8 Things You Need To Know On FInancial Markets.

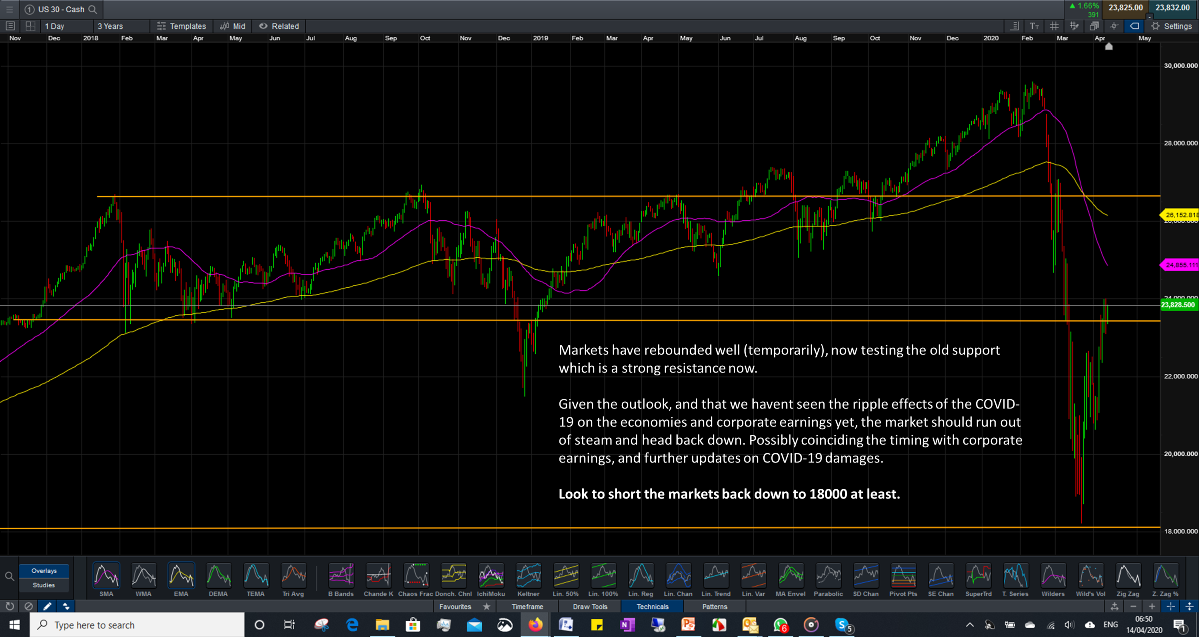

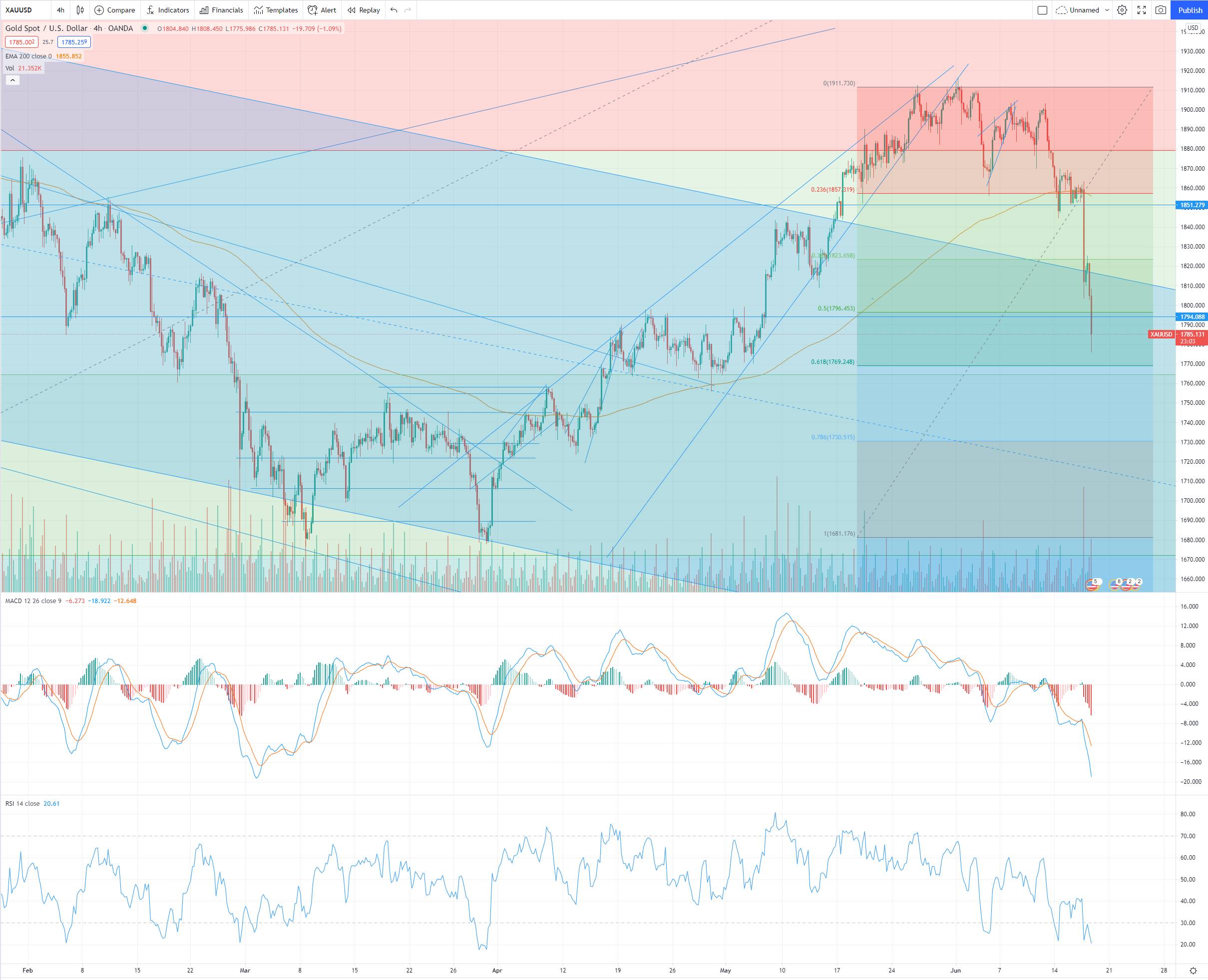

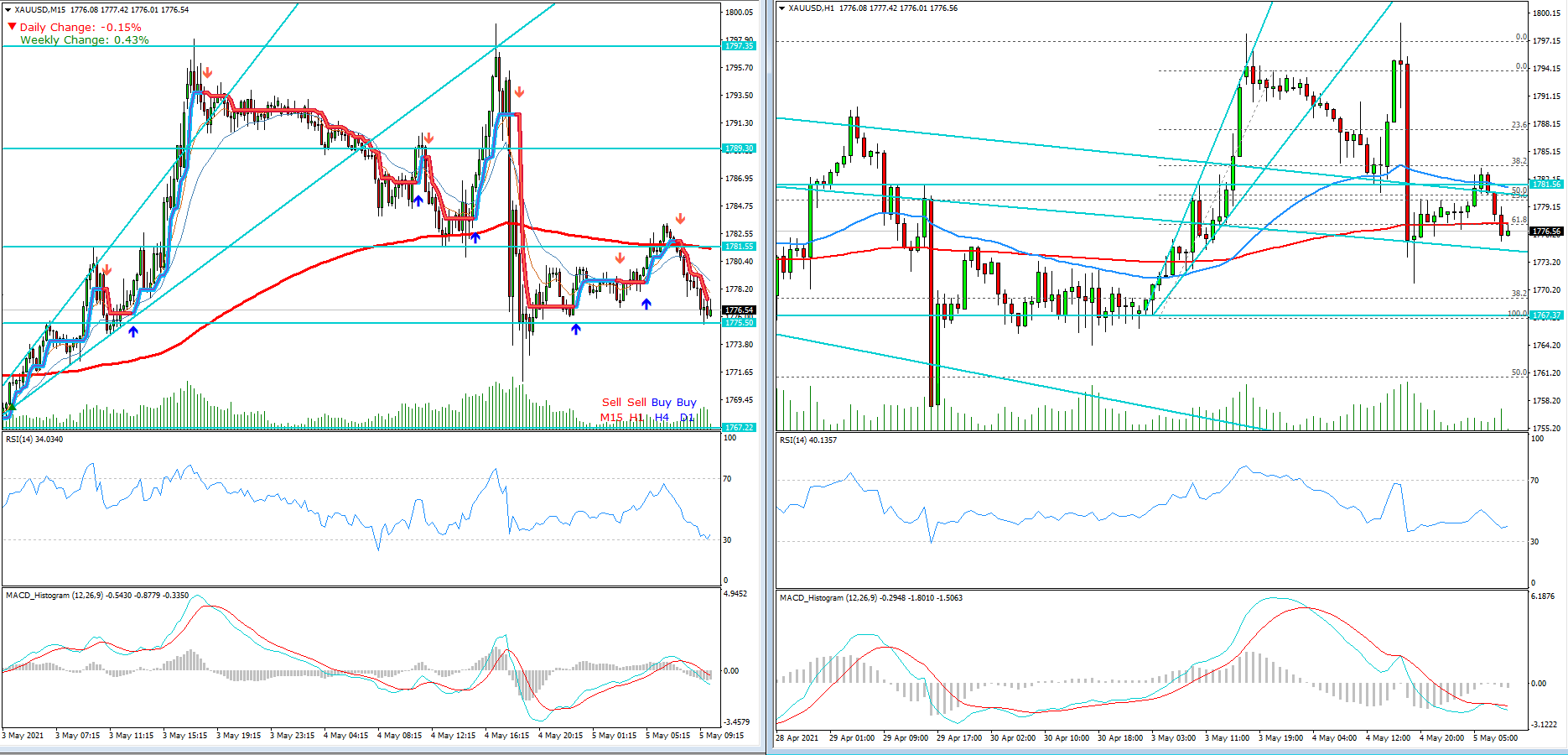

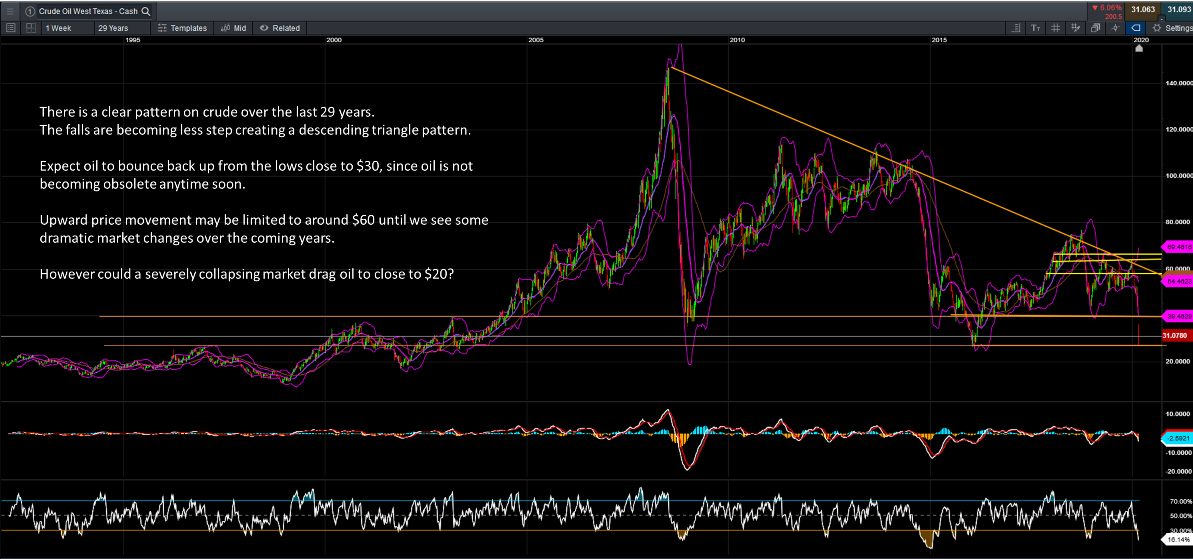

A dull start to the week, Crude oil continues to move sideways, but we can see scope for a drop to $80s in the near term. Market volatility is likely to pick up from today, here's what you need to know on the market. Enjoy!

