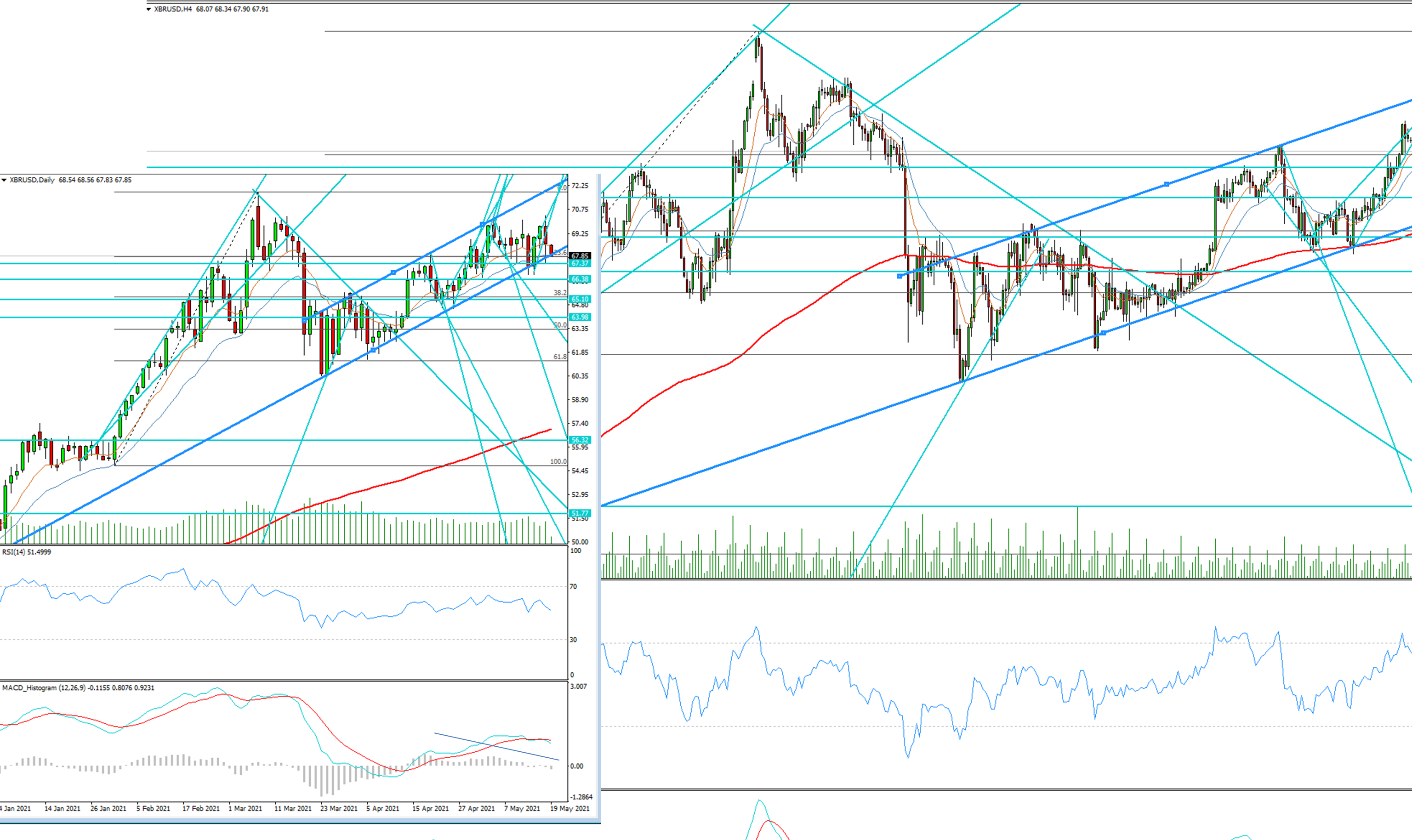

Brent Crude Oil Technical Analysis - 22Feb 2024

At the moment there are not clear short positions to take, we are looking to see if brent oil price will reach around $84-$86 for signs of market reversal

