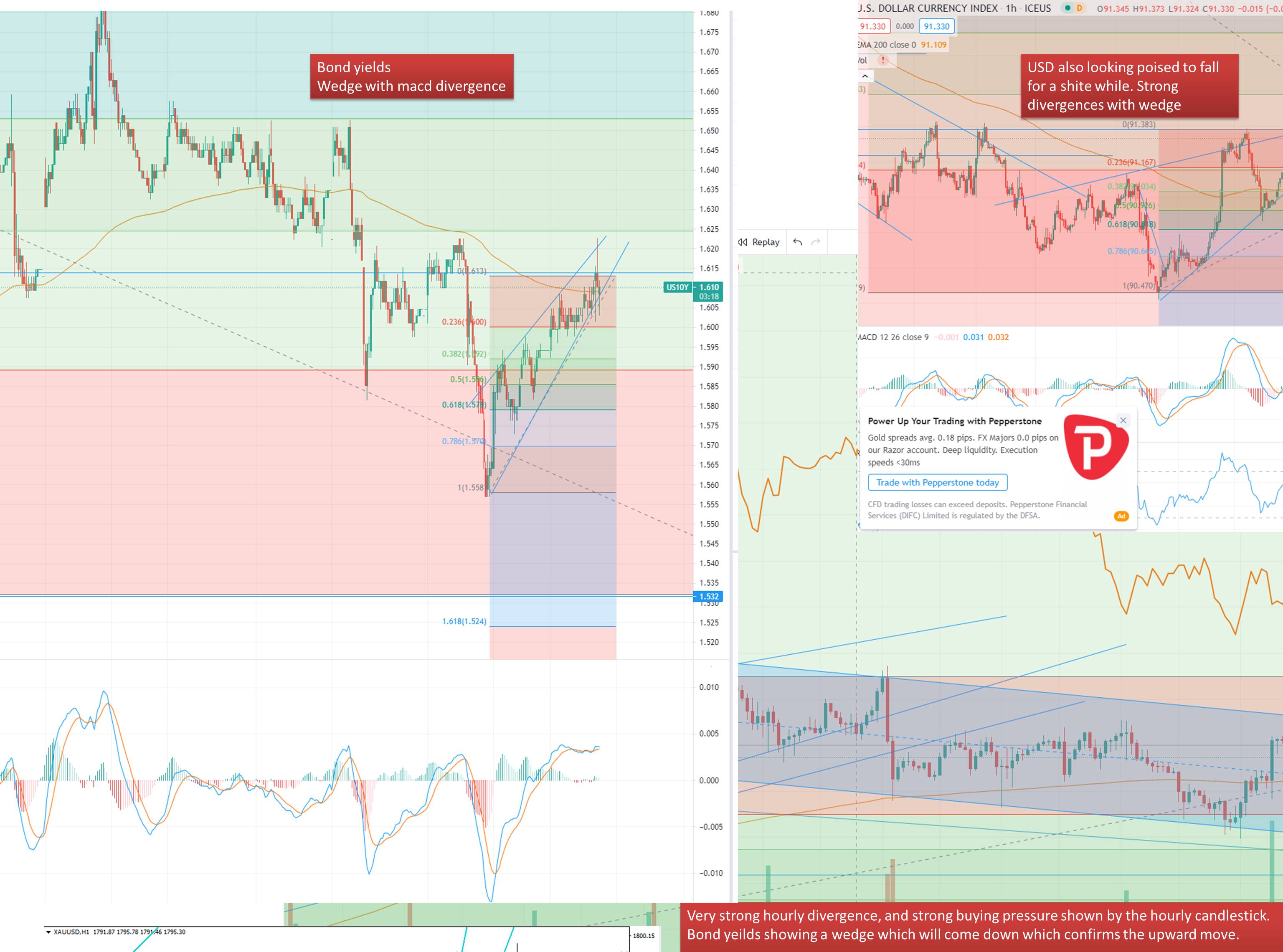

Bond Yields up long term. Expect 2%+

- Home

- Bond Yields up long term. Expect 2%+