- Home

- 8 Things You Need To Know On FInancial Markets.

U.S Interest Rates

Three Federal Reserve officials said the pace of interest-rate cuts will depend on incoming economic data, suggesting the path to lower borrowing costs may look different than in previous ratecutting cycles. Boston Fed President Susan Collins and New York’s John Williams said the Fed’s first rate

cut will likely be appropriate “later this year,” while Atlanta’s Raphael Bostic said he’s currently penciling in a cut for sometime this summer. Meanwhile, Thursday’s core personal consumption expenditures gauge will likely highlight the bumpy path the central bank faces in achieving its 2% target.

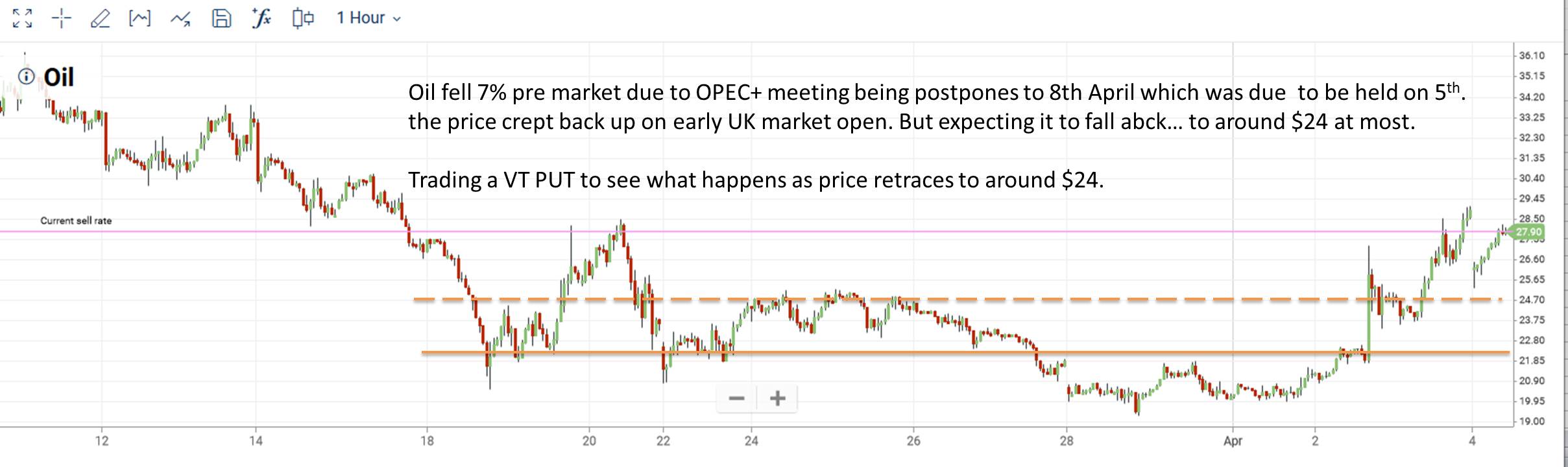

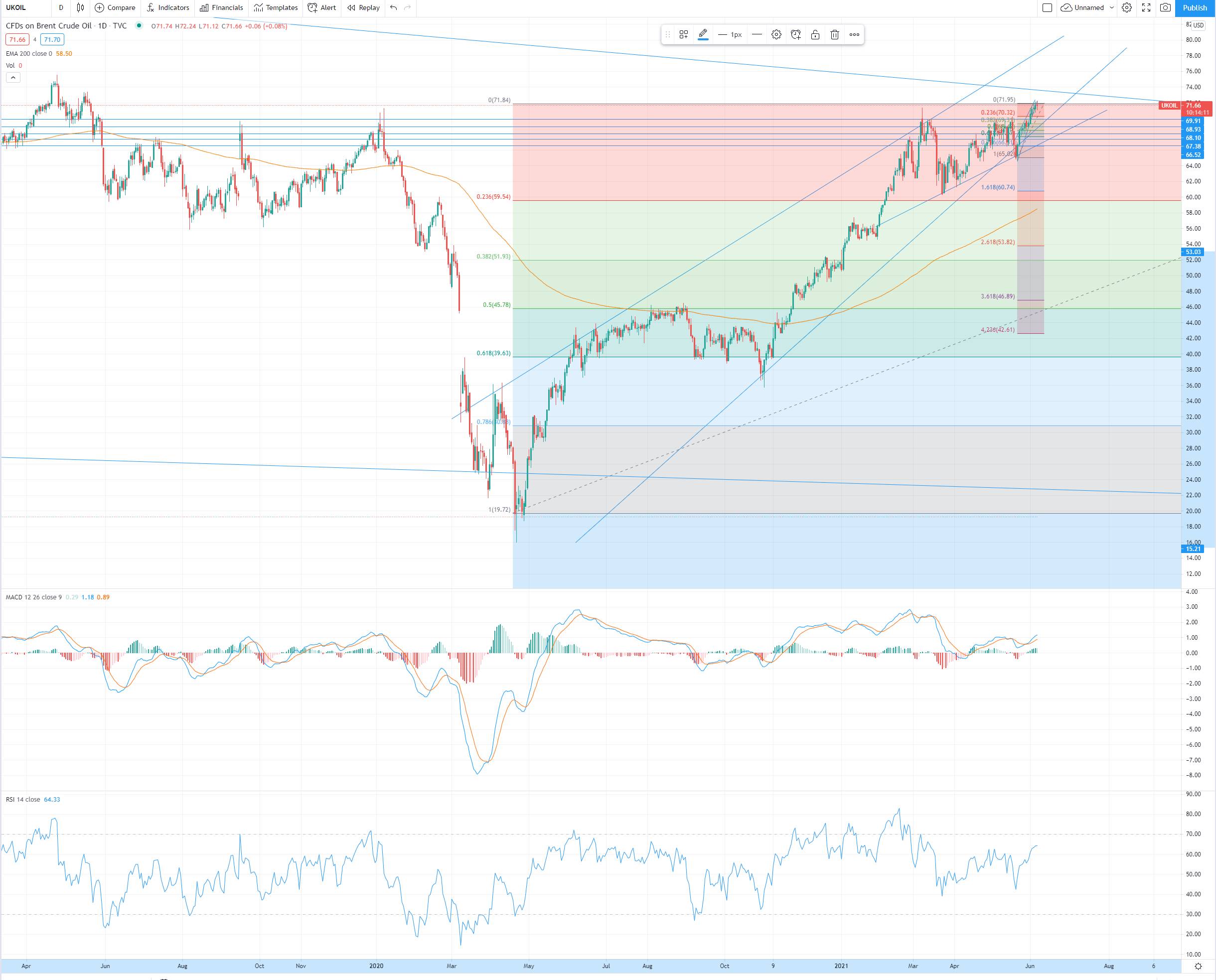

OPEC+

Many expect OPEC+ to rollover its “voluntary”

