7 Things You Need To Know

Good Day, S&P reaches new all time high, Chinese stock markets continues to tumble and Buy-the-dip recommendations from two Wall Street giants, the best hedge funds last year.

- Home

- 7 Things You Need To Know

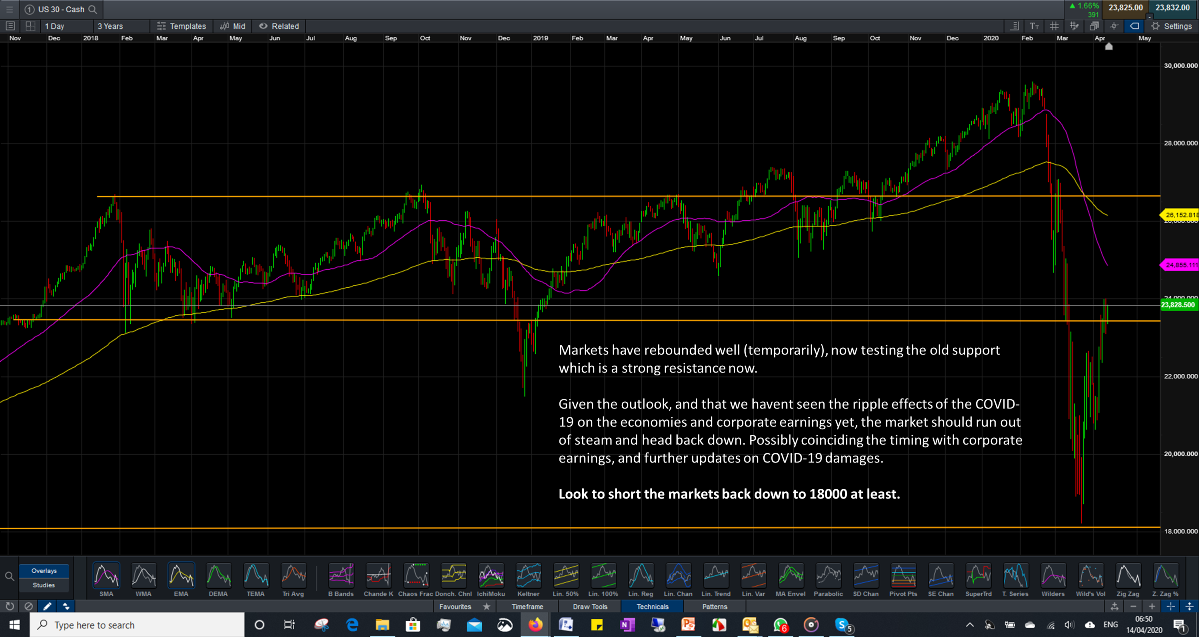

Buy the Dip

Two major Wall Street firms are recommending investors start buying five-year US notes after they saw their worst rout since May last week. Morgan Stanley sees scope for a rebound in Treasuries on expectations data in the coming weeks may surprise to the downside. JPMorgan is suggesting investors buy five-year notes as yields have already climbed to levels last seen in December, though it warned that markets are still too aggressive in pricing for an early start to central bank interest-rate cuts.

China’s Gloom

Skepticism over Chinese assets is spreading beyond stocks, with investors expecting the yuan and government bonds to underperform in a year when the Federal Reserve’s dovish pivot is set to buoy emerging markets. While the gloom adds impetus for the People’s Bank of China to lower interest rates, investors say the monetary authority has less room to cut than its major global peers, whose borrowing costs are now at multi-year highs.

Best Year for Hedge Funds

Billionaire money managers Chris Hohn and Ken Griffin led hedge funds to deliver one of the best years for clients in 2023. The industry produced combined gains worth $218 billion after fees, according to estimates by LCH Investments, a fund of hedge funds. Hohn’s TCI Fund Management made $12.9 billion to top LCH’s rankings, followed by Citadel, which made $8.1 billion. The top 20 firms, which oversee less than a fifth of the industry’s assets, generated roughly a third of the gains last year.