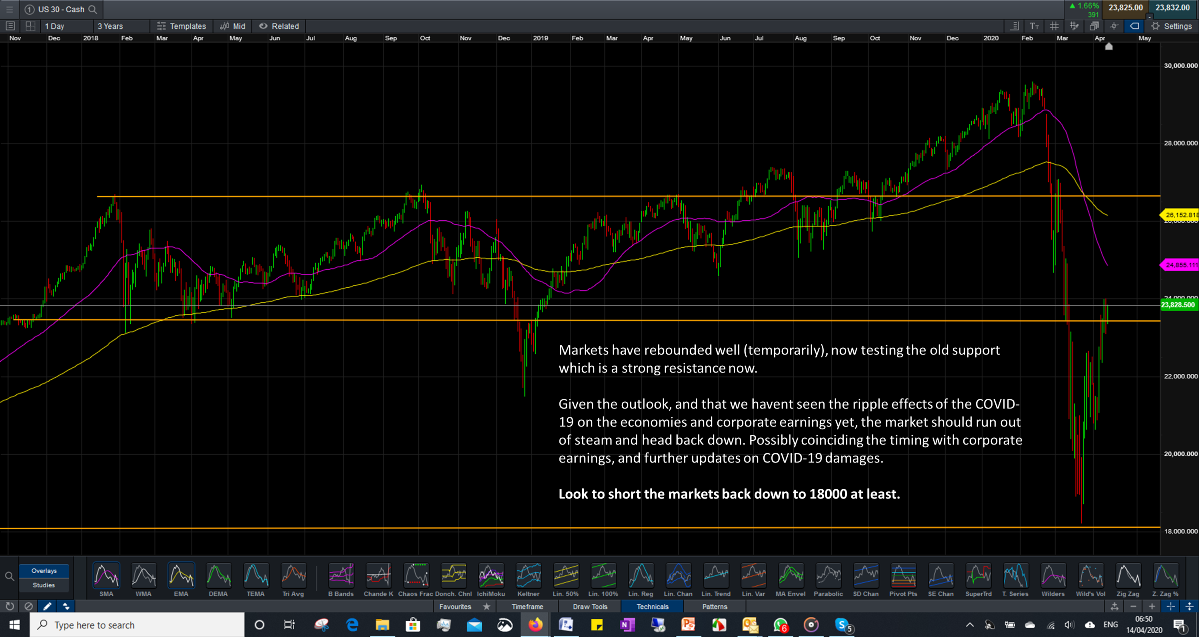

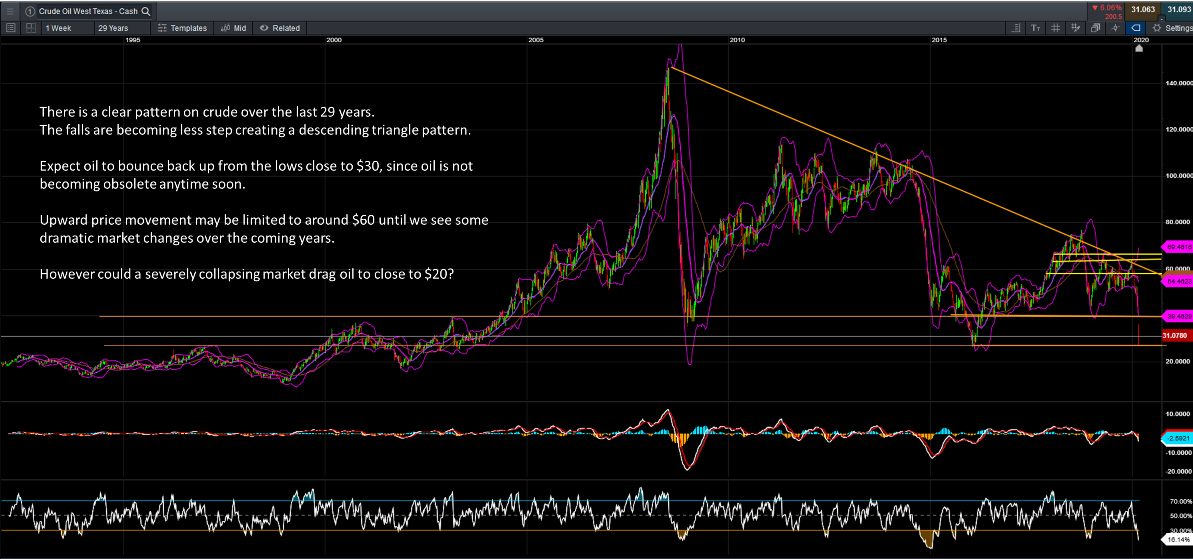

What are the chances of this.