oil output cuts, Javier Blas writes. But he believes the cartel has a chance to add a bit of extra supply, taking some short-term pain for a

long-term gain

BOJ

Bank of Japan Board Member Hajime Takata sent a strong signal that the case for ending the negative

interest rate policy is gaining momentum, comments that pushed the yen and government bond yields

higher. “There are uncertainties for Japan’s economy but my view is that the price target is finally coming into sight,” Takata said in a speech to local business leaders in Shiga, western Japan Thursday. The

comments will likely underpin speculation in the market that the bank is poised to conduct Japan’s first

rate hike since 2007 in the coming months.

China Quants

Chinese regulators are taking steps to gradually shrink the size of a popular quantitative trading strategy that contributed to turmoil in the nation’s stock market this month. Some quant funds that

manage “Direct Market Access” products for external clients were told to stop accepting new inflows

and phase out their existing products, which typically use swap contracts and are often highly leveraged,

according to people familiar with the matter. The guidance curbs a popular trade that enabled quant

funds to boost returns in 2023 but was blamed for exacerbating a stock-market selloff this year. Such

products stood at as much as $27.8 billion at the start of the year, according to estimates by hedge

fund Shanghai Banxia Investment Management Center.

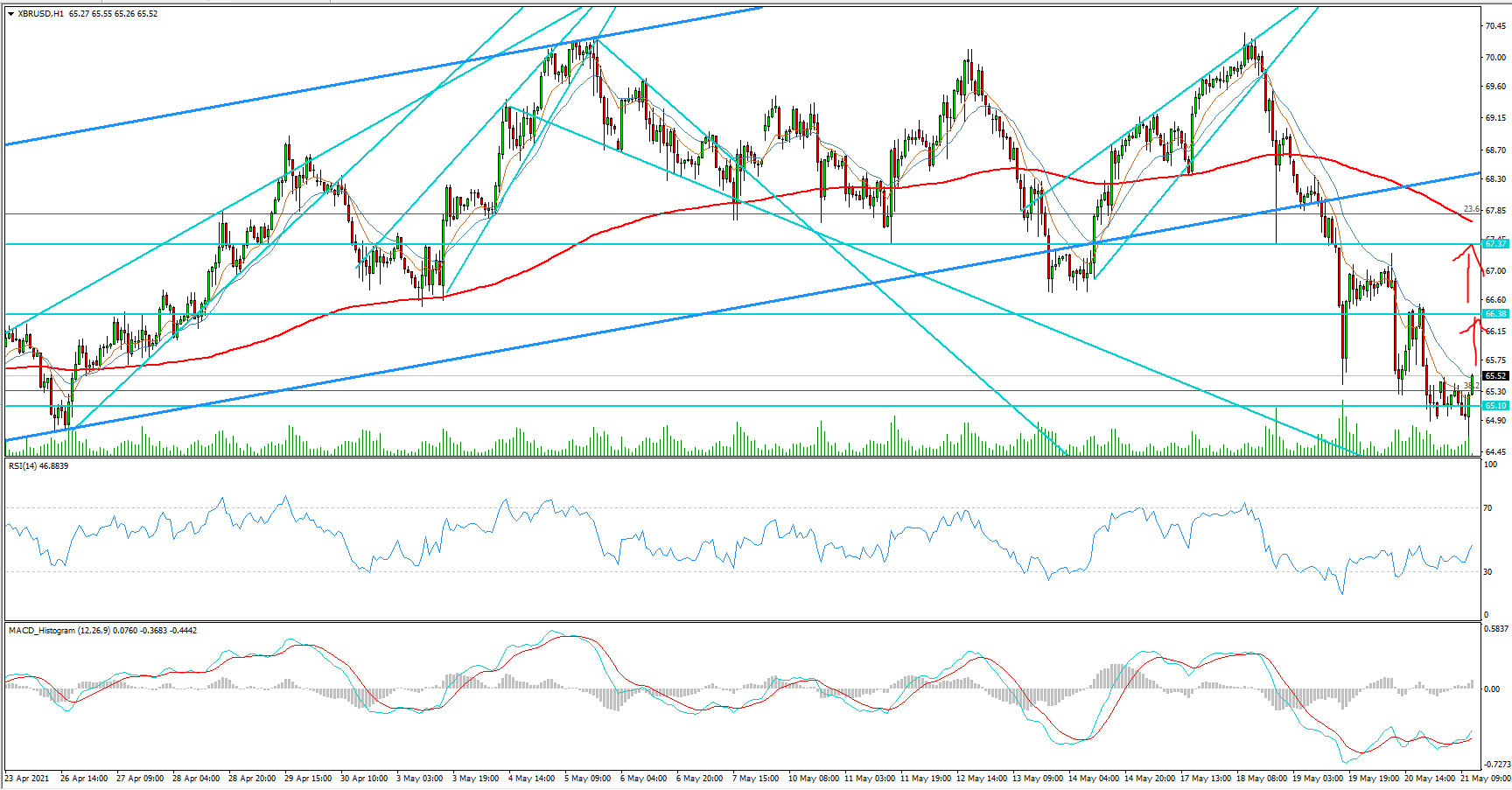

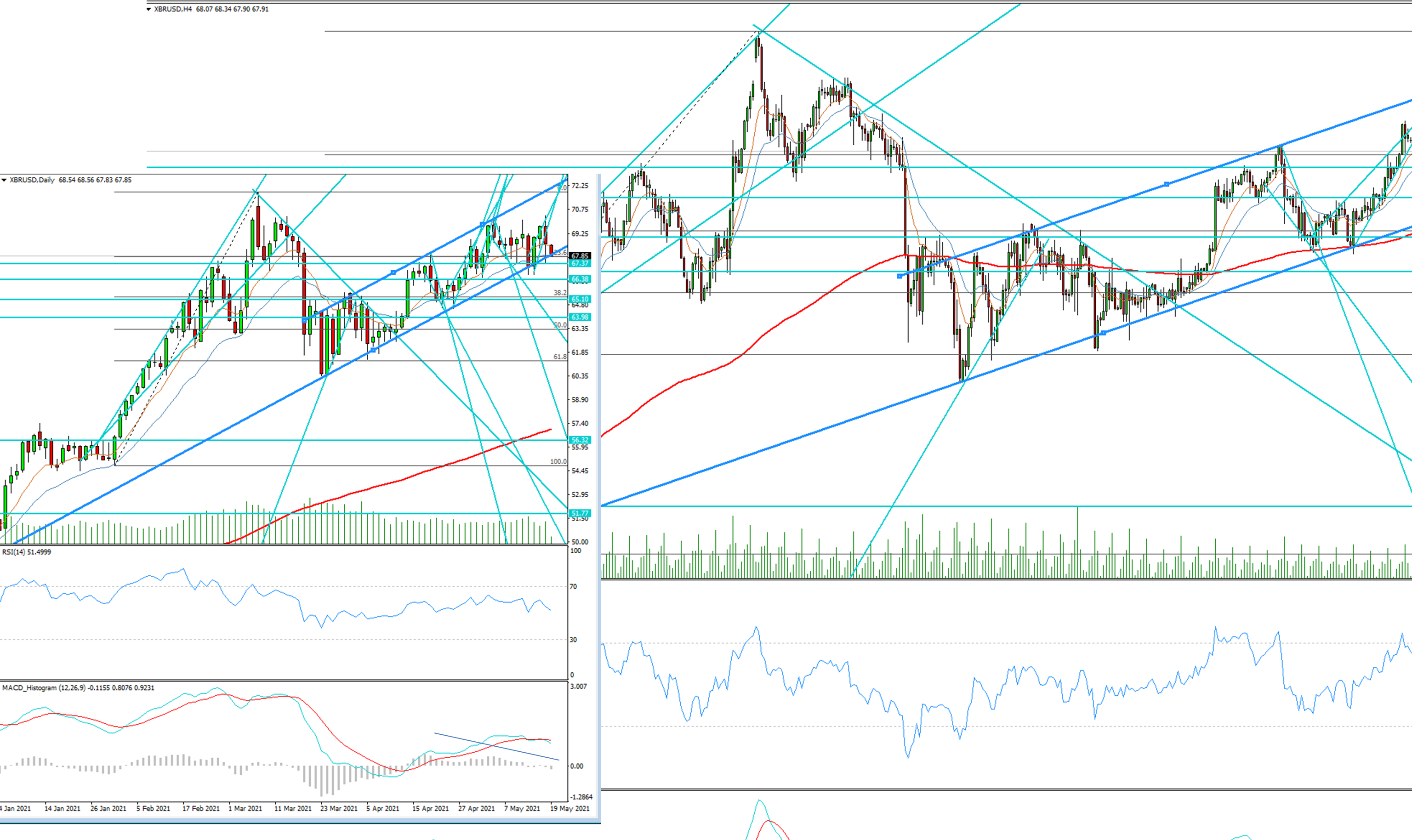

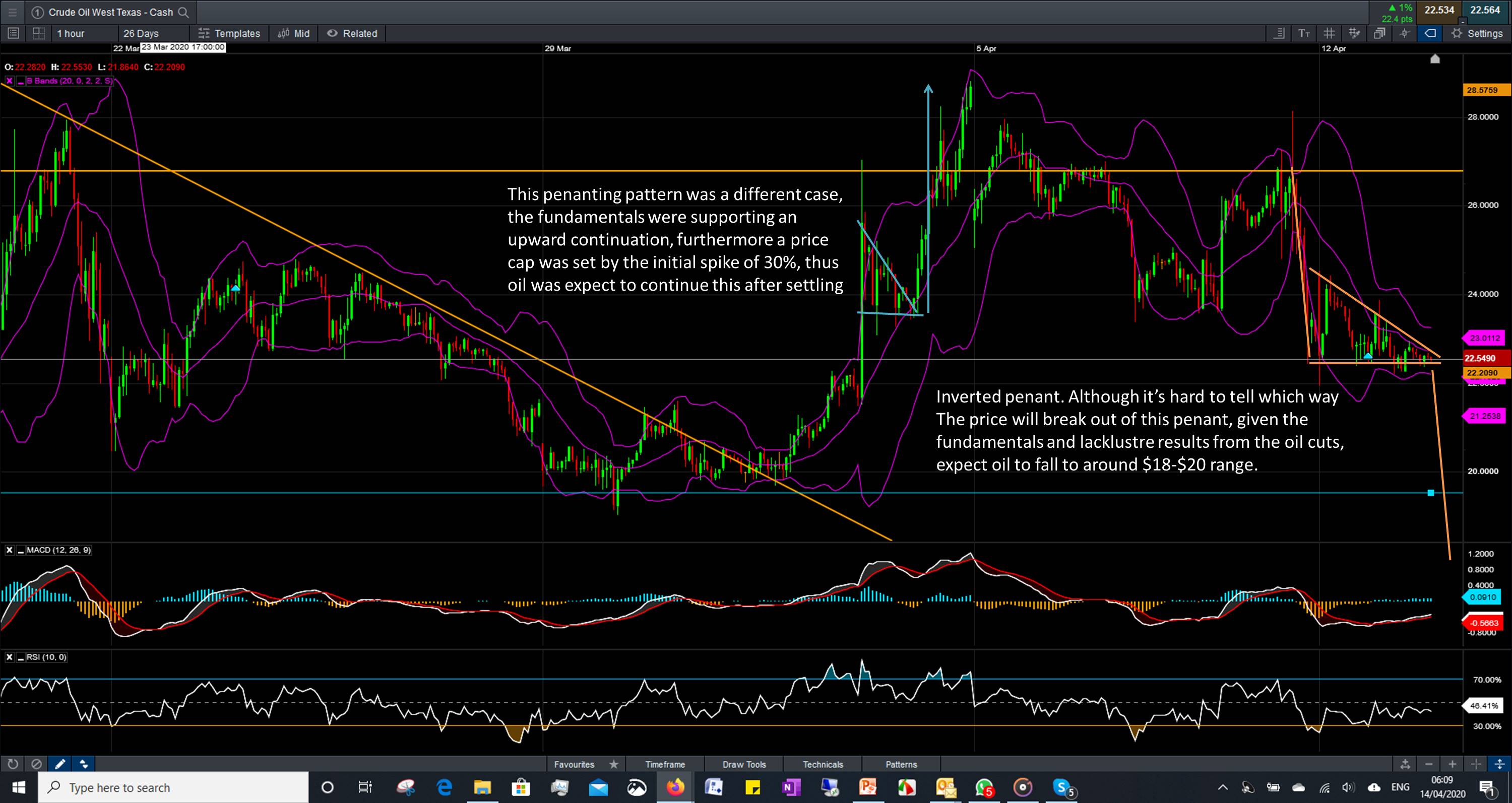

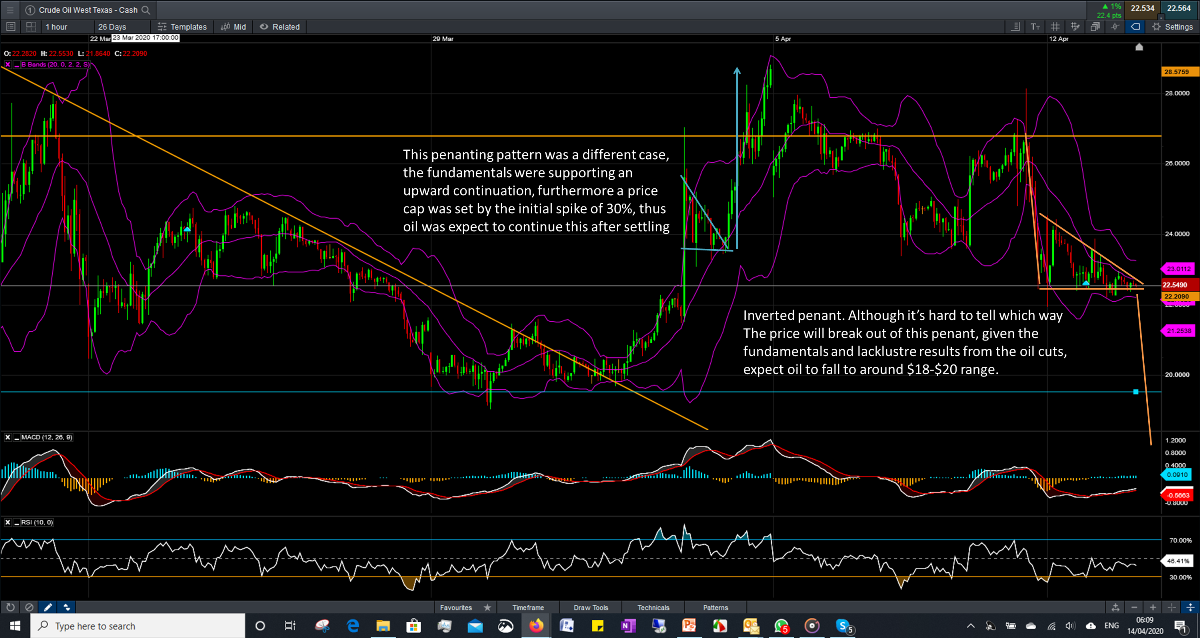

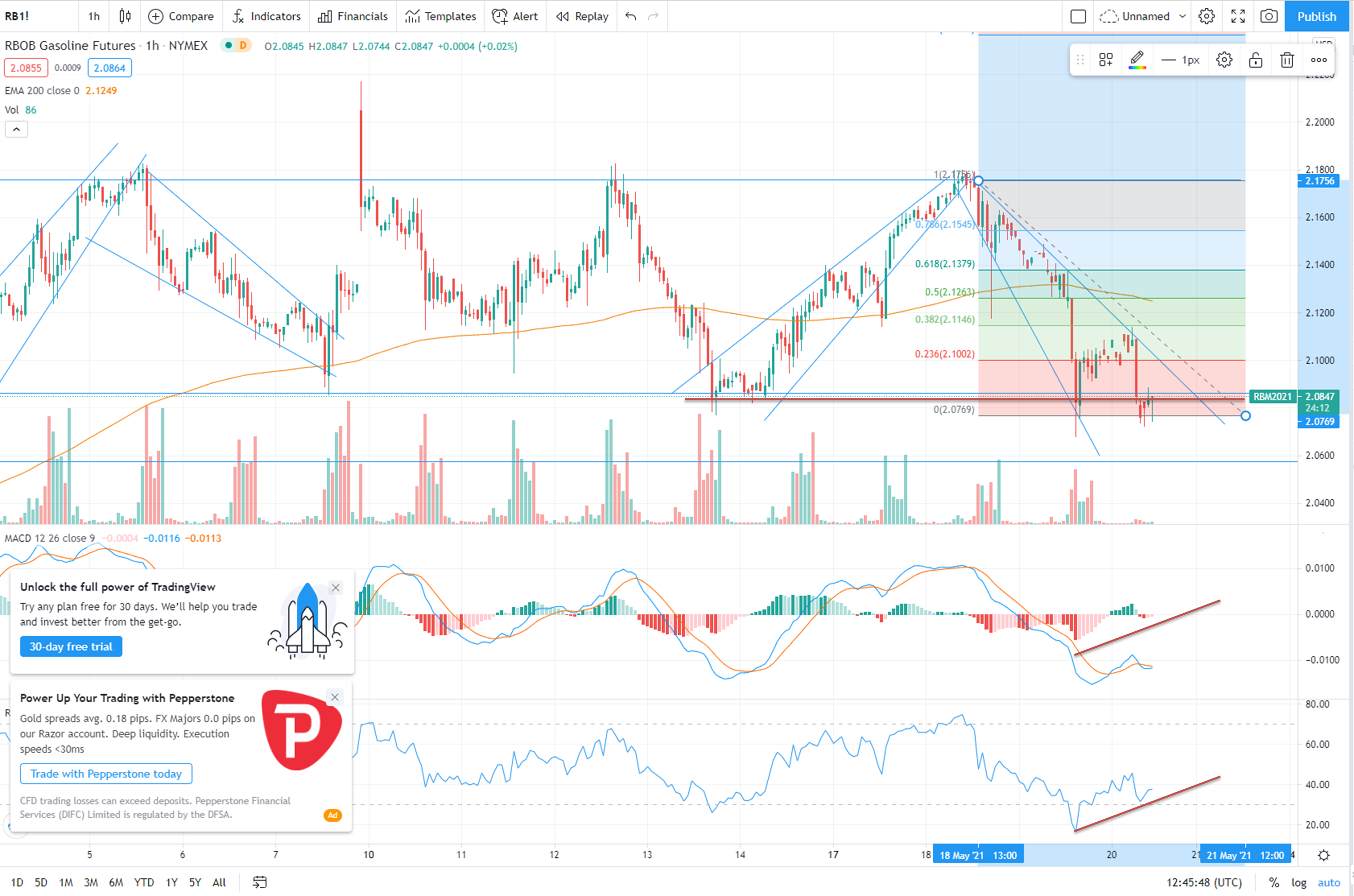

Oil Market Yesterday

Oil prices on Thursday extended declines from the

previous session after a larger-than-expected build

in U.S. crude stockpiles stoked worries about slow

demand, while signs that U.S. interest rates could

remain elevated added to pressure.

U.S. crude oil stockpiles rose while gasoline and distillate inventories fell last weekas refiners ran at below seasonal lows due to planned and unplanned

outages, the Energy Information Administration said

on Wednesday. Crude inventories rose for the fifth

consecutive week, increasing by 4.2 million barrels

to 447.2 million barrels in the week ending Feb. 23,

the EIA said, compared with analysts' expectations

in a Reuters poll for a 2.7-million-barrel rise.

Six tankers with Russian oil in ships sanctioned by

the United States were sailing to Chinese ports this

week, but it wasn't clear if they would be allowed to

discharge, according to LSEG, Kpler, Vortexa shipping data and two industry sources.

Russia's six-month ban on gasoline exports from

March 1 has resulted in a 5.7% decline in wholesale

prices in the state's domestic market in the two days

to Wednesday, two traders said and Reuters calculations showed.