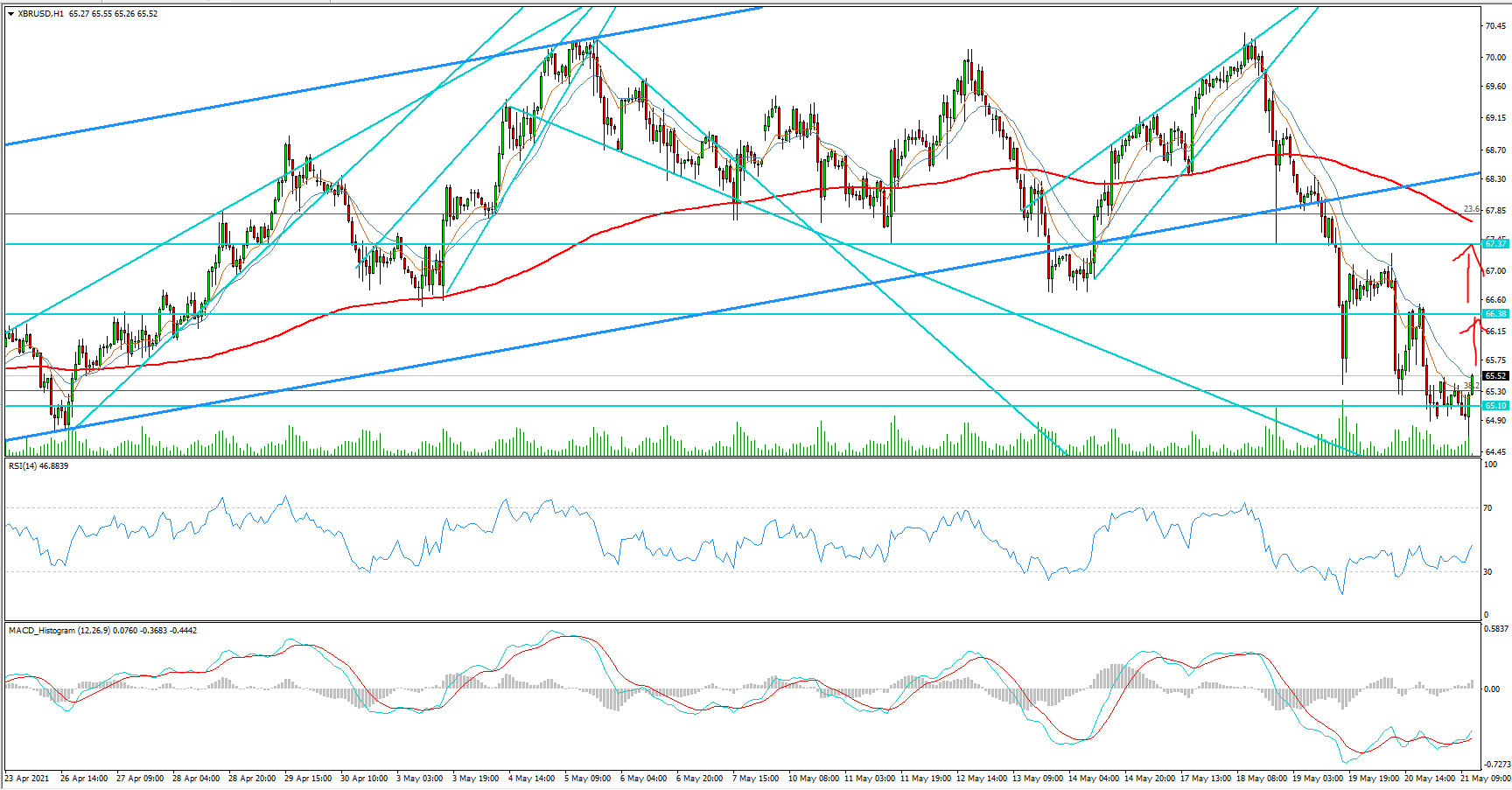

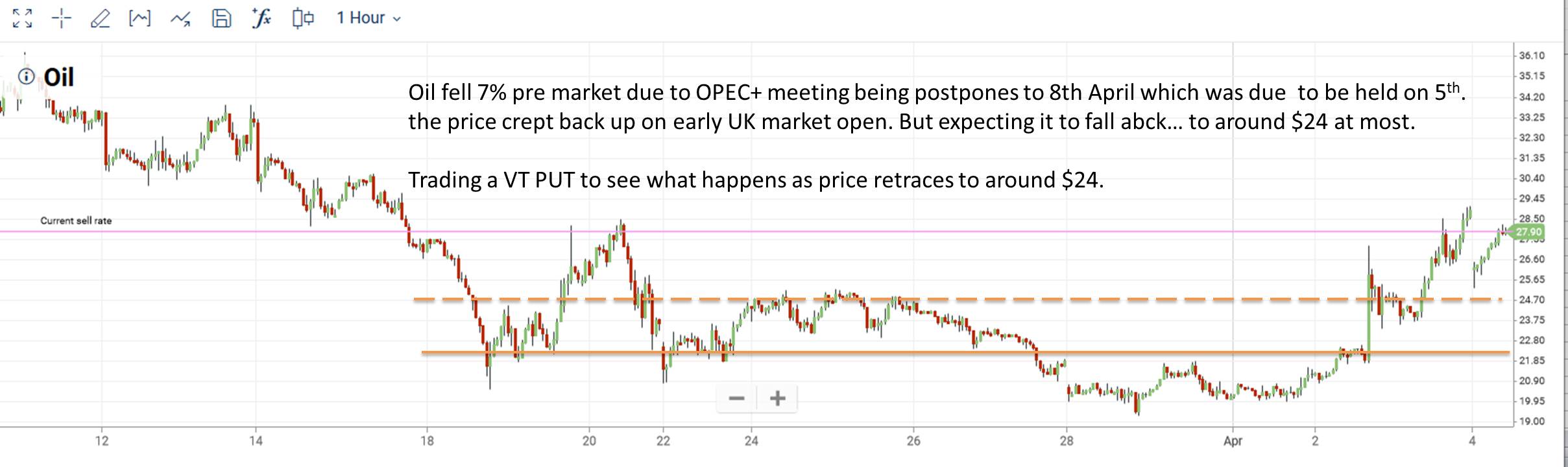

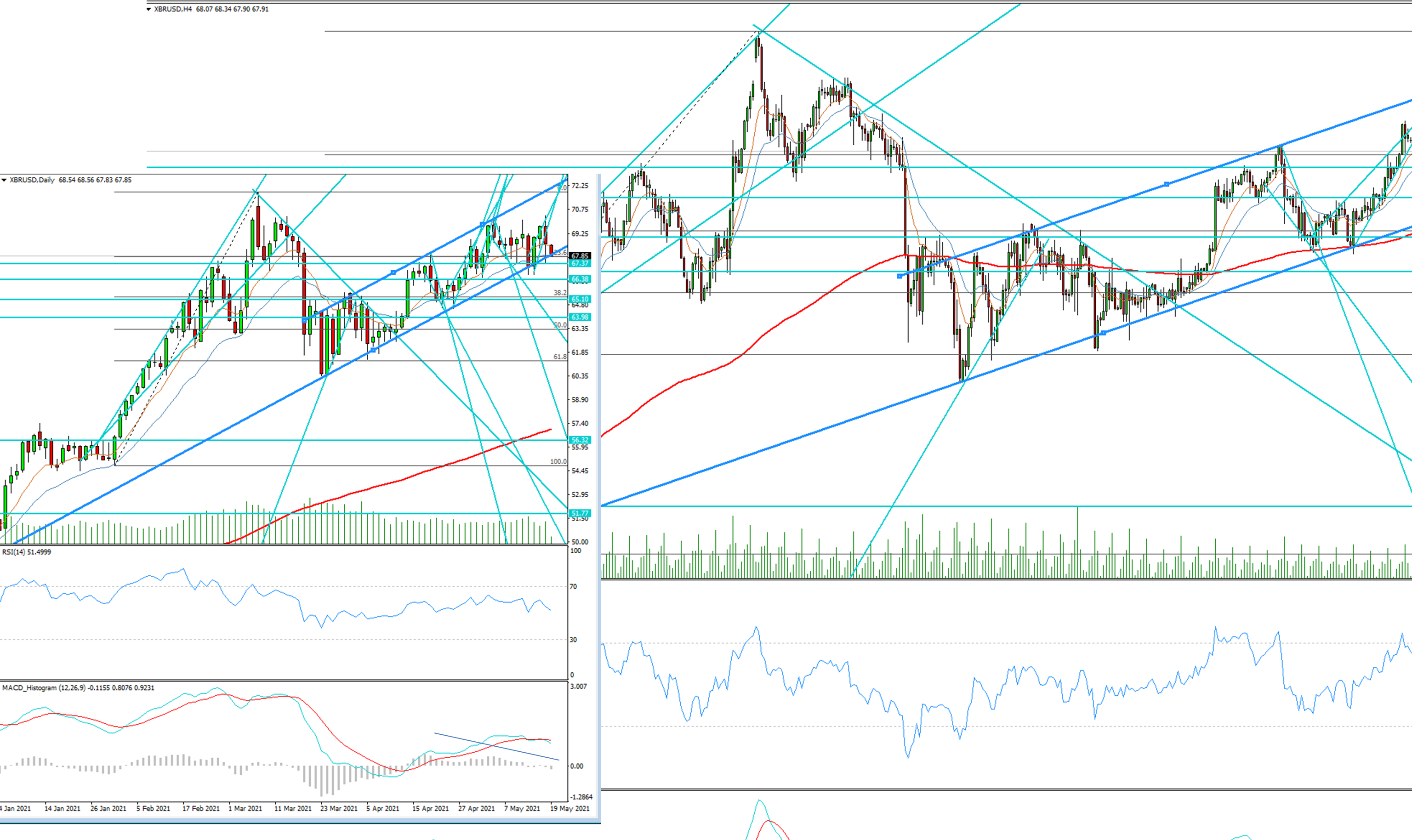

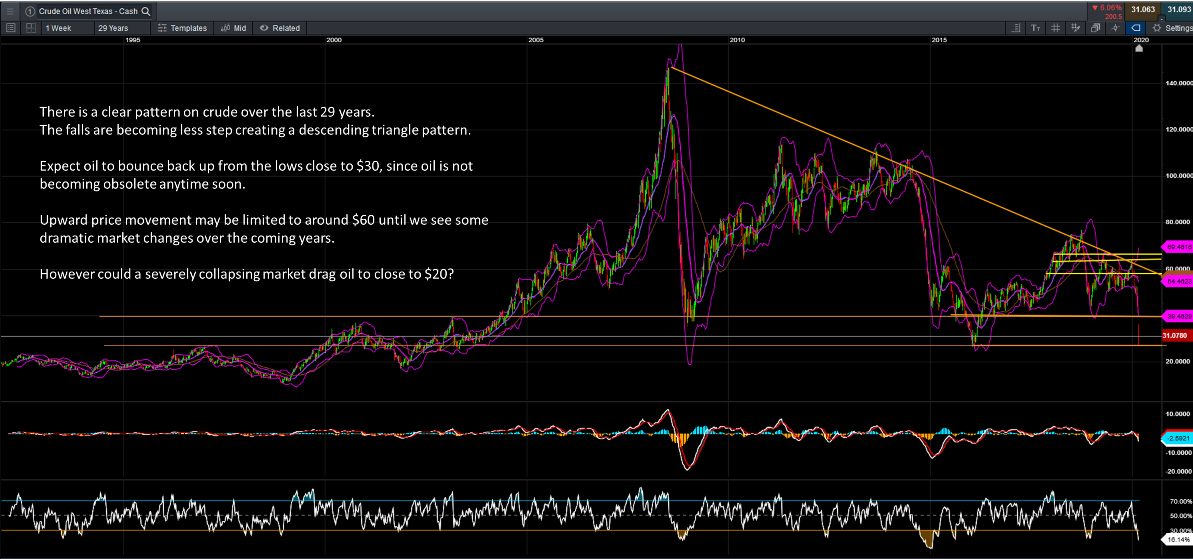

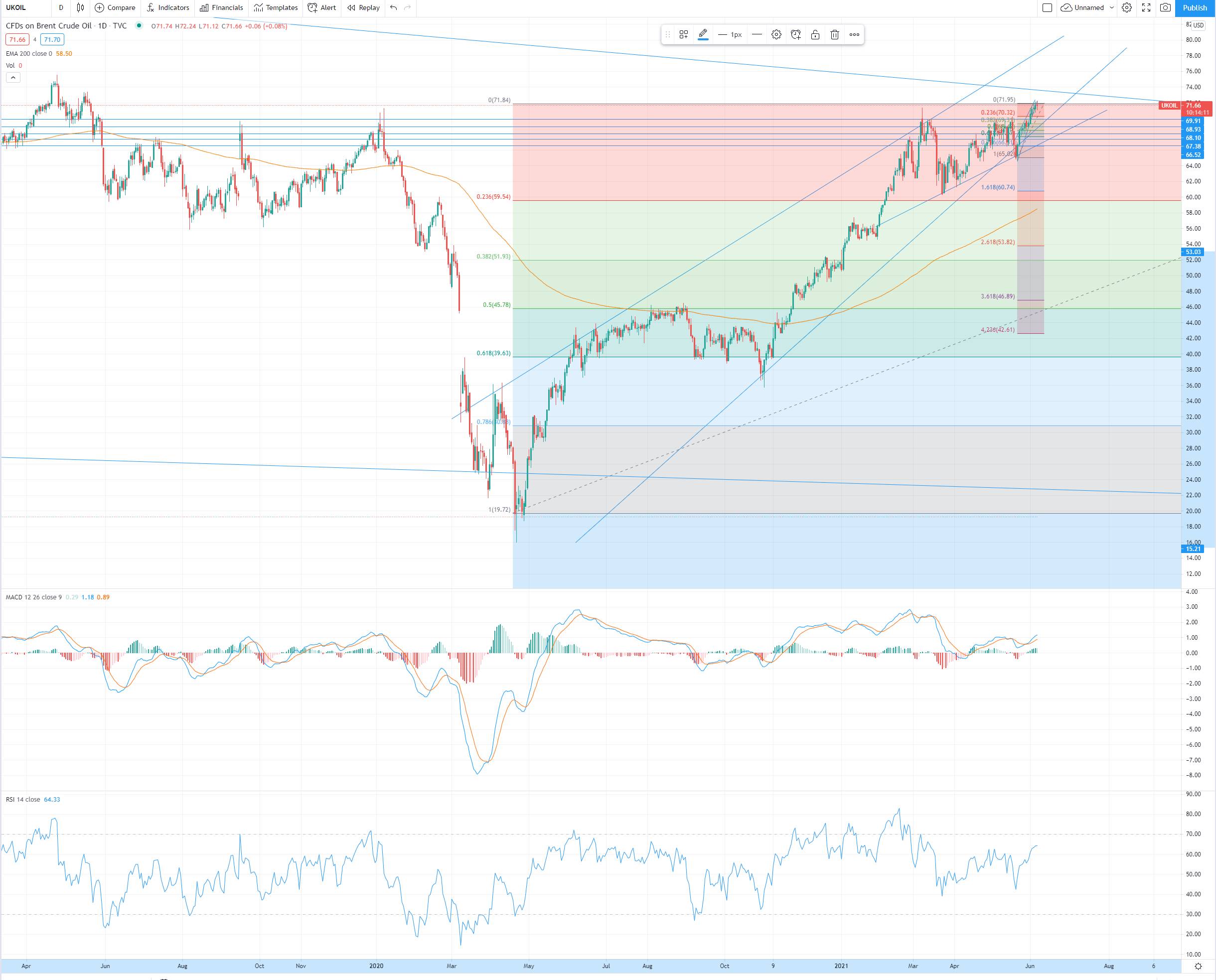

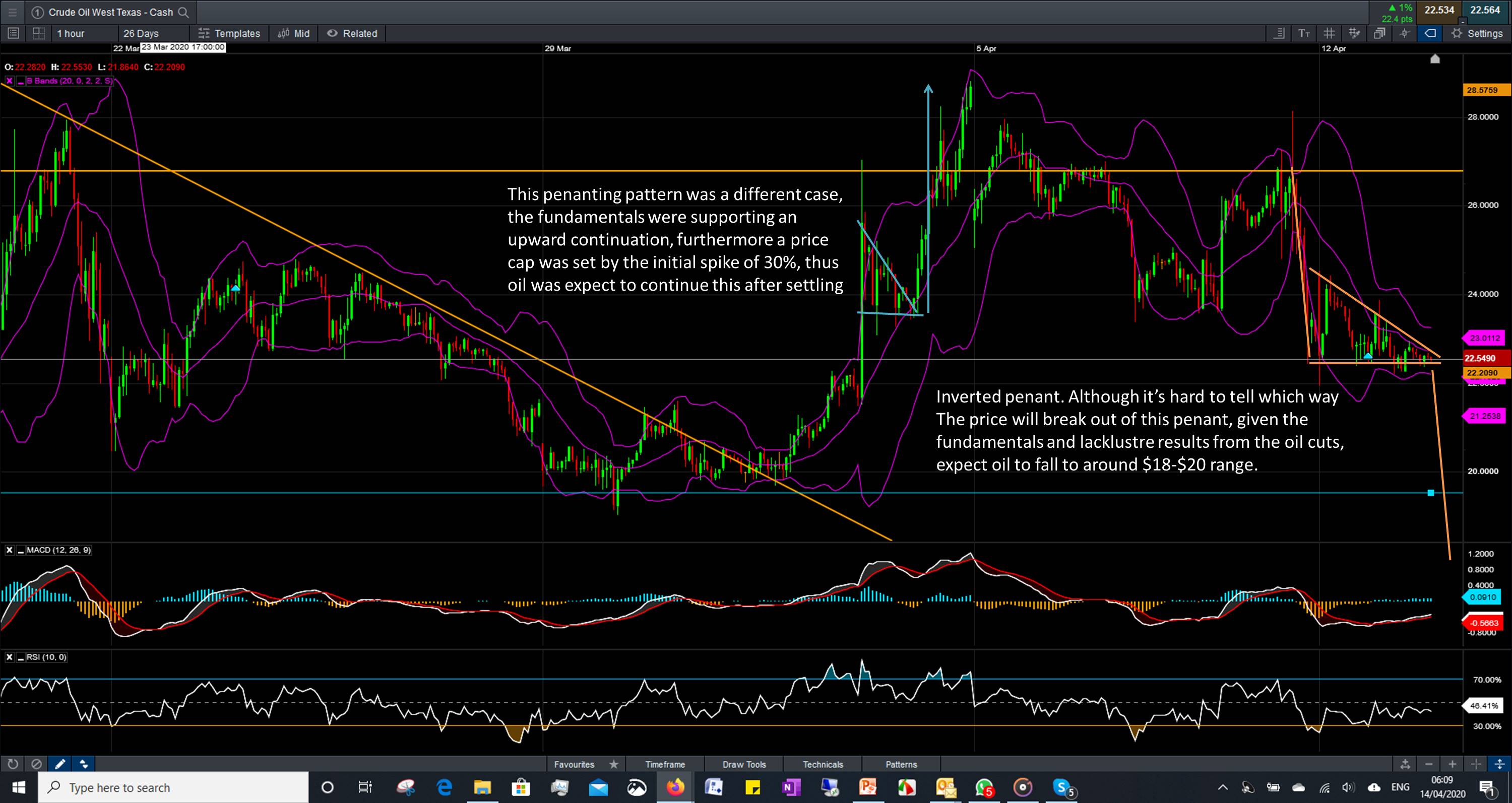

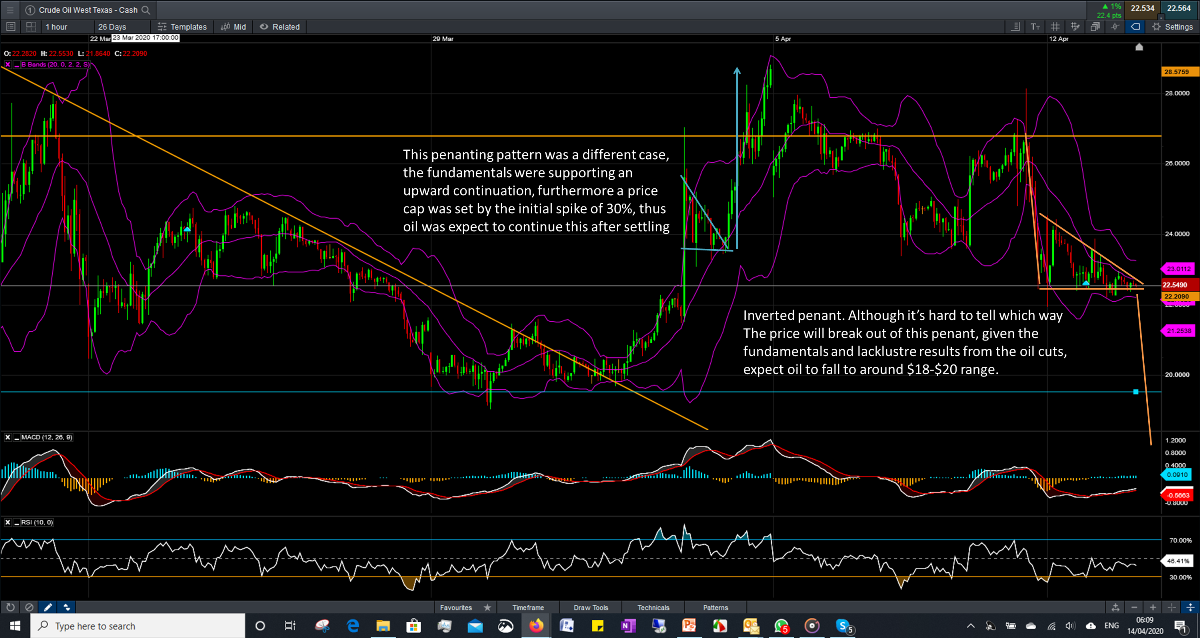

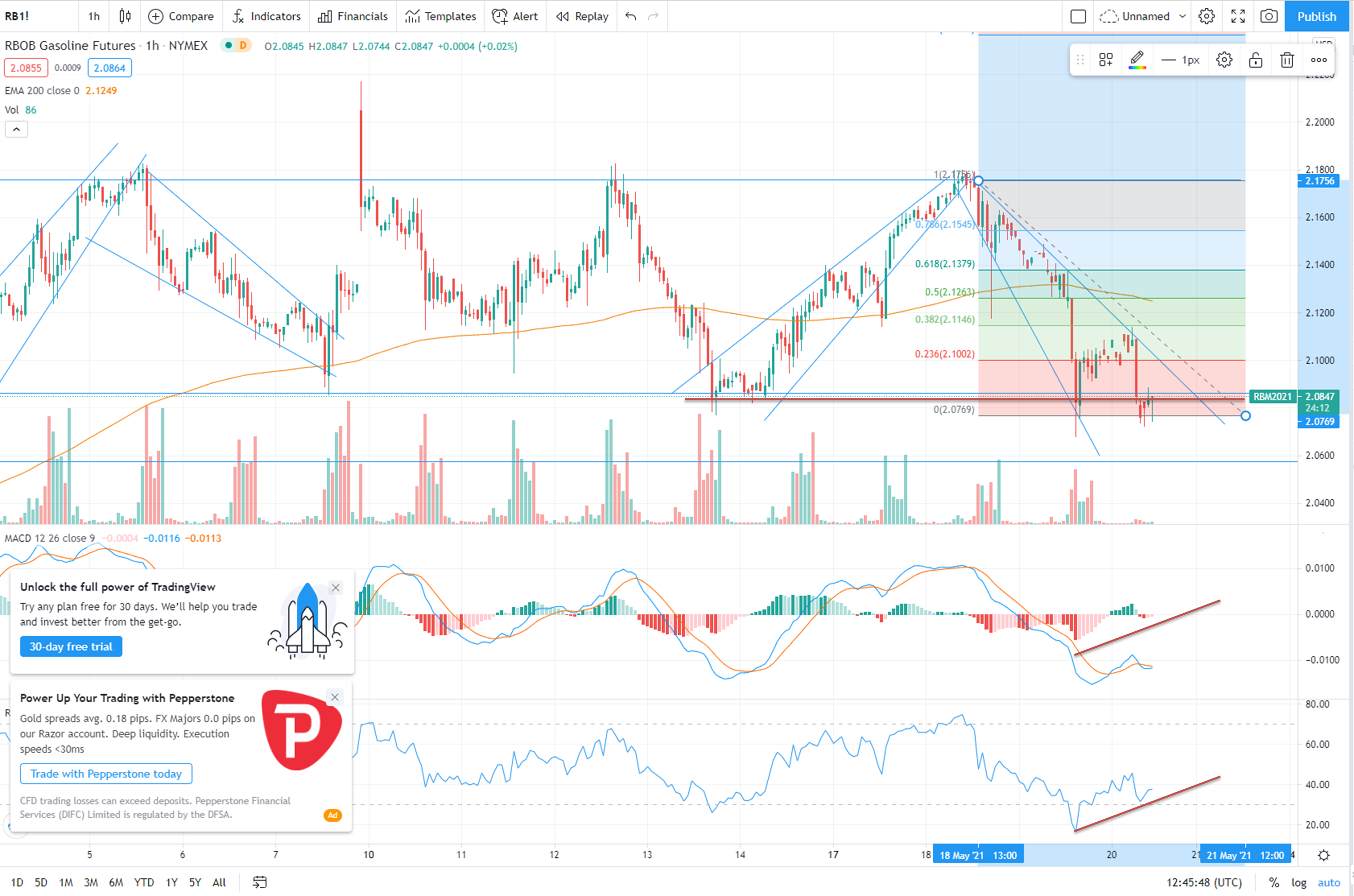

Oil Market

Yesterday Oil prices struggled to push ahead on Monday as economic headwinds pressured the global oil demand outlook and offset geopolitical concerns in the Middle East and an attack on a Russian fuel export terminal over the weekend. A force majeure was declared on Jan. 7 after protesters from the Southwestern Ubari region closed the field in protest against rising fuel prices, poor economic opportunities and unemployment. Sharara is operated by a joint venture between Libya's National Oil Corp, Equinor, OMV, Repsol and Total Energies. Russian energy company Novatek said on Sunday it had been forced to suspend some operations at a huge Baltic Sea fuel export terminal due to a fire started by what Ukrainian media said was a drone attack. Russia leapfrogged Saudi Arabia to become China's top crude oil supplier in 2023, data showed on Saturday, as the world's biggest crude importer defied Western sanctions to purchase vast quantities of discounted oil for its processing plants. U.S. energy firms this week added oil and natural gas rigs for the first time in three weeks, energy services firm Baker Hughes said in its closely followed report on Friday.