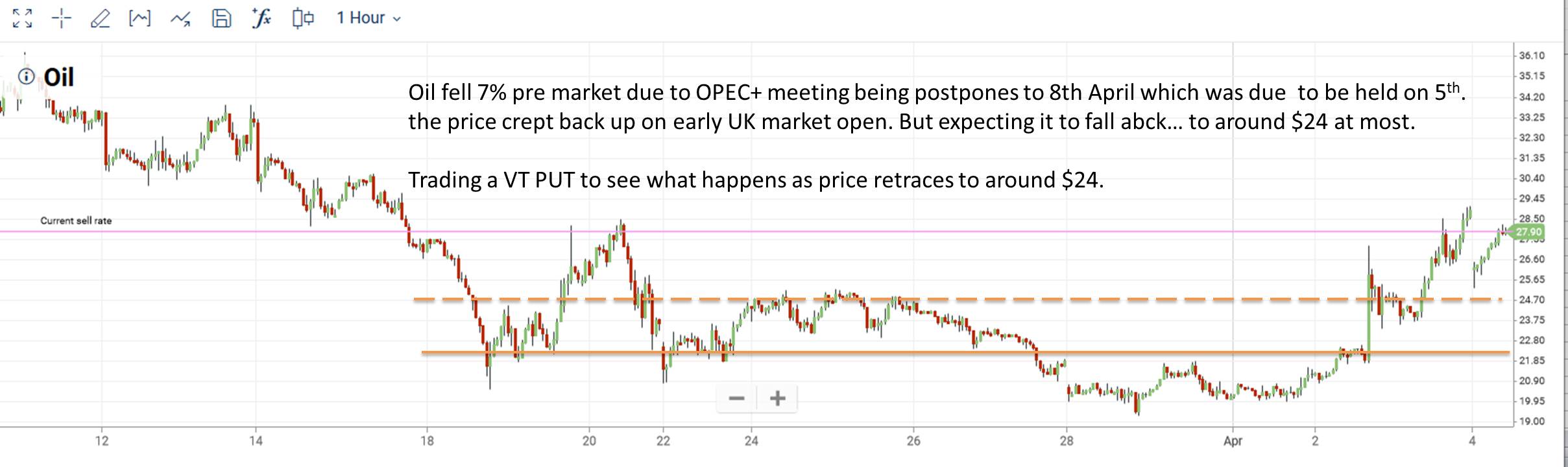

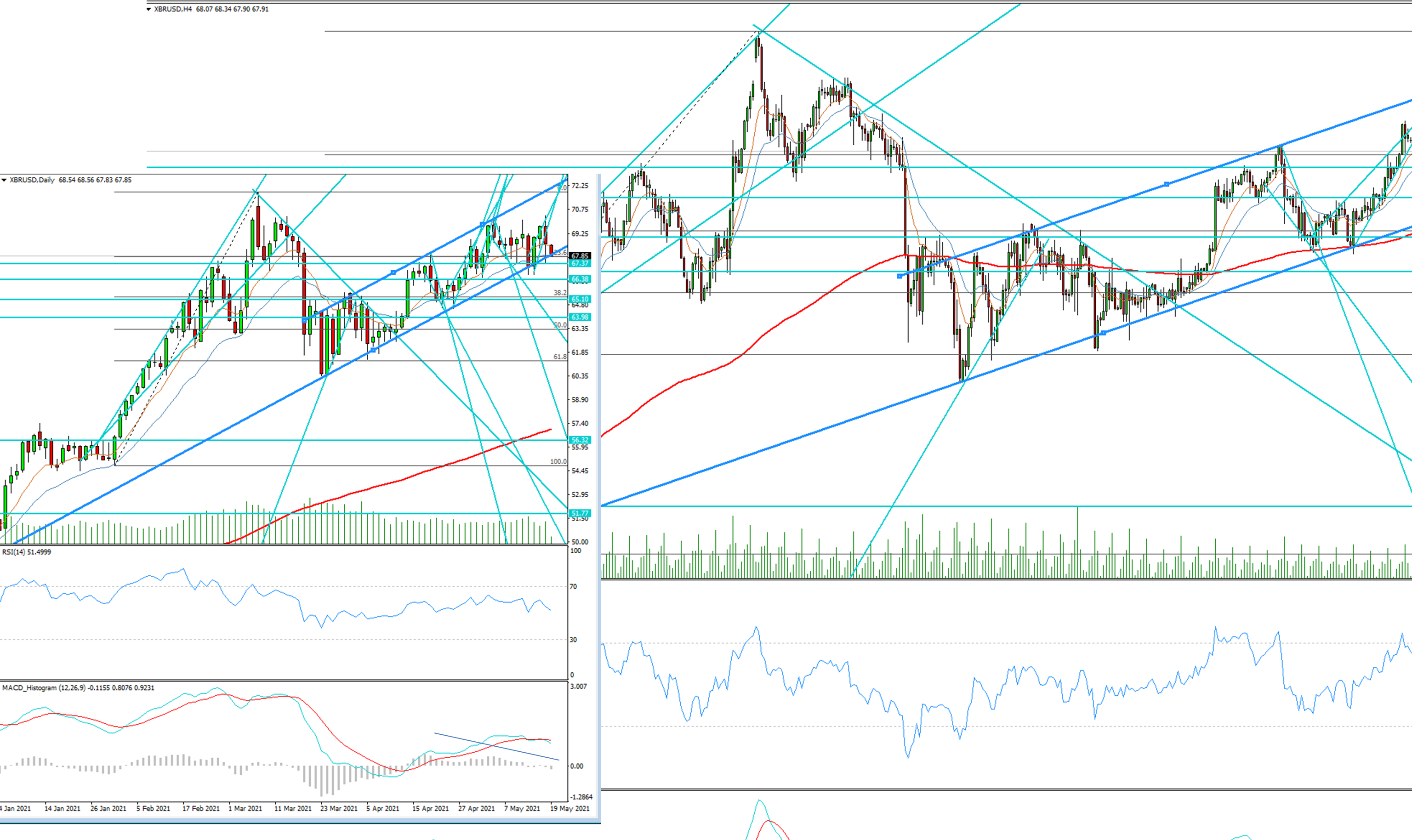