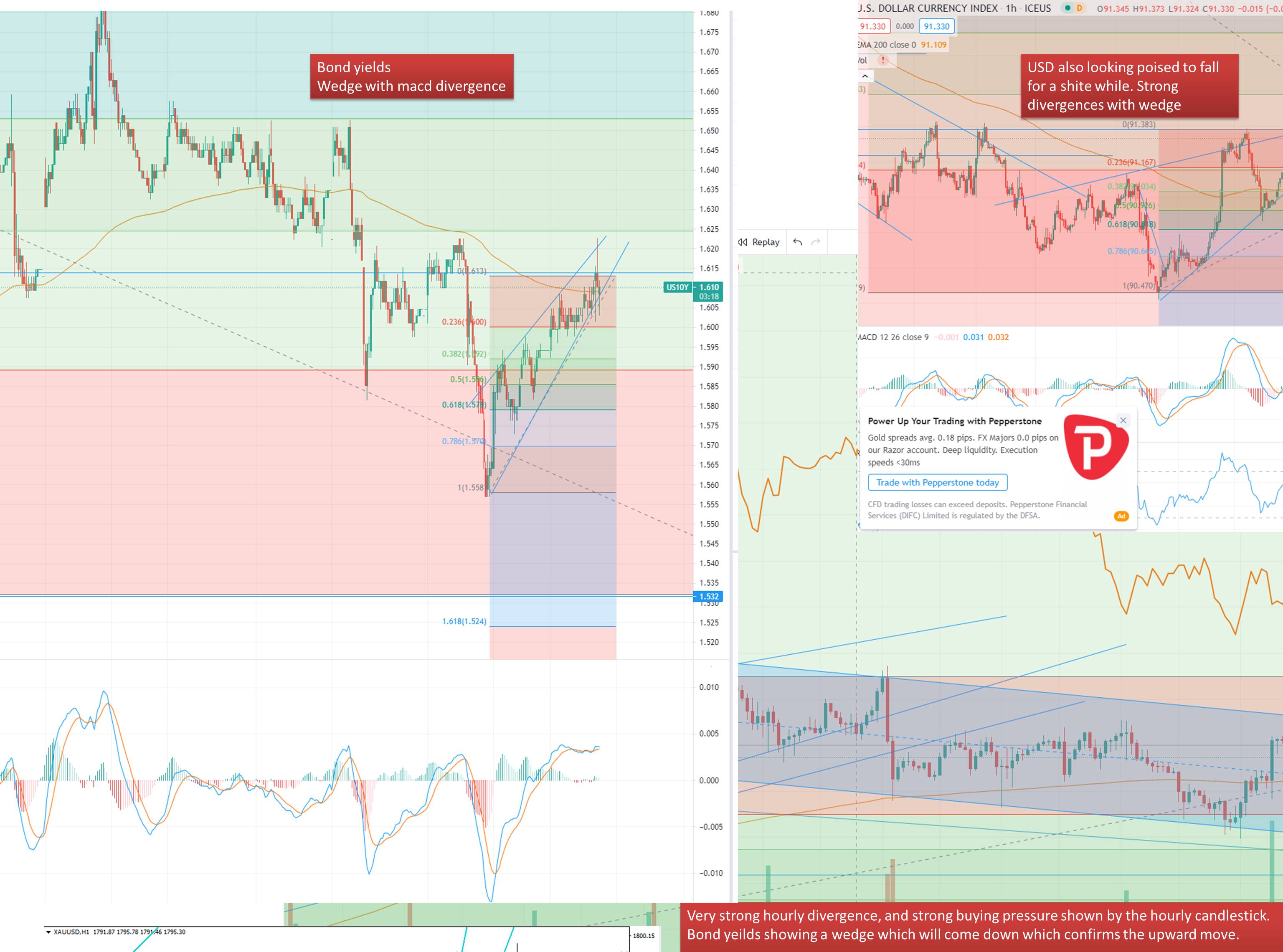

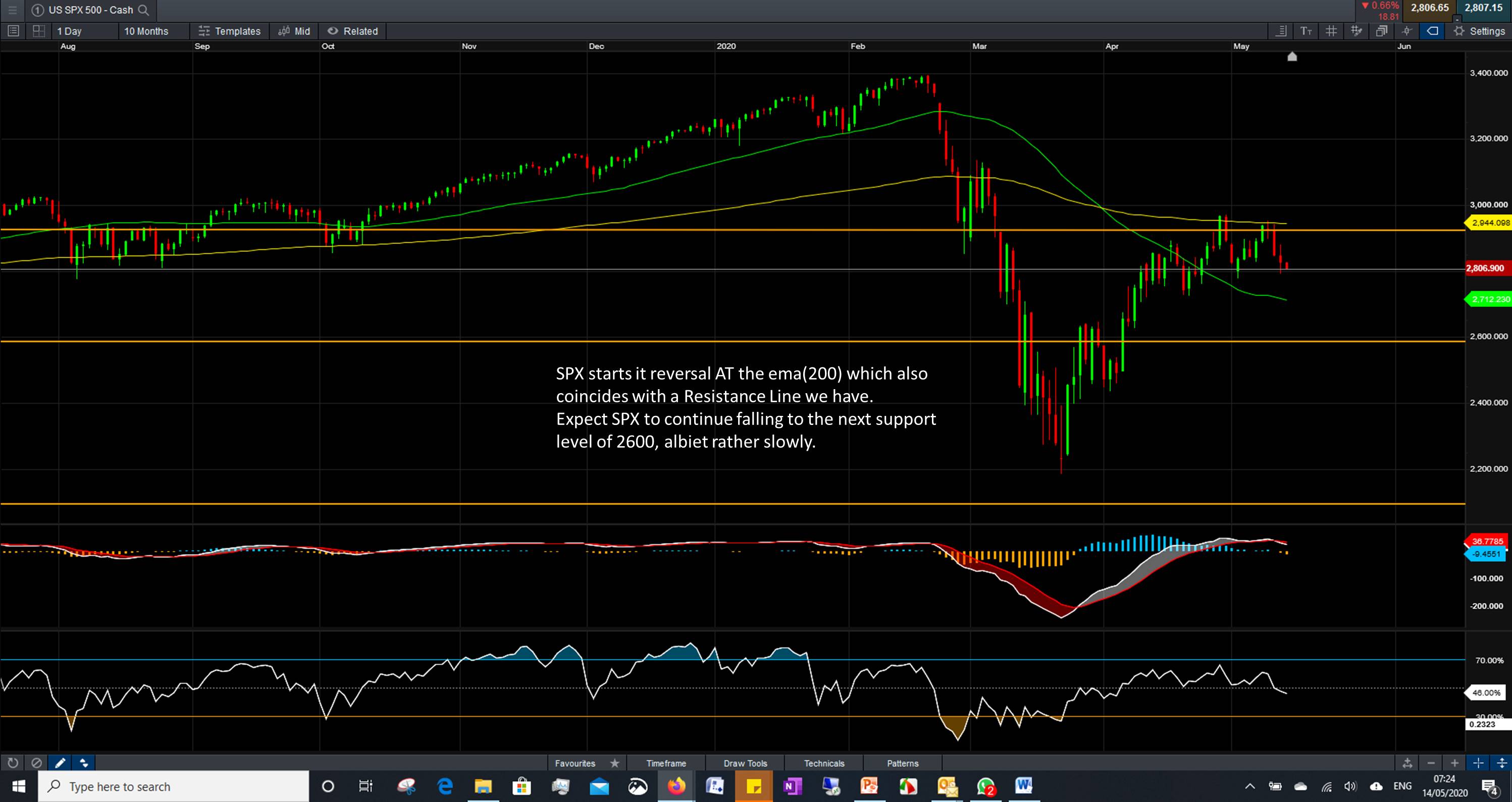

MACRO Economics

The U.S. dollar held firm on Thursday in the lead up

to U.S. inflation data that could ruffle the interest

rate outlook, while the yen found its footing after

comments from Bank of Japan official hinted at the

need to exit ultra-easy policies.

Bank of Japan board member Hajime Takata said

the central bank must consider overhauling its ultraloose monetary policy, including an exit from negative interest rates and bond yield control. Measures

that should be under consideration include an exit

from yield curve control, negative interest rates and

a tweak to the BOJ's commitment to keep expanding its monetary base until inflation stably exceeds

2%, he said in a speech on Thursday.

The European Central Bank will acknowledge an improved inflation outlook when it meets next week

but it must avoid any commitment to an interest

rate cut and should hold off on any such step until

June, Peter Kazimir, Slovakia's central bank chief

said. The ECB has kept rates at a record high since

September but with inflation now quickly retreating,

policymakers are debating when to start unwinding

some of the 10 hikes that took the deposit rate from

