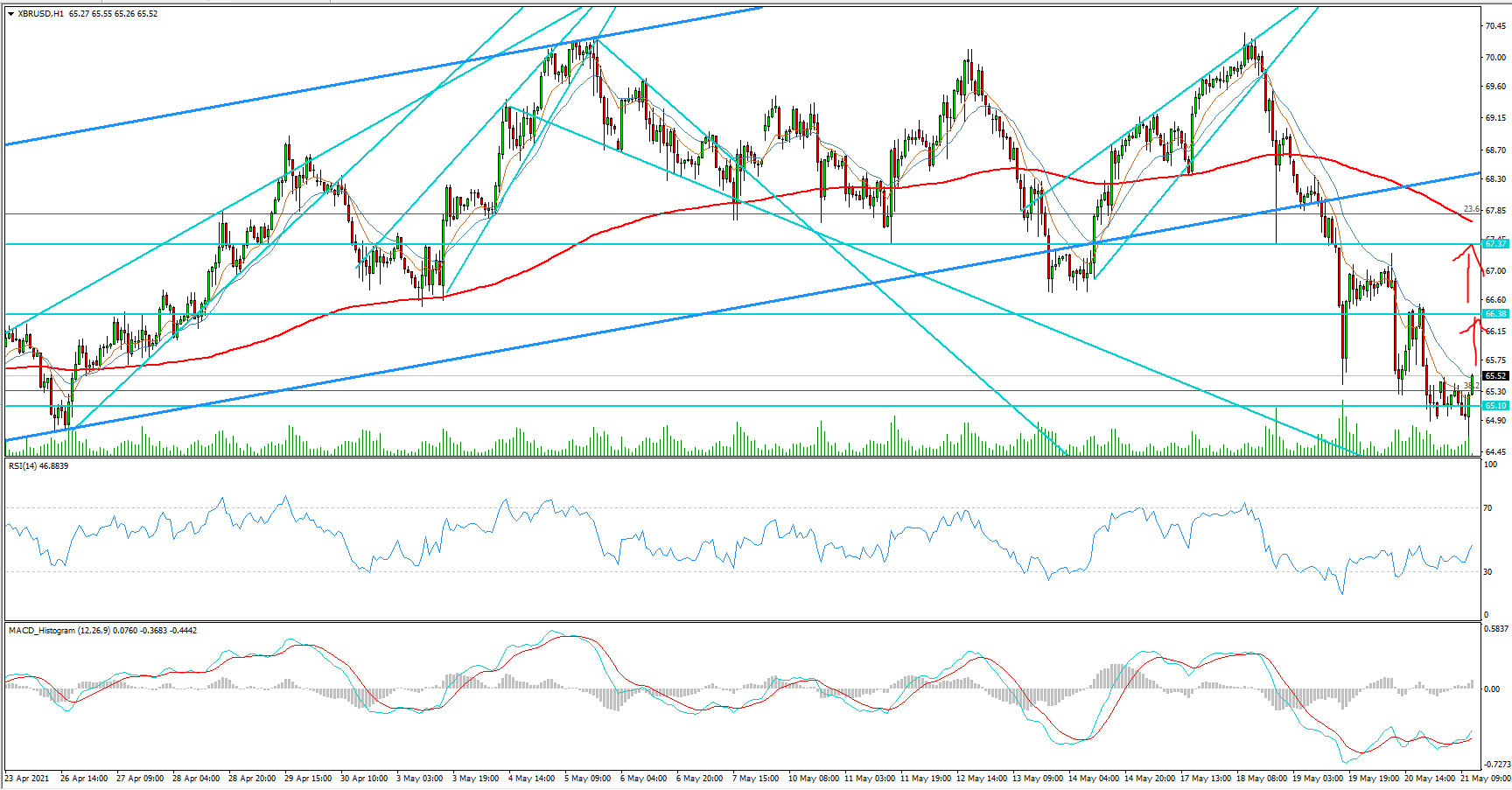

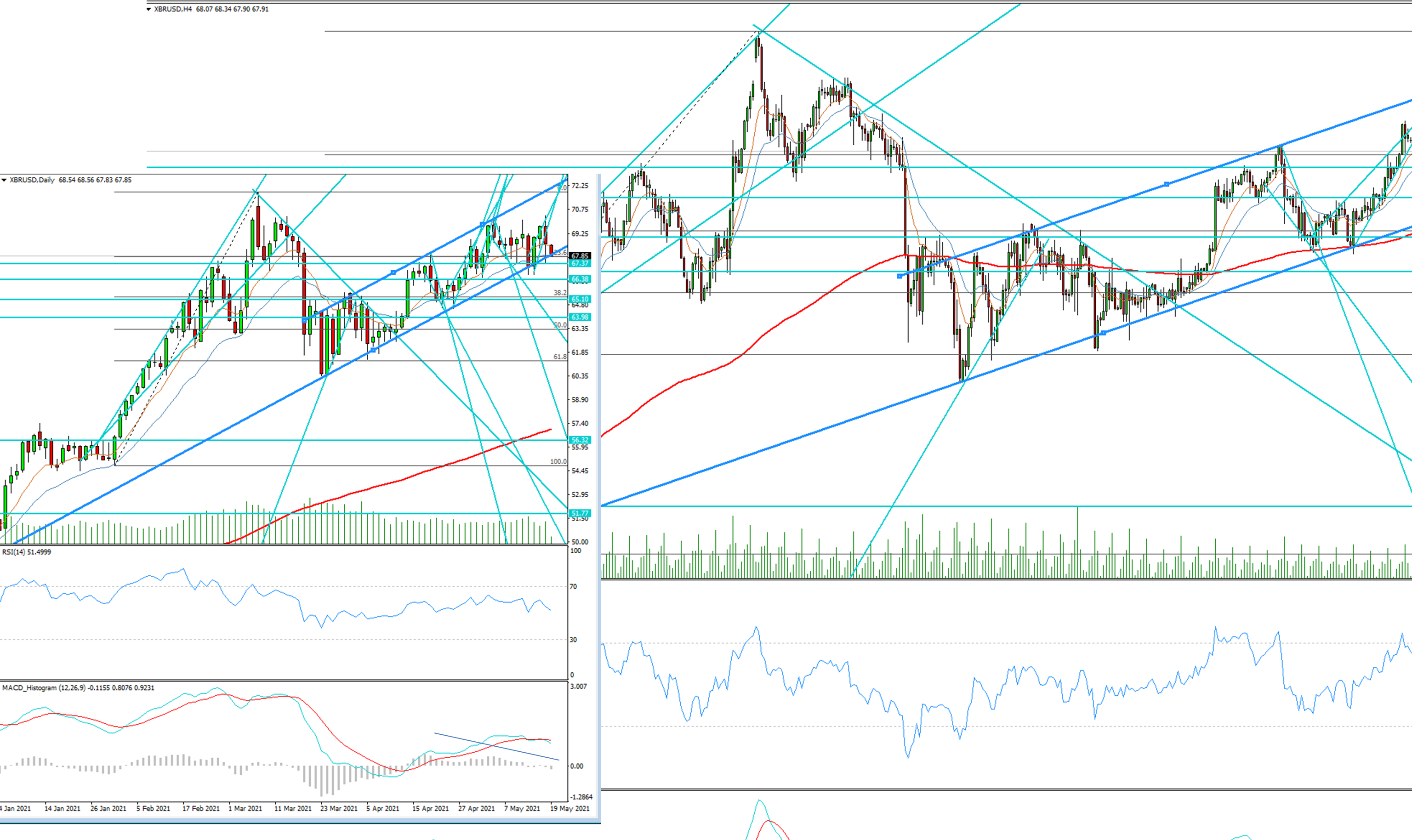

Brent Crude Oil Technical Analysis - 6 May 2024

I have to admit, this year has been tough so far, I couldn't see many trading opportunities in crude oil. I'm getting back into action, expecting to see markets move again, here's my technical analysis on Brent Crude Oil.

- Home

- Brent Crude Oil Technical Analysis - 6 May 2024

I have to admit, this year has been tough so far, I couldn't see many trading opportunities in crude oil.

I'm getting back into action, expecting to see markets move again, here's my technical analysis on Brent Crude Oil:

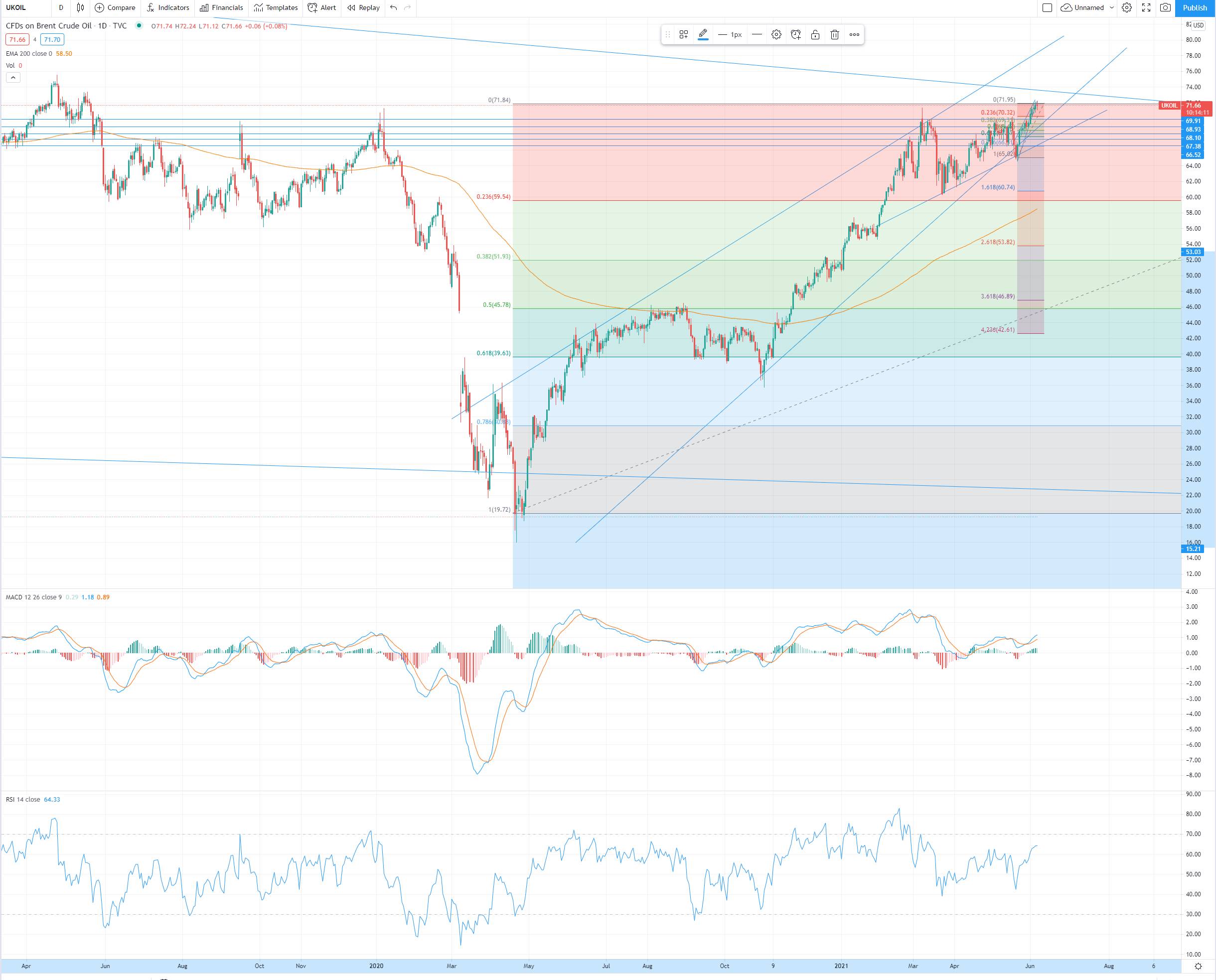

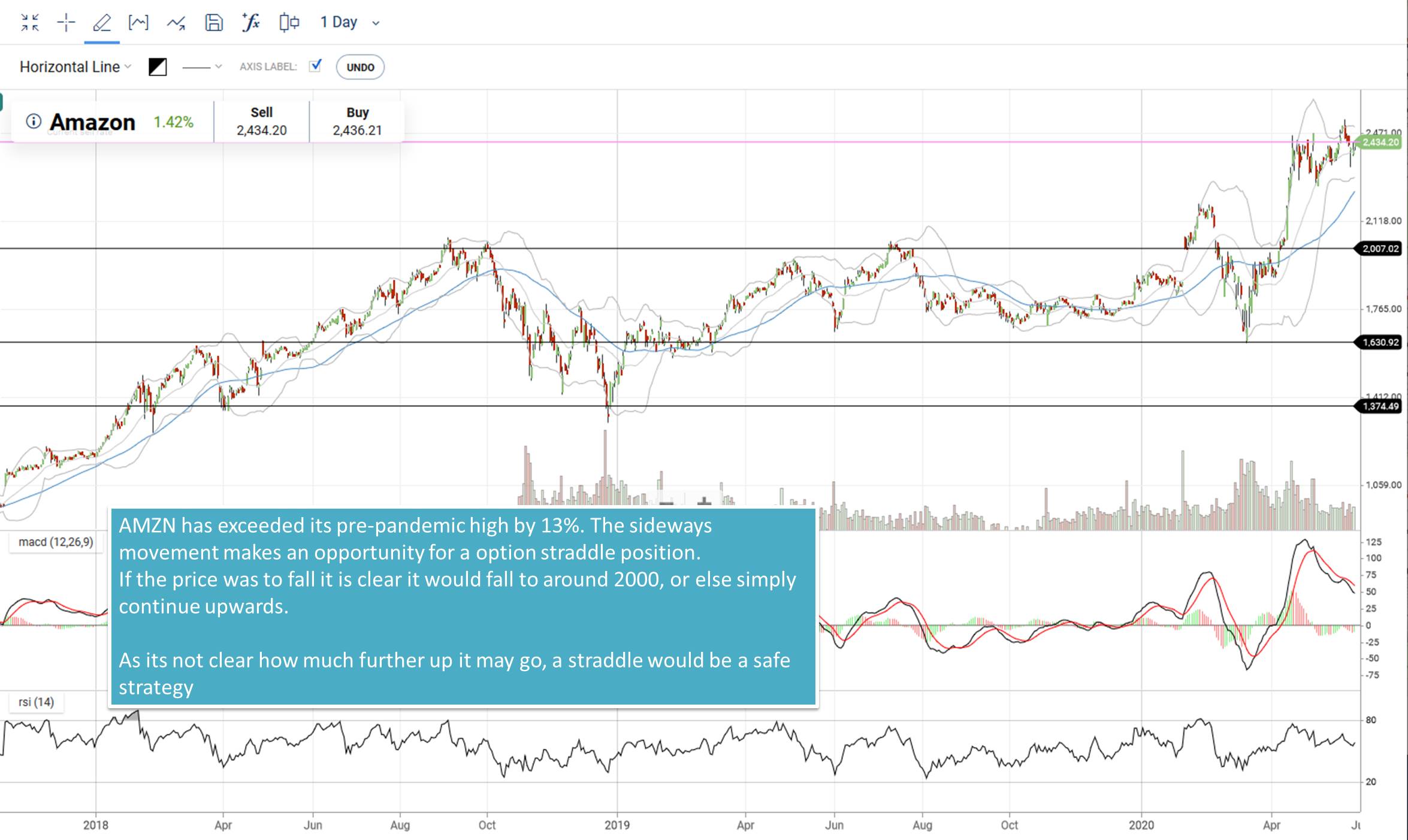

SHORT Case

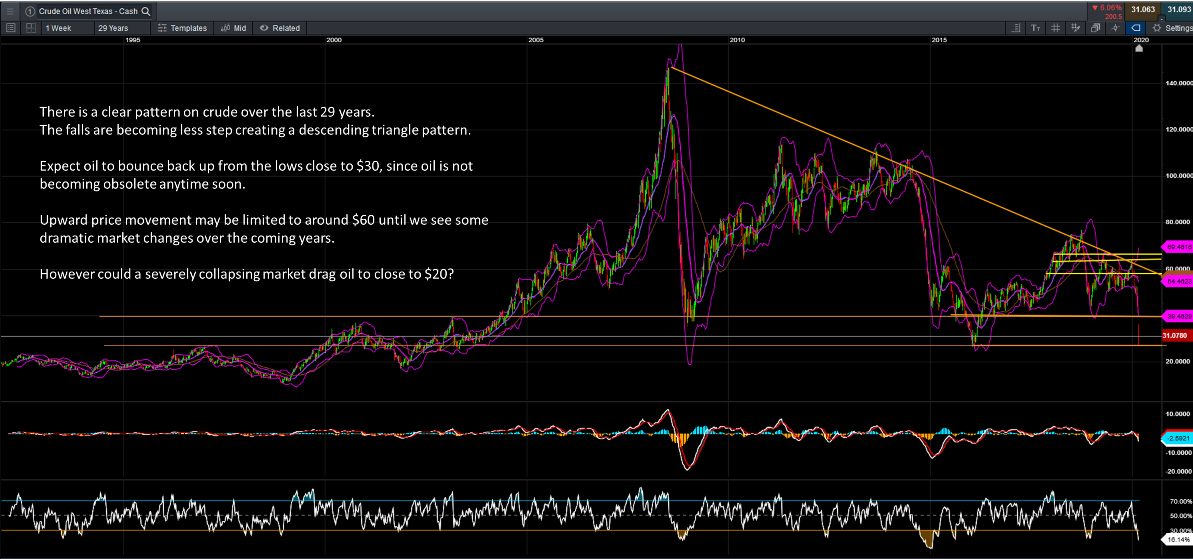

· · It seems most of the falling is done on Crude Oil, and price will most likely hold around the $80s.

· · We are looking to see if Brent will push closer to $80, at which point we would be looking for Buy positions.

· · Short selling crude oil seems like a very high risk strategy at the moment.

LONG Case

· · We’re expecting some sort of strong upward movement as Crude oil prices get closed to $80s.

· · If we can find a bottom closer to $80, there will be a high probability of oil pushing back up towards $95.

· · Ideally stay on the buy side of Crude Oil, overall in the medium to longer terms BRENT looks good to keep rising, beyond $100+

- Admin

- 06 May 24

- 0 Comment

Related Posts

You have to logged in for comment.

Email Newsletter

Get subscriber only insights & news delivered by Financial Markets Club

Weekly Trading Lessons by Email

Do you want to Learn to Trade like a Pro? Every Week we will share some Trading Tips to help you Succeed.

Just enter your Name and Email, and click Subscribe!

FinancialMarkets

FinancialMarkets

Comments