MACRO Economics

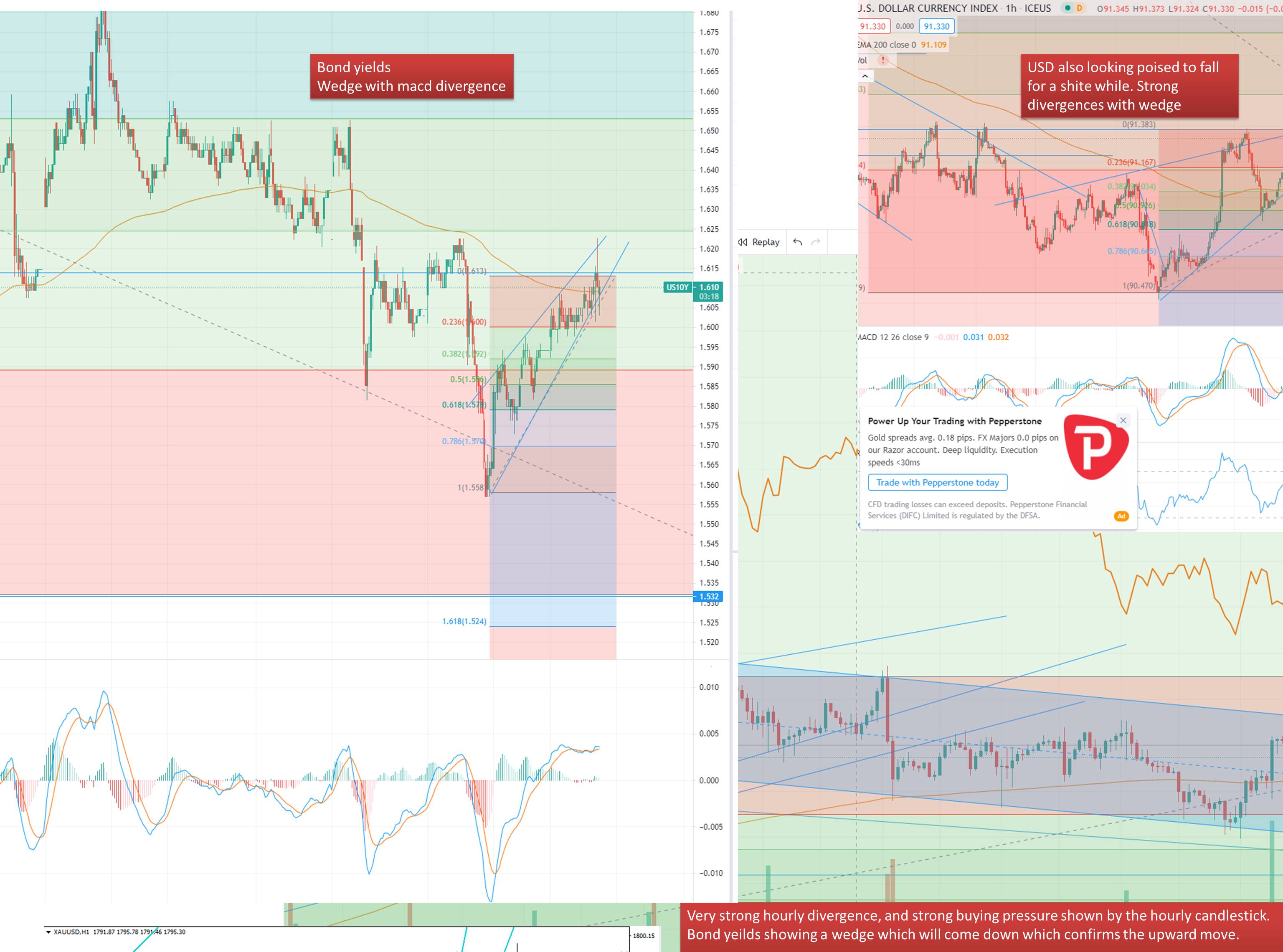

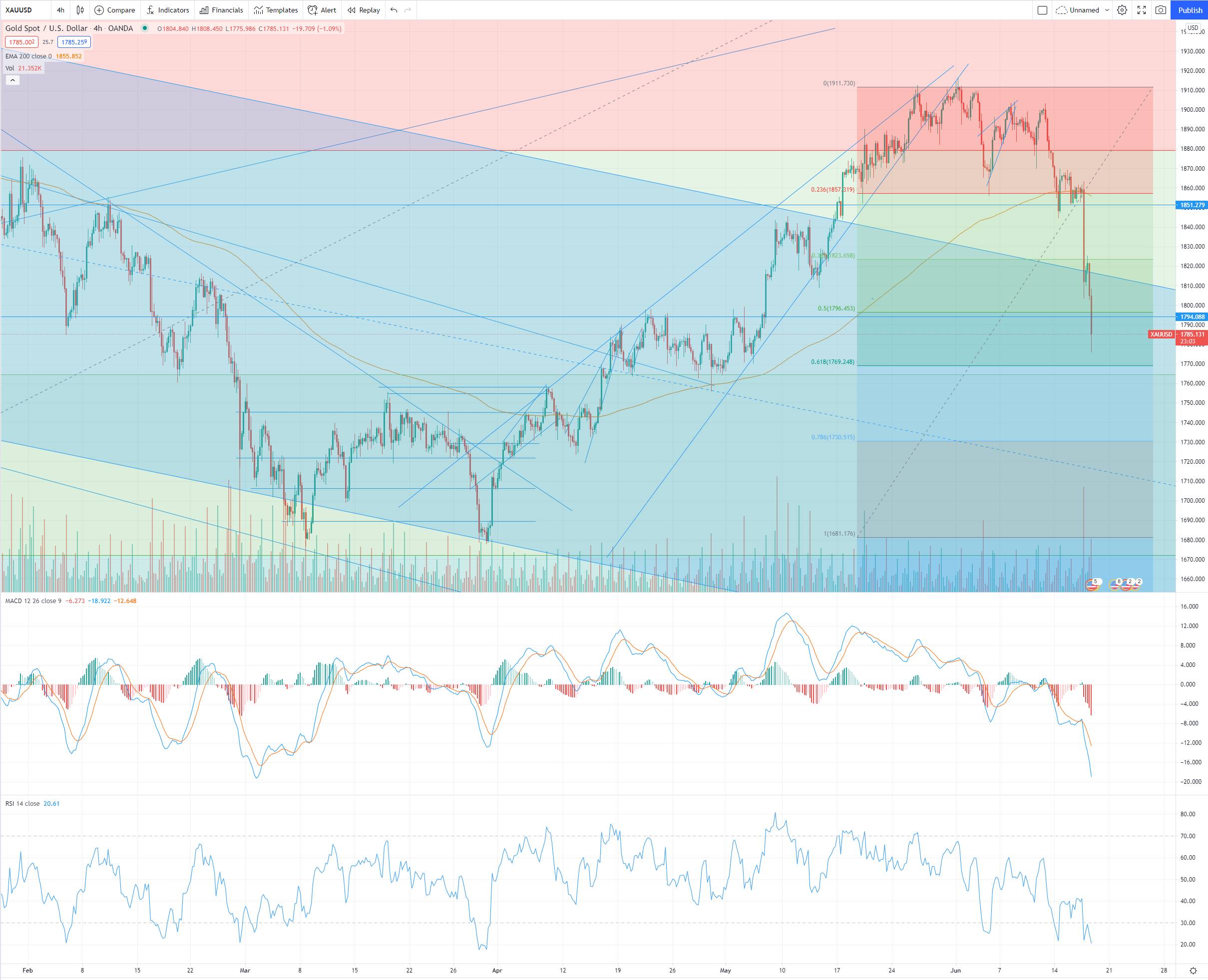

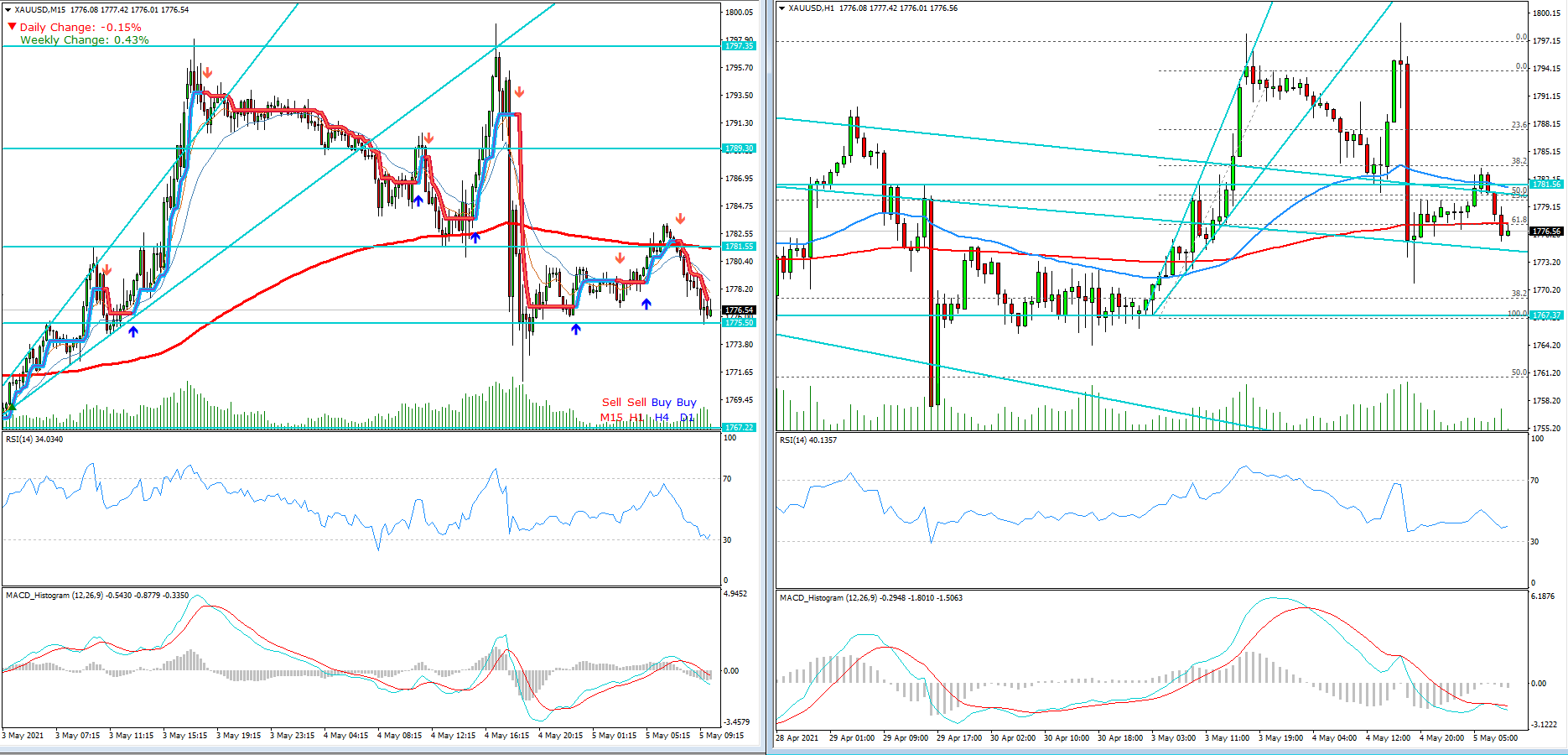

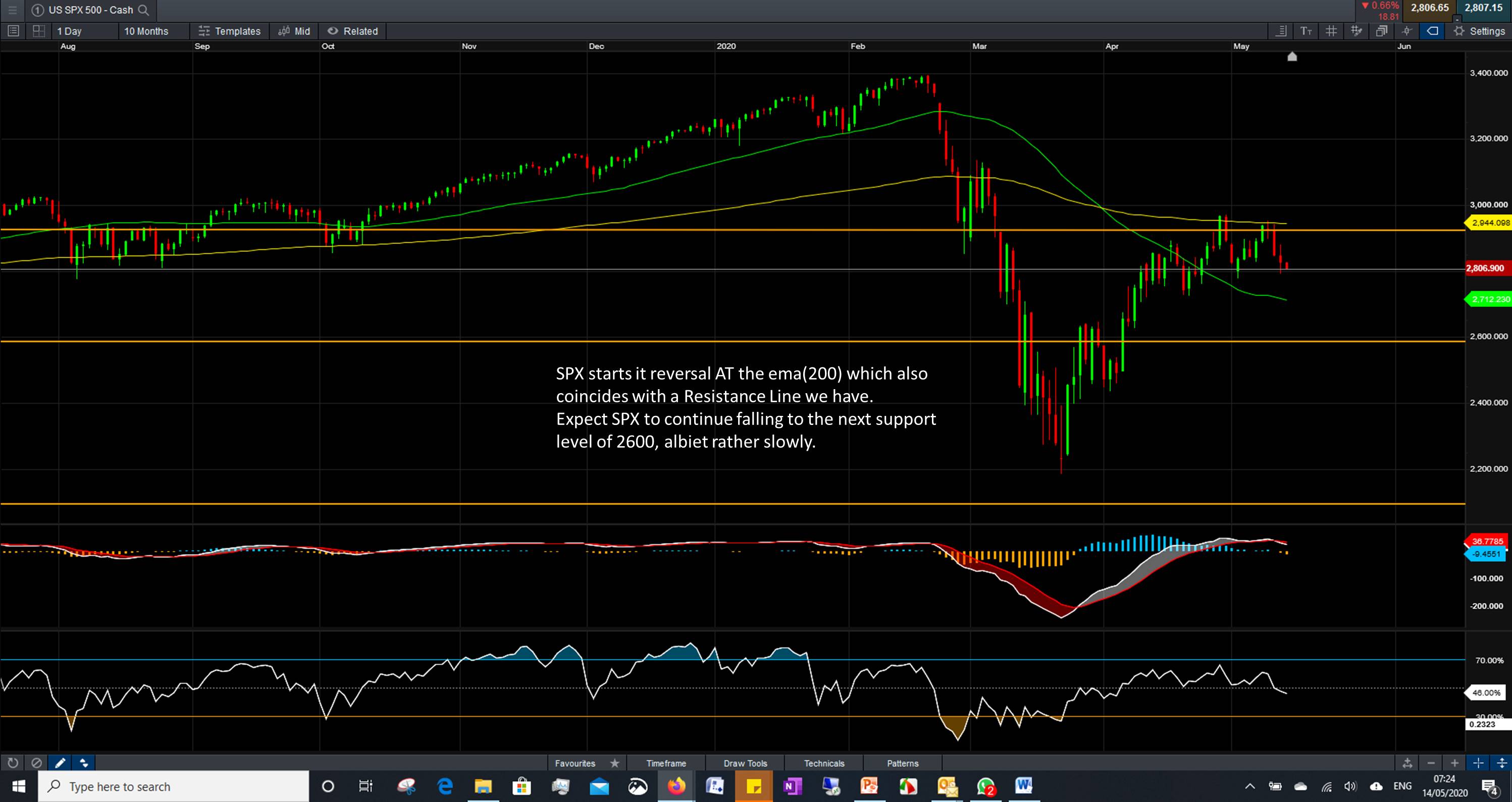

The U.S. dollar struggled to keep gains on Monday as looming central bank decisions in Japan and Europe and vacillating market expectations for Fed rate cuts forced a pause in its data-spurred rally late last week. Japanese shares led U.S. and European futures higher on Monday as AI hype juiced up the tech sector ahead of a week brimming with central bank meetings, major economic data and corporate earnings. Japan's Nikkei share average rallied to a fresh 34- year peak on Monday as the U.S. S&P 500's recordhigh close on Friday buoyed investor sentiment, despite