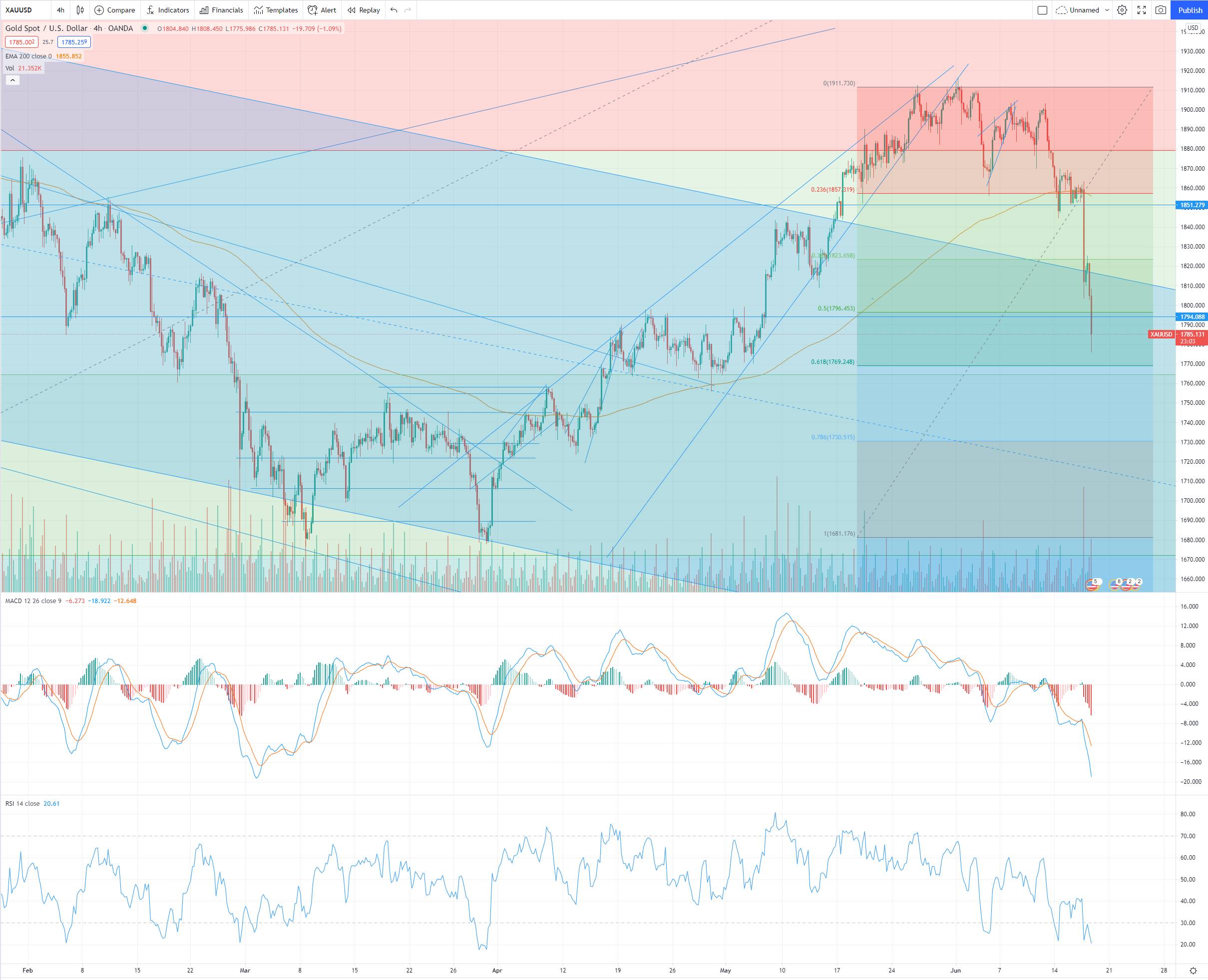

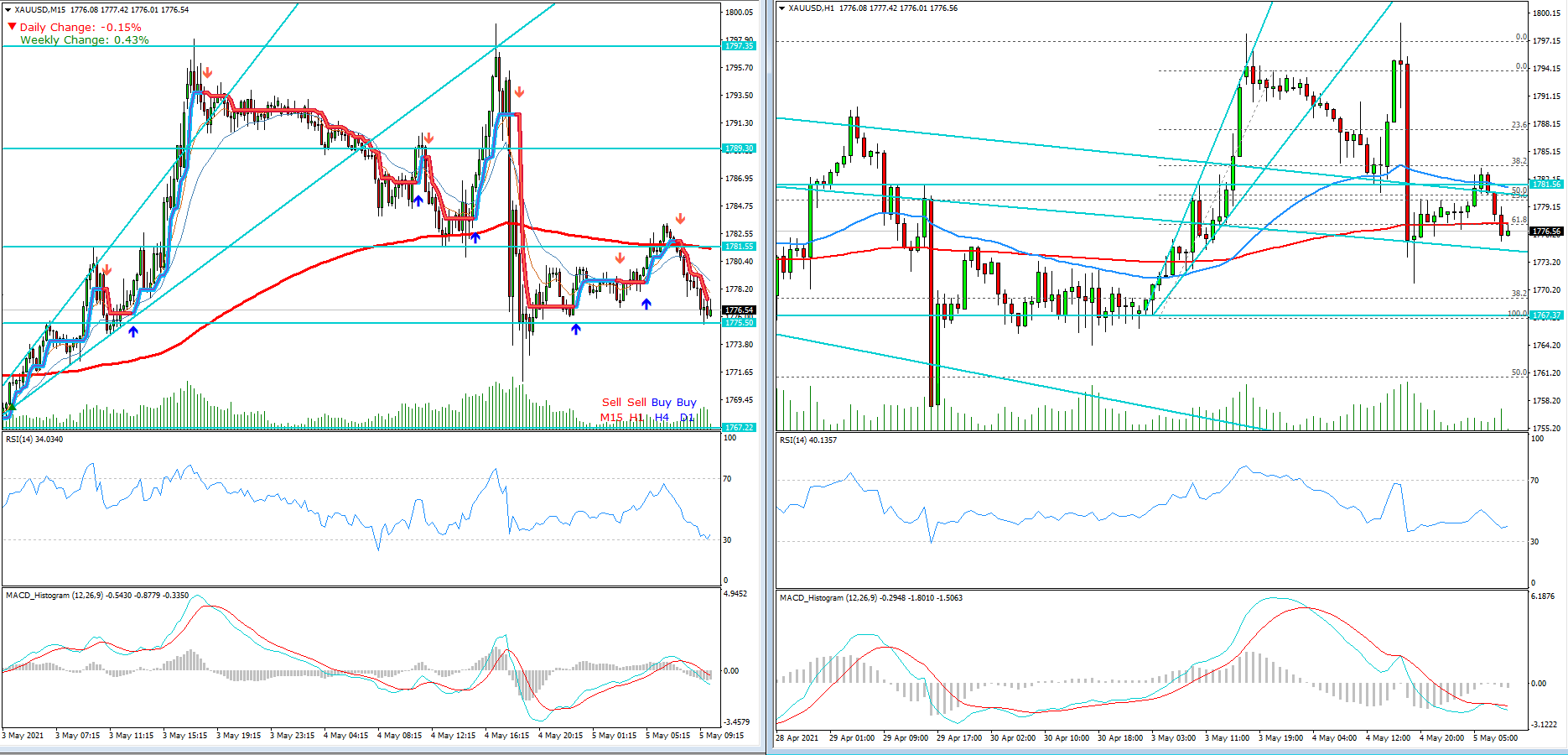

A Backward wedge on US 10 year treasury yields - just when we are seeing signs of USD strengthening and Gold to get hammered in the medium term.

