Oil Falls Beyond Expectation - now at $12.40! (WTI Spot price)

- Home

- Oil Falls Beyond Expectation - now at $12.40! (WTI Spot price)

Hi All,

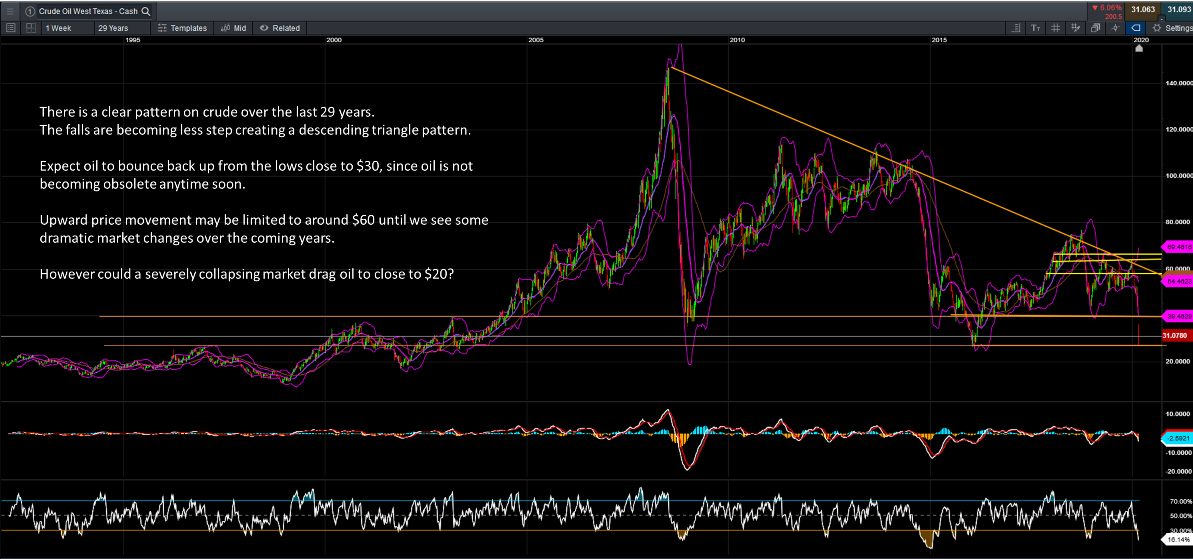

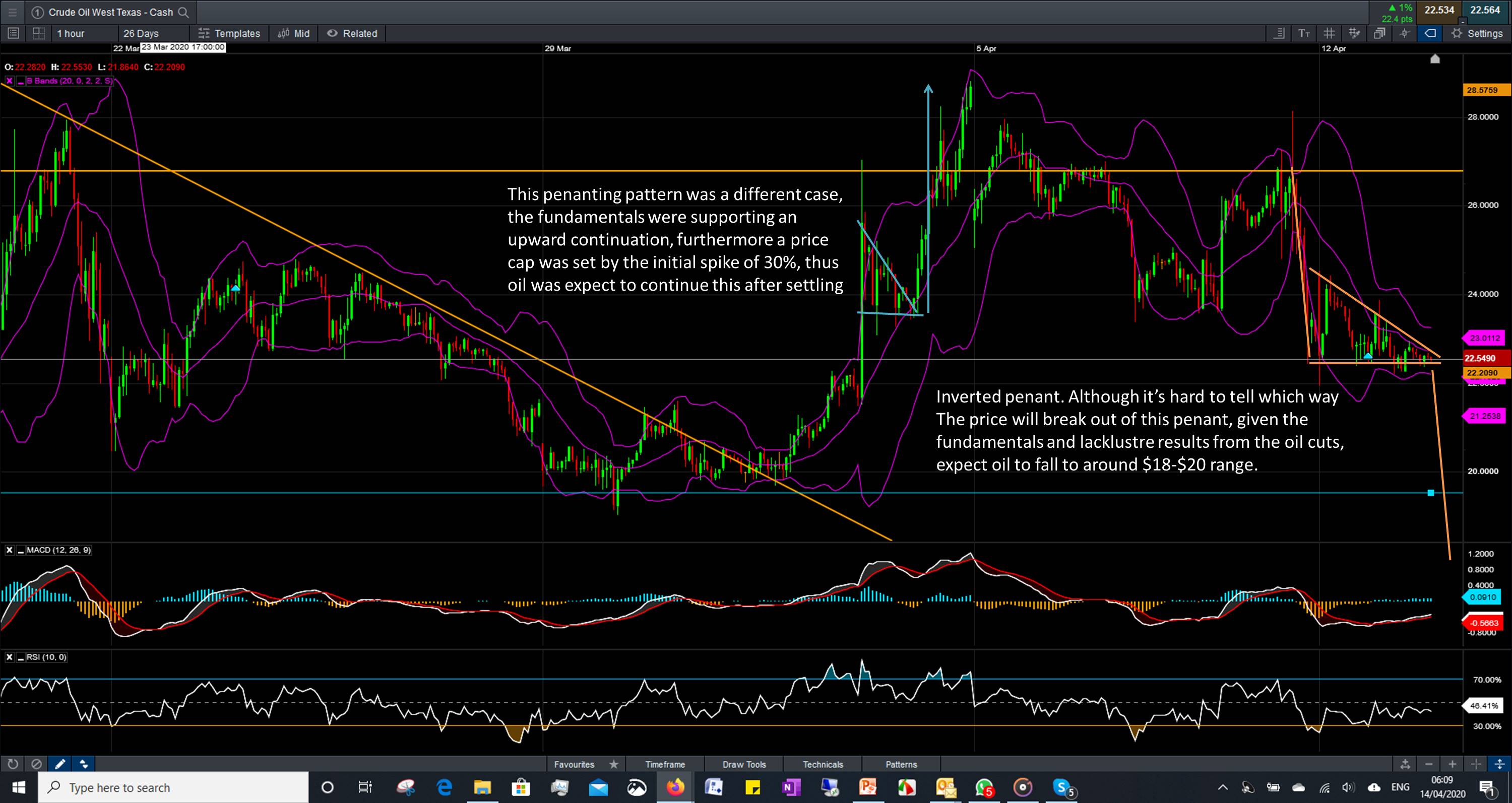

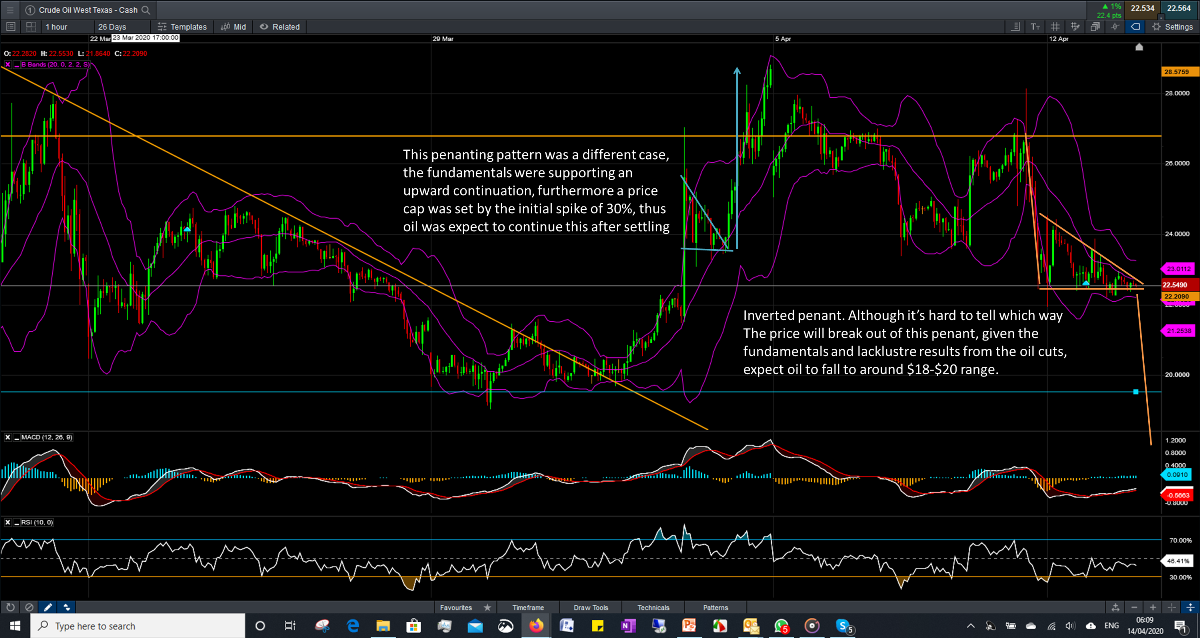