continued signs of overheating in the Asian market. Hong Kong shares slumped 2% to a 14-month low on Monday and Chinese stocks were struggling, despite signs of support from state-backed funds, as foreign outflows continued over concerns about the region's deepening economic woes. Gold prices were little changed on Monday, as traders cautiously awaited fresh data on the U.S. economy and the Federal Reserve's preferred inflation gauge due later this week, leading up to the central bank's interest rate decision next week.Key Market Data

Today / Tomorrow

Monday + Tuesday

Nothing Major in our opinion

Wednesday

Manufacturing PMI

9.45

Services PMI

09.45

Crude Oil Inventories

10.30

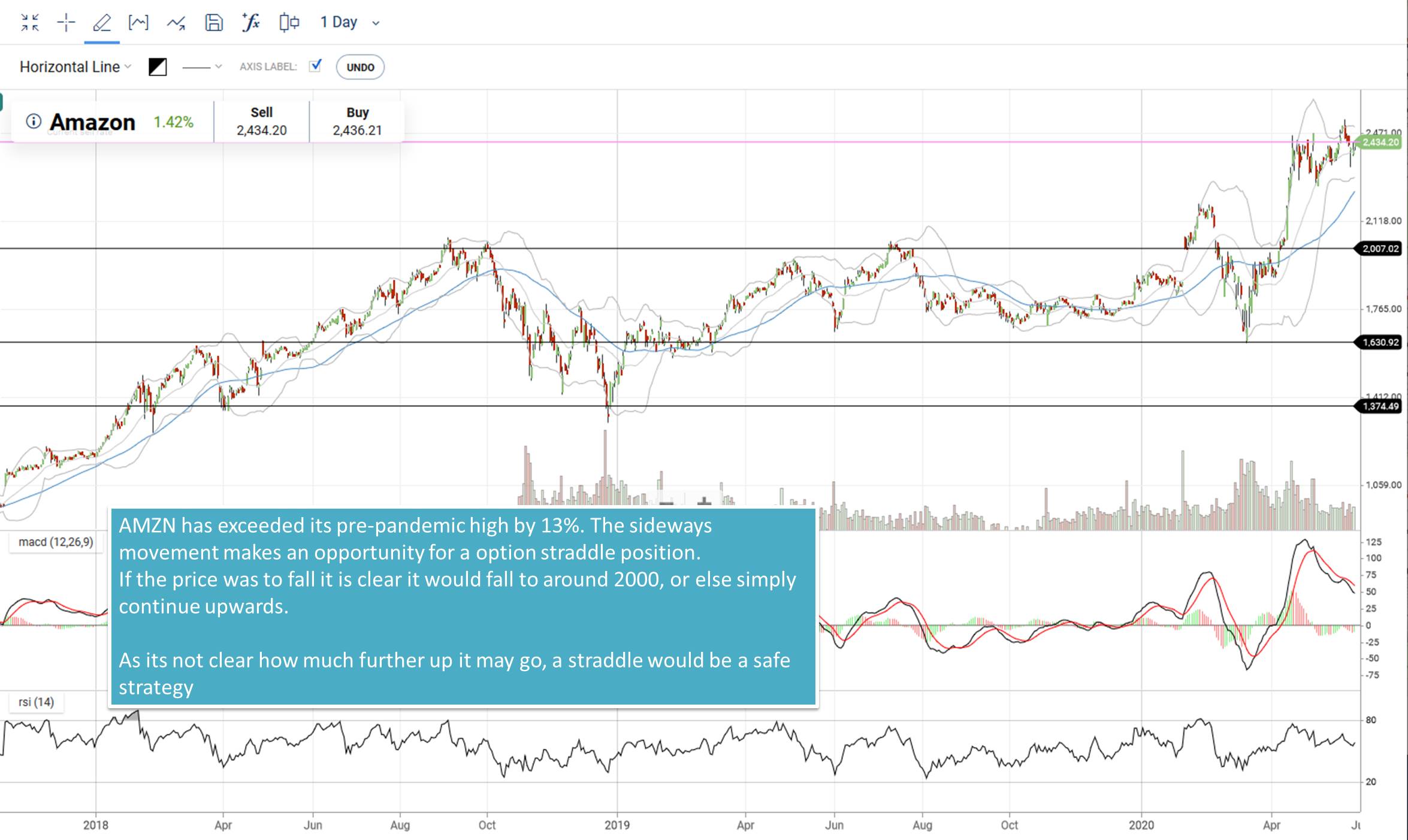

Is your Paper Trading on Brent Crude making 5-15% Profit Monthly?

Our Oil Trading Clients in Dubai gained 85% Profit in 2023,

on Oil Paper Trading, by following our unique Strategies.

Book a Meeting Today

To discuss your Challenges with Oil Hedging & Paper Trading

Call: +971 58 540 0412

Email: nasir@financialmarkets.club

- Admin

- 22 Jan 24

- 0 Comment

Related Posts

You have to logged in for comment.

Email Newsletter

Get subscriber only insights & news delivered by Financial Markets Club

Weekly Trading Lessons by Email

Do you want to Learn to Trade like a Pro? Every Week we will share some Trading Tips to help you Succeed.

Just enter your Name and Email, and click Subscribe!

FinancialMarkets

FinancialMarkets

Comments