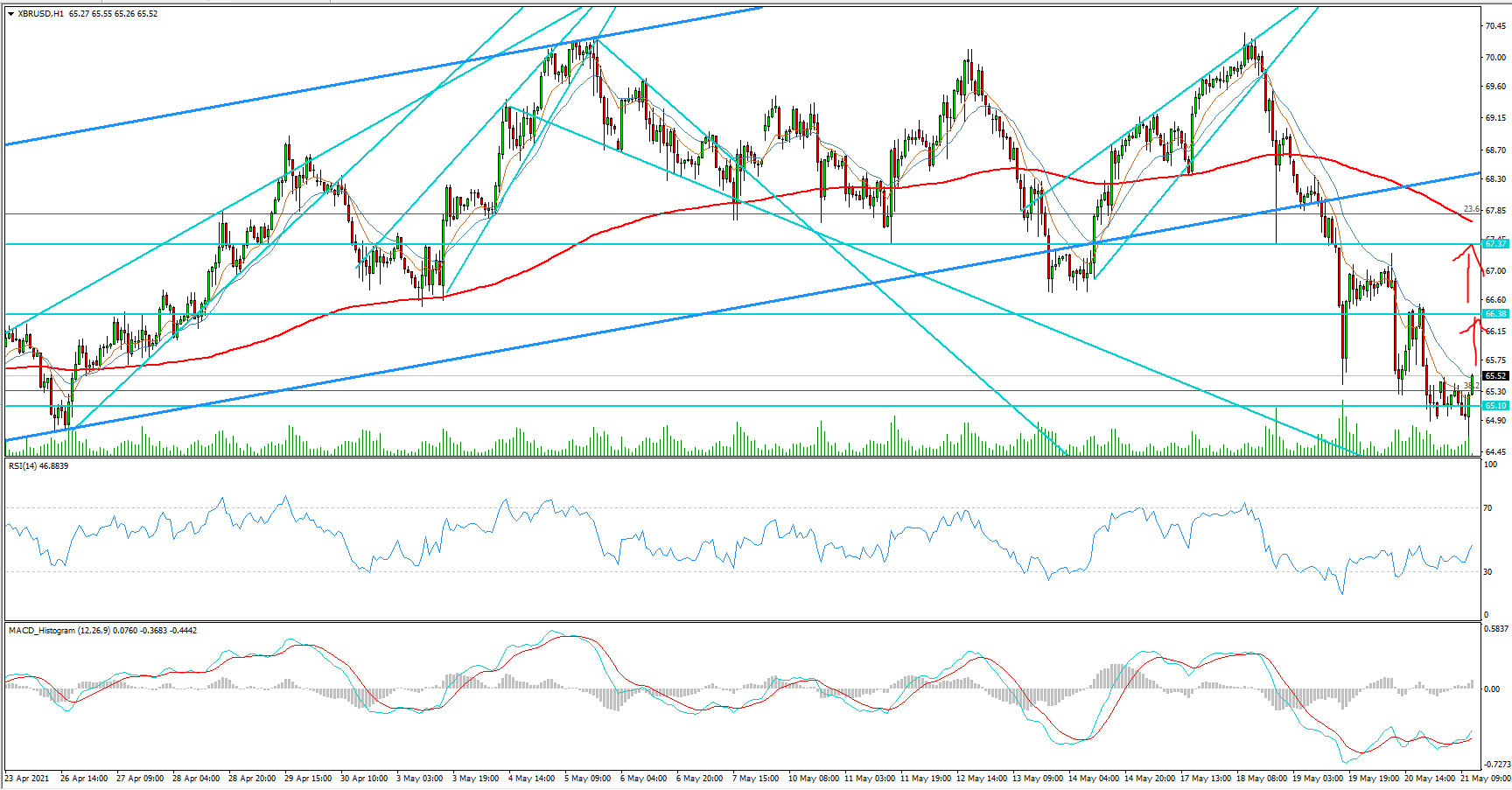

Backward wedge has already broken upwards – that has been causing GOLD prices to fall – perfectly timed.

Historically GOLD was not that closely correlated with Bond Yields, but as of late, something to do with all the money printing has made Gold and US10 bond yields highly correlated.

Once again 61% FIB level is a key S/R level.

- Admin

- 28 May 21

- 0 Comment

Related Posts

You have to logged in for comment.

Email Newsletter

Get subscriber only insights & news delivered by Financial Markets Club

Weekly Trading Lessons by Email

Do you want to Learn to Trade like a Pro? Every Week we will share some Trading Tips to help you Succeed.

Just enter your Name and Email, and click Subscribe!

FinancialMarkets

FinancialMarkets

Comments