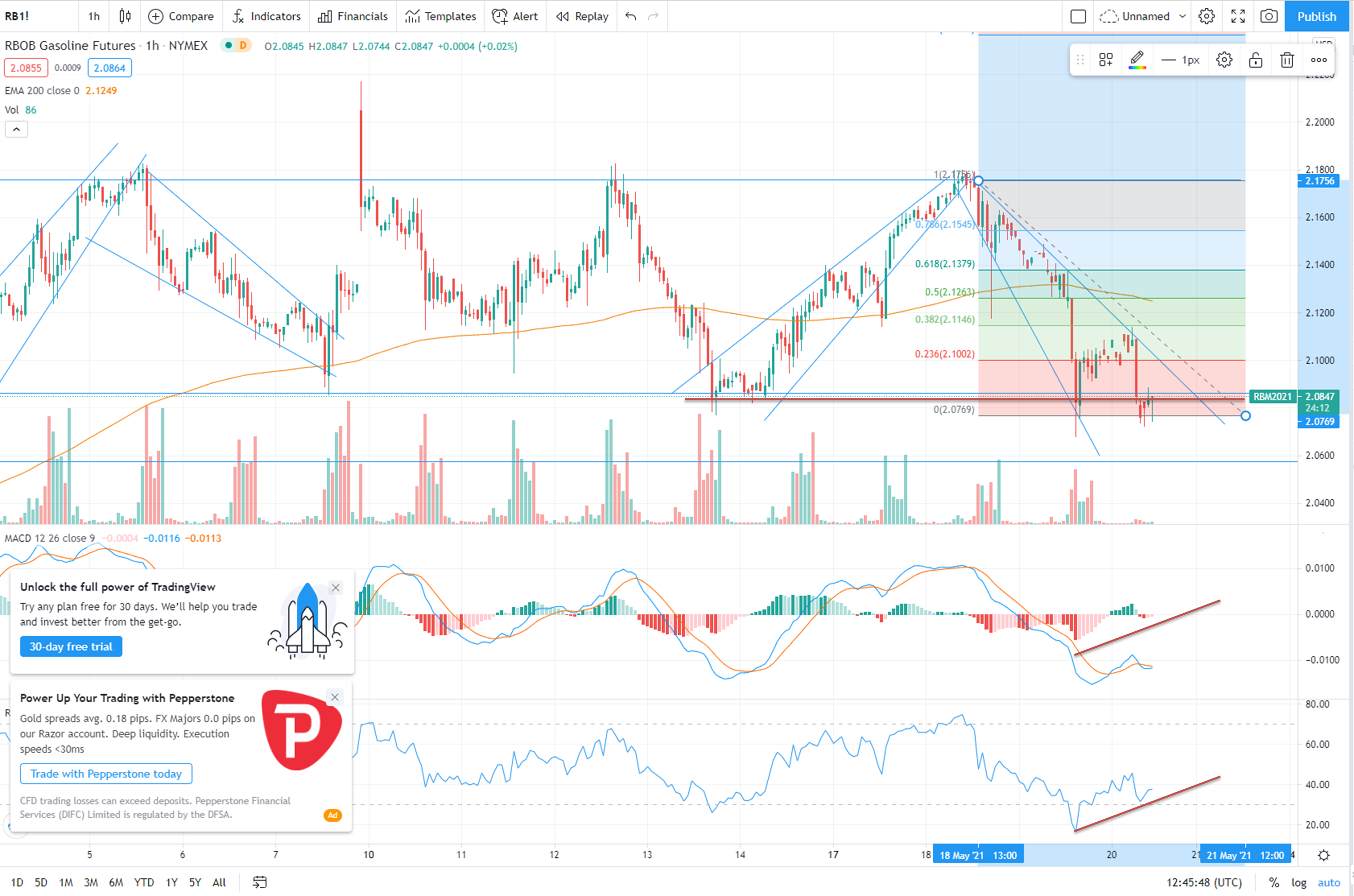

I wanted to quickly give you an update on what happened to the chart pattern I showed on the previous post.

