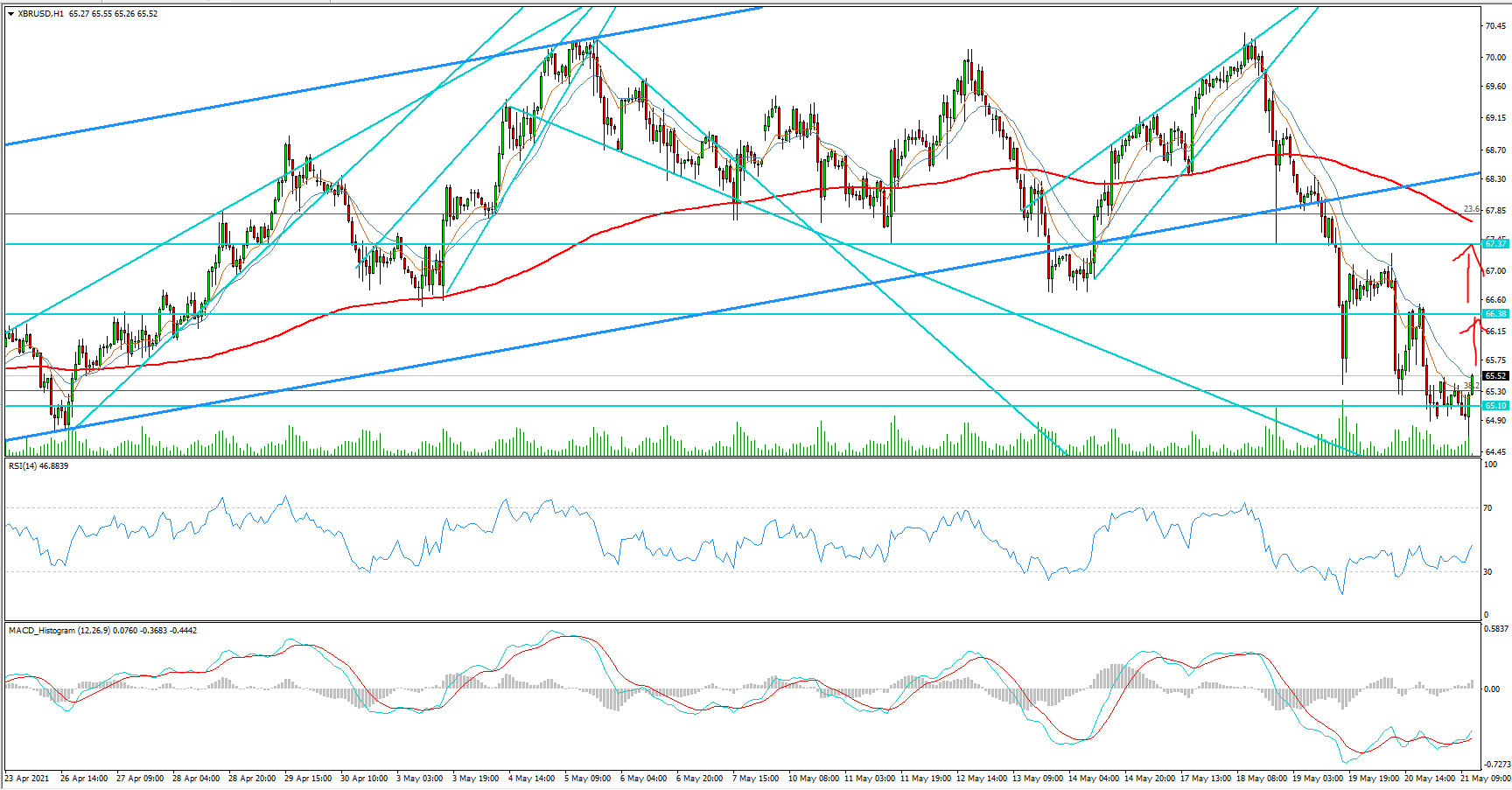

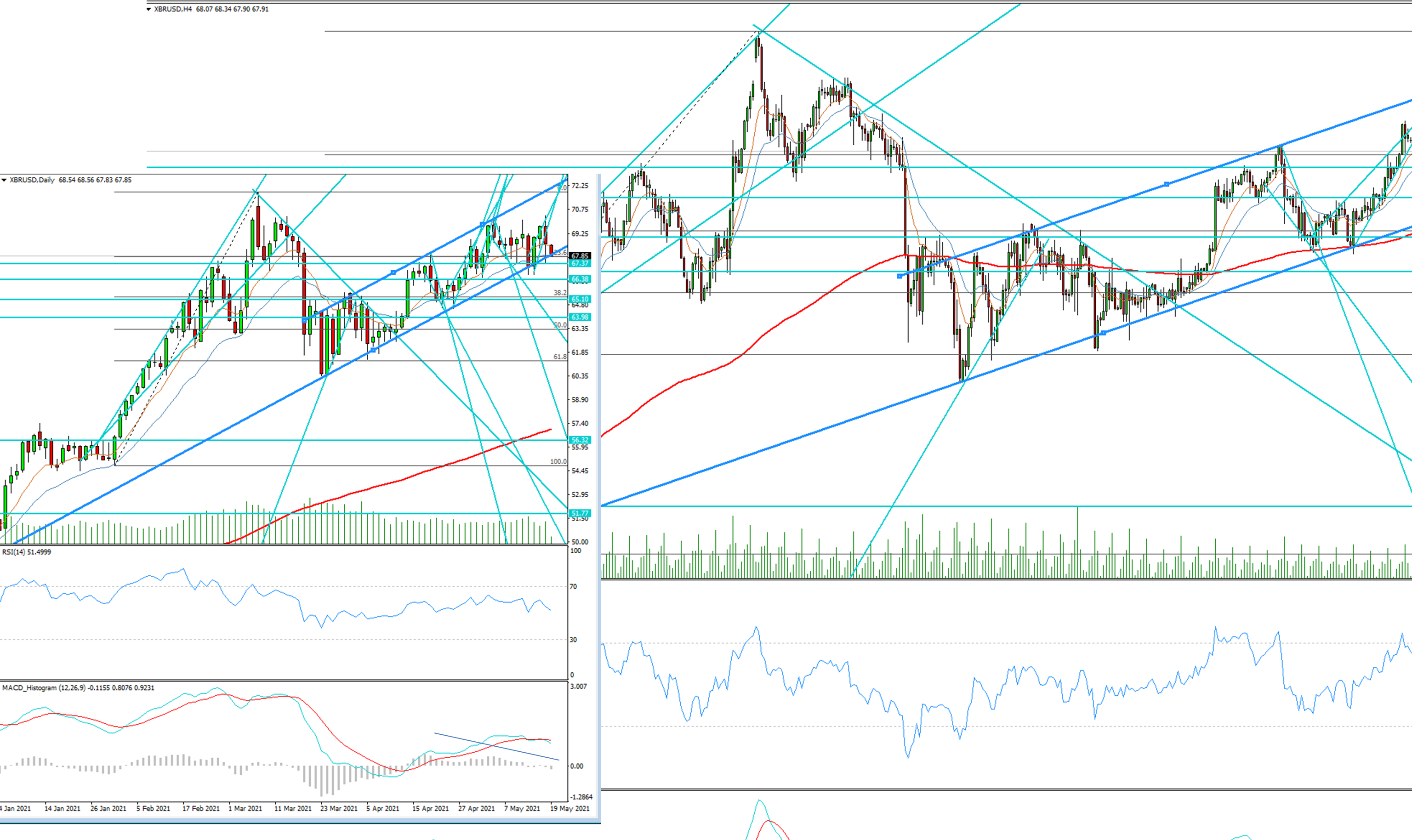

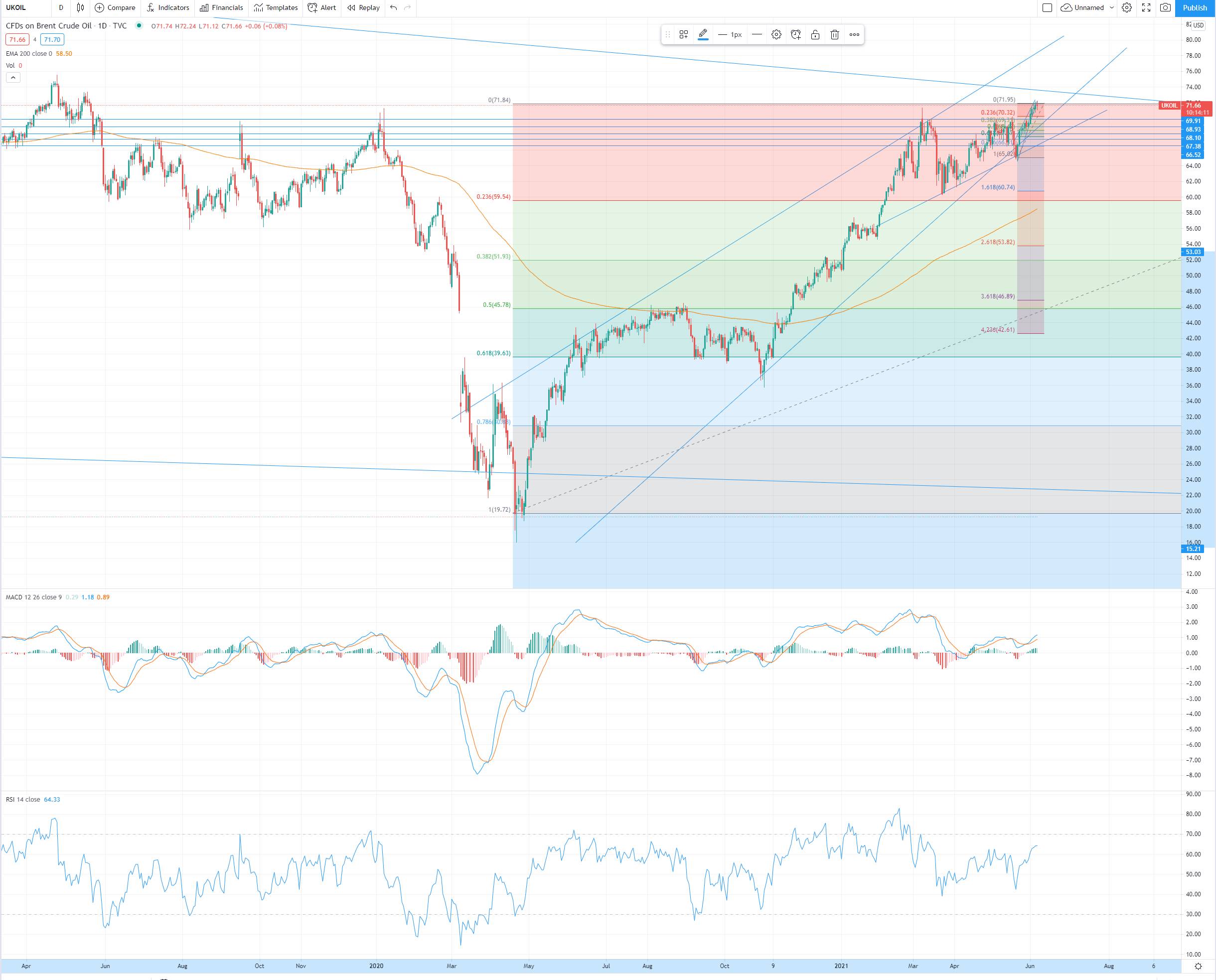

Brent Crude Oil Technical Analysi (XBRUSD) - 24-Nov-2023

Cautious incase Brent Oil could drop to $72-$75 area

- Home

- Brent Crude Oil Technical Analysi (XBRUSD) - 24-Nov-2023

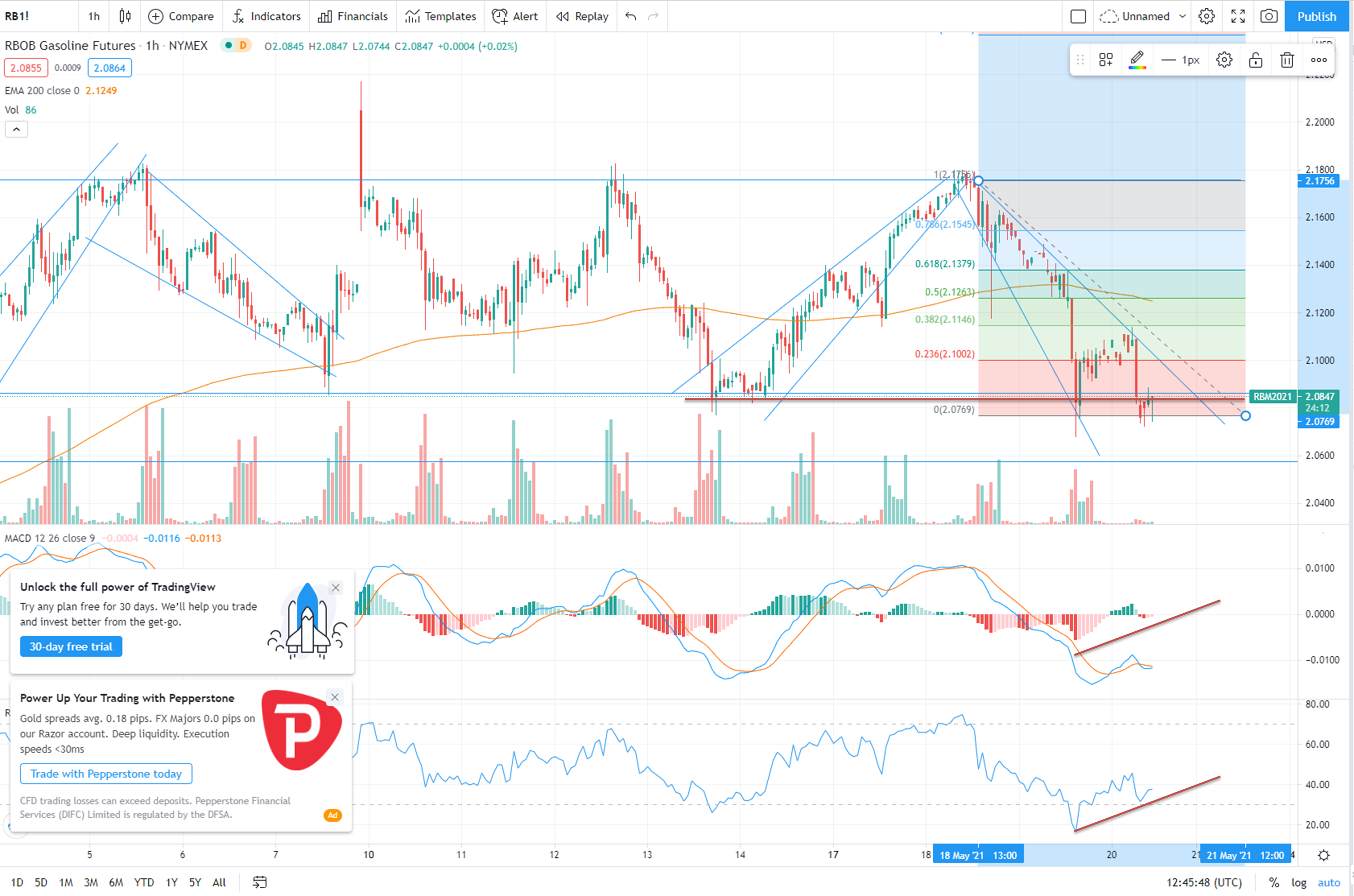

OPEC+ has delayed their meeting to discuss oil output cuts to 30th Nov. Three OPEC+ sources said this was