deep in negative territory to 4% in just over a year.

has context menu.

Key Market Data Today / Tomorrow

All times are Eastern Time (EST). We focus on U.S economic data mainly, as the U.S data drives the markets mostly. Sometimes we look at Key China data as well as European Union data.

Thursday

Core PCE Prices

08.30

Initial Jobless Claims

08.30

Chicago PMI

09.45

Friday

Eurozone CPI

05.00

ISM Manufacturing PMI

10.00

Michigan Inflation Expectation

10.00

Is your Paper Trading on Brent Crude making

5-15% Profit Monthly?

Our Oil Trading Clients in Dubai gained 85% Profit in 2023,

on Oil Paper Trading, by following our unique Strategies.

Book a Meeting Today

To discuss your Challenges with Oil Hedging & Paper Trading

Call: +971 58 540 0412

Email: nasir@financialmarkets.club

- Admin

- 29 Feb 24

- 0 Comment

Related Posts

You have to logged in for comment.

Email Newsletter

Get subscriber only insights & news delivered by Financial Markets Club

Weekly Trading Lessons by Email

Do you want to Learn to Trade like a Pro? Every Week we will share some Trading Tips to help you Succeed.

Just enter your Name and Email, and click Subscribe!

FinancialMarkets

FinancialMarkets

Comments