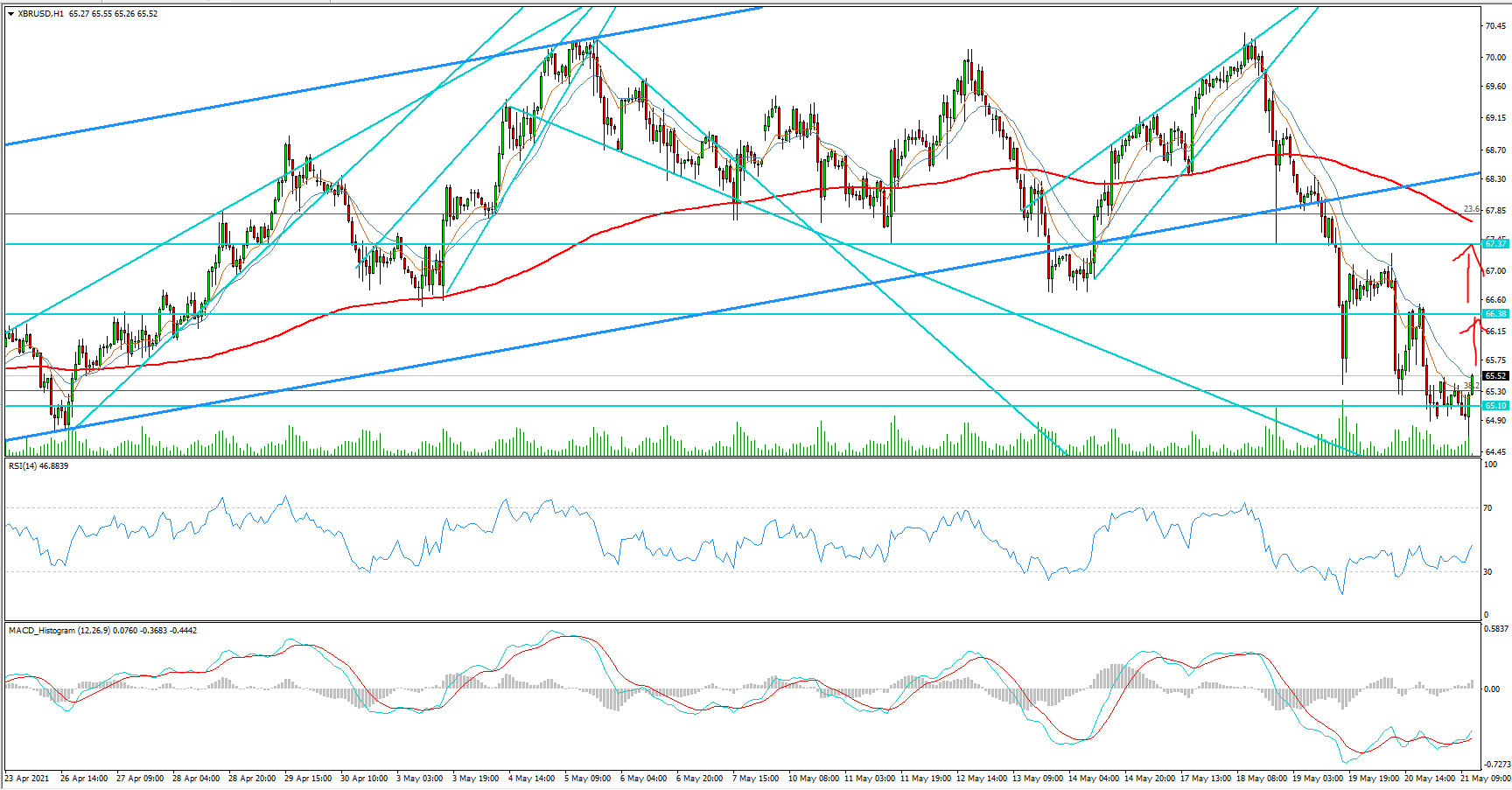

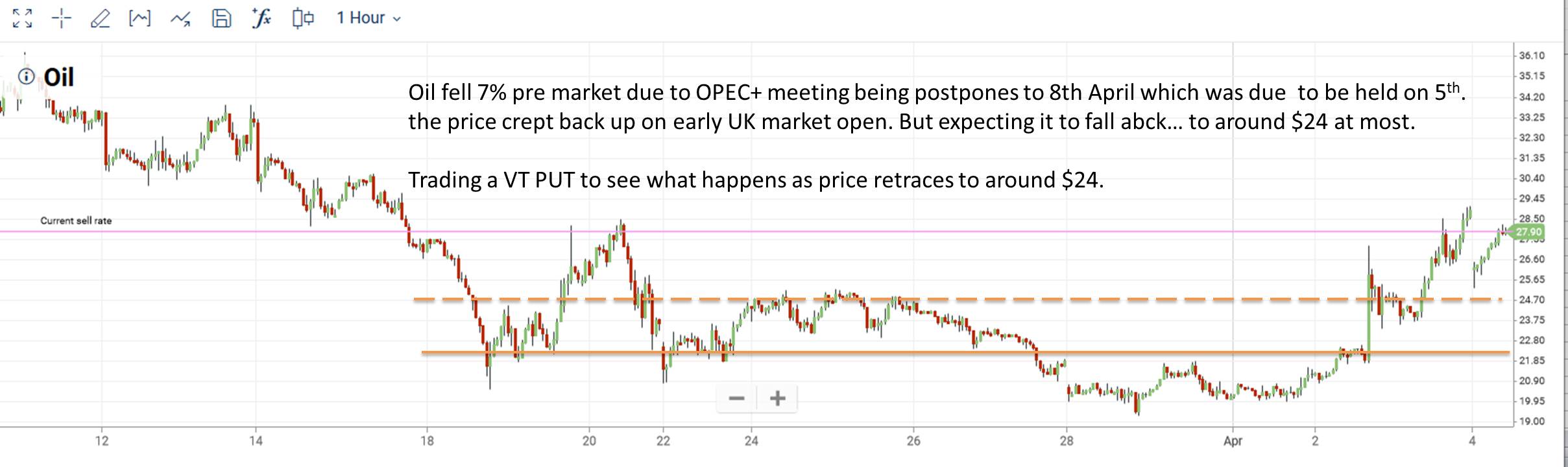

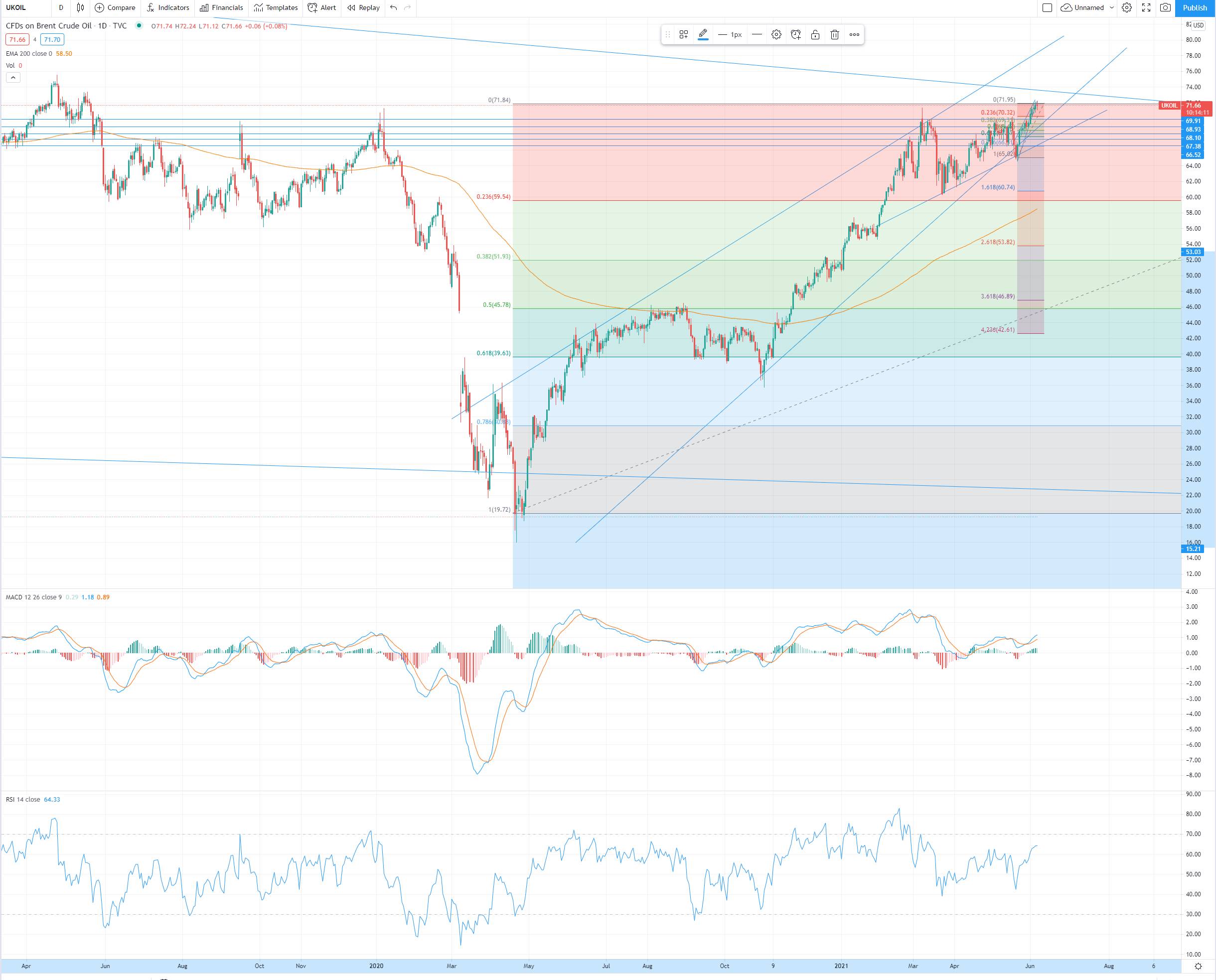

As you can see Oil did head down comfortably, and there was some turbulence around $18 before continuing.

However, it has fallen beyond my expectation, I am shocked that WTI spot price could fall as low as $12.40 (as at the time of taking the chart today). My expectation as $15 at worst.

So why is this happening? To be honest, I can't understand for sure, but the May Oil contracts are due to expire tomorrow (as I learn today), and with an oversupply in the market, there is a storage problem. Thus traders are essentially offloading at whatever price they can so they don't have to take delivery and store the oil.

It all sounds confusing I know, and the purpose of this post is not to go into the logistical ins and outs of physical oil trading. But the key thing to watch out for next is the June future prices, which are around $10 more! Normally the prices would have converged by now, but now we have a situation known as Contango, where the future price is far higher than the current spot price, thus giving this huge gap in the oil price. I am really keen to see what happens over the next 2 days as the May contracts expire and the June contracts kick in.

- Admin

- 20 Apr 20

- 0 Comment

Related Posts

You have to logged in for comment.

Email Newsletter

Get subscriber only insights & news delivered by Financial Markets Club

Weekly Trading Lessons by Email

Do you want to Learn to Trade like a Pro? Every Week we will share some Trading Tips to help you Succeed.

Just enter your Name and Email, and click Subscribe!

FinancialMarkets

FinancialMarkets

Comments