- Home

- Brent Crude Oil Technical Analysis - 22Feb 2024

Brent Crude Oil Technical Analysis

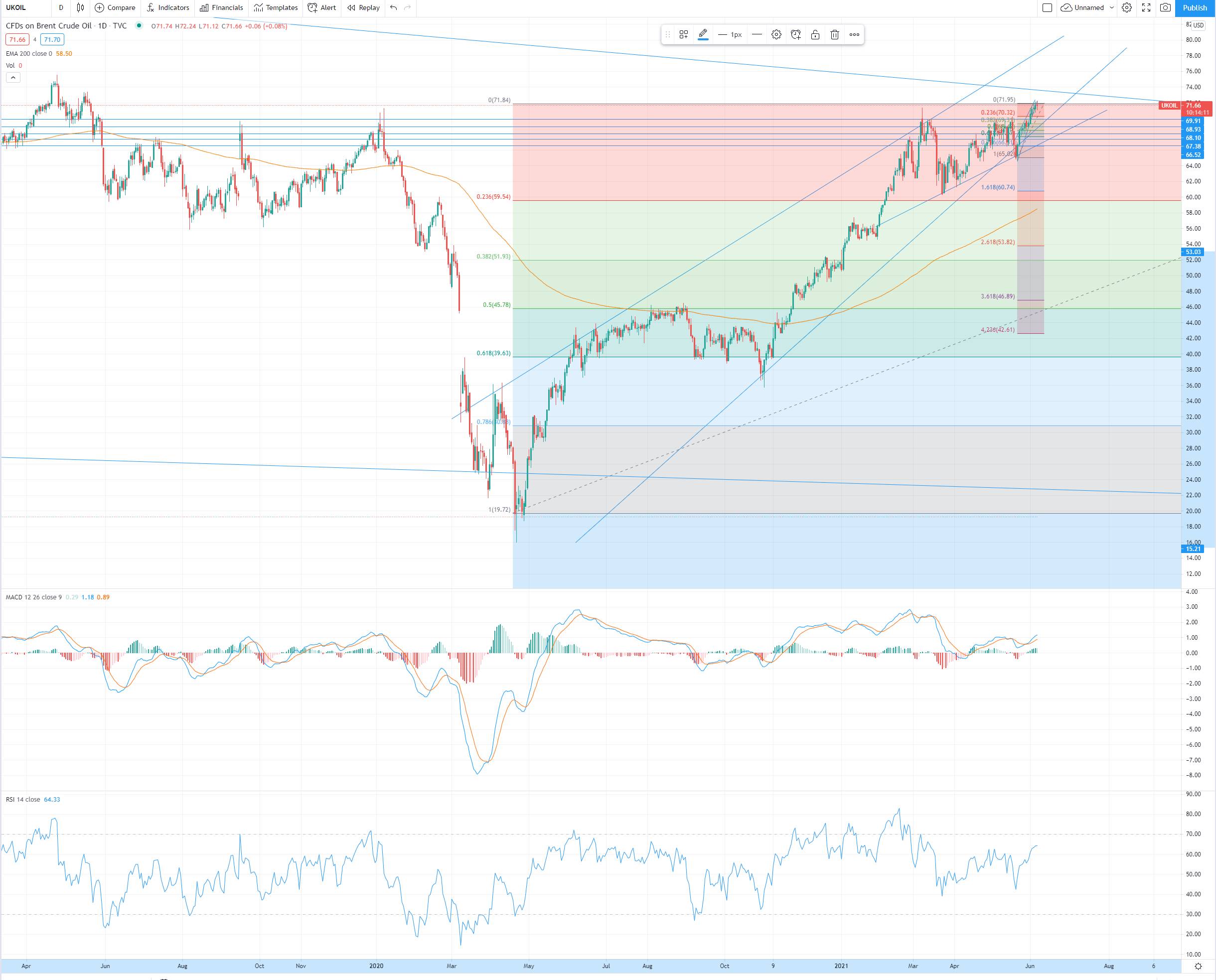

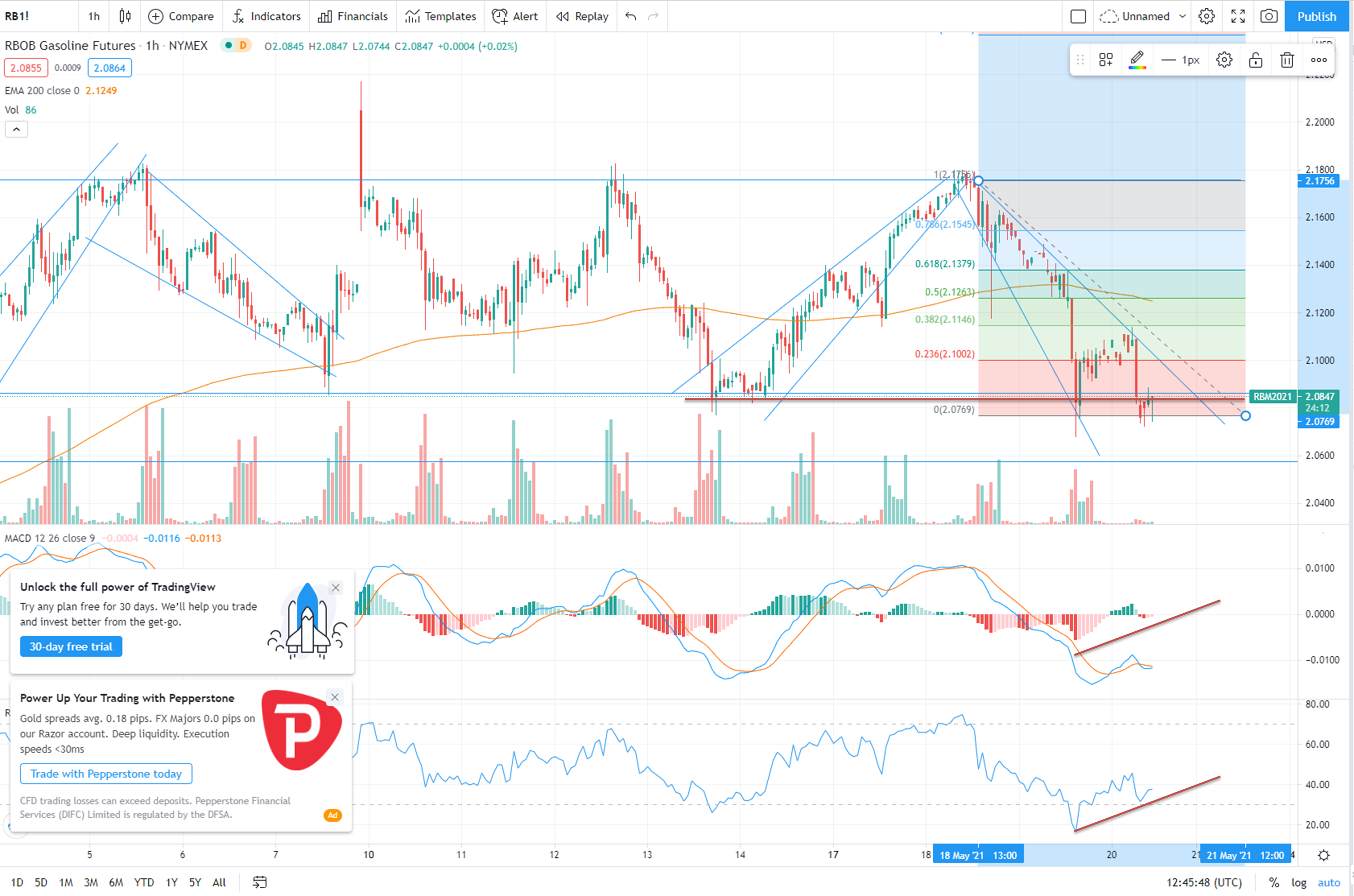

SHORT Case

At the moment there are not clear short positions to take, we are looking to see if brent oil price will reach

around $84-$86 for signs of market reversal. We would use short term sell positions to protect longer term buy positions here onwards, unless we see oil

breach $72 level, which at the moment seems unlikely as we saw oil break confidently above $80s last week.

LONG Case

Better to stay on the buy side of brent crude until around $84-$86 where we might get sell opportunities.

Now the near term outlook is in line with the longer term outlook, we’re expecting a dramatic upward move in

the medium term, heading back towards $100 levels. We expect any sell off in oil to be a buying opportunity for the longer term.

#oilandgas #crudeoil #crudeoiltrading #oilandgasindustry #oilprice

#hedging #derivativestrading #oilandgas #crudeoil #crudeoiltrading

#oilandgasindustry #oilprice #hedging #derivativestrading

#commoditytrading #commoditymarkets

- Admin

- 22 Feb 24

- 0 Comment

Related Posts

You have to logged in for comment.

Email Newsletter

Get subscriber only insights & news delivered by Financial Markets Club

Weekly Trading Lessons by Email

Do you want to Learn to Trade like a Pro? Every Week we will share some Trading Tips to help you Succeed.

Just enter your Name and Email, and click Subscribe!

FinancialMarkets

FinancialMarkets

Comments