linked to African countries. OPEC+ said after its last meeting in June that the 2024 output quotas of Angola, Nigeria and Congo were conditional on reviews by outside analysts.

We saw Crude Oil react badly to this plan change, with oil dropping 4% and then climbing right back up on the same day.

It is best to be a bit cautious over the weekend, and not hold any oil positions over the weekend.

I can see scope for oil to possibly fall further to as low as $72-$75 area running up to the OPEC+ meeting, but there is no real validity behind this, so it doesn't really make it a sensible sell trade either.

💰I help Oil Trading firms Hedge their risk and generate 5-15% additional profit on their Oil Derivatives Paper Trading.

*If you know any Oil Traders who need Help with Hedging and Paper Trading, please share my number with them. Thanks*

#oilandgas #crudeoil #crudeoiltrading #oilandgasindustry #oilprice #hedging #derivativestrading

- Admin

- 23 Nov 23

- 0 Comment

Related Posts

You have to logged in for comment.

Email Newsletter

Get subscriber only insights & news delivered by Financial Markets Club

Weekly Trading Lessons by Email

Do you want to Learn to Trade like a Pro? Every Week we will share some Trading Tips to help you Succeed.

Just enter your Name and Email, and click Subscribe!

FinancialMarkets

FinancialMarkets

Comments